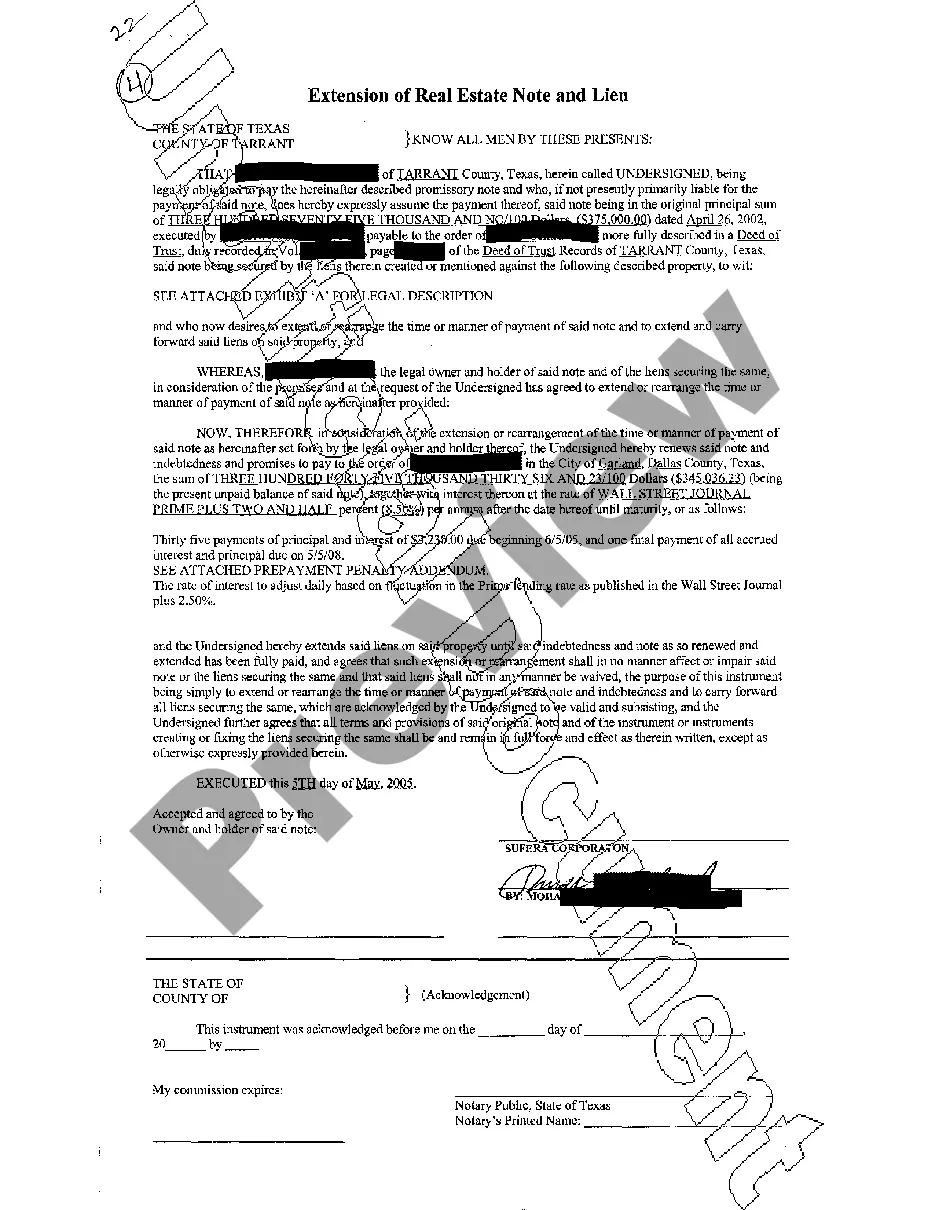

The Fort Worth Texas Extension of Real Estate Note and Lien refers to a legal process involving the extension of a real estate note and lien in the city of Fort Worth, Texas. This extension is a legal agreement made between a lender and a borrower to extend the repayment terms of a real estate loan and maintain the lien on the property until the debt is fully satisfied. When a borrower is unable to meet the original agreed-upon terms of their real estate note, they may request an extension to provide them with additional time to repay their debt. The extension of the real estate note can benefit both parties involved, as the borrower is given an opportunity to catch up on missed payments or reorganize their finances, while the lender continues to hold a valid lien on the property as security. In Fort Worth, Texas, the extension of real estate notes and liens is governed by the state's property laws and regulations, ensuring the process is carried out in a fair and lawful manner. The extension can be granted through a formal agreement and should include details such as the new repayment schedule, any revised interest rates, and any additional fees associated with the extension. There may be different types of real estate note and lien extensions available in Fort Worth, Texas, depending on the specific circumstances of the borrower and lender. Some of these extensions may include: 1. Temporary Extension: This type of extension allows the borrower a short-term reprieve from their repayment obligations, typically of a few months, to give them time to gather their finances and resume regular payments. 2. Permanent Extension: In certain cases, a borrower may request a permanent extension, which permanently alters the terms of the original real estate note. This can involve adjusting the interest rate, extending the repayment period, or even modifying the principal amount. 3. Conditional Extension: This type of extension is contingent on certain conditions being met by the borrower. For example, the lender may require the borrower to provide additional collateral or demonstrate improved financial stability before granting the extension. 4. Purchase Money Mortgage Extension: When a borrower has obtained a loan solely to purchase the property, they may request an extension specifically for the purchase money mortgage. This type of extension may involve modifying the terms of repayment, including interest rates and the duration of the note. It is important for both lenders and borrowers in Fort Worth, Texas, to understand the specific requirements and legal implications associated with each type of real estate note and lien extension. Seeking legal advice from a real estate attorney or consulting the appropriate authorities can ensure compliance with the local laws and protect the rights and interests of both parties involved.

Fort Worth Texas Extension of Real Estate Note and Lien

State:

Texas

City:

Fort Worth

Control #:

TX-JW-0071

Format:

PDF

Instant download

This form is available by subscription

Description

Extension of Real Estate Note and Lien

