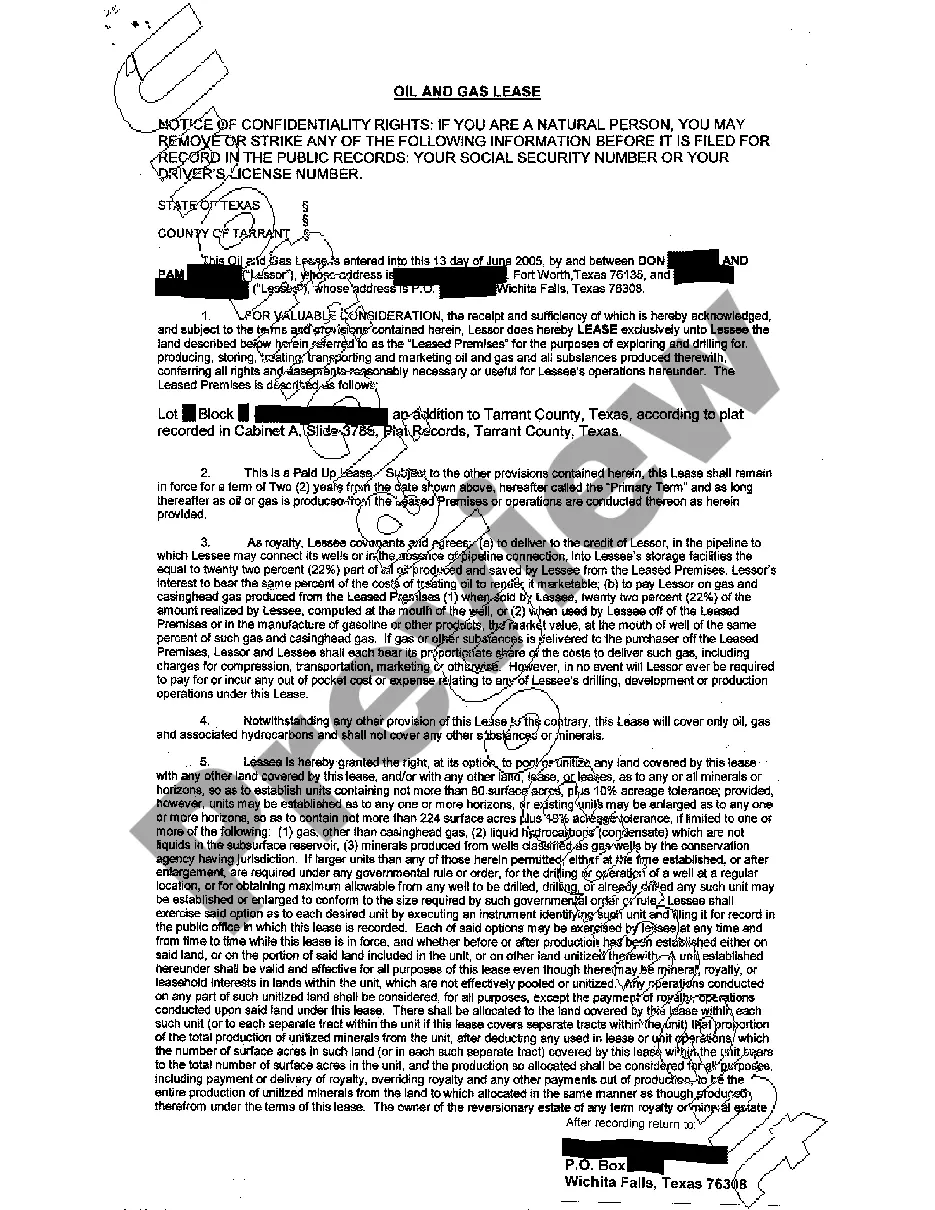

This lease grants exclusive rights to the land for the purposes of exploring and drilling for producing, storing, treating, transporting and marketing oil and gas and all substances produced to the Lessee.

