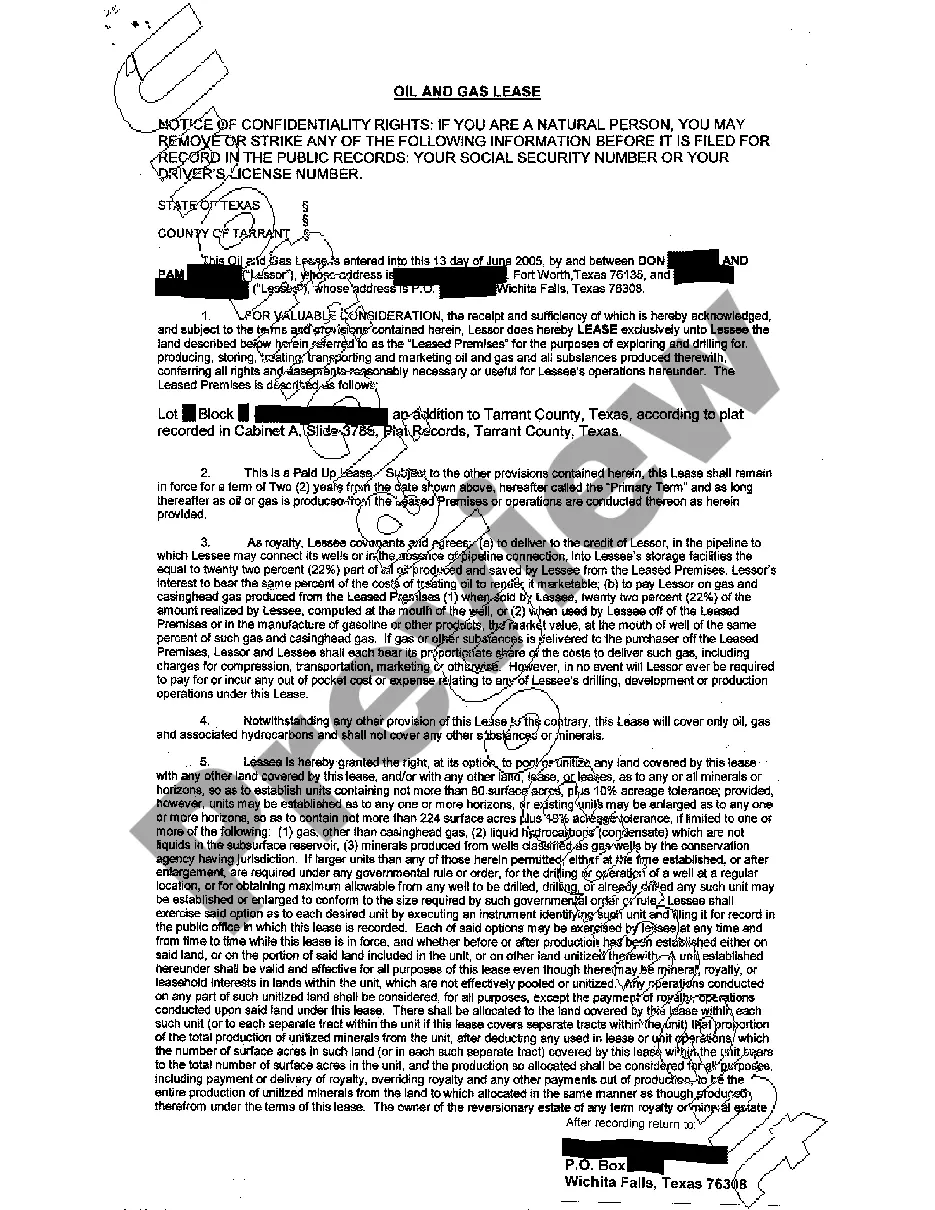

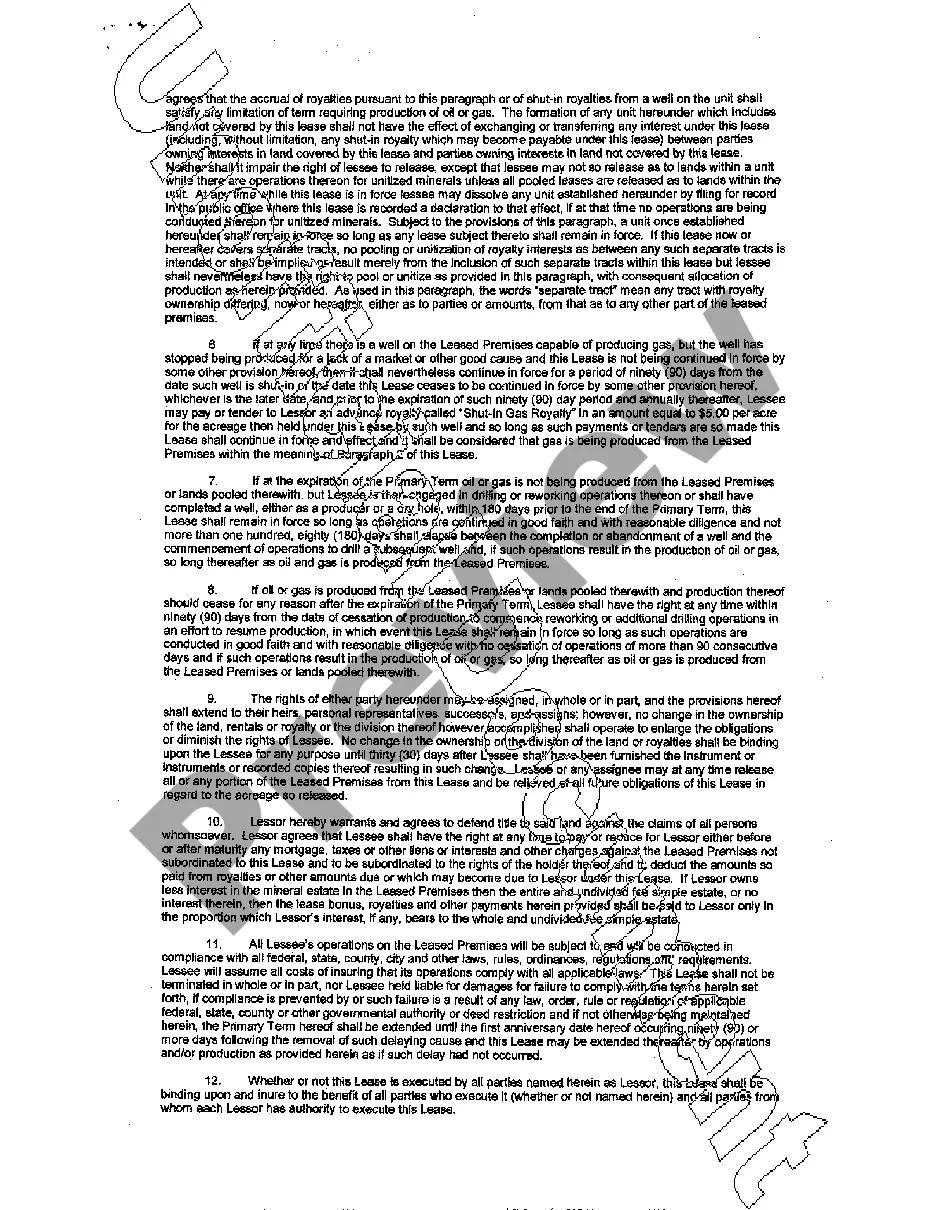

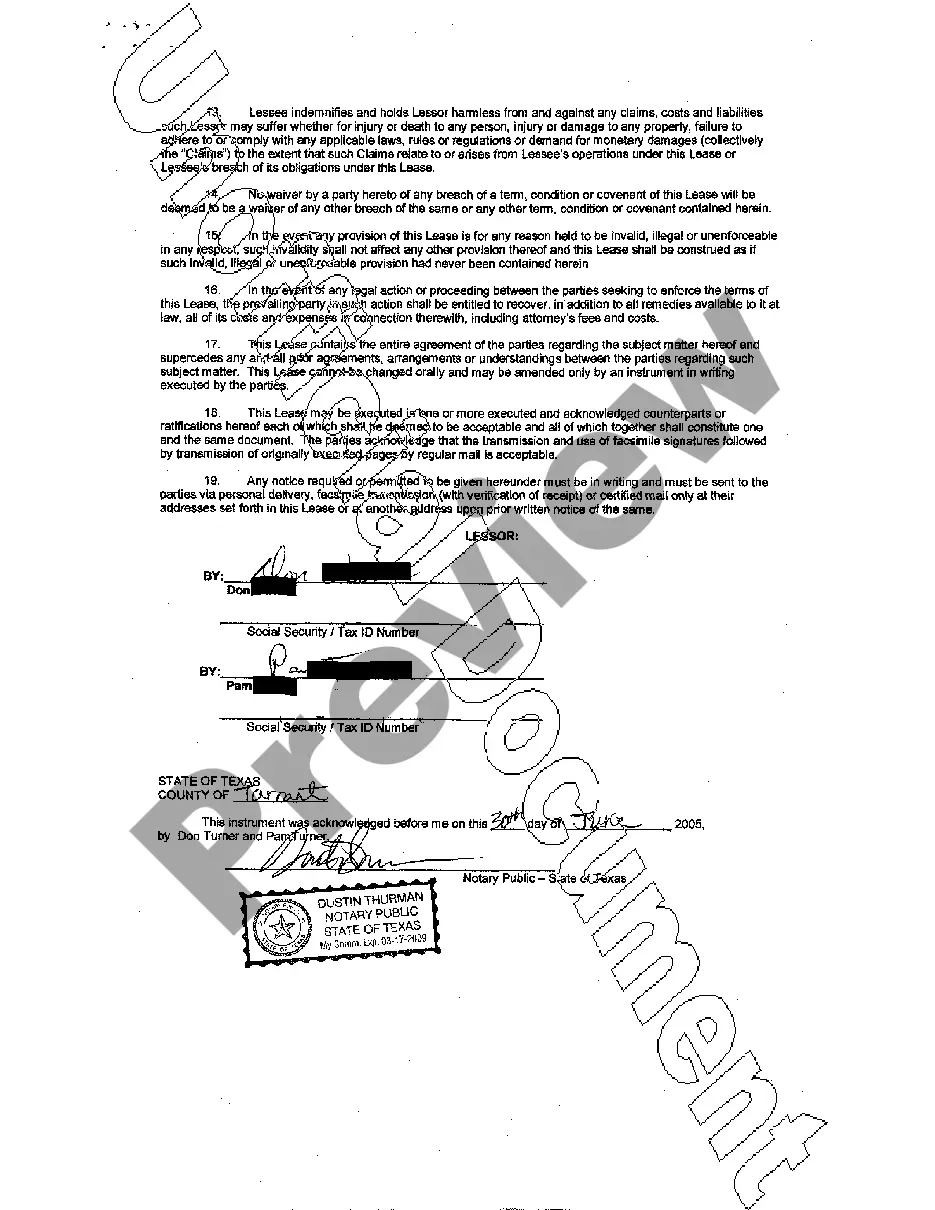

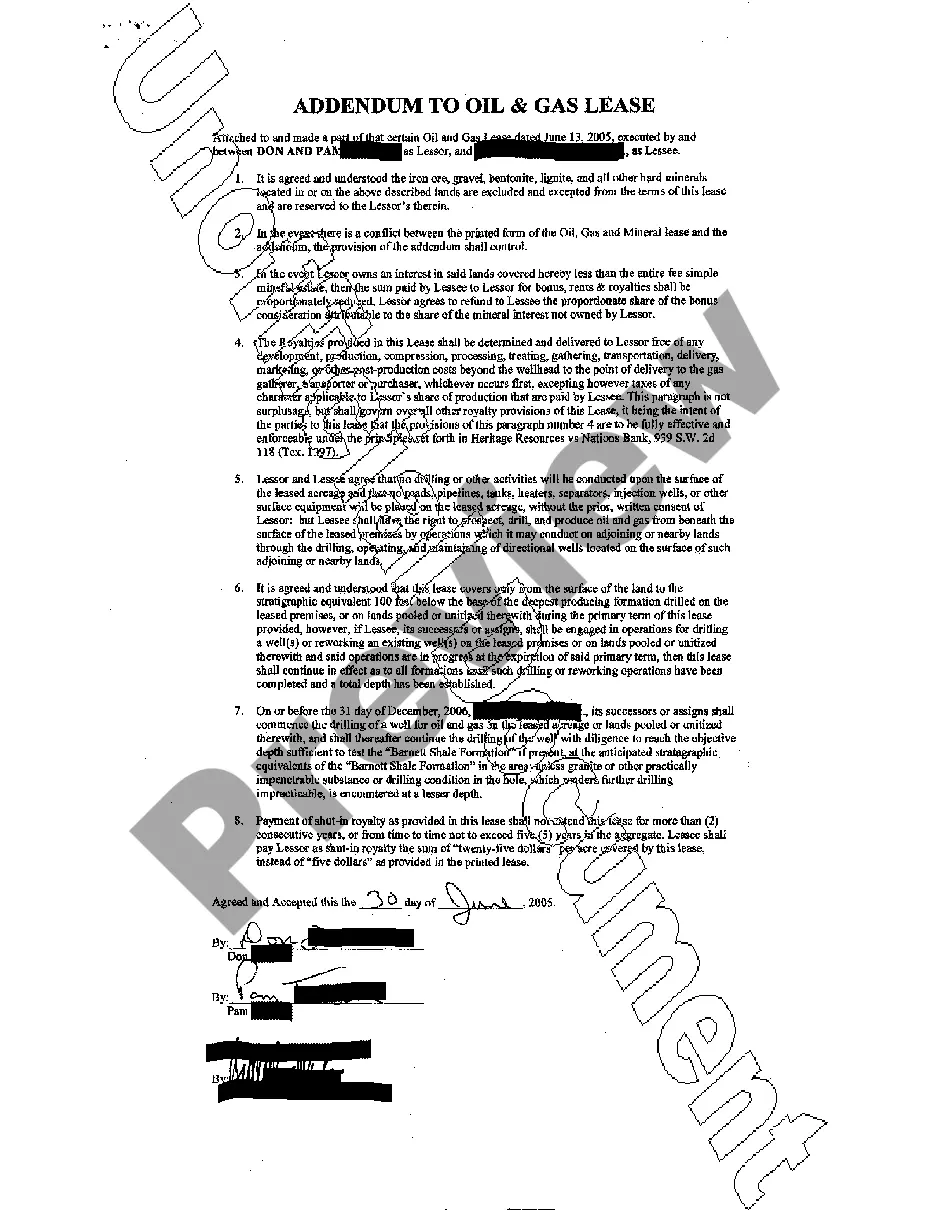

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

Pearland, Texas Oil and Gas Lease: A Pearland, Texas oil and gas lease refers to a legal agreement between the landowner and an exploration and production (E&P) company, granting permission for the extraction of oil and gas resources from the land located in Pearland, Texas. This lease grants the E&P company the exclusive rights to explore, drill, and produce oil and gas from the leased property. Key Features of Pearland, Texas Oil and Gas Lease: 1. Lease Terms: The lease outlines specific terms and conditions, including the duration of the lease, which is typically determined by years or until the exhaustion of oil or gas resources. 2. Royalties: A critical aspect of the Pearland oil and gas lease is the provision regarding royalty payment. Landowners receive a percentage of the revenue generated from the sale of oil and gas extracted from their property. The royalty percentage may differ depending on negotiations. 