The McKinney Texas Extension of Real Estate Note and Lien refers to the legal process of extending the duration of a real estate note and lien in McKinney, Texas. This extension essentially allows the debtor more time to fulfill their financial obligations related to the property in question. In this article, we will delve into the intricacies of the McKinney Texas Extension of Real Estate Note and Lien, highlighting its importance, process, and potential variations that may exist. Importance of McKinney Texas Extension of Real Estate Note and Lien: The McKinney Texas Extension of Real Estate Note and Lien holds significant importance for both lenders and borrowers involved in real estate transactions. For lenders, it serves as a means to protect their investment by ensuring that the borrower has additional time to repay the loan. On the other hand, borrowers benefit from this extension as it grants them the opportunity to address financial challenges and avoid potential foreclosure of the property. Process of McKinney Texas Extension of Real Estate Note and Lien: The process of extending a real estate note and lien in McKinney, Texas involves certain steps that both parties must follow. First, the borrower must approach the lender and request an extension, providing valid reasons that justify the need for additional time. The lender will then assess the borrower's request and evaluate the associated risks and potential benefits of extending the note and lien. Upon approval, a formal agreement outlining the terms of the extension is drafted, signed, and notarized by both parties. This agreement typically includes the extended duration, any revised terms of payment, and any additional fees that may be applicable. Once the extension is in effect, the borrower must adhere to the newly established terms in order to avoid any legal consequences. Types of McKinney Texas Extension of Real Estate Note and Lien: While there may not be specific variations in the types of McKinney Texas Extension of Real Estate Note and Lien, it is essential to note that every extension varies according to the mutually agreed terms between the lender and borrower. The terms can include changes in the repayment schedule, interest rates, penalties, or fees incurred during the extension period. Therefore, it is crucial for both parties to negotiate and clearly define these terms to avoid any potential future disputes. In conclusion, the McKinney Texas Extension of Real Estate Note and Lien is a legal process that grants borrowers extra time to fulfill their financial obligations related to a property in McKinney, Texas. It provides a means for borrowers to rectify financial challenges and avoid foreclosure while allowing lenders to protect their investment. By understanding the process and potential variations, both parties can enter into an extension agreement that works in their mutual best interest.

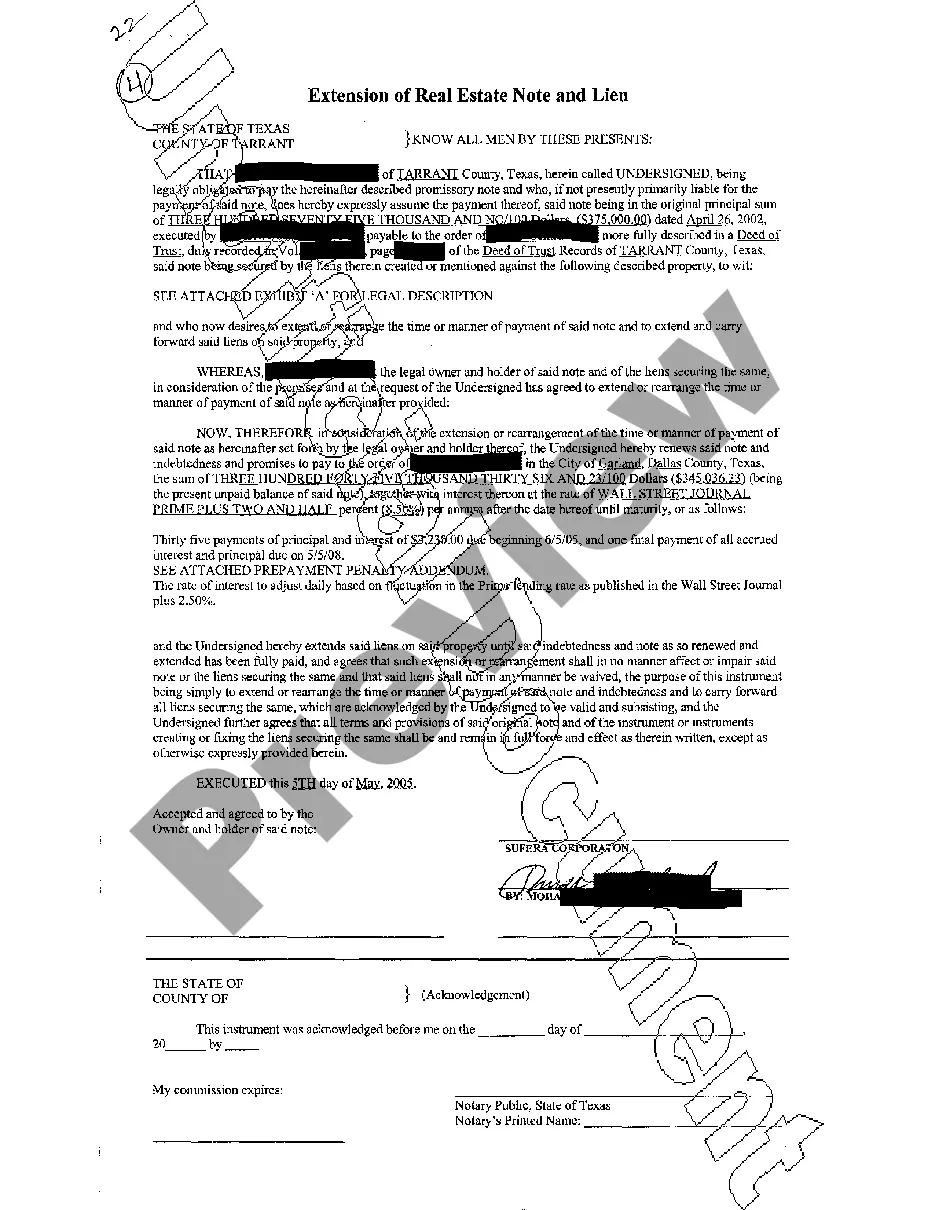

McKinney Texas Extension of Real Estate Note and Lien

Description

How to fill out McKinney Texas Extension Of Real Estate Note And Lien?

Make use of the US Legal Forms and get instant access to any form sample you require. Our beneficial website with thousands of templates makes it easy to find and get almost any document sample you need. It is possible to download, complete, and sign the McKinney Texas Extension of Real Estate Note and Lien in a few minutes instead of browsing the web for several hours seeking the right template.

Utilizing our collection is an excellent strategy to raise the safety of your document filing. Our professional attorneys regularly review all the documents to make certain that the forms are appropriate for a particular region and compliant with new acts and polices.

How do you obtain the McKinney Texas Extension of Real Estate Note and Lien? If you already have a subscription, just log in to the account. The Download button will appear on all the documents you view. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction below:

- Find the template you require. Ensure that it is the form you were looking for: examine its name and description, and use the Preview function if it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Choose the format to obtain the McKinney Texas Extension of Real Estate Note and Lien and edit and complete, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy form libraries on the internet. We are always happy to assist you in virtually any legal case, even if it is just downloading the McKinney Texas Extension of Real Estate Note and Lien.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!