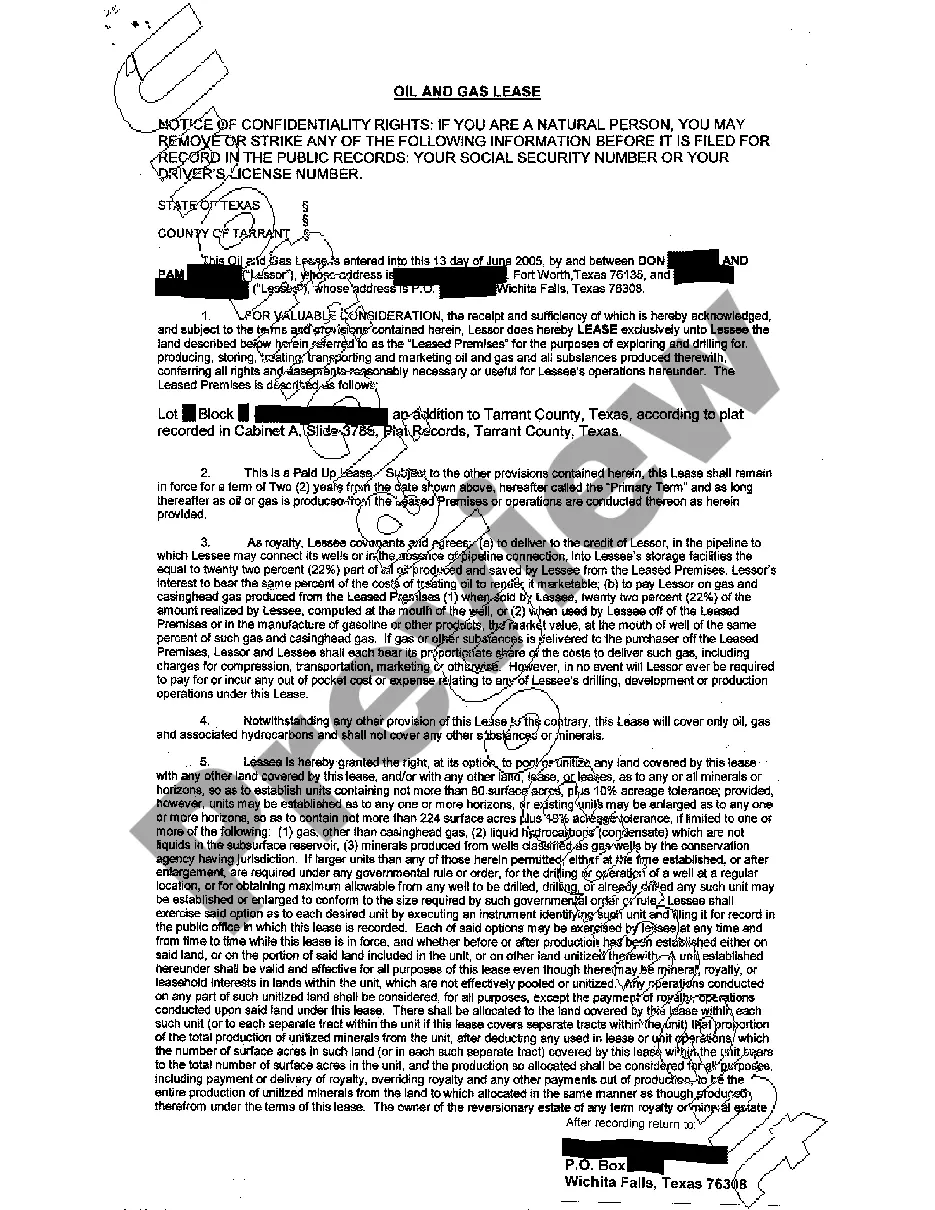

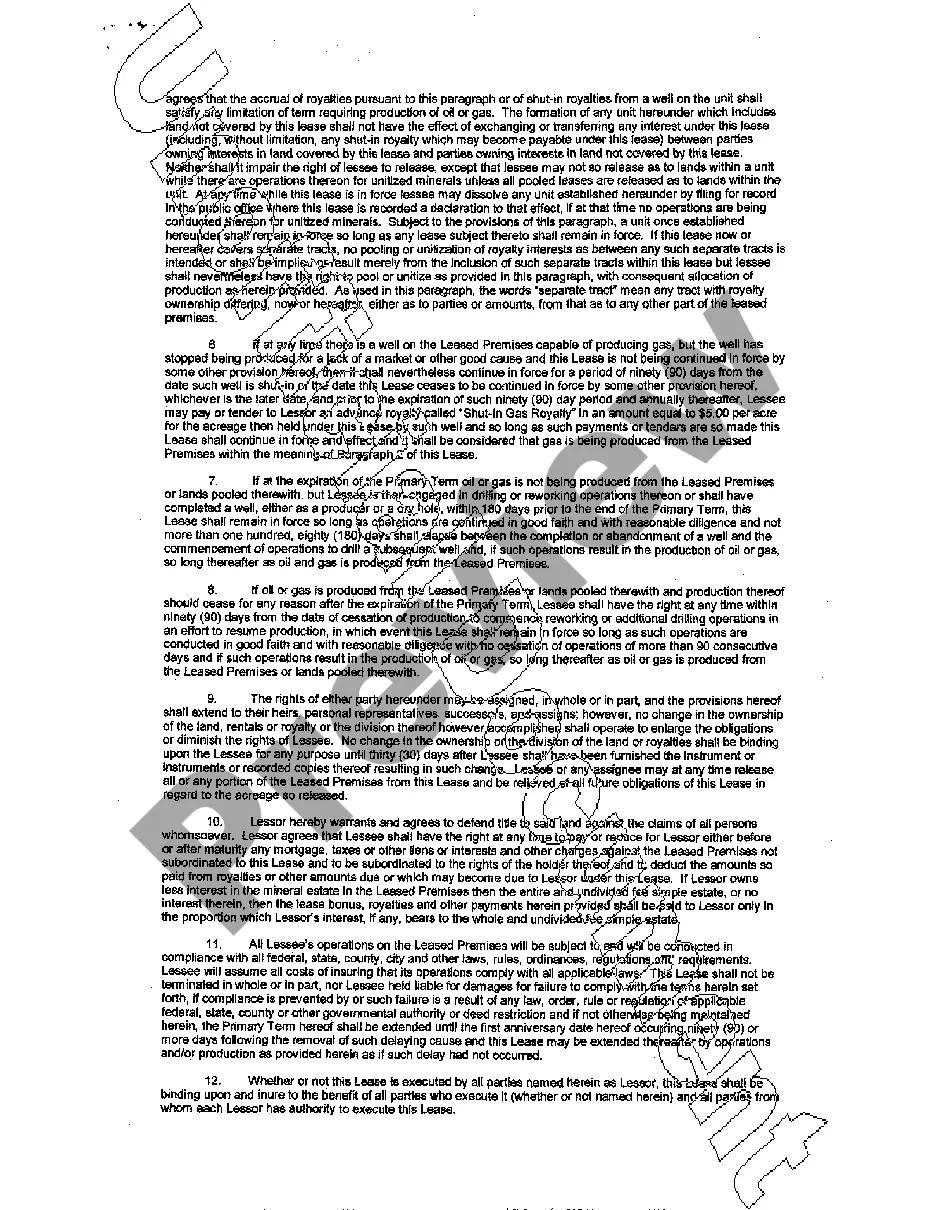

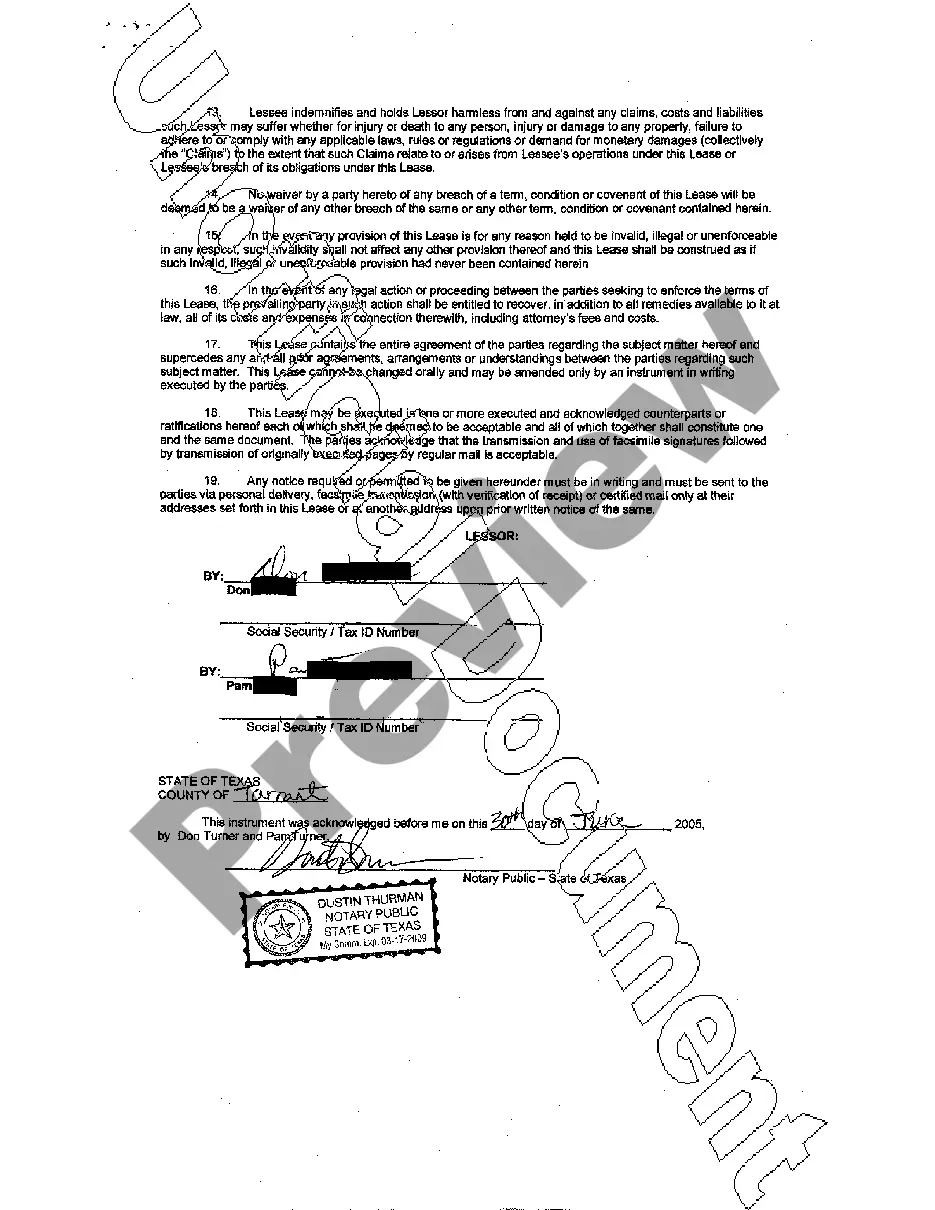

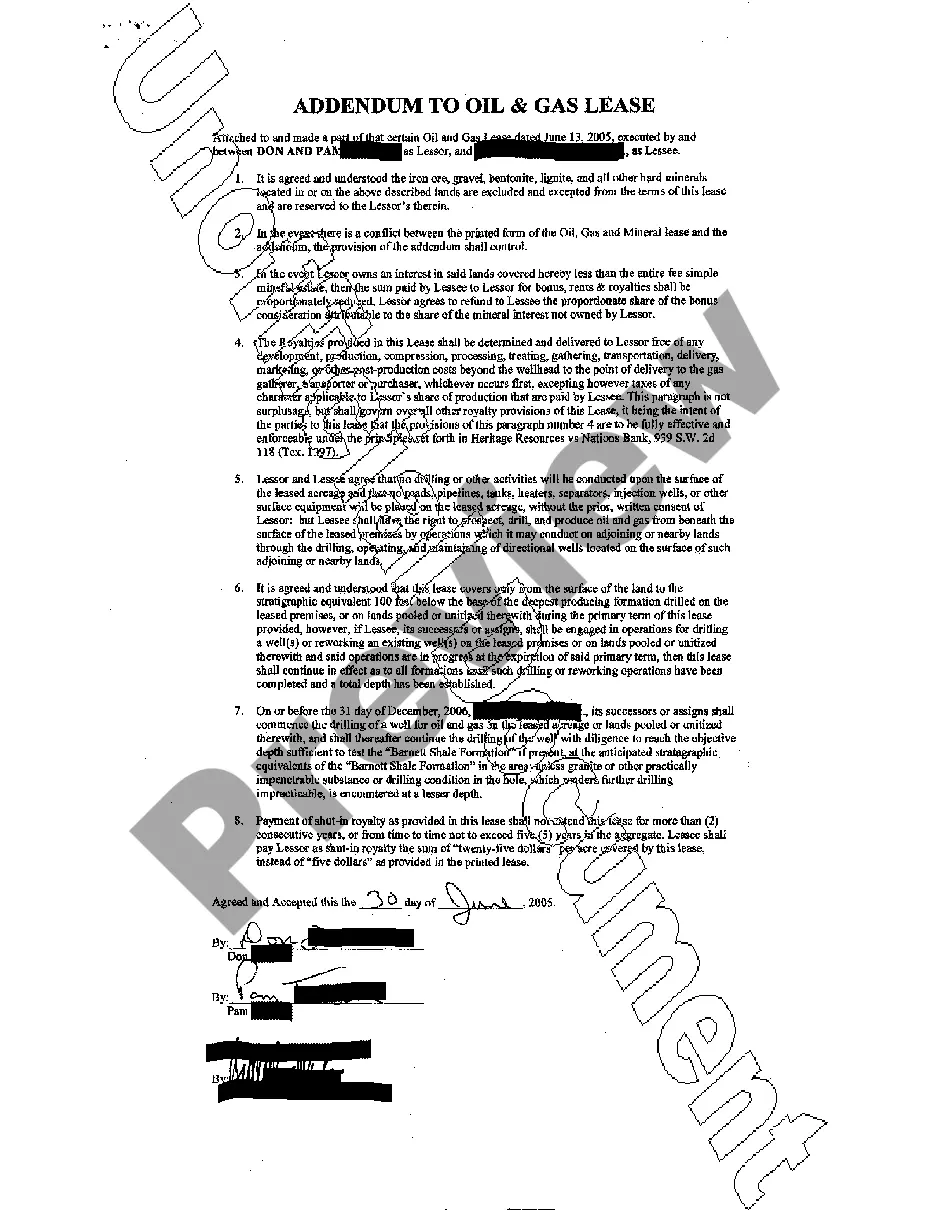

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

Title: Bexar Texas Oil and Gas Lease: A Comprehensive Overview and Various Lease Types Introduction: The Bexar Texas Oil and Gas Lease refers to a contractual agreement between a mineral rights owner (lessor) and an oil and gas company (lessee) allowing the lessee to explore and extract oil and gas resources from the lessor's property located in Bexar County, Texas. This detailed description explores various types of Bexar Texas Oil and Gas Leases, shedding light on their features, benefits, and legal considerations. 1. Primary Bexar Texas Oil and Gas Lease: The primary Bexar Texas Oil and Gas Lease is the initial lease agreement, typically encompassing a specific term, royalty rate, and lease bonus. The lessor grants the lessee exclusive rights to explore, drill, and extract resources within a designated area for a predetermined period, in exchange for compensation. 2. Extension and Renewal Bexar Texas Oil and Gas Lease: Under the primary lease, there may be provisions allowing for an extension or renewal of the lease term. Extensions typically require lessees to fulfill certain obligations, such as drilling a well within