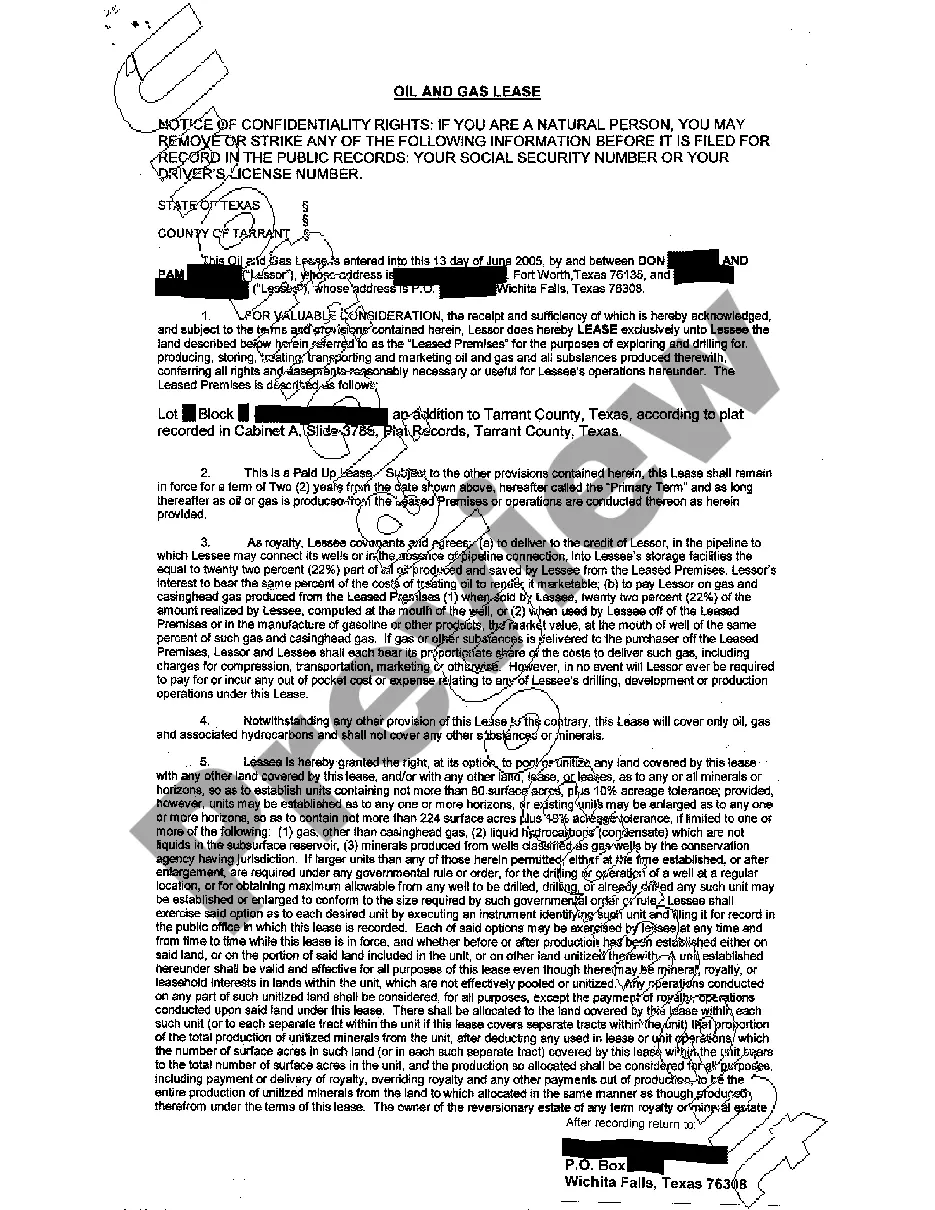

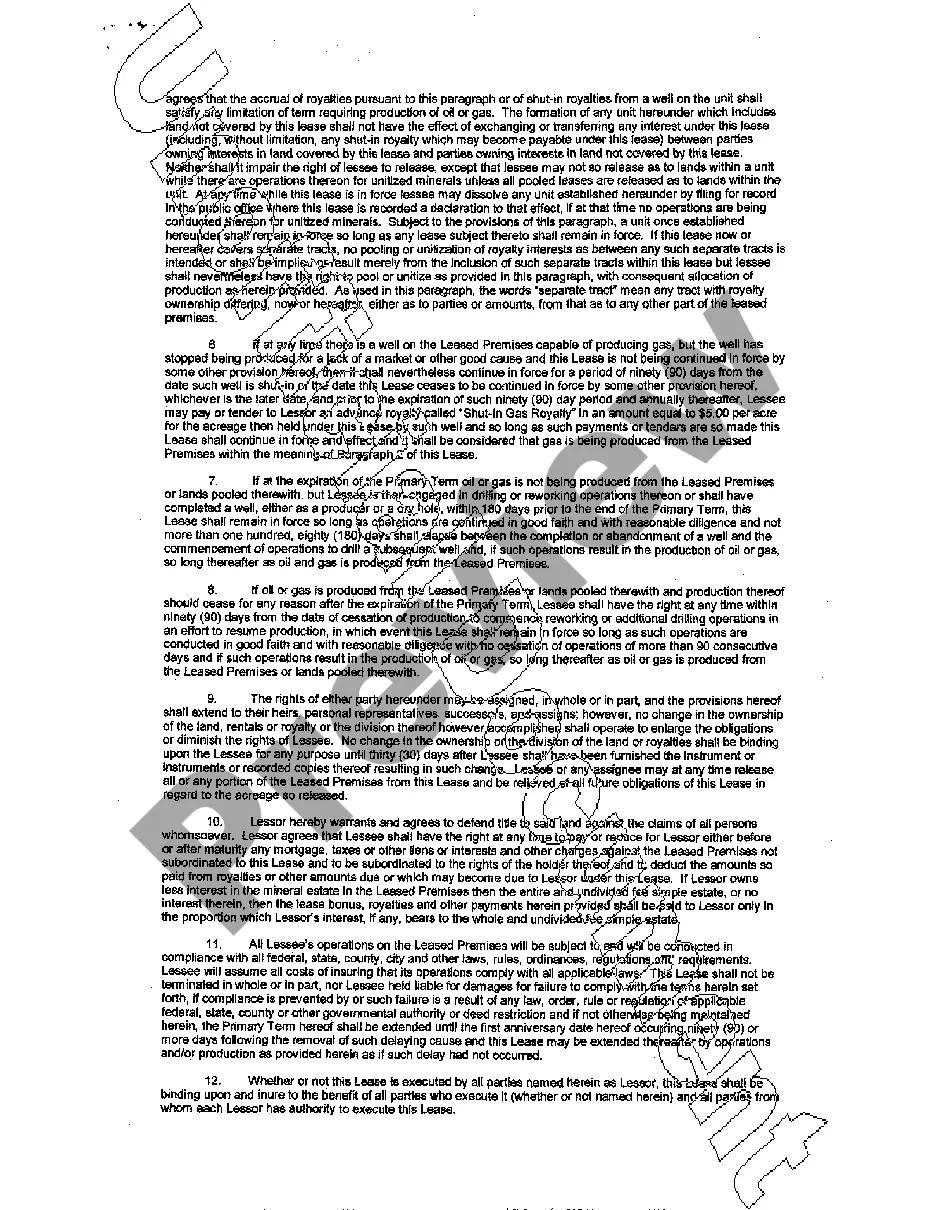

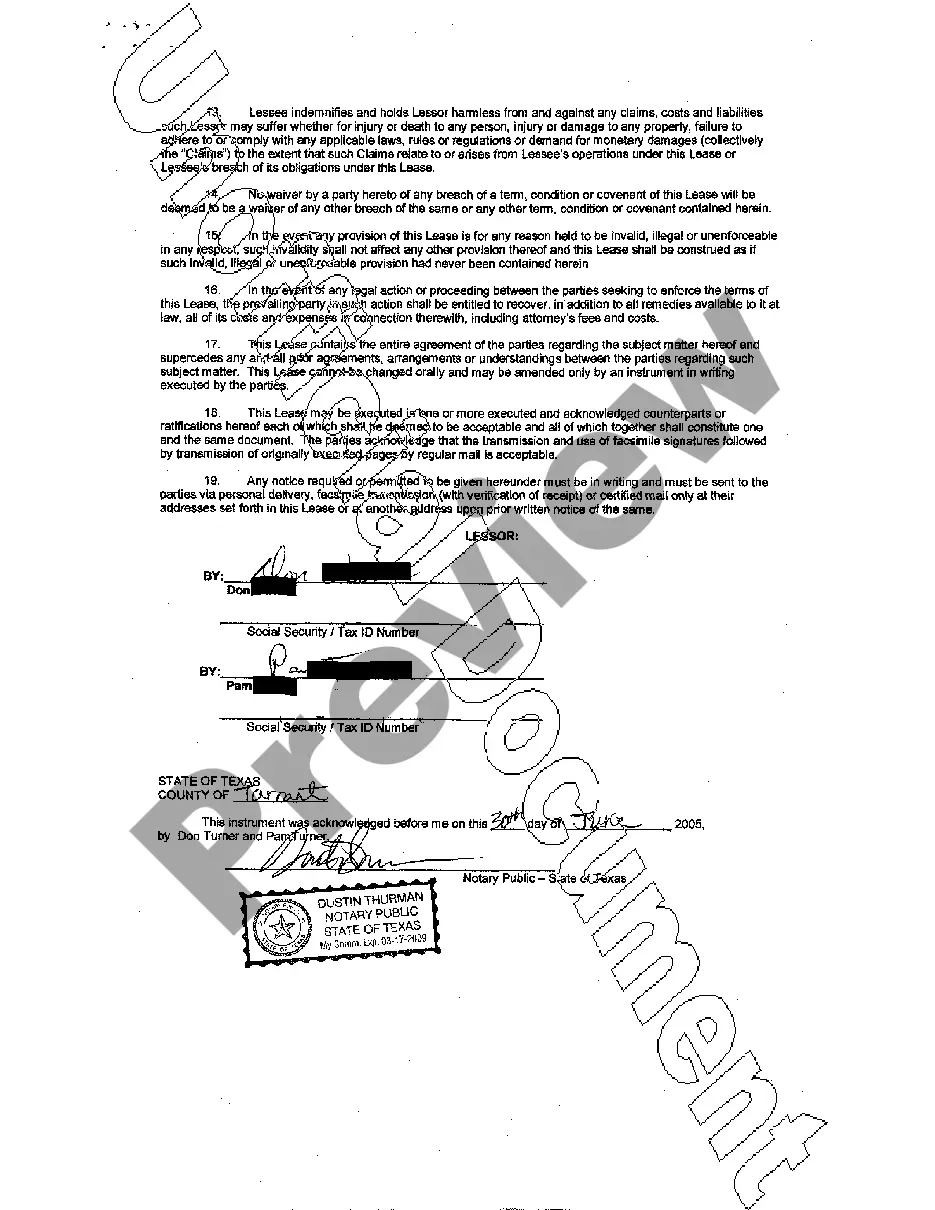

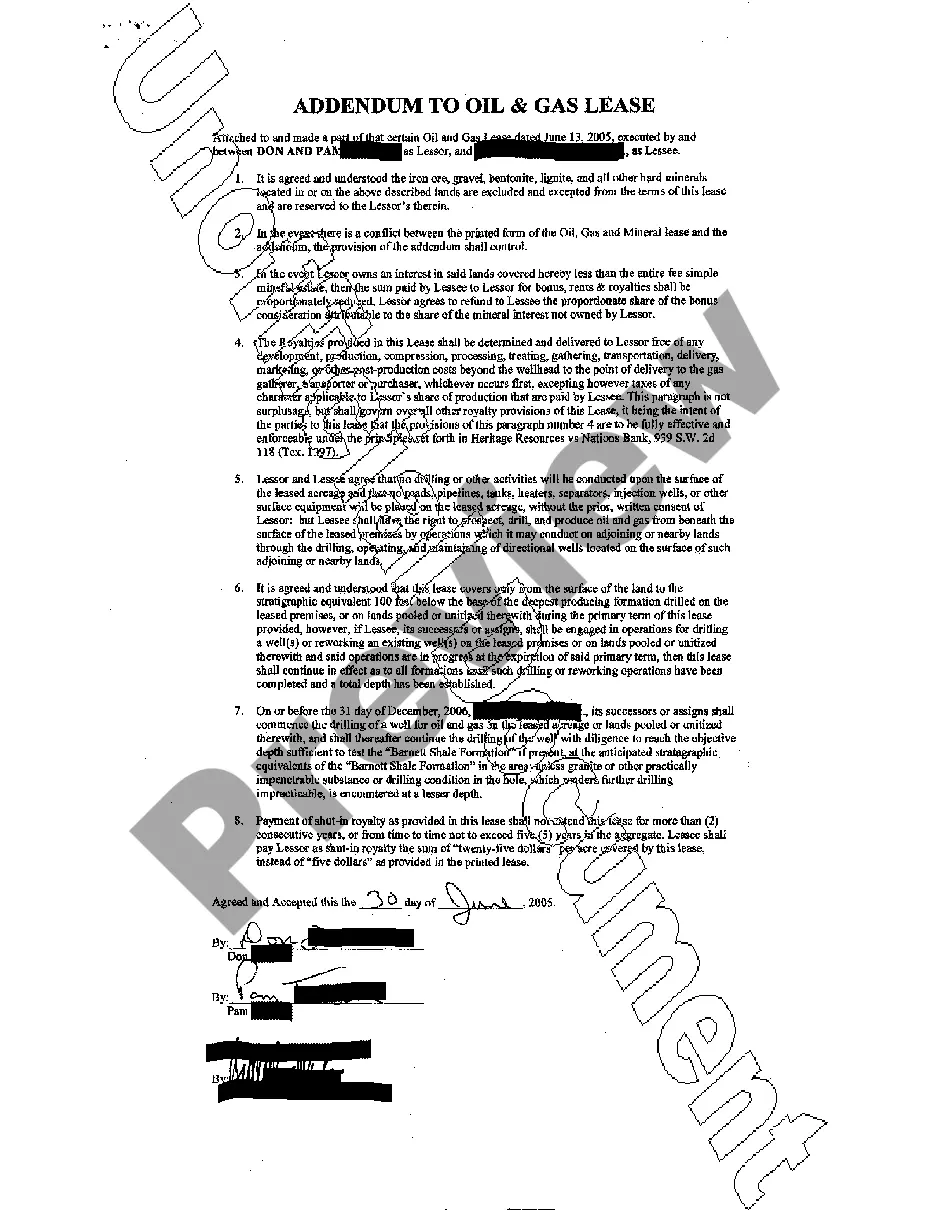

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

The Austin Texas Oil and Gas Lease refers to a legal agreement between a landowner (lessor) and an oil or gas exploration and production company (lessee) that grants the lessee the right to explore, extract, and produce oil and gas resources from a specific parcel of land in the Austin, Texas region. This lease is crucial for unlocking the potential of oil and gas reserves present in the area. The Austin Texas oil and gas lease provides a framework for both parties to establish their rights, obligations, and compensation concerning the extraction and production of oil and gas resources. Key elements typically found in such leases include the duration of the lease, the permitted activities (such as drilling and production), royalties or payments to be made to the lessor, environmental protection measures, and other terms and conditions governing the operations. It is essential to note that different types of Austin Texas Oil and Gas Leases exist, each catering to specific circumstances or priorities. One common type is the "Paid-up Lease," which