This deed grants, bargains, sells, conveys, and transfers to Grantee an undivided ten percent interest in and to all of Grantor's right, title, and interest in the oil, gas, and other minerals in, on, and under that may be produced from the agreed upon land.

Tarrant Texas Mineral Deed

Description

How to fill out Texas Mineral Deed?

If you have previously utilized our service, Log In to your account and download the Tarrant Texas Mineral Deed onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to obtain your file.

You have lifelong access to every document you have purchased: you can find it in your profile within the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Ensure you've found a suitable document. Review the description and use the Preview option, if accessible, to confirm if it fulfills your requirements. If it does not meet your criteria, utilize the Search tab above to discover the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Tarrant Texas Mineral Deed. Select the file format for your document and store it on your device.

- Finalize your sample. Print it or take advantage of professional online editors to complete it and sign it digitally.

Form popularity

FAQ

To obtain mineral rights on your property in Texas, you first need to review your current property deed. A Tarrant Texas Mineral Deed can help you transfer or secure those rights effectively. You may consider consulting a real estate attorney to ensure you understand your rights and obligations. Additionally, using platforms like US Legal Forms can simplify the process by providing the necessary documents to facilitate your claim.

To place mineral rights into a trust, start by drafting a trust agreement that clearly outlines the terms and beneficiaries. Then, execute a conveyance deed transferring the rights to the trust. Finally, record the deed in the county where the property is located to ensure the transfer is legally recognized, particularly important for your Tarrant Texas Mineral Deed.

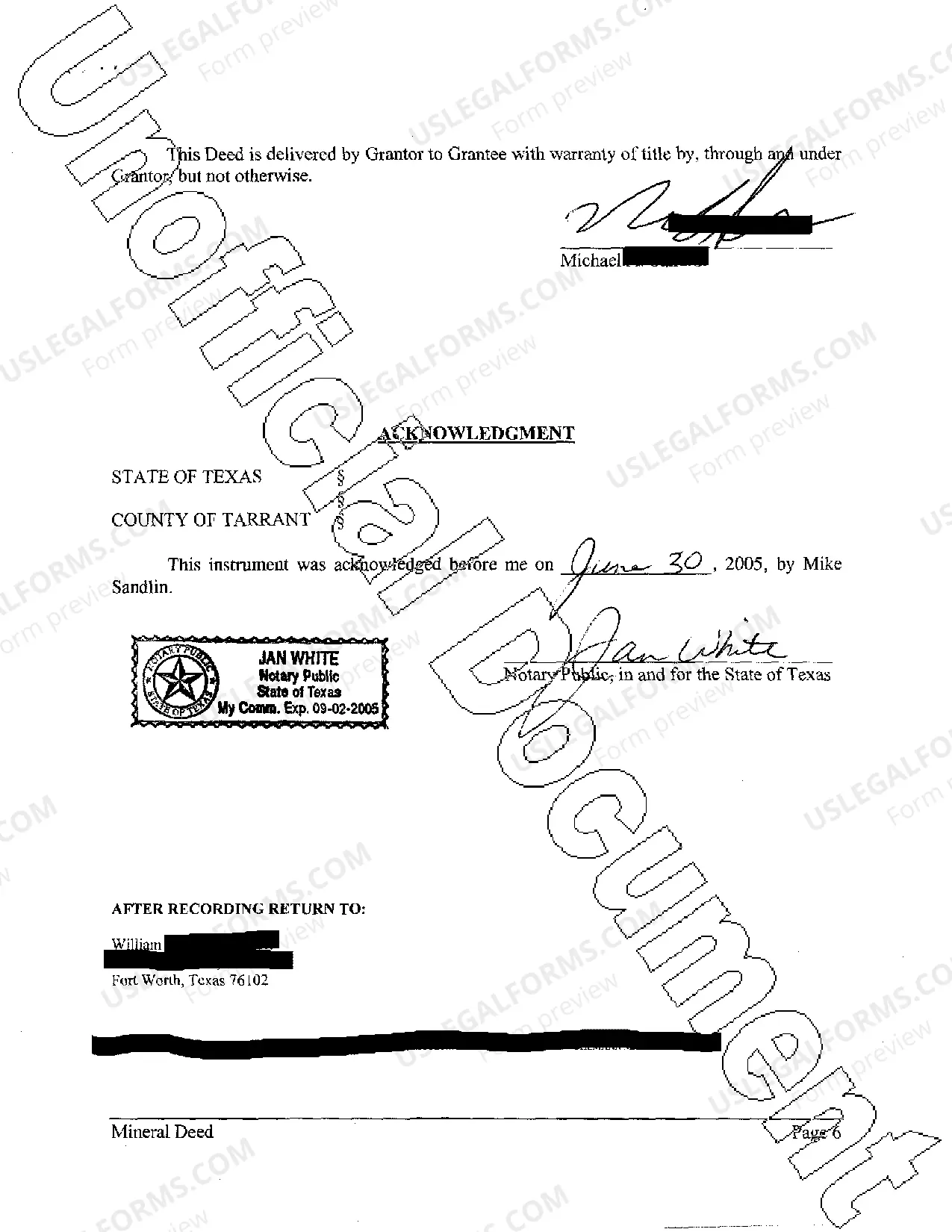

Filling out a Texas warranty deed is straightforward. First, include the grantor's and grantee's names and addresses clearly. Next, accurately describe the property by including its legal description. Finally, ensure that the document is signed in front of a notary public to create a valid Tarrant Texas Mineral Deed.