a specified time frame, while renewals occur when both parties agree to continue the lease beyond its original term. 3. Lease Assignment: Bexar Texas Oil and Gas Leases may allow lessees to assign or transfer their lease rights to another company or individual. Assignment provisions often involve the lessor's consent and can offer flexibility for lessees to optimize their operations or income potential. 4. Overriding Royalty Interest (ORRIS) Lease: An ORRIS lease, commonly used in Bexar Texas Oil and Gas Leases, grants a specific royalty interest to a party other than the lessor. This lease type ensures that a certain fraction or percentage of production revenue goes directly to the ORRIS owner, allowing them to profit from extracted resources without directly owning the mineral rights. 5. Surface Use Agreement: To address surface rights and minimize the impact of drilling operations, lessees may enter into a surface use agreement with the landowner, separate from the primary Bexar Texas Oil and Gas Lease. These agreements lay out specific terms for land use, compensation for surface damages, and environmental stewardship. 6. Modified Gross and Net Leases: Bexar Texas Oil and Gas Leases can include modified gross or net provisions that impact royalty calculations. In a modified gross lease, the lessee covers some costs before calculating the royalty amount, while a net lease deducts specific expenses from the royalty calculation. These variations play a crucial role in determining the lessor's ultimate royalty rate. Conclusion: The Bexar Texas Oil and Gas Lease serves as a critical framework for exploration and extraction activities conducted by oil and gas companies on mineral rights owned by individuals or companies in Bexar County, Texas. Exploring various lease types such as primary leases, extensions, lease assignments, ORRIS leases, surface use agreements, and modified gross/net leases ensures efficient and mutually beneficial arrangements between lessors and lessees. Understanding the intricacies of these lease types can empower both parties to make informed decisions and establish successful oil and gas operations.Title: Bexar Texas Oil and Gas Lease: A Comprehensive Overview and Various Lease Types Introduction: The Bexar Texas Oil and Gas Lease refers to a contractual agreement between a mineral rights owner (lessor) and an oil and gas company (lessee) allowing the lessee to explore and extract oil and gas resources from the lessor's property located in Bexar County, Texas. This detailed description explores various types of Bexar Texas Oil and Gas Leases, shedding light on their features, benefits, and legal considerations. 