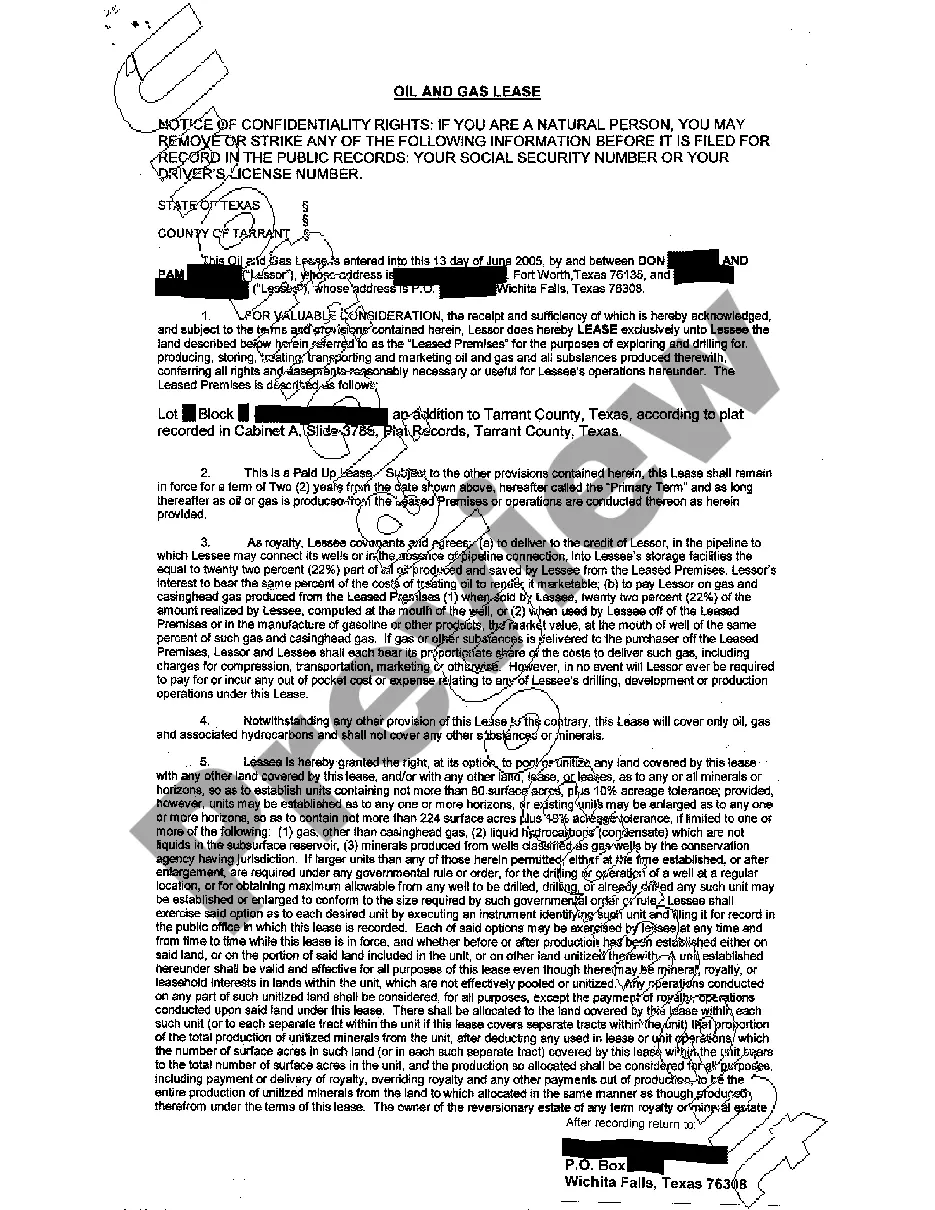

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

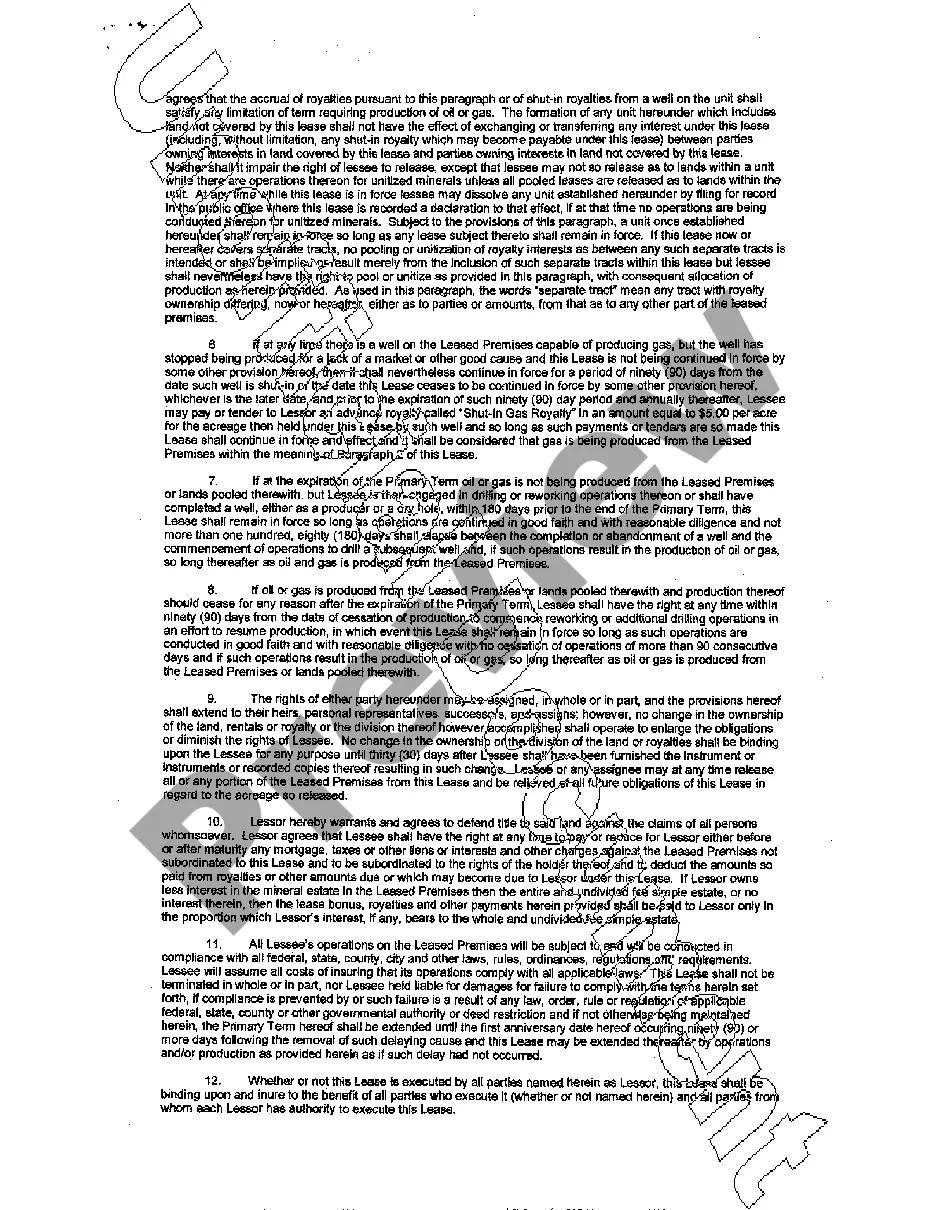

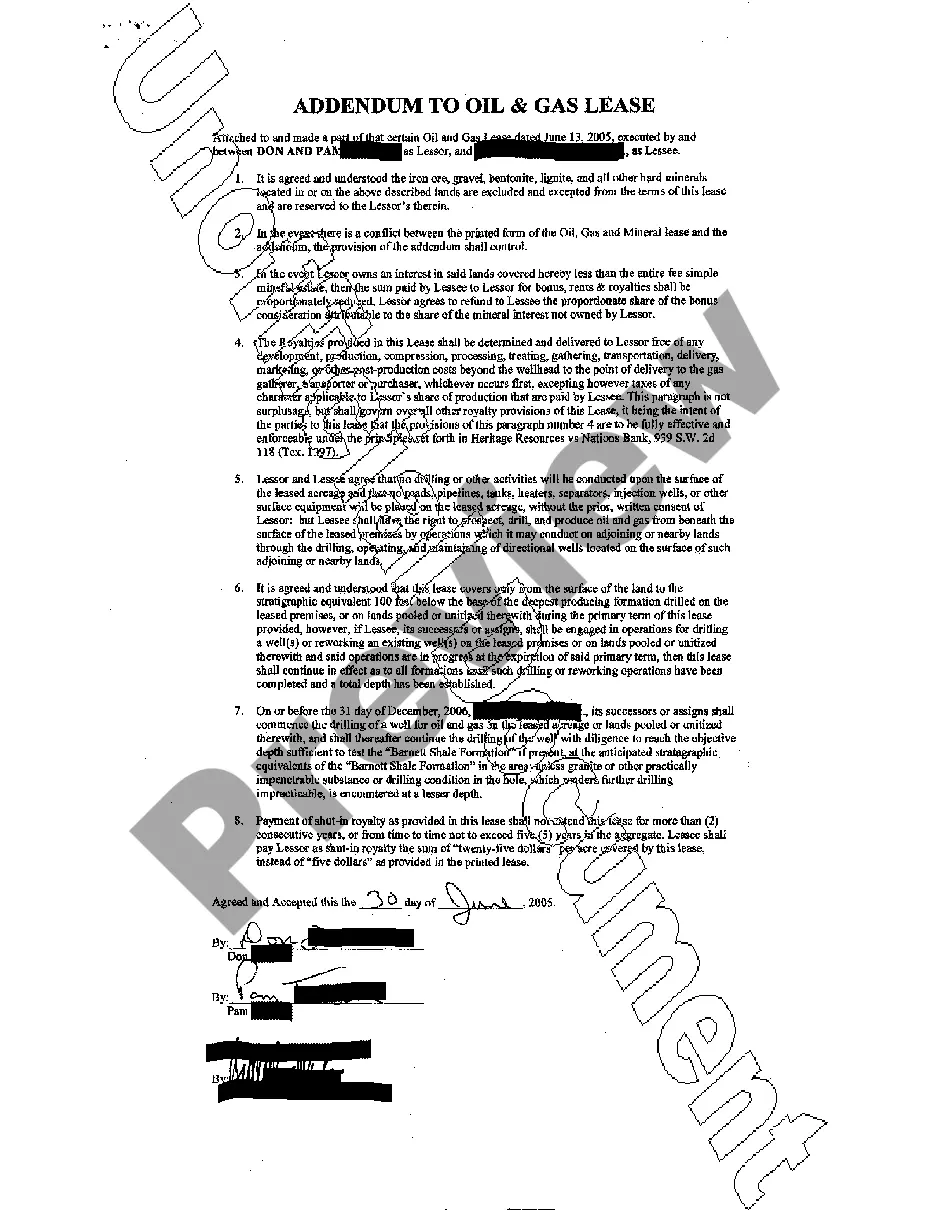

Round Rock Texas Oil and Gas Lease refers to a legal agreement between a property owner (lessor) and an oil and gas company (lessee) granting the lessee the right to explore, drill, and extract oil and gas resources on the lessor's land in Round Rock, Texas. This lease is crucial for the oil and gas industry as it allows companies to access and utilize valuable natural resources while providing compensation to landowners. The Round Rock Texas Oil and Gas Lease typically includes various provisions that cover important aspects of the agreement. These provisions may include the duration of the lease, the payment structure, environmental regulations, rights of entry, indemnity clauses, and royalty rates. The specific terms and conditions may vary depending on the negotiations between the parties involved. There are different types of Round Rock Texas Oil and Gas Leases, each with its variations and considerations. Here are a few: 1. Fee Lease: This type of lease grants the lessee the right to explore and extract oil and gas resources for a specified period, typically in exchange for an upfront bonus payment and ongoing royalty payments based on production. 2. Royalty Lease: Under this lease, the lessor receives a predetermined percentage of the value of the extracted petroleum or gas. The lessee covers all exploration and production costs. 3. Overriding Royalty Interest (ORRIS) Lease: In this case, the lessor retains a royalty interest on the extracted oil and gas, which is separate from any other royalty interests. ORRIS holders receive a percentage of the production but do not bear the costs of exploration and production. 