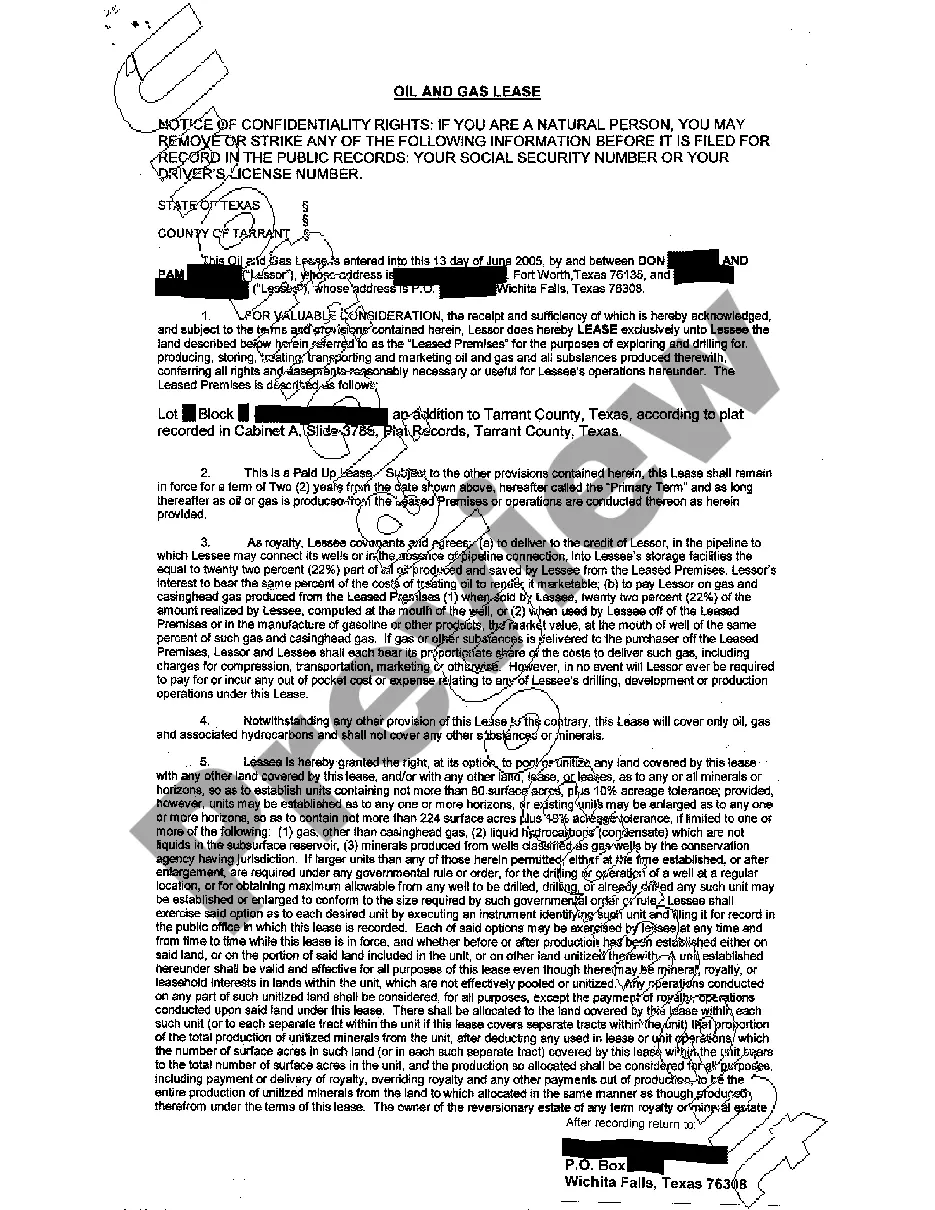

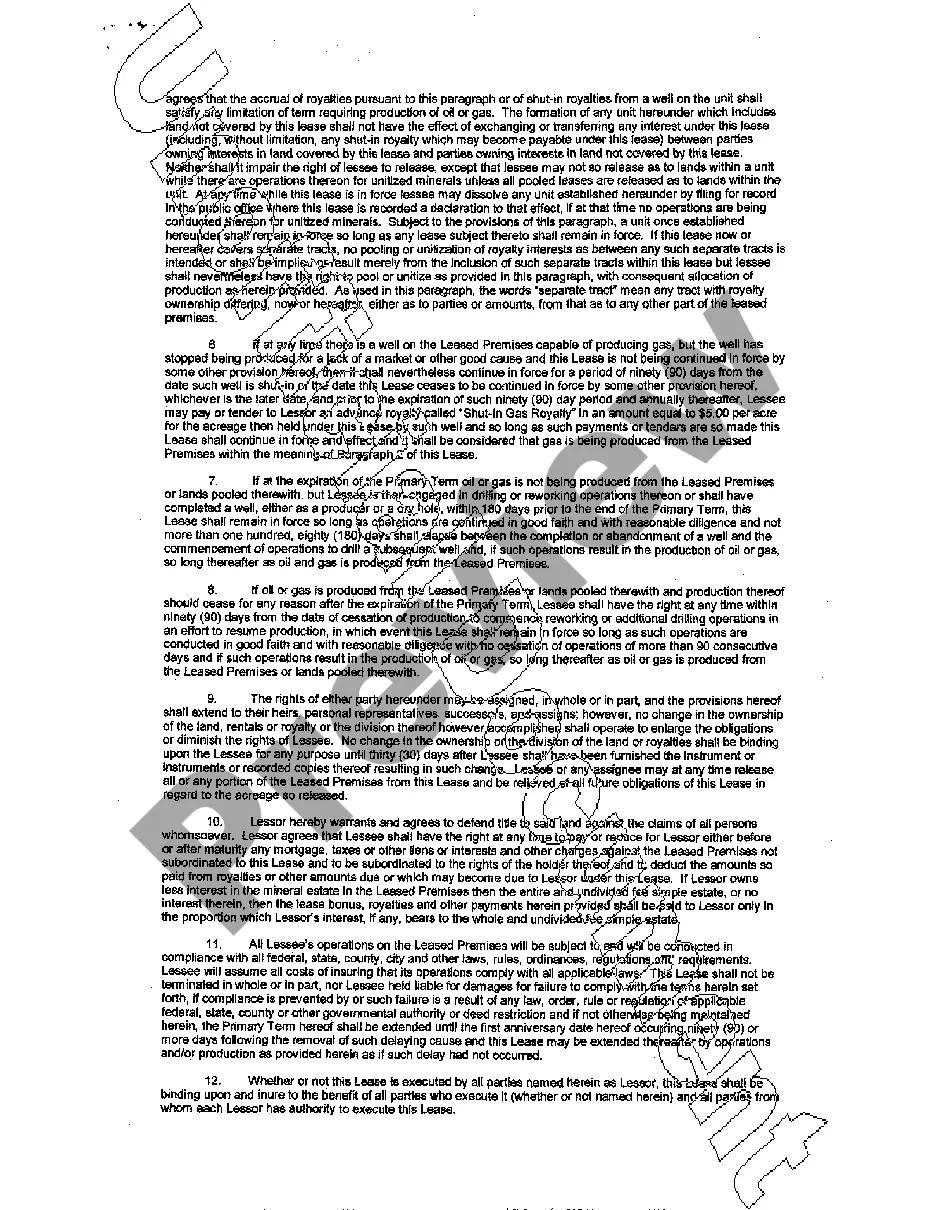

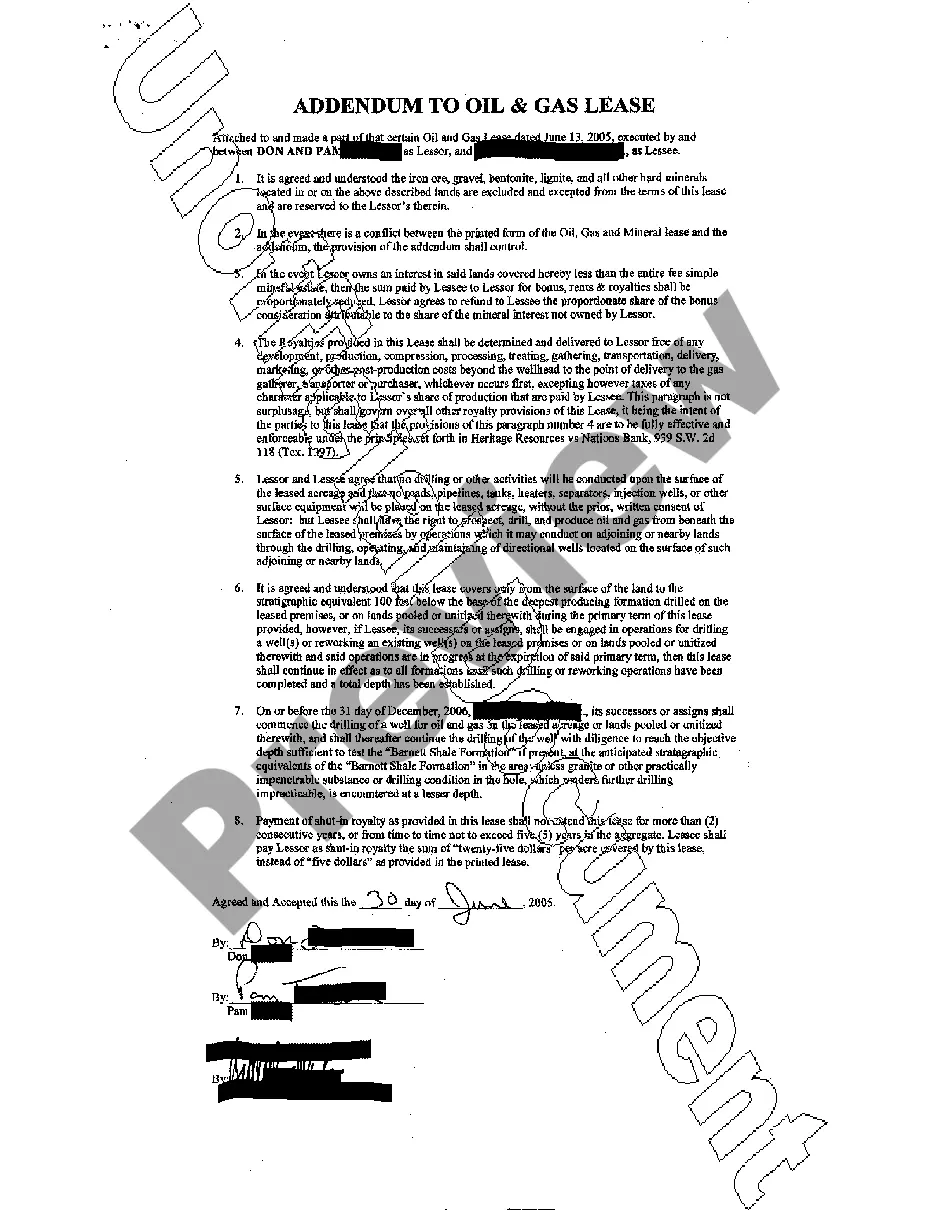

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

A Beaumont Texas Oil and Gas Lease is a legally binding agreement between a landowner (lessor) and an exploration and production company (lessee) to grant the lessee the right to explore, drill, and extract oil and gas resources from the lessor's property in Beaumont, Texas. This lease allows the lessee to conduct operations on the leased property in exchange for financial compensation known as royalties. Beaumont, Texas, located within the prolific oil-rich East Texas Basin, has a long history of oil and gas production. The region is well-known for its vast hydrocarbon resources, making it valuable for energy companies seeking to tap into its potential. Consequently, various types of Beaumont Texas Oil and Gas Leases exist, catering to different needs and circumstances. Some notable types of leases include: 1. Surface Lease: This type of lease grants the lessee only surface rights, allowing for activities like drilling, construction, and operation on the top layer of the leased property. It does not include the rights to extract oil and gas beneath the surface. 2. Mineral Lease: A mineral lease exclusively covers the rights to extract oil, gas, and other minerals from the leased property. Lessees have the freedom to explore and drill into the subsurface to access and produce hydrocarbon resources. 3. Undivided Interest Lease: In an undivided interest lease, multiple lessors collectively lease their undivided interests in a property to a lessee. Each lessor owns a fractional percentage of the property, and royalties are allocated accordingly. 