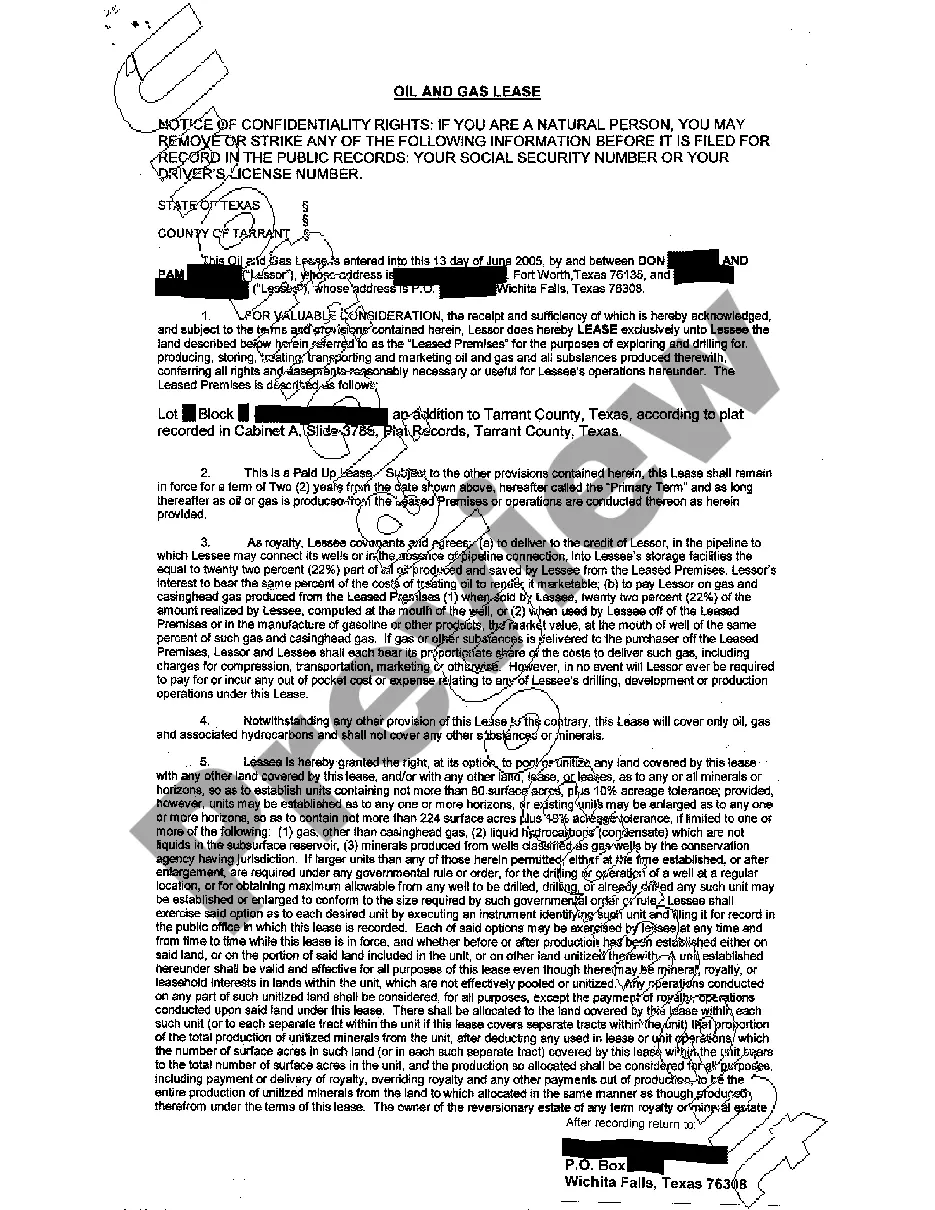

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

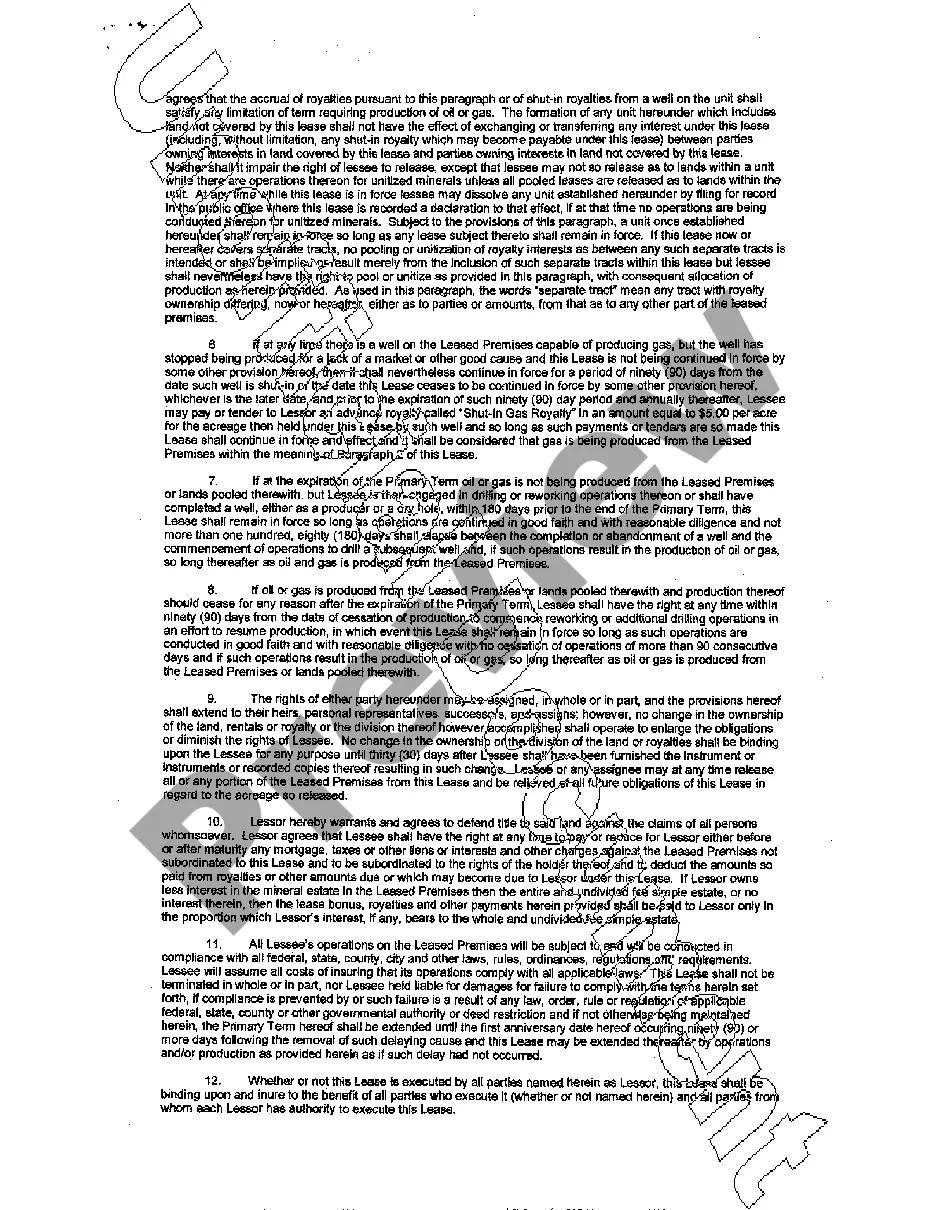

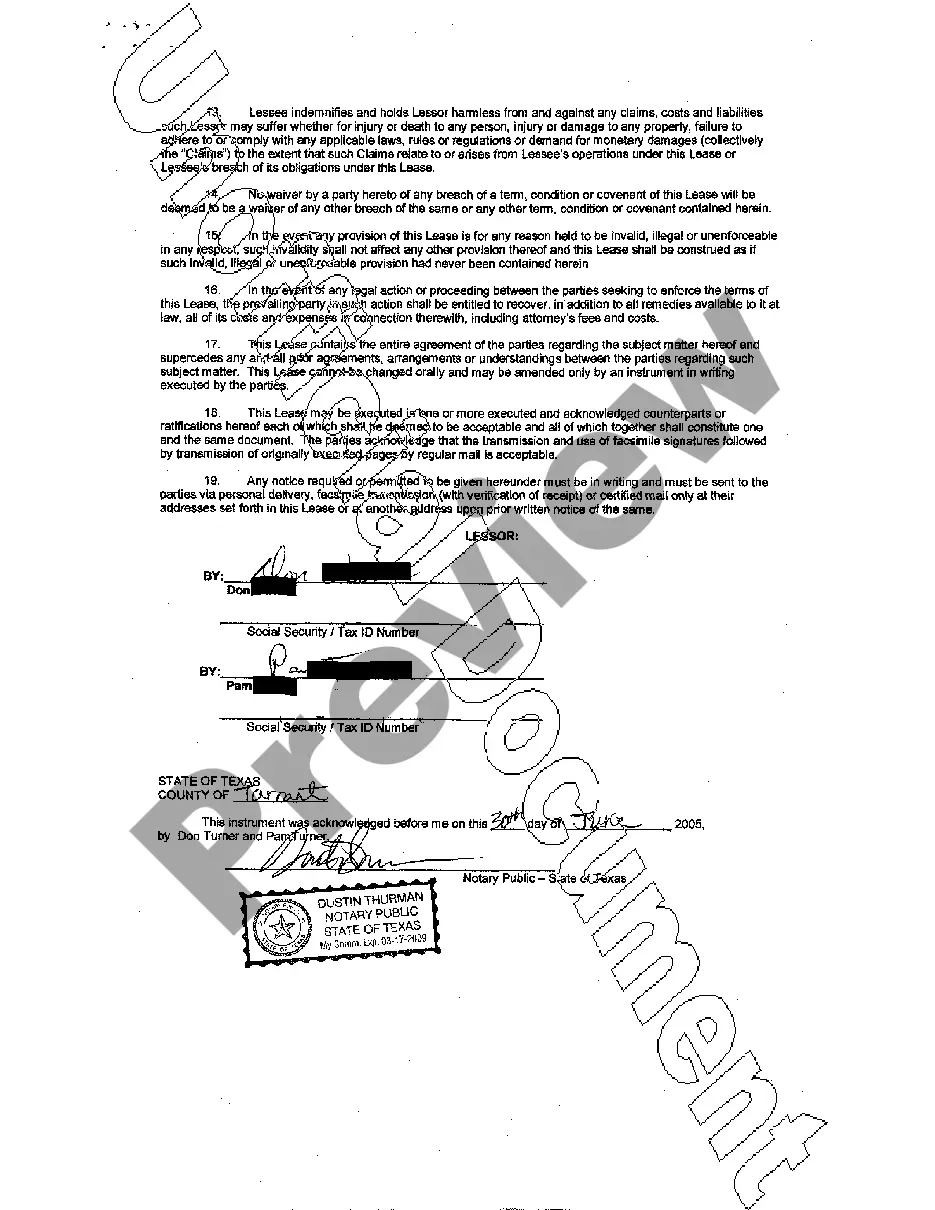

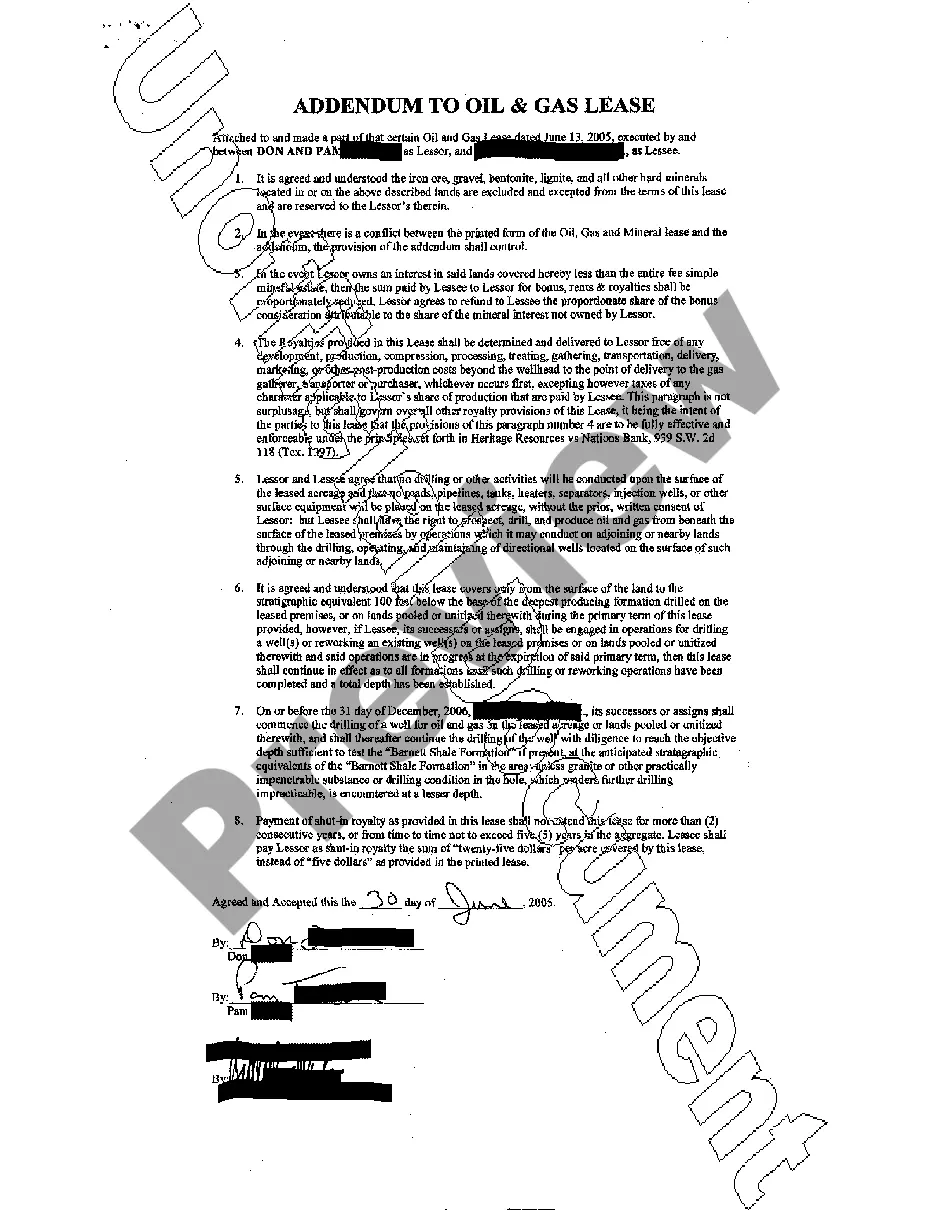

Fort Worth Texas Oil and Gas Lease is a type of legal agreement that grants a specific party or individual, known as the lessee, the rights to explore, extract, and produce oil and gas resources within a designated area in Fort Worth, Texas. This lease is commonly utilized in the energy industry to facilitate oil and gas exploration and production activities. The Fort Worth Texas Oil and Gas Lease typically involves several key provisions and terms that outline the rights and obligations of both the lessor (the landowner) and the lessee. These provisions include: 1. Primary Term: The initial period during which the lessee has the right to explore and produce oil and gas on the leased property. It is usually a fixed term ranging from a few years to a few decades. 2. Bonus Consideration: The money paid by the lessee to the lessor as a one-time upfront payment for the lease. It is a form of compensation for granting the right to explore and produce oil and gas on the property. 