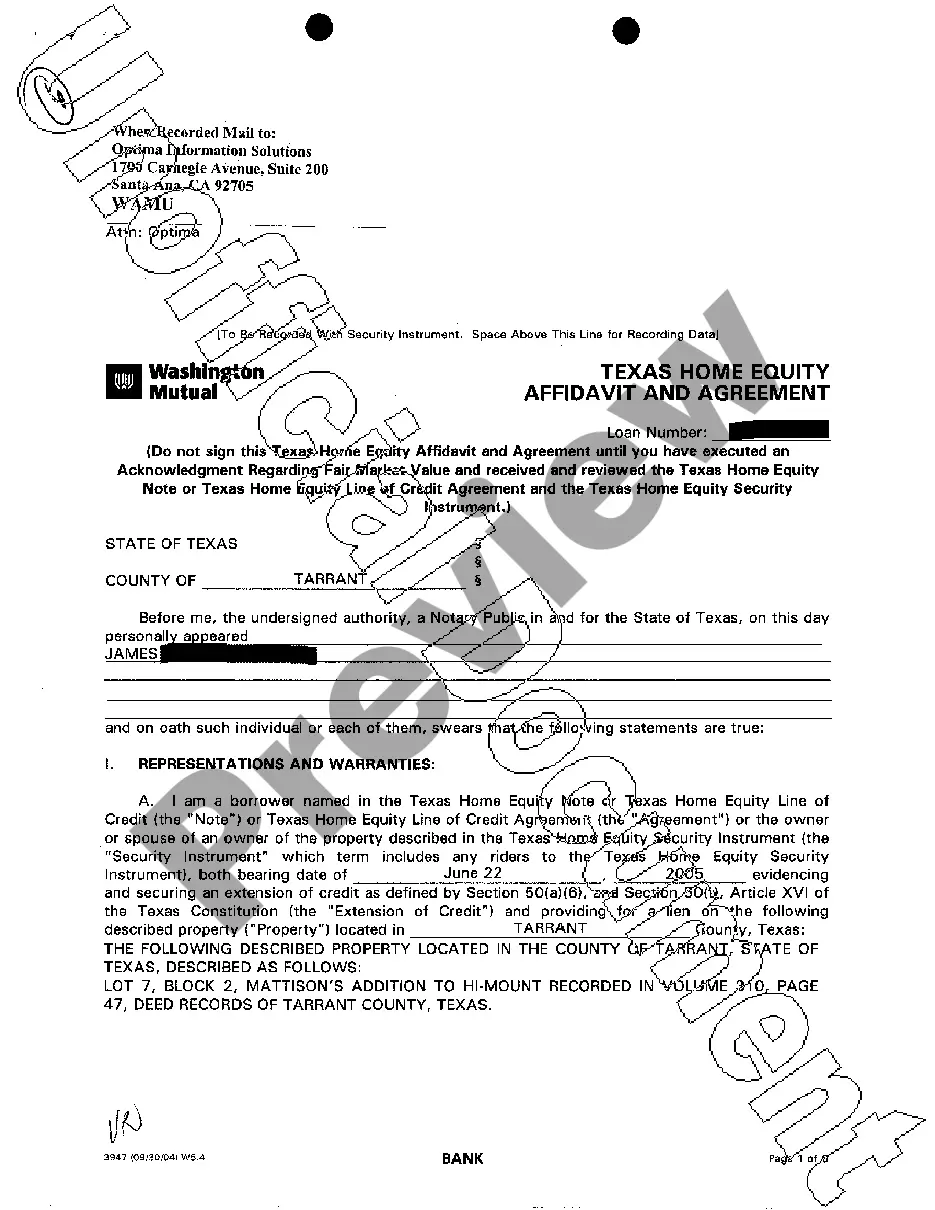

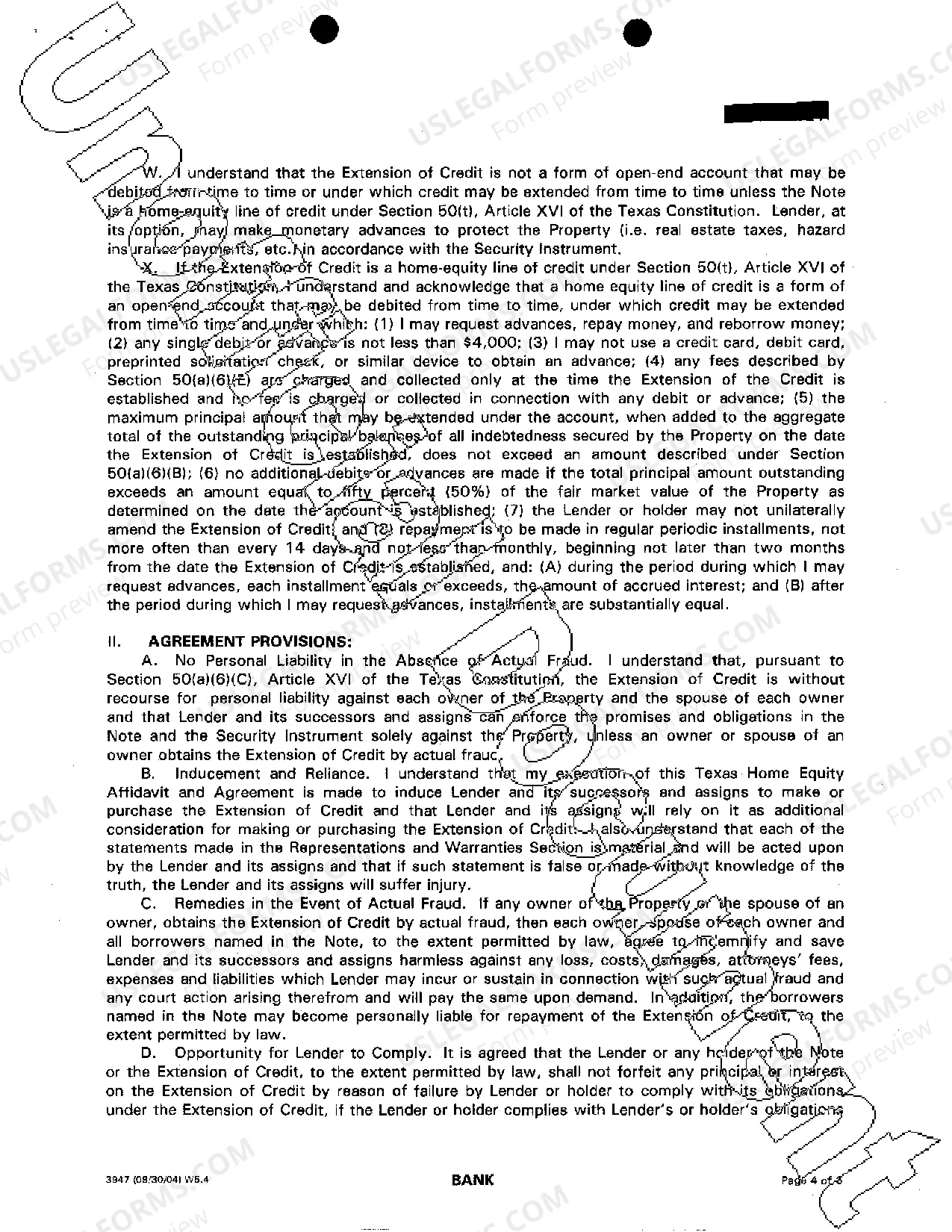

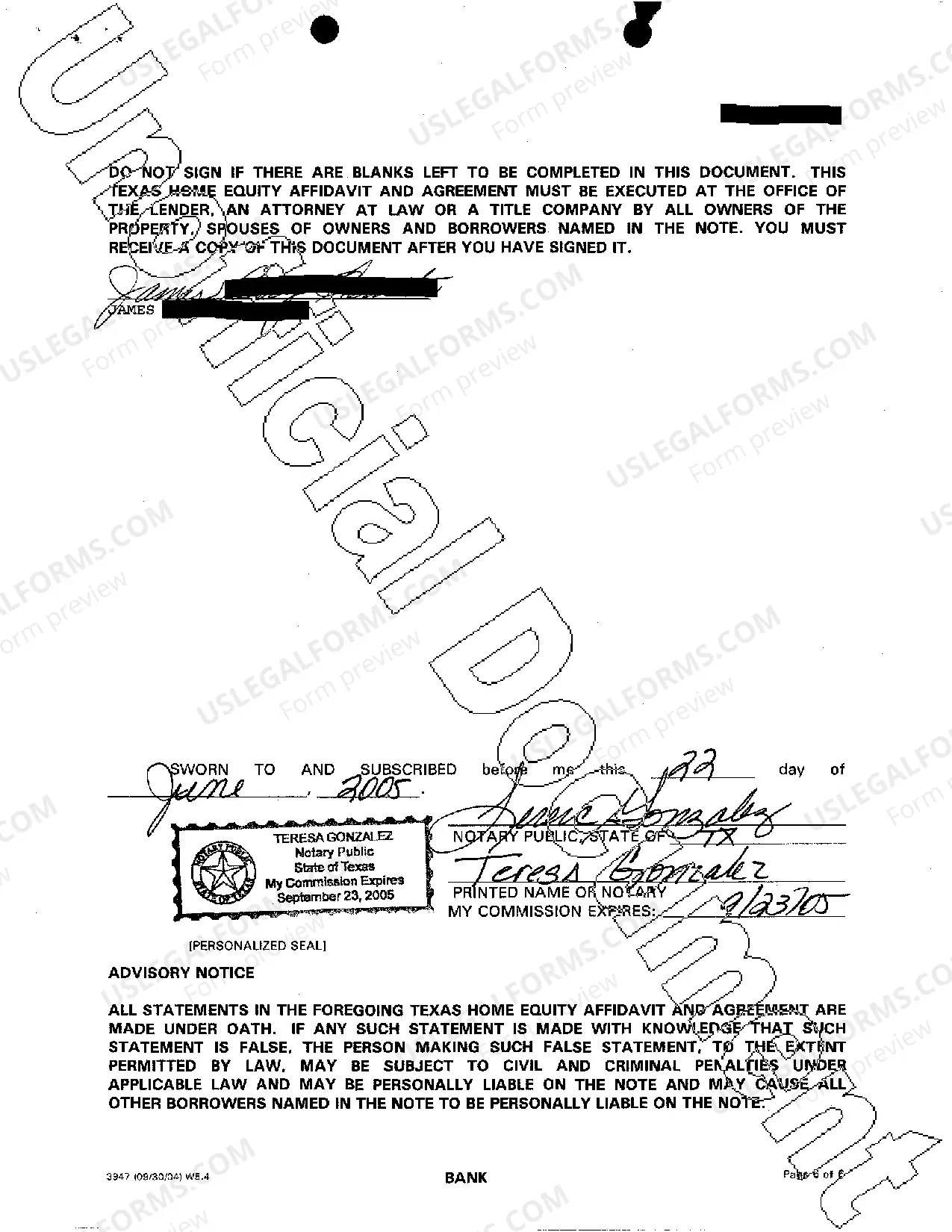

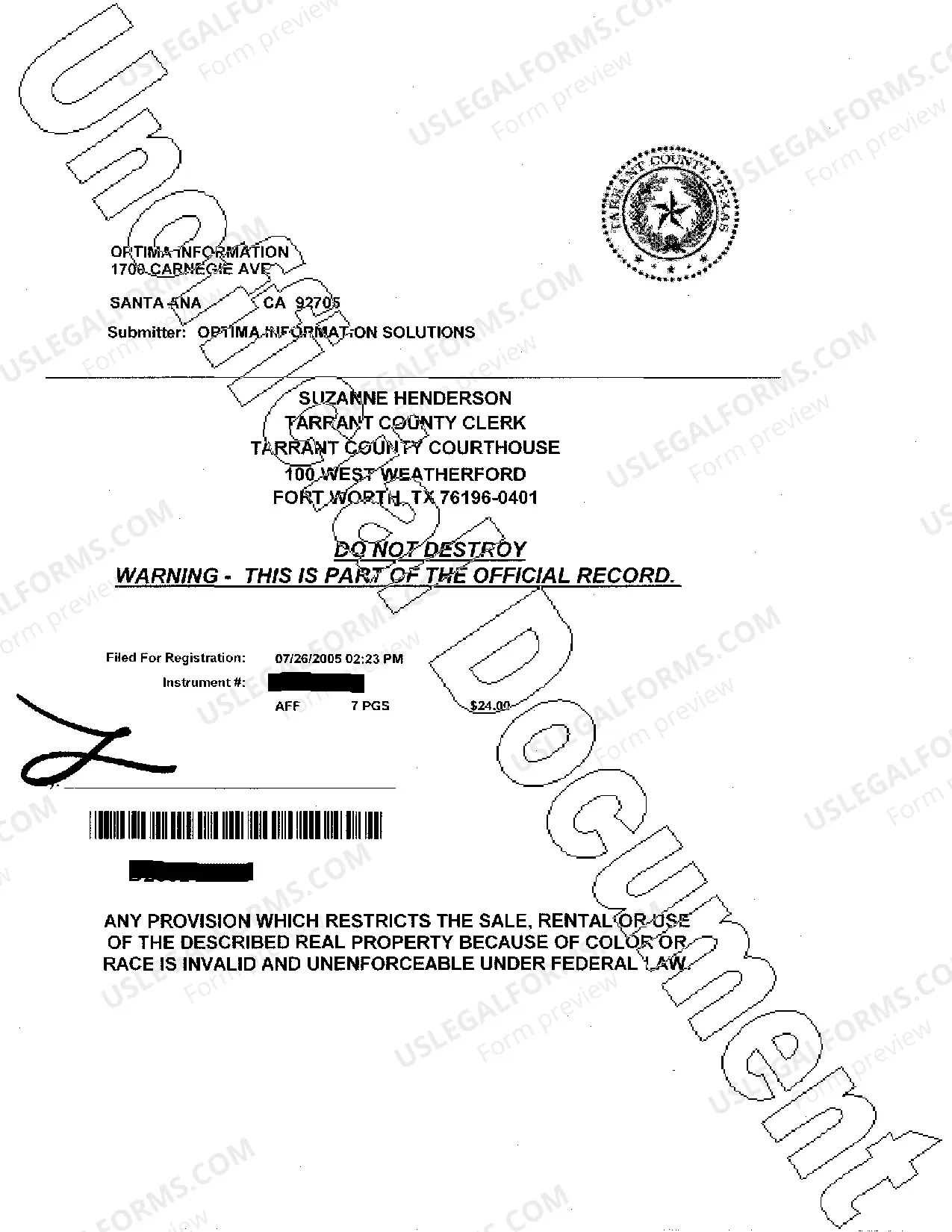

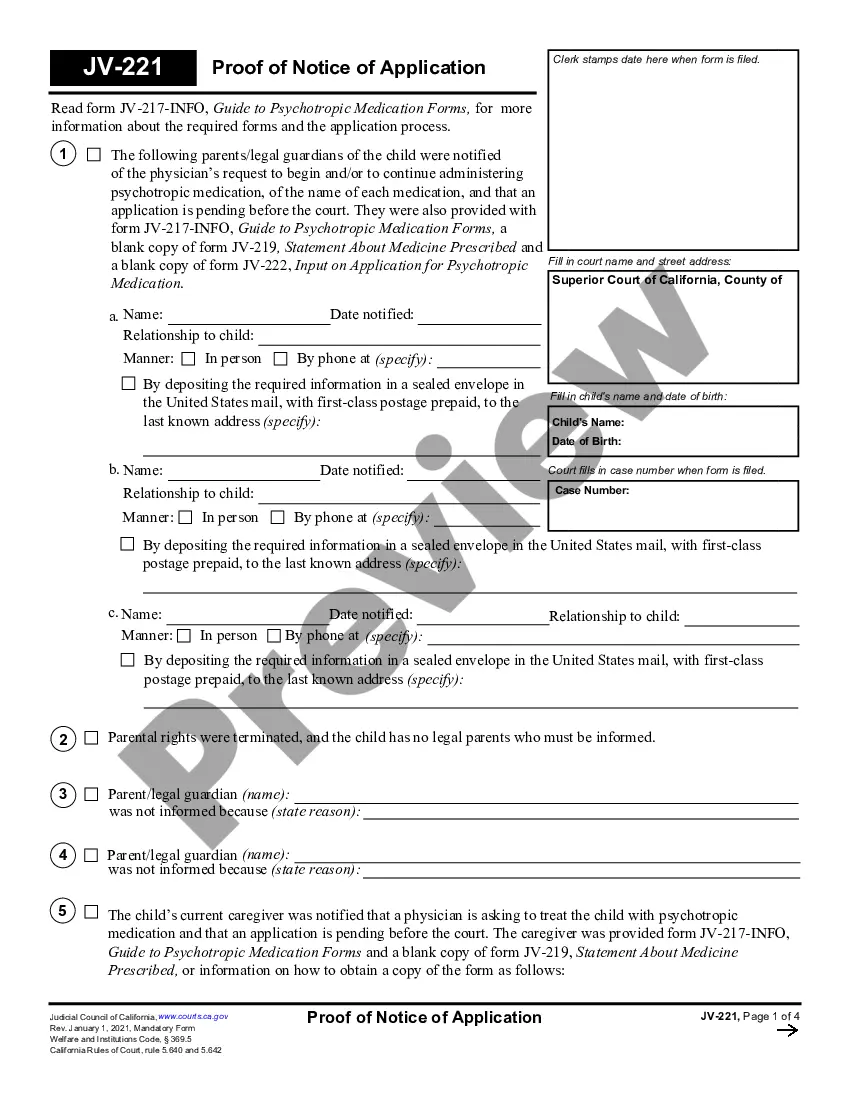

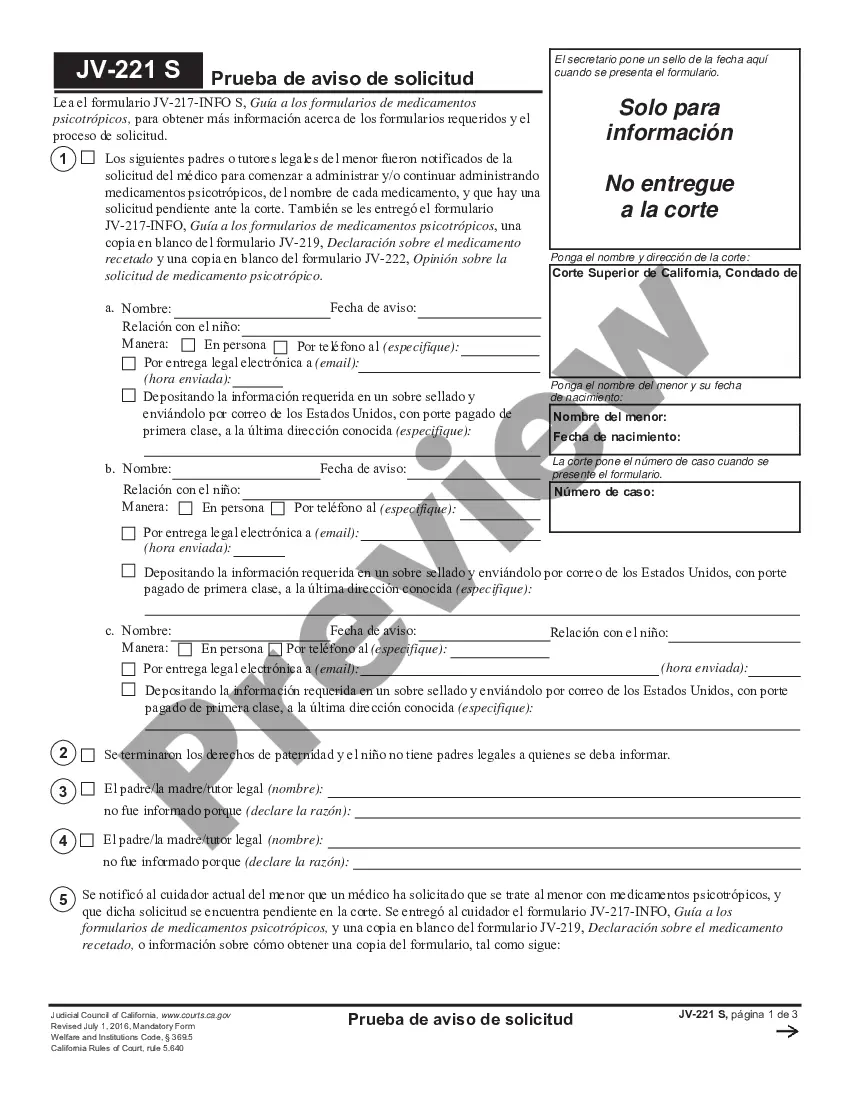

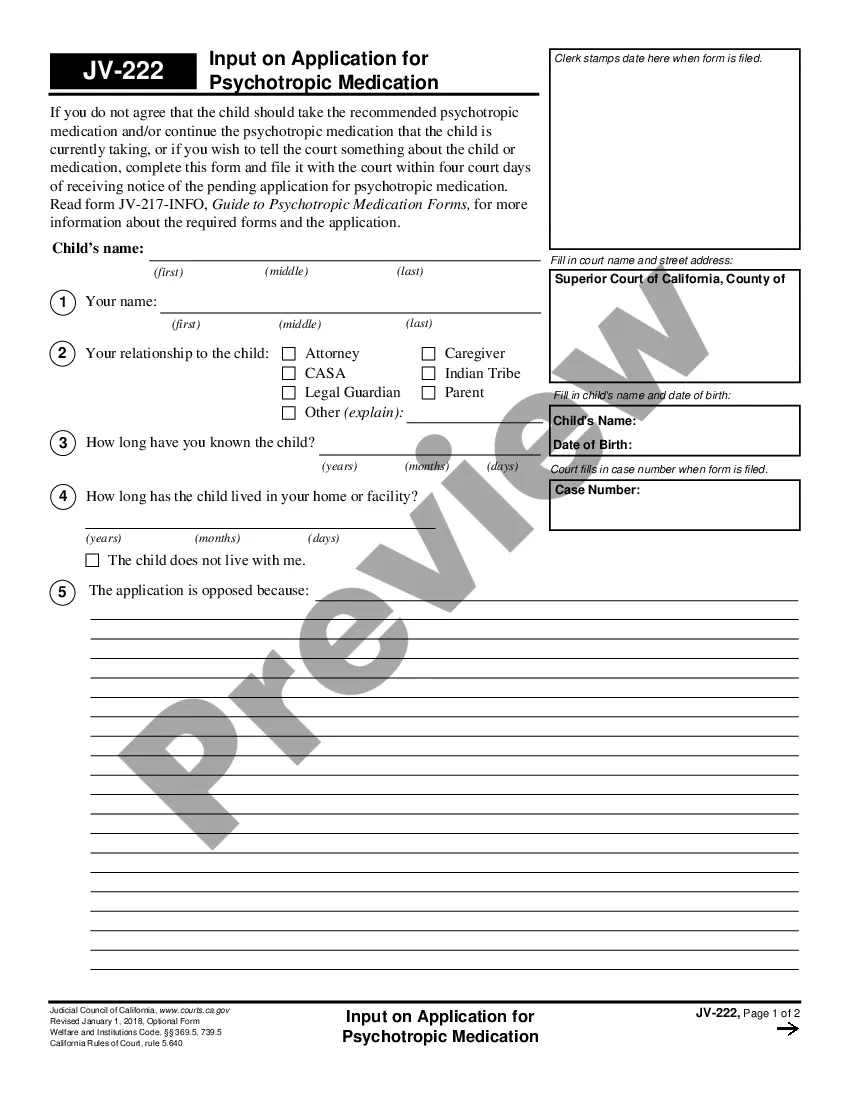

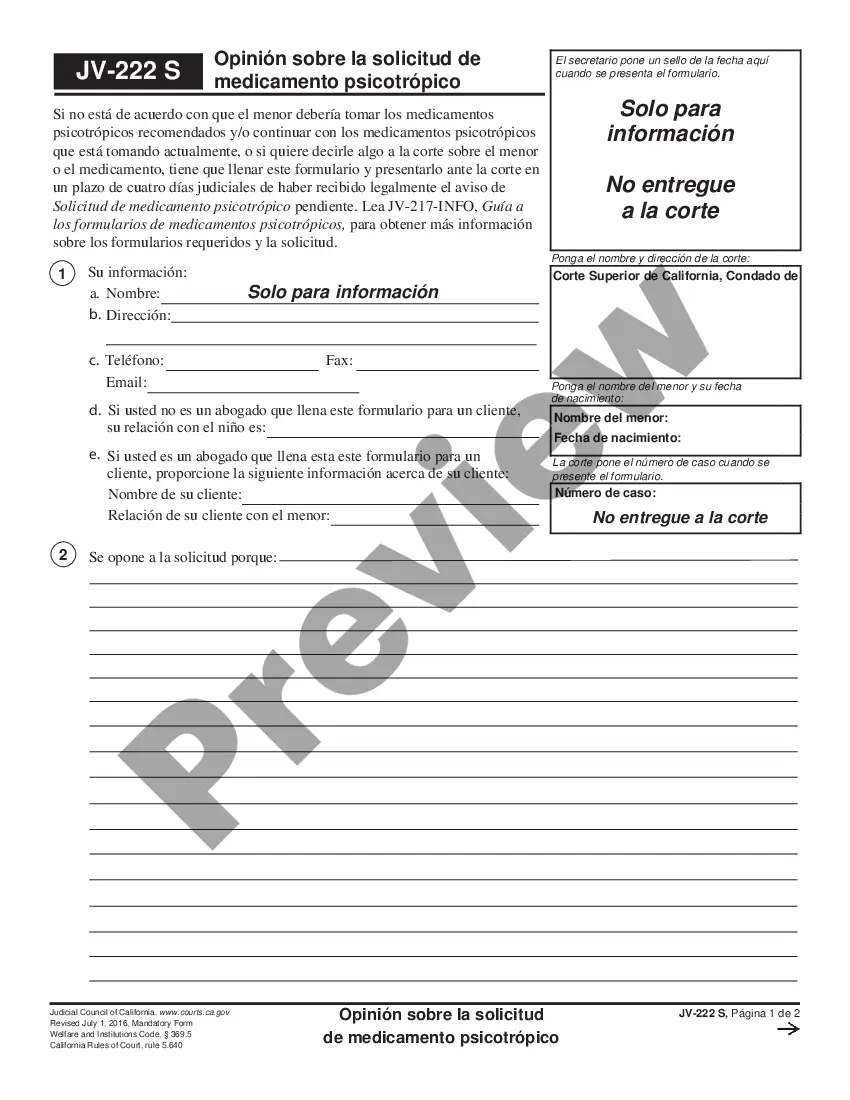

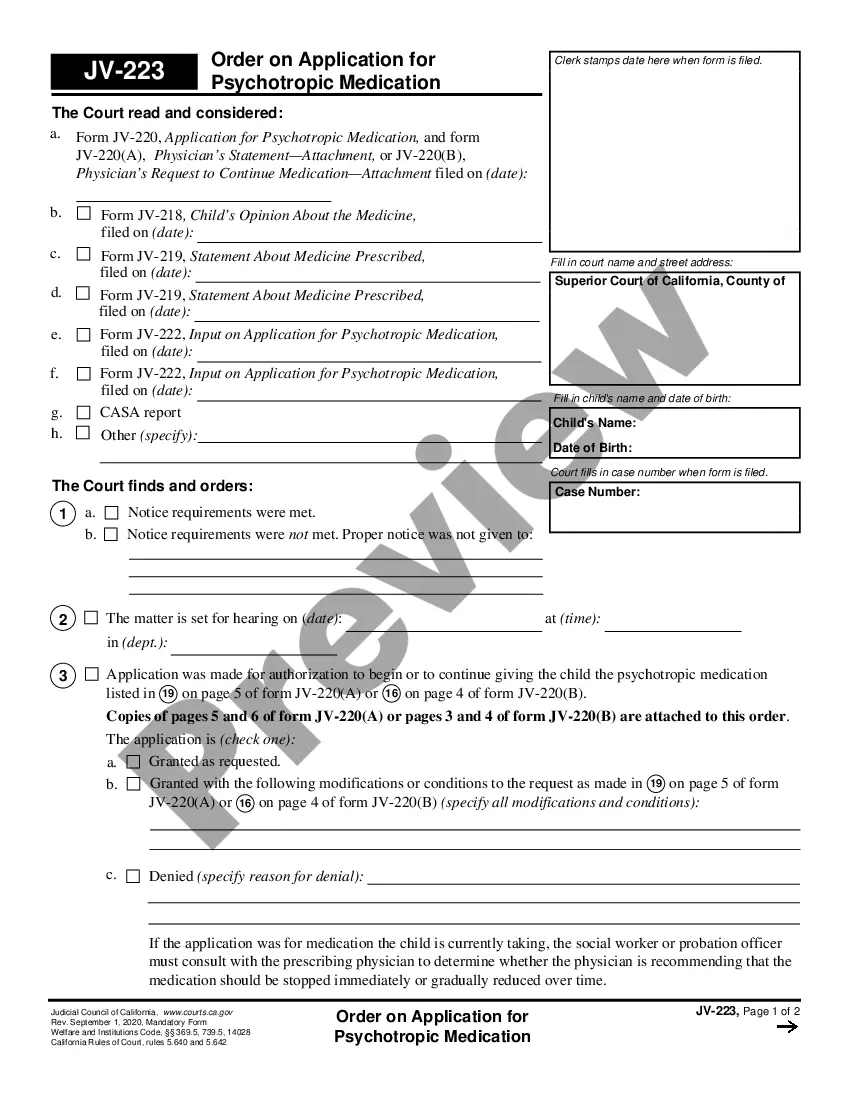

The Austin Texas Home Equity Affidavit and Agreement is a legal document that is used in the state of Texas for real estate transactions involving home equity loans. It is a crucial document that helps protect the rights and interests of both lenders and borrowers when a homeowner leverages the equity in their property as collateral for a loan. This affidavit and agreement is specifically designed to comply with the Texas