4. Top Lease: A top lease is established when a new lease is granted on a property that already has an existing lease. It allows a secondary lessee to gain the rights to extract oil and gas if the primary lease expires or is prematurely terminated. 5. Royalty Lease: A royalty lease is an arrangement where the lessor receives a percentage of the revenues generated from the production of oil and gas. The lessee bears the costs of exploration, extraction, and marketing, while the lessor enjoys a share of the profits. It is essential for landowners considering a Beaumont Texas Oil and Gas Lease to thoroughly evaluate the terms, including royalty rates, lease duration, surface and subsurface rights, environmental provisions, and indemnification clauses. Engaging legal counsel is recommended to ensure the lease is fair and addresses all necessary considerations, ultimately protecting the interests of all parties involved.A Beaumont Texas Oil and Gas Lease is a legally binding agreement between a landowner (lessor) and an exploration and production company (lessee) to grant the lessee the right to explore, drill, and extract oil and gas resources from the lessor's property in Beaumont, Texas. This lease allows the lessee to conduct operations on the leased property in exchange for financial compensation known as royalties. Beaumont, Texas, located within the prolific oil-rich East Texas Basin, has a long history of oil and gas production. The region is well-known for its vast hydrocarbon resources, making it valuable for energy companies seeking to tap into its potential. Consequently, various types of Beaumont Texas Oil and Gas Leases exist, catering to different needs and