3. Bonus Payment: Alongside royalties, landowners often receive a one-time bonus payment at the commencement of the lease. This payment is based on the prospectively of the land and negotiation between the landowner and the E&P company. 4. Drilling Obligations: The lease specifies drilling obligations, including the timeframe within which the E&P company must commence drilling operations after the lease's execution. 5. Environmental Considerations: To protect the environment and ensure responsible drilling practices, Pearland oil and gas leases often include clauses regarding environmental precautions and compliance with local, state, and federal regulations. 6. Surface Rights and Surface Damages: While the oil and gas lease mainly focuses on subsurface rights, it may also include provisions relating to surface rights, such as the ability to use the surface area for drilling and any compensation for damages caused during operations. Different Types of Pearland, Texas Oil and Gas Lease: 1. Paid-up Lease: In a paid-up lease, the landowner receives a lump-sum payment upfront instead of periodic royalty payments. This type of lease relieves the E&P company from making further royalty payments throughout the lease's duration. 2. Term Lease: A term lease has a specific duration, often a fixed number of years, after which it expires unless renewed or renegotiated by both parties. 3. Overriding Royalty Interest (ORRIS) Lease: An ORRIS lease grants a percentage interest in the mineral production to an overriding royalty owner. This interest is separate from the landowner's royalty interest and is usually retained by a previous owner or party. 4. Nonparticipating Royalty Interest (NPR) Lease: In an NPR lease, the landowner retains their royalty interest but sells a portion or all future royalty payments to a third party. By understanding the various types of Pearland, Texas oil and gas leases and their associated features, landowners can make informed decisions regarding leasing their mineral rights while protecting their financial and environmental interests.Pearland, Texas Oil and Gas Lease: A Pearland, Texas oil and gas lease refers to a legal agreement between the landowner and an exploration and production (E&P) company, granting permission for the extraction of oil and gas resources from the land located in Pearland, Texas. This lease grants the E&P company the exclusive rights to explore, drill, and produce oil and gas from the leased property. Key Features of Pearland, Texas Oil and Gas Lease: 1. Lease Terms: The lease outlines specific terms and conditions, including the duration of the lease, which is typically determined by years or until the exhaustion of oil or gas resources. 