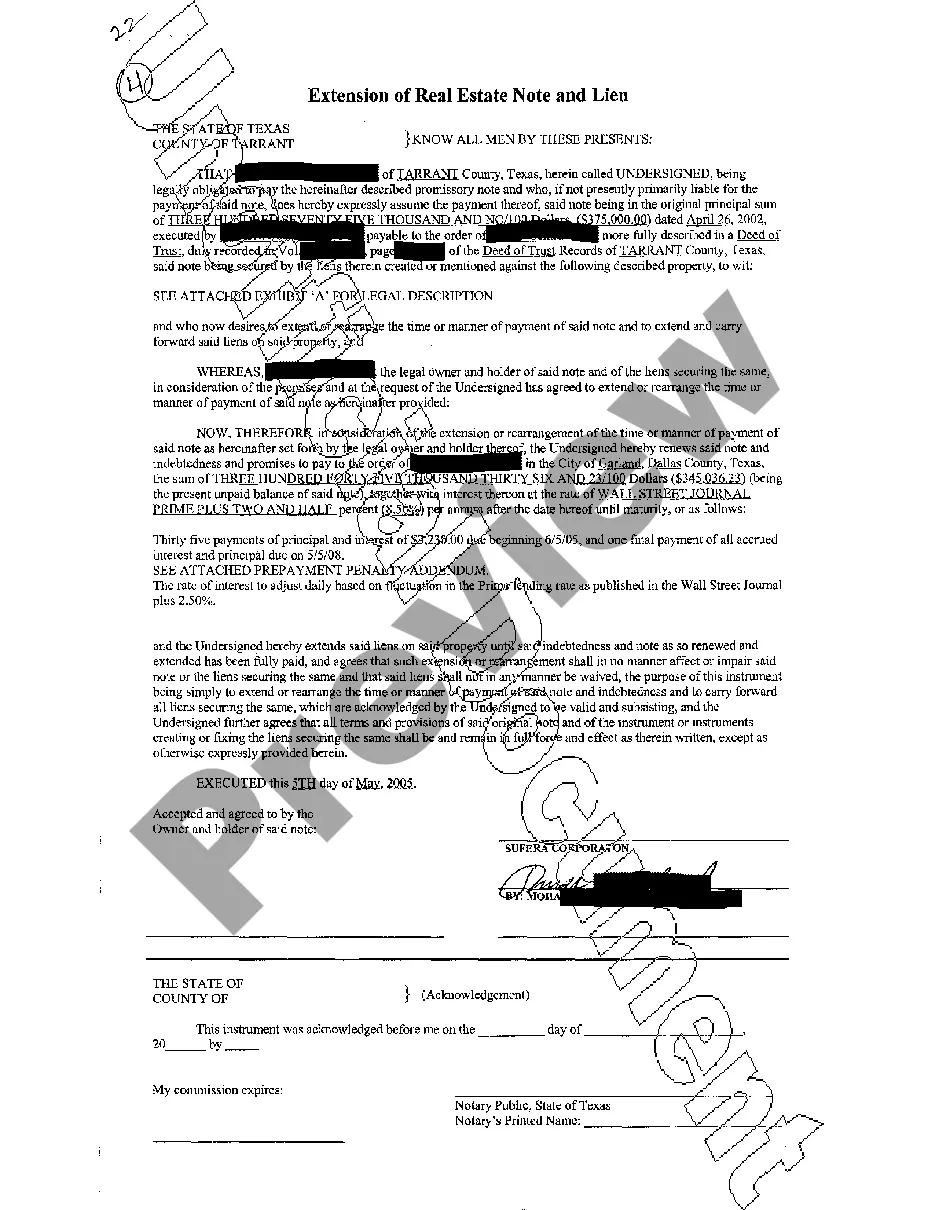

The Mesquite Texas Extension of Real Estate Note and Lien is a legal concept regarding the extension of real estate notes and liens in the city of Mesquite, Texas. This extension refers to the process by which the maturity date of a real estate note or the expiration date of a lien is extended beyond the original agreed-upon date. This allows for the continuation of the loan repayment or lien enforcement process. In Mesquite, Texas, there are different types of extensions available for real estate notes and liens. These variations cater to specific scenarios and situations, offering flexibility and options for both borrowers and lenders. Some notable types of Mesquite Texas extensions of real estate notes and liens, include: 1. Maturity Date Extension: This type of extension involves extending the maturity date of a real estate note, which is the date at which the loan is due to be fully repaid. Borrowers who are unable to meet the original repayment terms or wish to negotiate new terms can request a maturity date extension. This enables them to have more time to repay the loan, potentially avoiding default and foreclosure. 2. Lien Expiration Date Extension: When a lien is placed on a property, it typically has a set expiration date, after which the lien claim is no longer valid. However, in certain cases, lien holders may agree to extend the expiration date if the debt remains unpaid or unresolved. This extension ensures that the lien remains in effect, potentially providing the lien holder with the ability to enforce the claim and recover their debt. 3. Conditional Extension: This type of extension is granted under specific conditions or circumstances, typically agreed upon by both parties involved in the real estate transaction. For example, a conditional extension may be requested if the borrower is awaiting funds from a pending property sale or if there are legal disputes that need to be resolved before the loan can be repaid or the lien enforced. 4. Consent to Extend: In some instances, property owners may proactively seek an extension of their real estate note or lien to accommodate personal financial circumstances or changes in their loan repayment ability. This extension requires the consent of the lender or lien holder and may involve negotiating new terms, such as interest rates, repayment periods, or payment plans. It's important to consult with a real estate attorney or legal professional familiar with Mesquite, Texas, to get precise details and guidance regarding the specific extensions available for real estate notes and liens in the area. These professionals can assist in navigating the legal complexities and ensuring compliance with all relevant laws and regulations.

