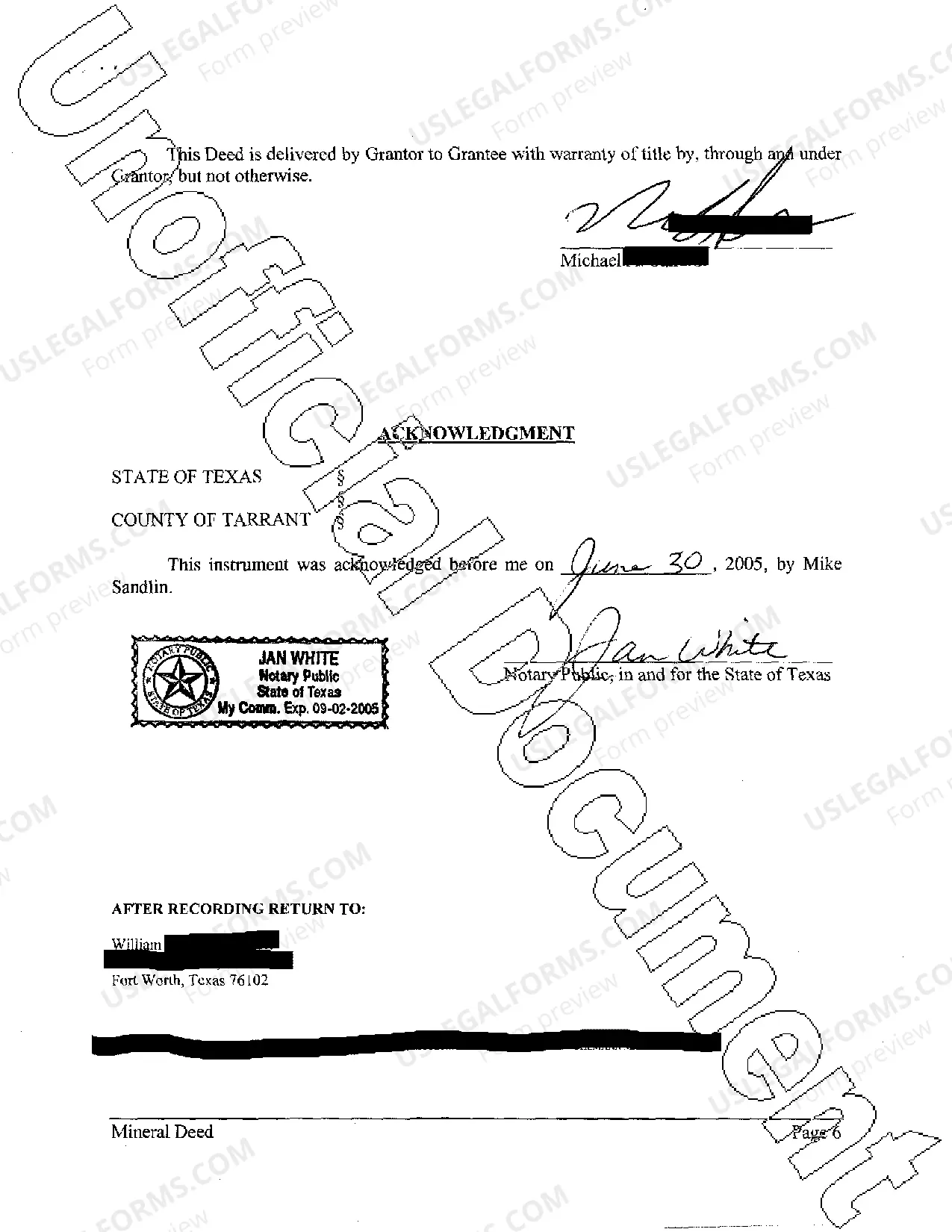

This deed grants, bargains, sells, conveys, and transfers to Grantee an undivided ten percent interest in and to all of Grantor's right, title, and interest in the oil, gas, and other minerals in, on, and under that may be produced from the agreed upon land.

A mineral deed, commonly known as a mineral rights deed or mineral interest deed, is a legal document that transfers the ownership and rights to the minerals beneath a specific piece of land. In Round Rock, Texas, a mineral deed holds significant value due to the region's rich oil and gas reserves. Round Rock, located in Williamson County, lies within the prolific oil-rich Permian Basin and Eagle Ford Shale. As a result, owning mineral rights in this area can be highly lucrative for individuals and businesses involved in the oil and gas industry. There are several types of mineral deeds that are commonly used in Round Rock, Texas, depending on the specific nature of the transaction and the parties involved. Some different types of mineral deeds include: 1. General Mineral Deed: This is the most common type of mineral deed, wherein the current owner of the mineral rights transfers their ownership to a new owner. This type of deed provides a comprehensive and all-inclusive transfer of the rights to explore, extract, and manage the minerals present in the land. 2. Limited Mineral Deed: In certain cases, a mineral owner may choose to transfer only a portion or limited rights to the minerals, while retaining some rights for themselves. This type of deed outlines the specific limitations and restrictions on the transferred rights. 3. Royalty Deed: A royalty deed allows the transfer of only the rights to receive royalties from mineral production, without actually transferring the ownership of the minerals themselves. This type of deed is commonly used when a mineral owner wants to maintain full ownership but still receive regular income from the extracted minerals. 4. Leasehold Mineral Deed: In situations where an individual or company wants to lease their mineral rights to an oil or gas company, a leasehold mineral deed is used. This type of deed grants the lessee the exclusive right to explore, extract, and produce minerals from the land for a specific period, typically through a lease agreement. It is essential to consult with a qualified attorney or land professional specializing in mineral rights before entering into any mineral deed transactions. These professionals can ensure that the deed accurately represents the intended agreement and protects the interests of all parties involved.A mineral deed, commonly known as a mineral rights deed or mineral interest deed, is a legal document that transfers the ownership and rights to the minerals beneath a specific piece of land. In Round Rock, Texas, a mineral deed holds significant value due to the region's rich oil and gas reserves. Round Rock, located in Williamson County, lies within the prolific oil-rich Permian Basin and Eagle Ford Shale. As a result, owning mineral rights in this area can be highly lucrative for individuals and businesses involved in the oil and gas industry. There are several types of mineral deeds that are commonly used in Round Rock, Texas, depending on the specific nature of the transaction and the parties involved. Some different types of mineral deeds include: 1. General Mineral Deed: This is the most common type of mineral deed, wherein the current owner of the mineral rights transfers their ownership to a new owner. This type of deed provides a comprehensive and all-inclusive transfer of the rights to explore, extract, and manage the minerals present in the land. 2. Limited Mineral Deed: In certain cases, a mineral owner may choose to transfer only a portion or limited rights to the minerals, while retaining some rights for themselves. This type of deed outlines the specific limitations and restrictions on the transferred rights. 3. Royalty Deed: A royalty deed allows the transfer of only the rights to receive royalties from mineral production, without actually transferring the ownership of the minerals themselves. This type of deed is commonly used when a mineral owner wants to maintain full ownership but still receive regular income from the extracted minerals. 4. Leasehold Mineral Deed: In situations where an individual or company wants to lease their mineral rights to an oil or gas company, a leasehold mineral deed is used. This type of deed grants the lessee the exclusive right to explore, extract, and produce minerals from the land for a specific period, typically through a lease agreement. It is essential to consult with a qualified attorney or land professional specializing in mineral rights before entering into any mineral deed transactions. These professionals can ensure that the deed accurately represents the intended agreement and protects the interests of all parties involved.