4. Working Interest Lease: With a working interest lease, the lessor acts as a co-owner and shares both the costs and revenues associated with the oil and gas operations proportionally. 5. Farm out Agreements: These agreements involve a property owner (armor) leasing a portion of their acreage to an operator (farmer), allowing them to explore and develop specific areas for a defined period. The farmer carries the cost and risks of exploration, while the armor retains an interest in any successful discoveries. It is important for both parties to carefully consider and negotiate the terms of a Round Rock Texas Oil and Gas Lease to protect their rights and ensure a fair arrangement. Professional legal advice and thorough research are essential to understand the specific requirements and implications of these leases in Round Rock, Texas.Round Rock Texas Oil and Gas Lease refers to a legal agreement between a property owner (lessor) and an oil and gas company (lessee) granting the lessee the right to explore, drill, and extract oil and gas resources on the lessor's land in Round Rock, Texas. This lease is crucial for the oil and gas industry as it allows companies to access and utilize valuable natural resources while providing compensation to landowners. The Round Rock Texas Oil and Gas Lease typically includes various provisions that cover important aspects of the agreement. These provisions may include the duration of the lease, the payment structure, environmental regulations, rights of entry, indemnity clauses, and royalty rates. The specific terms and conditions may vary depending on the negotiations between the parties involved. There are different types of Round Rock Texas Oil and Gas Leases, each with its variations and considerations. Here are a few: 1. Fee Lease: This type of lease grants the lessee the right to explore and extract oil and gas resources for a specified period, typically in exchange for an upfront bonus payment and ongoing royalty payments based on production. 2. Royalty Lease: Under this lease, the lessor receives a predetermined percentage of the value of the extracted petroleum or gas. The lessee covers all exploration and production costs. 3. Overriding Royalty Interest (ORRIS) Lease: In this case, the lessor retains a royalty interest on the extracted oil and gas, which is separate from any other royalty interests. ORRIS holders receive a percentage of the production but do not bear the costs of exploration and production. 4. Working Interest Lease: With a working interest lease, the lessor acts as a co-owner and shares both the costs and revenues associated with the oil and gas operations proportionally. 5. Farm out Agreements: These agreements involve a property owner (armor) leasing a portion of their acreage to an operator (farmer), allowing them to explore and develop specific areas for a defined period. The farmer carries the cost and risks of exploration, while the armor retains an interest in any successful discoveries. It is important for both parties to carefully consider and negotiate the terms of a Round Rock Texas Oil and Gas Lease to protect their rights and ensure a fair arrangement. Professional legal advice and thorough research are essential to understand the specific requirements and implications of these leases in Round Rock, Texas.