Mesquite Texas Extension of Real Estate Note and Lien

Description

How to fill out Mesquite Texas Extension Of Real Estate Note And Lien?

We consistently endeavor to reduce or prevent legal complications when navigating intricate legal or financial matters.

To achieve this, we seek legal solutions that are typically quite expensive.

However, not every legal issue is as complicated as it seems. Many can be resolved independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to manage your affairs without the need for legal counsel.

If you happen to misplace the form, you can always re-download it from the My documents section. The process is equally simple for those unfamiliar with the site! You can create your account in just a few minutes.

- We provide access to legal form templates that are not always available to the public.

- Our templates are specific to states and regions, making the search process significantly easier.

- Utilize US Legal Forms whenever you need to acquire and download the Mesquite Texas Extension of Real Estate Note and Lien or any other form quickly and securely.

- Simply Log In to your account and click the Get button beside it.

Form popularity

FAQ

Yes, liens against property can expire if they are not acted upon within the applicable statute of limitations. In Texas, this expiration typically occurs after four years for most types of liens. To avoid losing your rights over a Mesquite Texas Extension of Real Estate Note and Lien, it’s essential to monitor the timeline and ensure appropriate actions are taken.

A lien has several limitations, including time restrictions and the types of property it can affect. In Texas, certain liens may be limited by laws that dictate how long they can remain effective before they must be resolved. Understanding the limitations of a Mesquite Texas Extension of Real Estate Note and Lien will empower you to manage your property claims effectively.

The statute of limitations on a property lien in Texas is typically four years from the date the debt becomes due. After this period, the lien may become unenforceable, which emphasizes the need for timely action. If you are dealing with a Mesquite Texas Extension of Real Estate Note and Lien, knowing this timeline can help you take the necessary steps to maintain your claim.

Yes, you can file a lien online in Texas, which simplifies the process significantly. Many counties offer online services that allow you to file your lien documents electronically. By using a trusted platform like US Legal Forms, you can easily navigate the necessary forms for a Mesquite Texas Extension of Real Estate Note and Lien, ensuring that everything is completed accurately and efficiently.

Yes, there is a statute of limitations that applies to property liens in Texas. Typically, for a property lien related to a debt, the statute of limitations can extend up to four years. This timeframe is crucial for ensuring that you can enforce a Mesquite Texas Extension of Real Estate Note and Lien before it expires, making timely action essential.

The timeline for a lien in Texas can vary depending on the type of lien. Generally, once a lien is filed, it remains in effect until it is resolved, typically during a foreclosure process or upon payment of the debt. In the context of a Mesquite Texas Extension of Real Estate Note and Lien, it’s important to understand that timely filing and proper procedures can help protect your rights and interests.

In Texas, lien waivers generally do not require notarization to be valid. However, notarization can provide added security and authenticity to the waiver. When dealing with a Mesquite Texas Extension of Real Estate Note and Lien, it is wise to ensure you have all documents signed properly, as this protects your interests. Uslegalforms offers templates that can streamline this process for you.

To file a notice of lien in Texas, first, prepare the required forms that detail the nature of the lien. Next, submit these forms to the county clerk’s office in the county where the property is located. If you follow these steps carefully, you can effectively secure your Mesquite Texas Extension of Real Estate Note and Lien. Always check for specific requirements in your county.

In Texas, a lien release does not need to be notarized to be effective. However, having it notarized makes it easier to verify the authenticity of the document. If you are handling a Mesquite Texas Extension of Real Estate Note and Lien, consider including notarization as it can simplify future transactions. Always keep copies of your documents for your records.

To find a lien on property in Texas, you can search the public records maintained by the county clerk's office. Many counties also provide online databases for easier access. If you're navigating the complexities of liens, the uslegalforms platform offers valuable resources to assist you in understanding the Mesquite Texas Extension of Real Estate Note and Lien and finding the information you need.