circumstances. Some notable types of leases include: 1. Surface Lease: This type of lease grants the lessee only surface rights, allowing for activities like drilling, construction, and operation on the top layer of the leased property. It does not include the rights to extract oil and gas beneath the surface. 2. Mineral Lease: A mineral lease exclusively covers the rights to extract oil, gas, and other minerals from the leased property. Lessees have the freedom to explore and drill into the subsurface to access and produce hydrocarbon resources. 3. Undivided Interest Lease: In an undivided interest lease, multiple lessors collectively lease their undivided interests in a property to a lessee. Each lessor owns a fractional percentage of the property, and royalties are allocated accordingly. 4. Top Lease: A top lease is established when a new lease is granted on a property that already has an existing lease. It allows a secondary lessee to gain the rights to extract oil and gas if the primary lease expires or is prematurely terminated. 5. Royalty Lease: A royalty lease is an arrangement where the lessor receives a percentage of the revenues generated from the production of oil and gas. The lessee bears the costs of exploration, extraction, and marketing, while the lessor enjoys a share of the profits. It is essential for landowners considering a Beaumont Texas Oil and Gas Lease to thoroughly evaluate the terms, including royalty rates, lease duration, surface and subsurface rights, environmental provisions, and indemnification clauses. Engaging legal counsel is recommended to ensure the lease is fair and addresses all necessary considerations, ultimately protecting the interests of all parties involved.