2. Royalties: A critical aspect of the Pearland oil and gas lease is the provision regarding royalty payment. Landowners receive a percentage of the revenue generated from the sale of oil and gas extracted from their property. The royalty percentage may differ depending on negotiations. 3. Bonus Payment: Alongside royalties, landowners often receive a one-time bonus payment at the commencement of the lease. This payment is based on the prospectively of the land and negotiation between the landowner and the E&P company. 4. Drilling Obligations: The lease specifies drilling obligations, including the timeframe within which the E&P company must commence drilling operations after the lease's execution. 5. Environmental Considerations: To protect the environment and ensure responsible drilling practices, Pearland oil and gas leases often include clauses regarding environmental precautions and compliance with local, state, and federal regulations. 6. Surface Rights and Surface Damages: While the oil and gas lease mainly focuses on subsurface rights, it may also include provisions relating to surface rights, such as the ability to use the surface area for drilling and any compensation for damages caused during operations. Different Types of Pearland, Texas Oil and Gas Lease: 1. Paid-up Lease: In a paid-up lease, the landowner receives a lump-sum payment upfront instead of periodic royalty payments. This type of lease relieves the E&P company from making further royalty payments throughout the lease's duration. 2. Term Lease: A term lease has a specific duration, often a fixed number of years, after which it expires unless renewed or renegotiated by both parties. 3. Overriding Royalty Interest (ORRIS) Lease: An ORRIS lease grants a percentage interest in the mineral production to an overriding royalty owner. This interest is separate from the landowner's royalty interest and is usually retained by a previous owner or party. 4. Nonparticipating Royalty Interest (NPR) Lease: In an NPR lease, the landowner retains their royalty interest but sells a portion or all future royalty payments to a third party. By understanding the various types of Pearland, Texas oil and gas leases and their associated features, landowners can make informed decisions regarding leasing their mineral rights while protecting their financial and environmental interests.