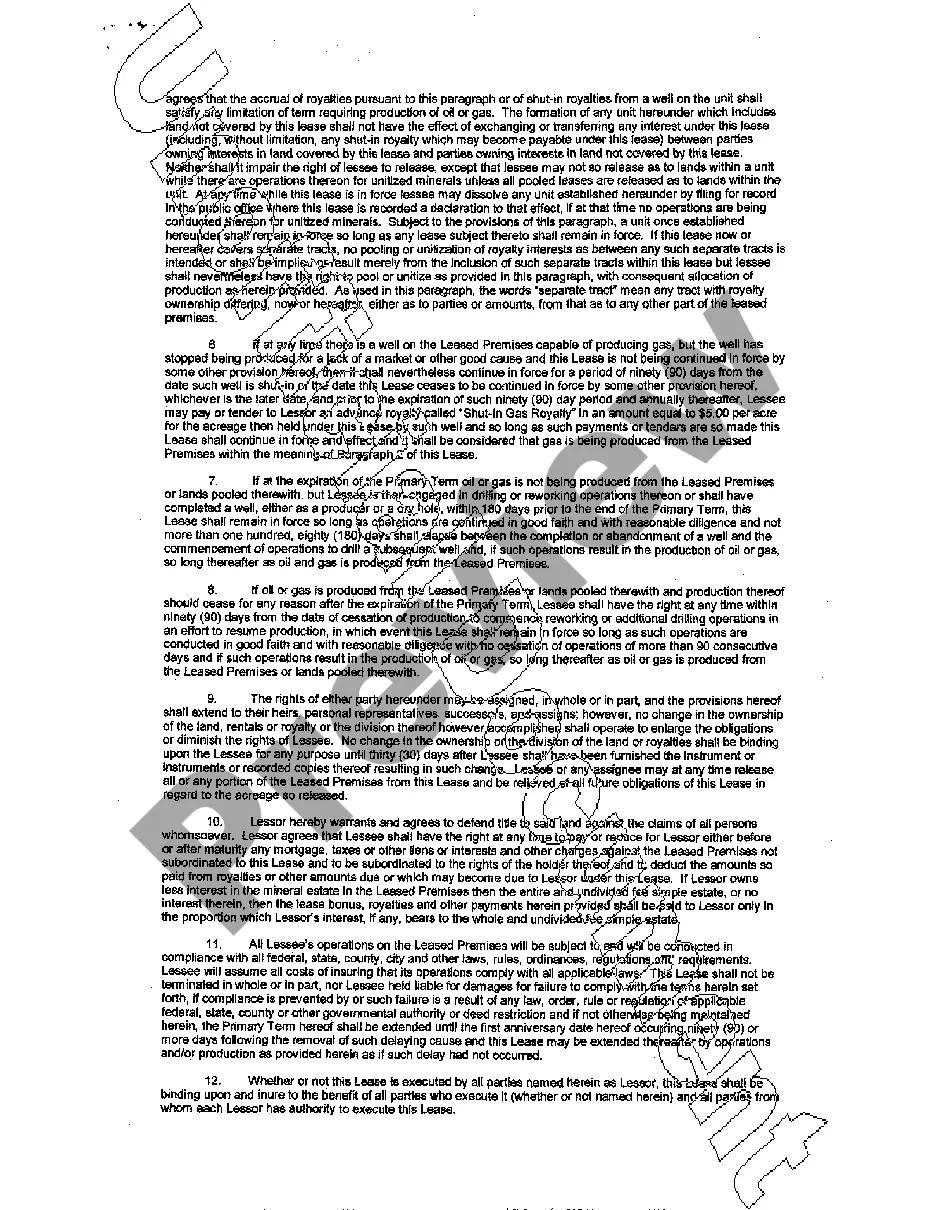

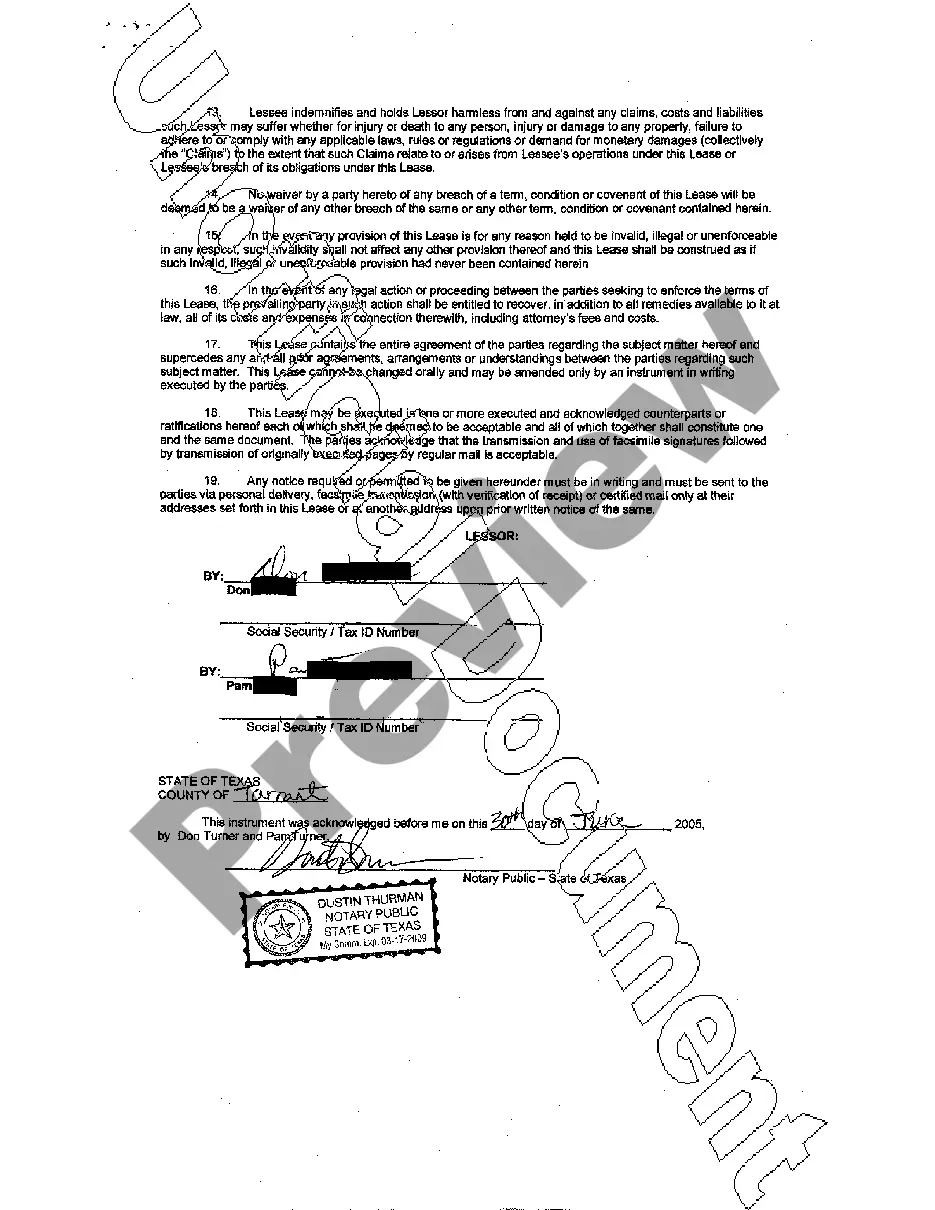

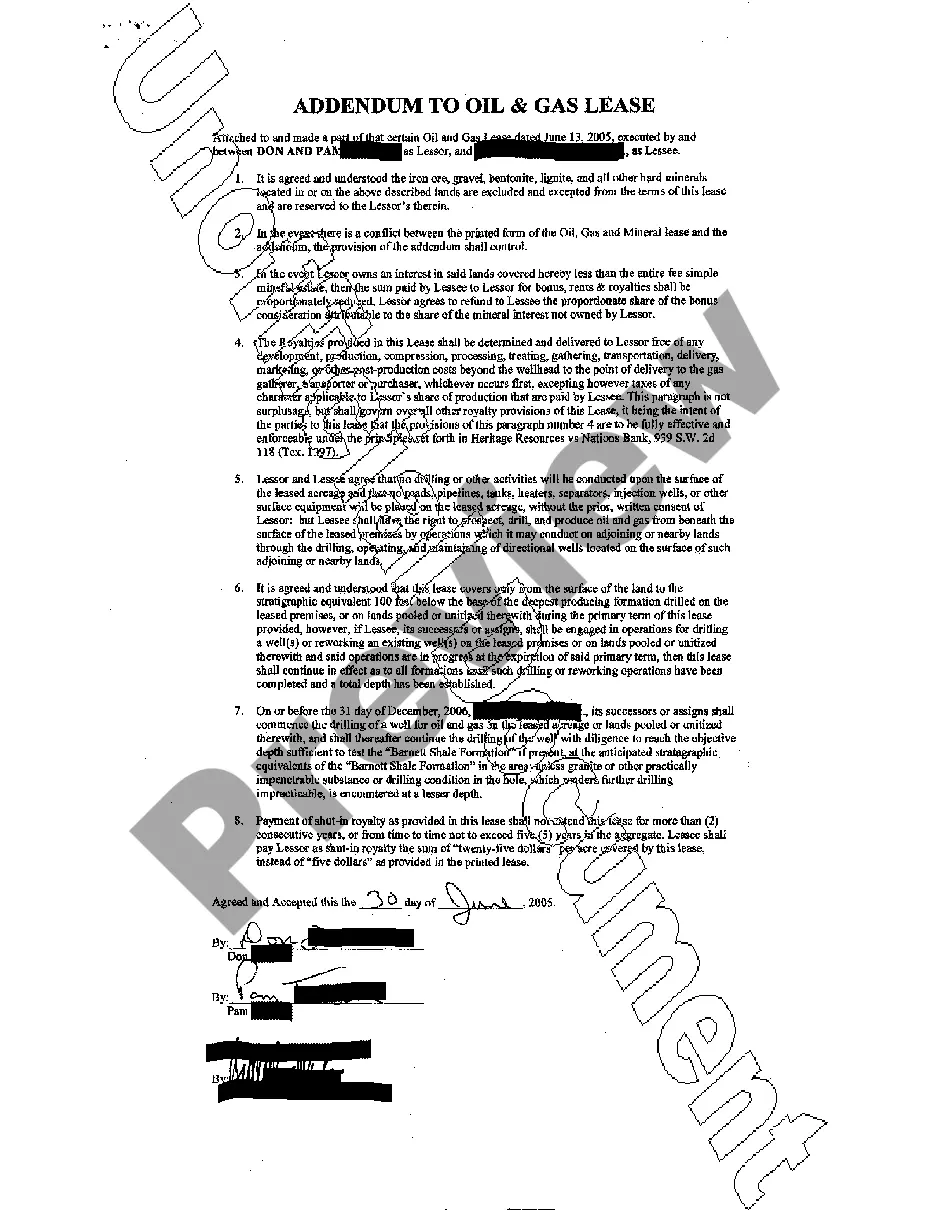

Tarrant Texas Oil and Gas Lease is a legally binding agreement between a landowner in Tarrant County, Texas, and an oil or gas company, granting the company the rights to explore, extract, and produce oil and gas resources on the landowner's property. This lease is essential for both parties as it lays out the terms and conditions that govern the relationship, including the duration of the lease, the royalty rate to be paid to the landowner, and the specific activities allowed by the oil or gas company. The Tarrant Texas Oil and Gas Lease provides a framework for the responsible extraction of oil and gas resources while protecting the rights of the landowner. There are several types of Tarrant Texas Oil and Gas Leases, each with its own characteristics and purposes. These types are: 1. Mineral Lease: A mineral lease grants the oil or gas company the exclusive rights to extract oil and gas resources from the land for a specific period, typically ranging from a few years to decades. This type of lease is commonly used when the landowner owns both the surface and mineral rights. 2. Royalty Lease: In a royalty lease, the landowner receives a royalty payment, typically a percentage of the value of the oil or gas produced from the leased land. The company bears the costs associated with exploration, drilling, and production activities. This type of lease is advantageous for landowners who prefer to minimize their involvement in the production process. 