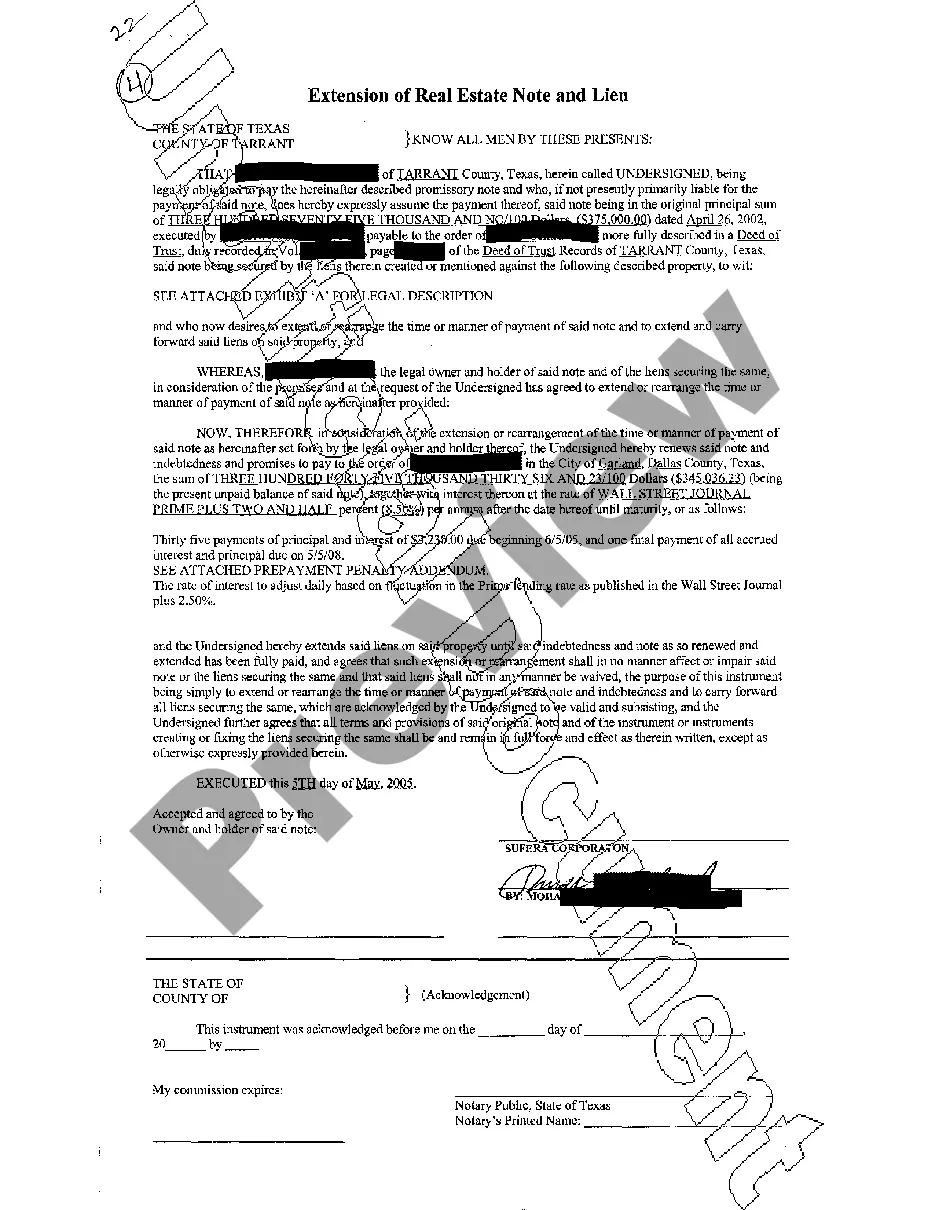

The Harris Texas Extension of Real Estate Note and Lien refers to a legal provision that allows property owners in Harris County, located in Texas, to extend the duration of a real estate note or lien that has been recorded against their property. This extension is granted to individuals who are unable to fulfill their financial obligations within the original agreed-upon timeframe. There are different types of Harris Texas Extension of Real Estate Note and Lien, depending on the specific circumstances and nature of the extension sought. These may include: 1. Mortgage Note Extension: This type of extension is applicable when a borrower is unable to pay off their mortgage note within the agreed term. By applying for a Harris Texas Extension of Real Estate Note and Lien, the borrower can request additional time to repay the loan, thus avoiding foreclosure. 2. Lien Extension: Property owners who have outstanding liens against their property can apply for a Harris Texas Extension to extend the duration of the lien. This allows them more time to address any outstanding debts or resolve the legal issues associated with the lien. 3. Judgment Lien Extension: In cases where a court has issued a judgment lien against a property owner in Harris County, the individual may request a Harris Texas Extension to extend the duration of the lien. This extension grants them additional time to satisfy the judgment and pay off any associated debts. 4. Tax Lien Extension: Property owners facing tax liens placed by the Harris County tax authorities can apply for a Harris Texas Extension of Real Estate Note and Lien to extend the duration of the lien. This extension enables property owners to arrange a suitable repayment plan or seek other means to address their tax liabilities. 5. Mechanic's Lien Extension: When a contractor or supplier has placed a mechanic's lien on a property due to non-payment for services or materials provided, the property owner can request a Harris Texas Extension to extend the duration of the lien. This extension allows property owners more time to settle the dispute or make necessary payments. Applying for a Harris Texas Extension of Real Estate Note and Lien requires proper legal documentation and adherence to specific procedures. It is important to seek appropriate legal advice and work with professionals experienced in real estate law to ensure a smooth extension process. Failure to comply with the terms of the extension may result in legal consequences and further complications for the property owner.

Harris Texas Extension of Real Estate Note and Lien

Description

How to fill out Harris Texas Extension Of Real Estate Note And Lien?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Harris Texas Extension of Real Estate Note and Lien or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Harris Texas Extension of Real Estate Note and Lien adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Harris Texas Extension of Real Estate Note and Lien is suitable for your case, you can select the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!