1. Primary Bexar Texas Oil and Gas Lease: The primary Bexar Texas Oil and Gas Lease is the initial lease agreement, typically encompassing a specific term, royalty rate, and lease bonus. The lessor grants the lessee exclusive rights to explore, drill, and extract resources within a designated area for a predetermined period, in exchange for compensation. 2. Extension and Renewal Bexar Texas Oil and Gas Lease: Under the primary lease, there may be provisions allowing for an extension or renewal of the lease term. Extensions typically require lessees to fulfill certain obligations, such as drilling a well within a specified time frame, while renewals occur when both parties agree to continue the lease beyond its original term. 3. Lease Assignment: Bexar Texas Oil and Gas Leases may allow lessees to assign or transfer their lease rights to another company or individual. Assignment provisions often involve the lessor's consent and can offer flexibility for lessees to optimize their operations or income potential. 4. Overriding Royalty Interest (ORRIS) Lease: An ORRIS lease, commonly used in Bexar Texas Oil and Gas Leases, grants a specific royalty interest to a party other than the lessor. This lease type ensures that a certain fraction or percentage of production revenue goes directly to the ORRIS owner, allowing them to profit from extracted resources without directly owning the mineral rights. 5. Surface Use Agreement: To address surface rights and minimize the impact of drilling operations, lessees may enter into a surface use agreement with the landowner, separate from the primary Bexar Texas Oil and Gas Lease. These agreements lay out specific terms for land use, compensation for surface damages, and environmental stewardship. 6. Modified Gross and Net Leases: Bexar Texas Oil and Gas Leases can include modified gross or net provisions that impact royalty calculations. In a modified gross lease, the lessee covers some costs before calculating the royalty amount, while a net lease deducts specific expenses from the royalty calculation. These variations play a crucial role in determining the lessor's ultimate royalty rate. Conclusion: The Bexar Texas Oil and Gas Lease serves as a critical framework for exploration and extraction activities conducted by oil and gas companies on mineral rights owned by individuals or companies in Bexar County, Texas. Exploring various lease types such as primary leases, extensions, lease assignments, ORRIS leases, surface use agreements, and modified gross/net leases ensures efficient and mutually beneficial arrangements between lessors and lessees. Understanding the intricacies of these lease types can empower both parties to make informed decisions and establish successful oil and gas operations.