The Fort Worth Texas Extension of Real Estate Note and Lien refers to a legal process involving the extension of a real estate note and lien in the city of Fort Worth, Texas. This extension is a legal agreement made between a lender and a borrower to extend the repayment terms of a real estate loan and maintain the lien on the property until the debt is fully satisfied. When a borrower is unable to meet the original agreed-upon terms of their real estate note, they may request an extension to provide them with additional time to repay their debt. The extension of the real estate note can benefit both parties involved, as the borrower is given an opportunity to catch up on missed payments or reorganize their finances, while the lender continues to hold a valid lien on the property as security. In Fort Worth, Texas, the extension of real estate notes and liens is governed by the state's property laws and regulations, ensuring the process is carried out in a fair and lawful manner. The extension can be granted through a formal agreement and should include details such as the new repayment schedule, any revised interest rates, and any additional fees associated with the extension. There may be different types of real estate note and lien extensions available in Fort Worth, Texas, depending on the specific circumstances of the borrower and lender. Some of these extensions may include: 1. Temporary Extension: This type of extension allows the borrower a short-term reprieve from their repayment obligations, typically of a few months, to give them time to gather their finances and resume regular payments. 2. Permanent Extension: In certain cases, a borrower may request a permanent extension, which permanently alters the terms of the original real estate note. This can involve adjusting the interest rate, extending the repayment period, or even modifying the principal amount. 3. Conditional Extension: This type of extension is contingent on certain conditions being met by the borrower. For example, the lender may require the borrower to provide additional collateral or demonstrate improved financial stability before granting the extension. 4. Purchase Money Mortgage Extension: When a borrower has obtained a loan solely to purchase the property, they may request an extension specifically for the purchase money mortgage. This type of extension may involve modifying the terms of repayment, including interest rates and the duration of the note. It is important for both lenders and borrowers in Fort Worth, Texas, to understand the specific requirements and legal implications associated with each type of real estate note and lien extension. Seeking legal advice from a real estate attorney or consulting the appropriate authorities can ensure compliance with the local laws and protect the rights and interests of both parties involved.

Free preview

How to fill out Fort Worth Texas Extension Of Real Estate Note And Lien?

If you’ve already utilized our service before, log in to your account and save the Fort Worth Texas Extension of Real Estate Note and Lien on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Fort Worth Texas Extension of Real Estate Note and Lien. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!