3. Royalty Clause: A provision that entitles the lessor to receive a certain percentage, known as the royalty rate, of the proceeds from the sale of oil and gas extracted from the leased property. 4. Cost Recovery Clause: This clause allows the lessee to recover certain exploration and development costs from the lessor's share of production before royalty payments are made. 5. Depth Clause: Specifies the depths at which the lease is valid, often differentiated as "shallow rights" and "deep rights." Shallow rights cover oil and gas resources close to the surface, while deep rights pertain to resources located at greater depths. 6. Drilling and Operations: Sets forth requirements and regulations related to the lessee's drilling operations, operational procedures, and environmental safeguards on the leased property. Different types of Fort Worth Texas Oil and Gas Leases may exist, mainly differentiated based on the nature of the leasing parties and their objectives. For instance: 1. Private Leases: These are negotiated between individual landowners and oil and gas companies for the use of their properties. Terms and conditions can vary depending on the specific agreement. 2. State Leases: These are leases issued by the State of Texas for state-owned lands. The terms and processes involved may be distinct from private leases. 3. Federal Leases: Issued by the Bureau of Land Management (BLM), these leases pertain to oil and gas exploration and production on federal lands. They adhere to federal regulations and may have specific lease terms. It is important to note that Fort Worth Texas Oil and Gas Leases conform to state regulations and industry standards, and specific details may vary from lease to lease. Consequently, it is crucial for any party involved in these leases to seek legal guidance and thoroughly understand the terms before entering into such agreements.Fort Worth Texas Oil and Gas Lease is a type of legal agreement that grants a specific party or individual, known as the lessee, the rights to explore, extract, and produce oil and gas resources within a designated area in Fort Worth, Texas. This lease is commonly utilized in the energy industry to facilitate oil and gas exploration and production activities. The Fort Worth Texas Oil and Gas Lease typically involves several key provisions and terms that outline the rights and obligations