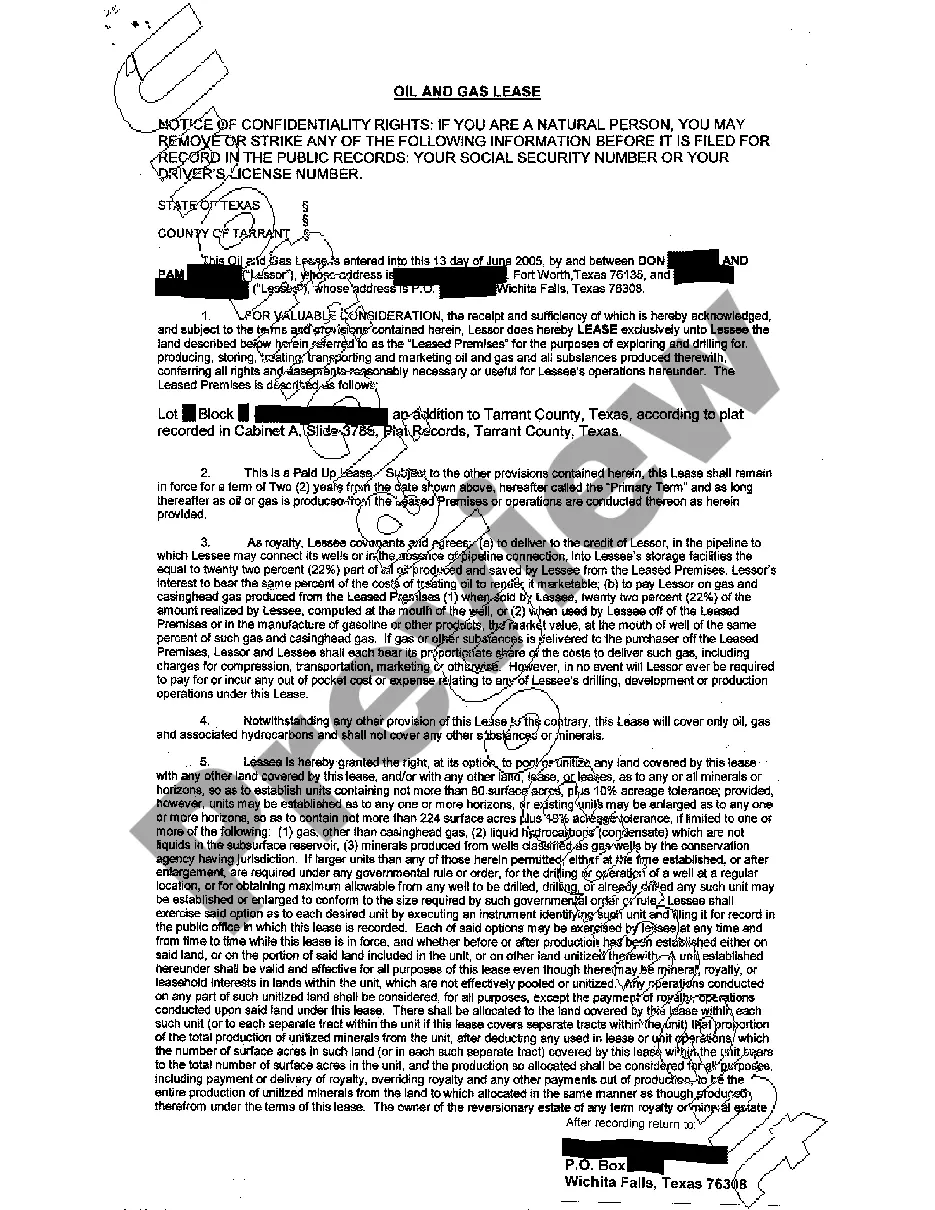

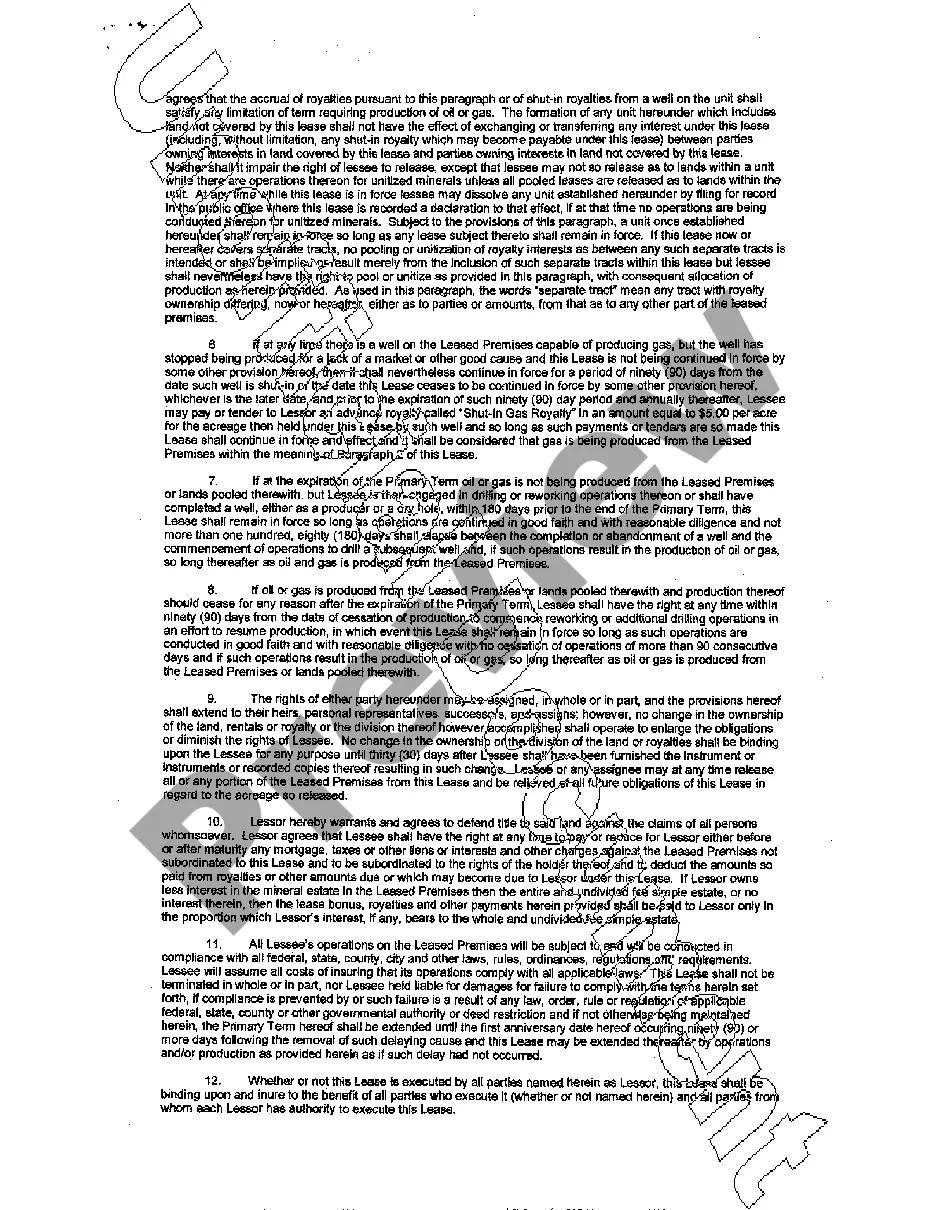

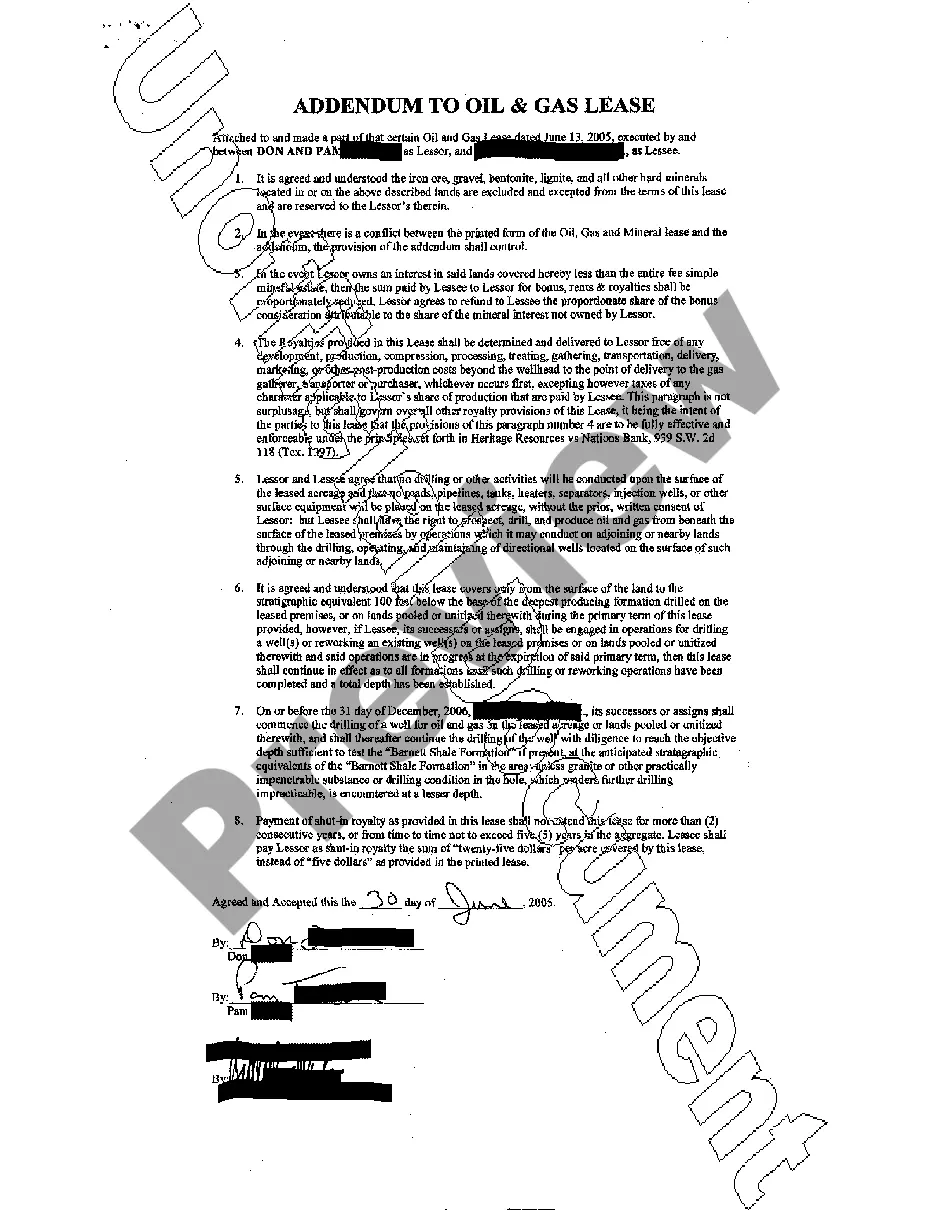

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

Abilene Texas Oil and Gas Lease is a legal agreement that grants the right to explore, extract, and produce oil and gas reserves located within specific properties in the Abilene, Texas region. It typically involves a landowner (lessor) and an oil or gas company (lessee). This lease serves as a framework for the commercial relationship between both parties and outlines the rights, responsibilities, and financial aspects of the agreement. Keywords: 1. Abilene Texas: Pertaining to the city of Abilene in the state of Texas, USA. 2. Oil and Gas: Refers to the natural resources being explored, extracted, and produced under the lease. 3. Lease: A legal contract that governs the rights and responsibilities of the lessor and lessee regarding the property and its resources. Types of Abilene Texas Oil and Gas Lease: 1. Standard Lease: This is the most common type of oil and gas lease, which outlines the fundamental terms and conditions of the exploration and production activities. It typically includes clauses related to royalty payments, lease duration, drilling obligations, and environmental responsibilities. 2. Royalty Lease: In this type of lease, the landowner (lessor) receives a percentage of the revenue generated from the sale of oil and gas as royalty payment. The royalty rate is often negotiated and specified in the lease agreement. 