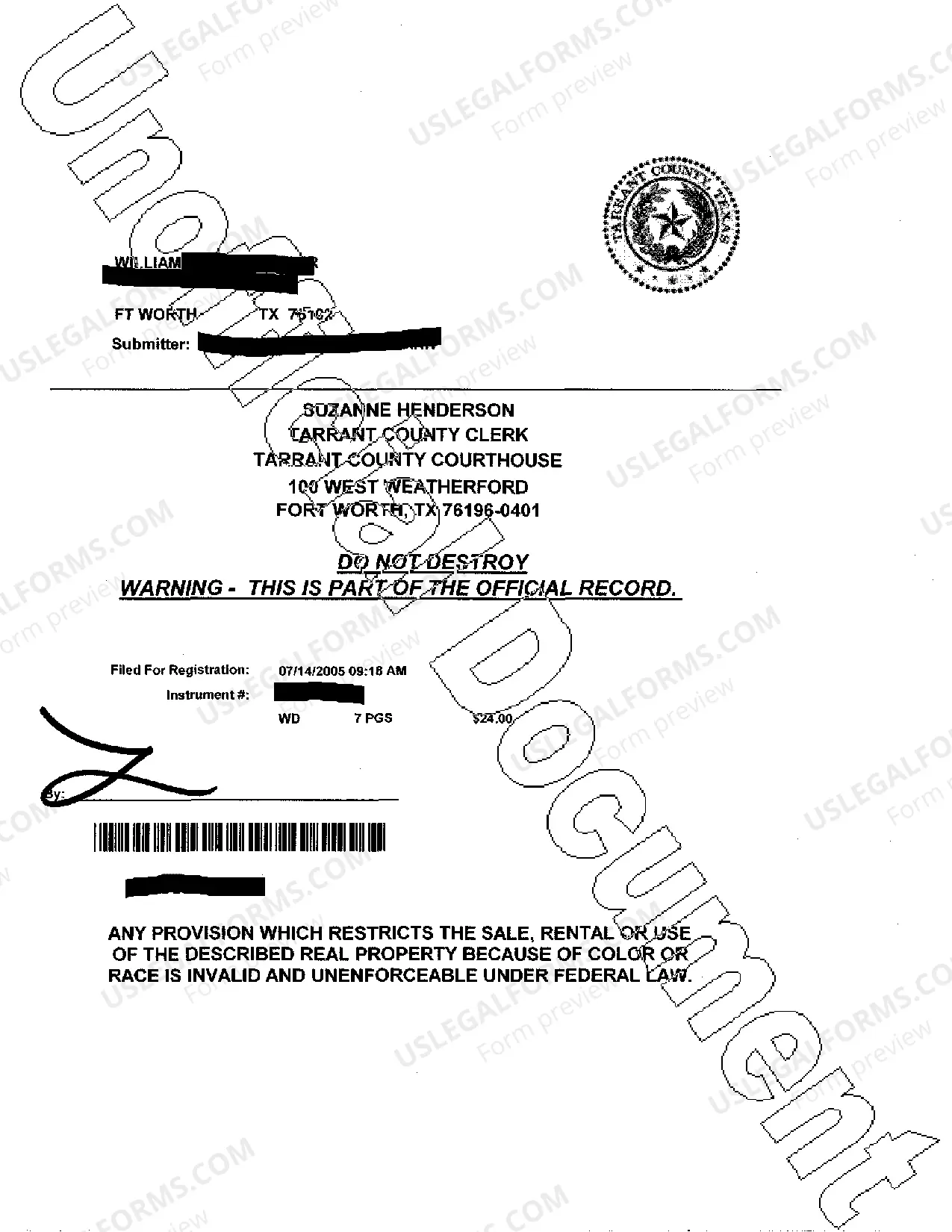

To transfer mineral rights in Texas, start by creating a Tarrant Texas Mineral Deed that includes essential information about the transfer. You will need to sign the deed in front of a notary and file it with the county clerk to formalize the process. Working with a legal professional can streamline the procedure and help navigate any complexities. Ensuring compliance with local laws is crucial to avoid future disputes.

Transferring ownership of mineral rights in Texas involves drafting a Tarrant Texas Mineral Deed. This legal document must state the new owner’s name, description of the property, and the extent of the mineral rights being conveyed. After preparing the deed, you should file it with the local county clerk’s office. It is always wise to get legal help to ensure the transfer meets all requirements.

The value of an acre of mineral rights in Texas can vary significantly based on location, potential reserves, and market demand. In Tarrant County, you may consider factors such as oil and gas production trends to estimate value. Conducting thorough research or obtaining an appraisal can give you a clearer picture. Tools available on platforms like uslegalforms can assist you in evaluations.

In Texas, mineral rights typically pass to heirs through a Tarrant Texas Mineral Deed as part of an estate. If the property owner did not specify otherwise in a will, the rights usually go to their direct descendants, spouse, or siblings. It is important to ascertain the chain of title to confirm ownership. Consulting an estate lawyer may clarify potential ownership disputes.

To claim mineral rights in Texas, you must first determine if the rights are part of a Tarrant Texas Mineral Deed. You can file a claim with the county clerk’s office or consult a local attorney to guide you through the process. This claim should include necessary documentation, such as survey maps or previous deeds. Engaging with professionals ensures you follow proper legal procedures.

No, mineral rights do not automatically convey in Texas. The transfer of mineral rights must be explicitly stated in a contract or deed. To avoid confusion, it is advisable to consult with a knowledgeable real estate attorney or use resources like US Legal Forms to ensure that all aspects of the Tarrant Texas Mineral Deed are clearly defined in your transactions.

In Texas, purchasing land does not automatically include ownership of mineral rights unless specified in the sale agreement. Often, mineral rights are severed from the land and may remain with a previous owner. Therefore, it is crucial to review the Tarrant Texas Mineral Deeds carefully to understand what rights you are acquiring when buying property.