of both the lessor (the landowner) and the lessee. These provisions include: 1. Primary Term: The initial period during which the lessee has the right to explore and produce oil and gas on the leased property. It is usually a fixed term ranging from a few years to a few decades. 2. Bonus Consideration: The money paid by the lessee to the lessor as a one-time upfront payment for the lease. It is a form of compensation for granting the right to explore and produce oil and gas on the property. 3. Royalty Clause: A provision that entitles the lessor to receive a certain percentage, known as the royalty rate, of the proceeds from the sale of oil and gas extracted from the leased property. 4. Cost Recovery Clause: This clause allows the lessee to recover certain exploration and development costs from the lessor's share of production before royalty payments are made. 5. Depth Clause: Specifies the depths at which the lease is valid, often differentiated as "shallow rights" and "deep rights." Shallow rights cover oil and gas resources close to the surface, while deep rights pertain to resources located at greater depths. 6. Drilling and Operations: Sets forth requirements and regulations related to the lessee's drilling operations, operational procedures, and environmental safeguards on the leased property. Different types of Fort Worth Texas Oil and Gas Leases may exist, mainly differentiated based on the nature of the leasing parties and their objectives. For instance: 1. Private Leases: These are negotiated between individual landowners and oil and gas companies for the use of their properties. Terms and conditions can vary depending on the specific agreement. 2. State Leases: These are leases issued by the State of Texas for state-owned lands. The terms and processes involved may be distinct from private leases. 3. Federal Leases: Issued by the Bureau of Land Management (BLM), these leases pertain to oil and gas exploration and production on federal lands. They adhere to federal regulations and may have specific lease terms. It is important to note that Fort Worth Texas Oil and Gas Leases conform to state regulations and industry standards, and specific details may vary from lease to lease. Consequently, it is crucial for any party involved in these leases to seek legal guidance and thoroughly understand the terms before entering into such agreements.