3. Overriding Royalty Interest Lease: An overriding royalty interest lease grants a percentage of the royalty payment to a third party, commonly an individual or a company who helped in acquiring or developing the lease. The landowner still receives their royalty payment as agreed upon in the lease. 4. Non-Participating Royalty Interest Lease: In this type of lease, the landowner receives a royalty payment but does not have the right to participate in the exploration or production activities. Non-participating royalty interest leases are often used when the landowner does not wish to invest in the drilling or operational aspects of the project. 5. Working Interest Lease: A working interest lease is a more complex and involved type of lease. The landowner and the oil or gas company become partners in the extraction operation, with the landowner sharing in both the costs and the revenues of the project. This type of lease is suitable for landowners who want to actively participate in the oil and gas activities and potentially maximize their returns. In conclusion, the Tarrant Texas Oil and Gas Lease is a crucial agreement that outlines the rights and responsibilities of both the landowner and the oil or gas company. Understanding the different types of leases available can help landowners make informed decisions about their involvement in oil and gas exploration and production on their property.Tarrant Texas Oil and Gas Lease is a legally binding agreement between a landowner in Tarrant County, Texas, and an oil or gas company, granting the company the rights to explore, extract, and produce oil and gas resources on the landowner's property. This lease is essential for both parties as it lays out the terms and conditions that govern the relationship, including the duration of the lease, the royalty rate to be paid to the landowner, and the specific activities allowed by the oil or gas company. The Tarrant Texas Oil and Gas Lease provides a framework for the responsible extraction of oil and gas resources while protecting the rights of the landowner. There are several types of Tarrant Texas Oil and Gas Leases, each with its own characteristics and purposes. These types are: 1. Mineral Lease: A mineral lease grants the oil or gas company the exclusive rights to extract oil and gas resources from the land for a specific period, typically ranging from a few years to decades. This type of lease is commonly used when the landowner owns both the surface and mineral rights. 2. Royalty Lease: In a royalty lease, the landowner receives a royalty payment, typically a percentage of the value of the oil or gas produced from the leased land. The company bears the costs associated with exploration, drilling, and production activities. This type of lease is advantageous for landowners who prefer to minimize their involvement in the production process. 3. Overriding Royalty Interest Lease: An overriding royalty interest lease grants a percentage of the royalty payment to a third party, commonly an individual or a company who helped in acquiring or developing the lease. The landowner still receives their royalty payment as agreed upon in the lease. 4. Non-Participating Royalty Interest Lease: In this type of lease, the landowner receives a royalty payment but does not have the right to participate in the exploration or production activities. Non-participating royalty interest leases are often used when the landowner does not wish to invest in the drilling or operational aspects of the project. 5. Working Interest Lease: A working interest lease is a more complex and involved type of lease. The landowner and the oil or gas company become partners in the extraction operation, with the landowner sharing in both the costs and the revenues of the project. This type of lease is suitable for landowners who want to actively participate in the oil and gas activities and potentially maximize their returns. In conclusion, the Tarrant Texas Oil and Gas Lease is a crucial agreement that outlines the rights and responsibilities of both the landowner and the oil or gas company. Understanding the different types of leases available can help landowners make informed decisions about their involvement in oil and gas exploration and production on their property.