3. Cash Bonus Lease: This lease involves a payment made upfront by the lessee to the lessor as a bonus or consideration for granting the exploration and production rights. The cash bonus amount is negotiated between the parties and specified in the lease agreement. 4. Production Sharing Lease: This type of lease involves a sharing arrangement whereby the lessor receives a percentage of the produced oil and gas as their share of the output instead of receiving a royalty payment. The sharing ratio is determined through negotiation and stated in the lease agreement. 5. Net Profit Lease: Under this lease, the lessor receives a share of the net profits generated from the sale of oil and gas after deducting production costs, taxes, and other expenses. The profit-sharing percentage is agreed upon and mentioned in the lease agreement. It is important to consult legal and industry professionals to obtain accurate and up-to-date information regarding the specific terms and types of Abilene Texas Oil and Gas Lease.Abilene Texas Oil and Gas Lease is a legal agreement that grants the right to explore, extract, and produce oil and gas reserves located within specific properties in the Abilene, Texas region. It typically involves a landowner (lessor) and an oil or gas company (lessee). This lease serves as a framework for the commercial relationship between both parties and outlines the rights, responsibilities, and financial aspects of the agreement. Keywords: 1. Abilene Texas: Pertaining to the city of Abilene in the state of Texas, USA. 2. Oil and Gas: Refers to the natural resources being explored, extracted, and produced under the lease. 