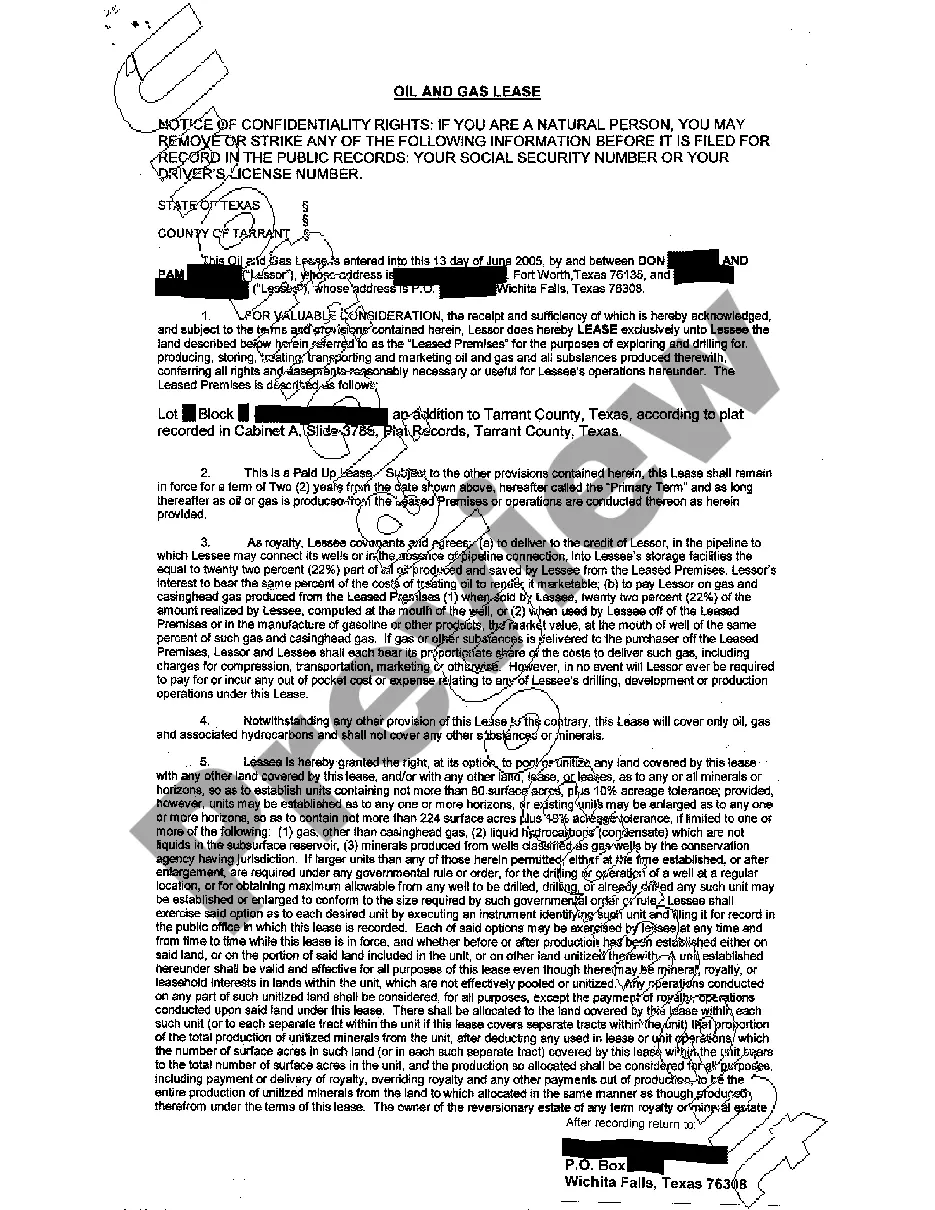

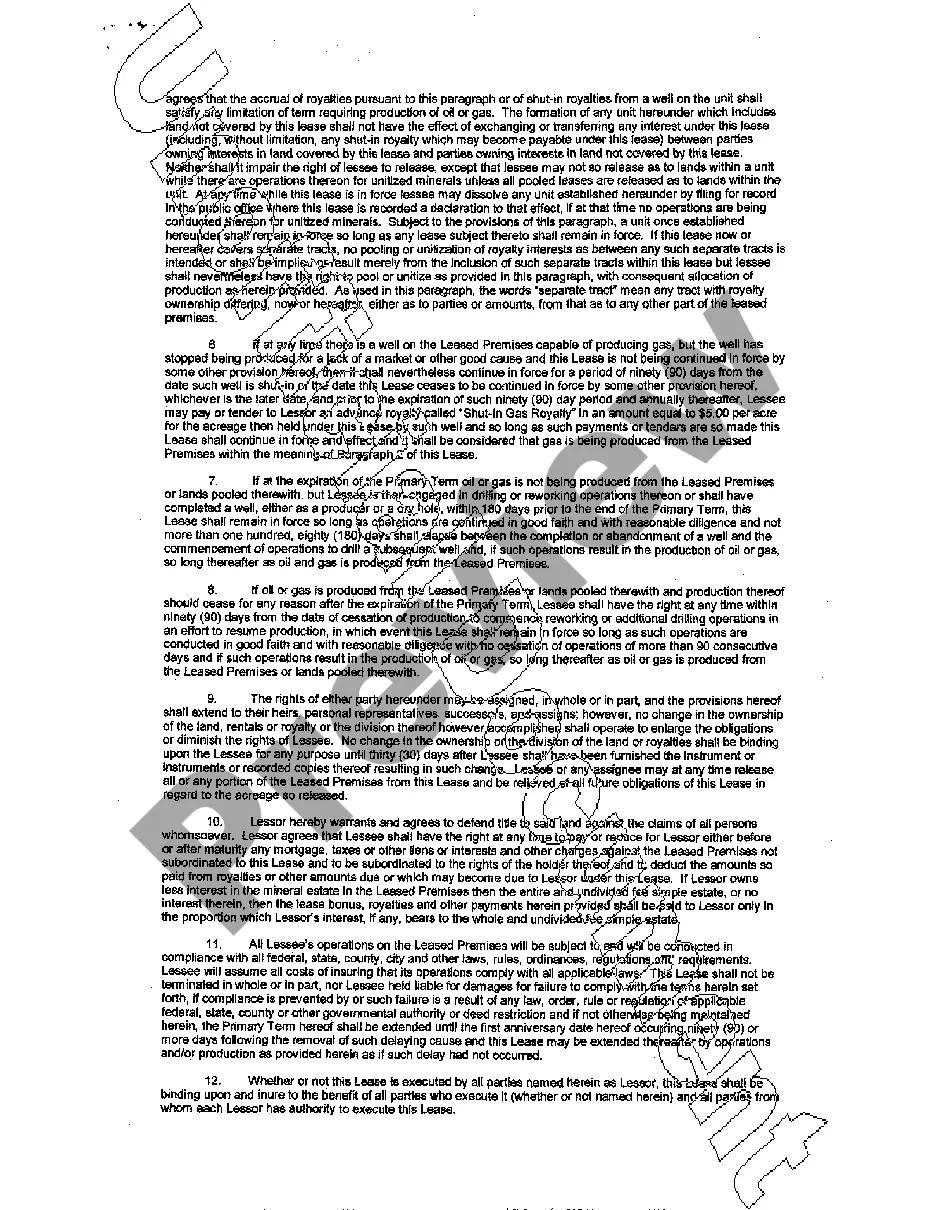

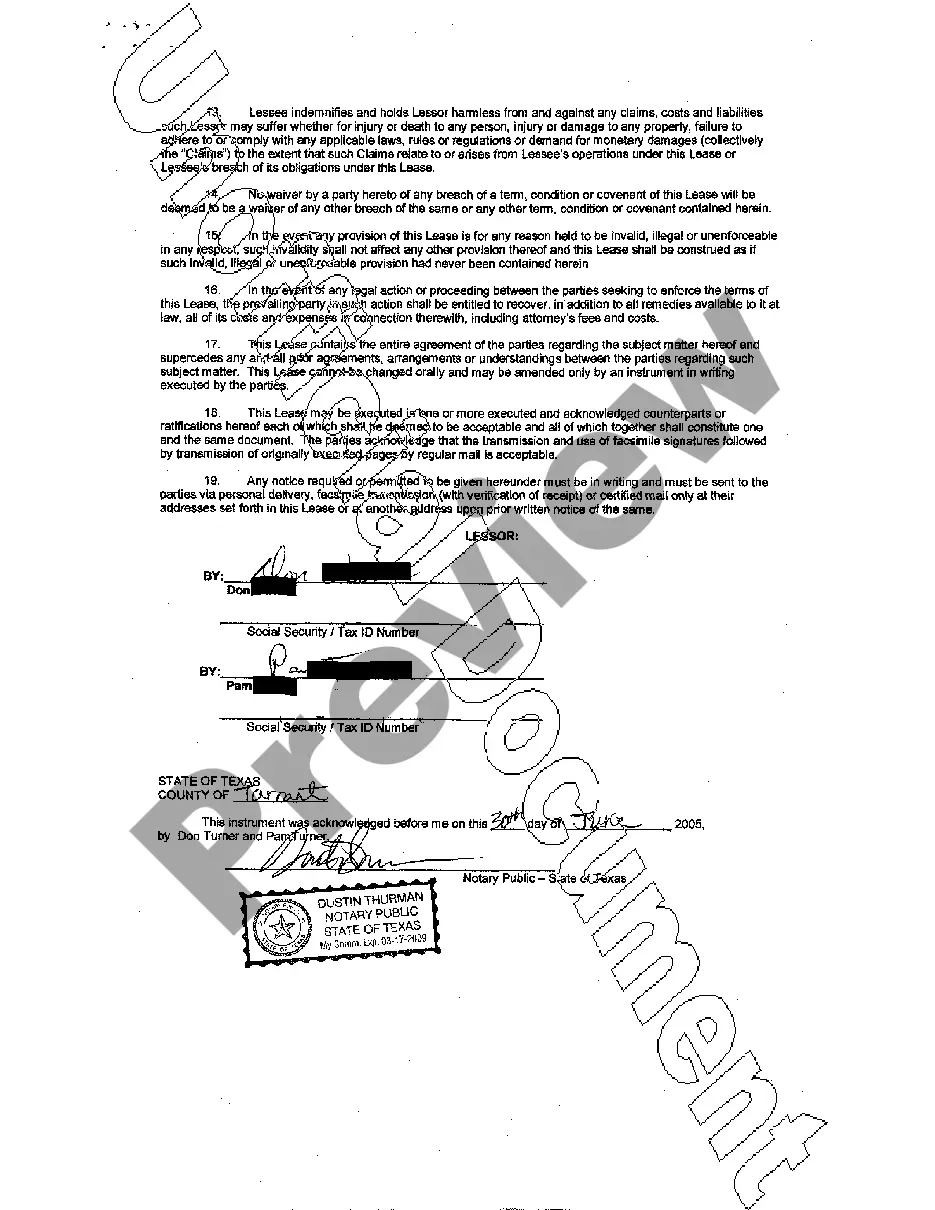

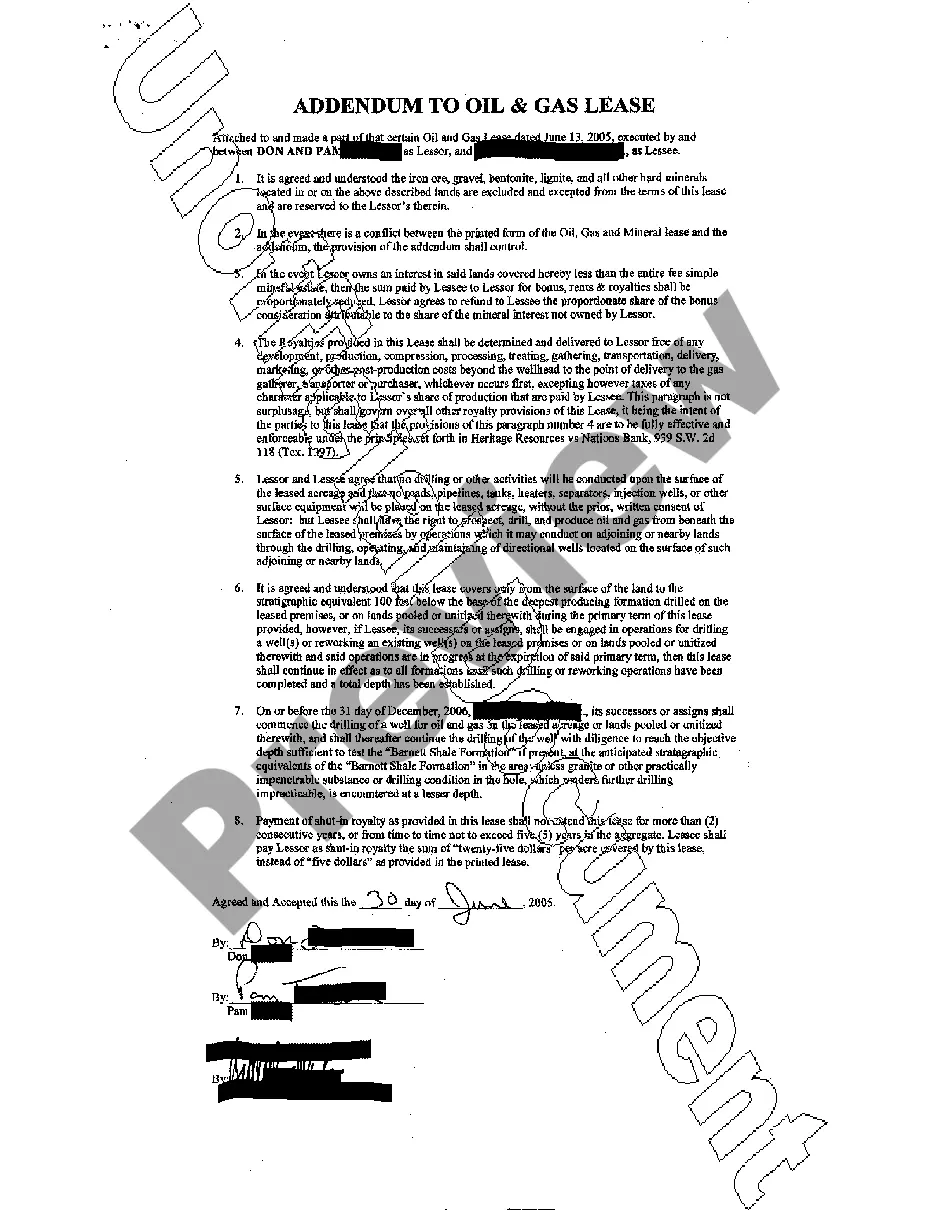

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

Harris Texas Oil and Gas Lease is a legally binding agreement between mineral rights owners (lessors) and oil and gas companies (lessees) for the exploration and extraction of oil and gas reserves in Harris County, Texas. The lease governs the terms and conditions under which the lessee has the right to explore, drill, and produce oil and gas from the lessor's land. Typically, a Harris Texas Oil and Gas Lease includes various key elements. Firstly, it outlines the specific property being leased, including legal descriptions and acreage. Secondly, it specifies the term of the lease, which can range from a few years to several decades, and may include extension options. The lease also covers the royalty rates, which dictate the percentage of oil and gas production proceeds that the lessor is entitled to receive. Additionally, it includes provisions regarding the lessee's obligations for drilling, operating, and maintaining the wells on the property, as well as regulations on environmental