Constitution, which imposes certain requirements and restrictions on home equity loans. It ensures that the loan transaction adheres to the legal framework set forth by the state. The Austin Texas Home Equity Affidavit and Agreement typically includes various sections and provisions that are fundamental to the loan process. These may include but are not limited to: 1. Identification of Parties: This section identifies the parties involved in the loan transaction, such as the borrower(s), lender(s), and possibly other relevant entities. 2. Loan Terms: This part outlines the specific terms of the loan, including the loan amount, interest rate, repayment period, and any other relevant details that both parties have agreed upon. 3. Home Equity Affidavit: This section contains affirmations from the borrower(s) stating that they meet the necessary legal criteria to avail of a home equity loan as per the provisions of the Texas Constitution. It may include statements confirming their occupancy of the property, the absence of any pending lawsuits or liens against the property, and compliance with other statutory requirements. 4. Waivers and Representations: Here, the borrower(s) typically waives their right to claim homestead exemptions under certain circumstances and represents that they have received adequate disclosures and counseling, if required. 5. Closing and Escrow: This part ensures that the loan closing is done properly, and it may outline the responsibilities of both parties regarding insurance, taxes, and escrow accounts. 6. Governing Law and Jurisdiction: This section states that the agreement is governed by the laws of the state of Texas and that any legal disputes arising from the agreement will be settled in a specific court or arbitration forum. It is important to note that while the description provided above generally applies to Austin, Texas, the Home Equity Affidavit and Agreement may differ slightly based on specific local regulations and practices. Additionally, variations in formats or documentation may exist between different lenders or title companies. It is advisable for borrowers to consult legal professionals or experienced real estate experts to ensure compliance with all relevant laws and regulations governing home equity loans in Austin, Texas.

Austin Texas Home Equity Affidavit and Agreement

State:

Texas

City:

Austin

Control #:

TX-JW-0083