involves the lessee making an upfront lump-sum payment to the lessor in exchange for the right to extract oil and gas without further monetary obligations. Another type is the "Term Lease," where the lease is granted for a specific period, typically a fixed number of years. At the end of the term, the lease may either terminate or be extended through negotiation. Additionally, there is the "Royalty Lease," wherein the lessor receives a percentage of the value of the oil and gas production (royalties) as compensation for granting the lease rights. This type of lease ensures that the lessor continues to receive income as long as the lessee is extracting resources. The percentage of royalty can vary depending on the negotiation between the parties involved and prevailing market conditions. Another type of Austin Texas Oil and Gas Lease is the "Overriding Royalty Interest (ORRIS) Lease." In this case, the lessor conveys a specific share of their royalties to a third party, called the overriding royalty interest owner. The ORRIS owner then receives a portion of the revenue generated from the lease in perpetuity or for a designated period. Given the significant role of oil and gas in the regional economy, the Austin Texas Oil and Gas Lease is a vital document enabling responsible resource development while ensuring fair compensation and protection of the landowner's interests.The Austin Texas Oil and Gas Lease refers to a legal agreement between a landowner (lessor) and an oil or gas exploration and production company (lessee) that grants the lessee the right to explore, extract, and produce oil and gas resources from a specific parcel of land in the Austin, Texas region. This lease is crucial for unlocking the potential of oil and gas reserves present in the area. The Austin Texas oil and gas lease provides a framework for both parties to establish their rights, obligations, and compensation concerning the extraction and production of oil and gas resources. Key elements typically found in such leases include the duration of the lease, the permitted activities (such as drilling and production), royalties or payments to be made to the lessor, environmental protection measures, and other terms and conditions governing the operations. It is essential to note that different types of Austin Texas Oil and Gas Leases exist, each catering to specific circumstances or priorities. One common type is the "Paid-up Lease," which involves the lessee making an upfront lump-sum payment to the lessor in exchange for the right to extract oil and gas without further monetary obligations. Another type is the "Term Lease," where the lease is granted for a specific period, typically a fixed number of years. At the end of the term, the lease may either terminate or be extended through negotiation. Additionally, there is the "Royalty Lease," wherein the lessor receives a percentage of the value of the oil and gas production (royalties) as compensation for granting the lease rights. This type of lease ensures that the lessor continues to receive income as long as the lessee is extracting resources. The percentage of royalty can vary depending on the negotiation between the parties involved and prevailing market conditions. Another type of Austin Texas Oil and Gas Lease is the "Overriding Royalty Interest (ORRIS) Lease." In this case, the lessor conveys a specific share of their royalties to a third party, called the overriding royalty interest owner. The ORRIS owner then receives a portion of the revenue generated from the lease in perpetuity or for a designated period. Given the significant role of oil and gas in the regional economy, the Austin Texas Oil and Gas Lease is a vital document enabling responsible resource development while ensuring fair compensation and protection of the landowner's interests.