protection and safety measures. There are several types of Harris Texas Oil and Gas Leases, each with its unique characteristics and considerations. Some notable types include: 1. Paid-Up Lease: A paid-up lease requires the lessee to make a lump sum payment to the lessor for the entire lease term upfront. This arrangement eliminates the need for ongoing royalty payments. 2. Term Lease: A term lease grants the lessee the right to explore and extract oil and gas reserves for a specific period. Once the term expires, the lease is terminated unless the lessee exercises an extension option. 3. Royalty Lease: In a royalty lease, the lessor receives a percentage of the proceeds from oil and gas production, commonly known as a royalty interest. Royalty rates can vary but are typically in the range of 12.5% to 25%. 4. Operating Lease: An operating lease obligates the lessee to cover all costs associated with drilling, operating, and maintaining the wells. In return, the lessor receives a share of the oil and gas produced. It is crucial for both lessors and lessees to thoroughly understand the terms and provisions outlined in a Harris Texas Oil and Gas Lease to ensure a fair and mutually beneficial agreement. Seeking legal advice is highly recommended addressing any questions and mitigate potential risks when entering into such leases.Harris Texas Oil and Gas Lease is a legally binding agreement between mineral rights owners (lessors) and oil and gas companies (lessees) for the exploration and extraction of oil and gas reserves in Harris County, Texas. The lease governs the terms and conditions under which the lessee has the right to explore, drill, and produce oil and gas from the lessor's land. Typically, a Harris Texas Oil and Gas Lease includes various key elements. Firstly, it outlines the specific property being leased, including legal descriptions and acreage. Secondly, it specifies the term of the lease, which can range from a few years to several decades, and may include extension options. The lease also covers the royalty rates, which dictate the percentage of oil and gas production proceeds that the lessor is entitled to receive. Additionally, it includes provisions regarding the lessee's obligations for drilling, operating, and maintaining the wells on the property, as well as regulations on environmental protection and safety measures. There are several types of Harris Texas Oil and Gas Leases, each with its unique characteristics and considerations. Some notable types include: 1. Paid-Up Lease: A paid-up lease requires the lessee to make a lump sum payment to the lessor for the entire lease term upfront. This arrangement eliminates the need for ongoing royalty payments. 2. Term Lease: A term lease grants the lessee the right to explore and extract oil and gas reserves for a specific period. Once the term expires, the lease is terminated unless the lessee exercises an extension option. 3. Royalty Lease: In a royalty lease, the lessor receives a percentage of the proceeds from oil and gas production, commonly known as a royalty interest. Royalty rates can vary but are typically in the range of 12.5% to 25%. 4. Operating Lease: An operating lease obligates the lessee to cover all costs associated with drilling, operating, and maintaining the wells. In return, the lessor receives a share of the oil and gas produced. It is crucial for both lessors and lessees to thoroughly understand the terms and provisions outlined in a Harris Texas Oil and Gas Lease to ensure a fair and mutually beneficial agreement. Seeking legal advice is highly recommended addressing any questions and mitigate potential risks when entering into such leases.