3. Lease: A legal contract that governs the rights and responsibilities of the lessor and lessee regarding the property and its resources. Types of Abilene Texas Oil and Gas Lease: 1. Standard Lease: This is the most common type of oil and gas lease, which outlines the fundamental terms and conditions of the exploration and production activities. It typically includes clauses related to royalty payments, lease duration, drilling obligations, and environmental responsibilities. 2. Royalty Lease: In this type of lease, the landowner (lessor) receives a percentage of the revenue generated from the sale of oil and gas as royalty payment. The royalty rate is often negotiated and specified in the lease agreement. 3. Cash Bonus Lease: This lease involves a payment made upfront by the lessee to the lessor as a bonus or consideration for granting the exploration and production rights. The cash bonus amount is negotiated between the parties and specified in the lease agreement. 4. Production Sharing Lease: This type of lease involves a sharing arrangement whereby the lessor receives a percentage of the produced oil and gas as their share of the output instead of receiving a royalty payment. The sharing ratio is determined through negotiation and stated in the lease agreement. 5. Net Profit Lease: Under this lease, the lessor receives a share of the net profits generated from the sale of oil and gas after deducting production costs, taxes, and other expenses. The profit-sharing percentage is agreed upon and mentioned in the lease agreement. It is important to consult legal and industry professionals to obtain accurate and up-to-date information regarding the specific terms and types of Abilene Texas Oil and Gas Lease.