Format:

PDF

Instant download

This form is available by subscription

Description

Texas Home Equity Affidavit and Agreement

The Austin Texas Home Equity Affidavit and Agreement is a legal document that is used in the state of Texas for real estate transactions involving home equity loans. It is a crucial document that helps protect the rights and interests of both lenders and borrowers when a homeowner leverages the equity in their property as collateral for a loan. This affidavit and agreement is specifically designed to comply with the Texas Constitution, which imposes certain requirements and restrictions on home equity loans. It ensures that the loan transaction adheres to the legal framework set forth by the state. The Austin Texas Home Equity Affidavit and Agreement typically includes various sections and provisions that are fundamental to the loan process. These may include but are not limited to: 1. Identification of Parties: This section identifies the parties involved in the loan transaction, such as the borrower(s), lender(s), and possibly other relevant entities. 2. Loan Terms: This part outlines the specific terms of the loan, including the loan amount, interest rate, repayment period, and any other relevant details that both parties have agreed upon. 3. Home Equity Affidavit: This section contains affirmations from the borrower(s) stating that they meet the necessary legal criteria to avail of a home equity loan as per the provisions of the Texas Constitution. It may include statements confirming their occupancy of the property, the absence of any pending lawsuits or liens against the property, and compliance with other statutory requirements. 4. Waivers and Representations: Here, the borrower(s) typically waives their right to claim homestead exemptions under certain circumstances and represents that they have received adequate disclosures and counseling, if required. 5. Closing and Escrow: This part ensures that the loan closing is done properly, and it may outline the responsibilities of both parties regarding insurance, taxes, and escrow accounts. 6. Governing Law and Jurisdiction: This section states that the agreement is governed by the laws of the state of Texas and that any legal disputes arising from the agreement will be settled in a specific court or arbitration forum. It is important to note that while the description provided above generally applies to Austin, Texas, the Home Equity Affidavit and Agreement may differ slightly based on specific local regulations and practices. Additionally, variations in formats or documentation may exist between different lenders or title companies. It is advisable for borrowers to consult legal professionals or experienced real estate experts to ensure compliance with all relevant laws and regulations governing home equity loans in Austin, Texas.

Free preview

How to fill out Austin Texas Home Equity Affidavit And Agreement?

If you’ve already used our service before, log in to your account and save the Austin Texas Home Equity Affidavit and Agreement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Austin Texas Home Equity Affidavit and Agreement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!