College Station Texas Home Equity Affidavit and Agreement

Description

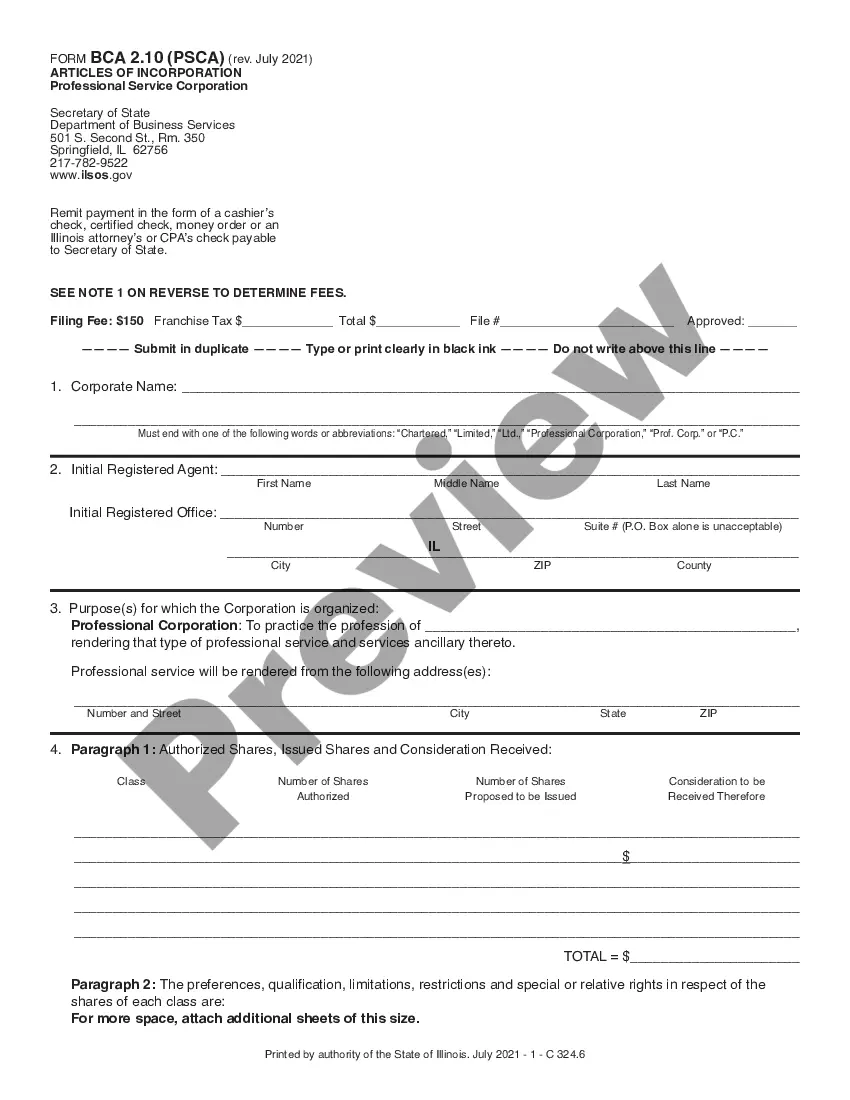

How to fill out Texas Home Equity Affidavit And Agreement?

We consistently aim to minimize or prevent legal complications when navigating intricate legal or financial issues.

To achieve this, we subscribe to legal assistance solutions that are often quite expensive.

However, not every legal problem is overly complicated. A majority can be managed on our own.

US Legal Forms is an online repository of current DIY legal documents encompassing various legal needs from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it from the My documents section. The procedure is just as simple if you’re not acquainted with the website! You can create your account within minutes. Ensure that the College Station Texas Home Equity Affidavit and Agreement aligns with the regulations and laws of your respective state and region. Furthermore, it is essential to review the description of the form (if available), and if you notice any inconsistencies with your original expectations, look for a different template. Once you’ve confirmed that the College Station Texas Home Equity Affidavit and Agreement fits your situation, you can choose the subscription plan and proceed with the payment. Afterward, you can download the form in any preferred file format. With over 24 years in the industry, we have assisted millions by providing customizable and up-to-date legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our collection empowers you to handle your matters independently without relying on a lawyer.

- We provide access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, making the search process significantly easier.

- Utilize US Legal Forms whenever you need to obtain and download the College Station Texas Home Equity Affidavit and Agreement or any other form promptly and securely.

Form popularity

FAQ

Yes, it is advisable to record your Texas home equity affidavit and agreement for legal protection and enforcement. Recording this document ensures that your rights are recognized and can prevent potential disputes. By taking this step, you reinforce your position and safeguard your interests within your College Station Texas Home Equity Affidavit and Agreement.

Home equity lending in Texas is governed by specific rules to protect consumers. Key regulations include limitations on the amount you can borrow, disclosure requirements, and mandatory waiting periods before closing. Familiarizing yourself with these rules can help you navigate your College Station Texas Home Equity Affidavit and Agreement with confidence.

A home equity affidavit and agreement is a legal document that outlines the terms and conditions associated with a home equity transaction. It formally establishes your rights and obligations, helping to clarify the terms agreed upon by both parties. This document is vital for protecting your interests in any College Station Texas Home Equity Affidavit and Agreement.

A home equity agreement allows you to access your home's equity without taking on additional debt. Instead of monthly repayments, you provide a share of your home's future value in exchange. This agreement can be a beneficial option for those looking to leverage their College Station Texas Home Equity Affidavit and Agreement while retaining flexibility.

The 2% rule in Texas refers to the regulations limiting the amount borrowers can take out in home equity loans. This rule allows homeowners to access up to 80% of their home’s value, minus any other liens. Understanding this rule is crucial when considering your College Station Texas Home Equity Affidavit and Agreement, as it allows you to make informed financial decisions.

In Texas, an affidavit of completion does not necessarily need to be recorded but can be beneficial to establish the completion of work on a property. Recording such an affidavit can help provide proof in any future disputes regarding the work done. It's often wise to consult with a legal professional to understand the implications specific to your College Station Texas Home Equity Affidavit and Agreement.

Yes, in Texas, a Deed of Trust must be recorded to be effective against third parties. Recording the deed publicly establishes your rights and interests in the property. This process also protects you in the event of disputes regarding the ownership or claims against your College Station Texas Home Equity Affidavit and Agreement.

One downside of a home equity agreement is the risk of losing your home if you cannot meet the repayment terms. Additional costs may arise, such as legal fees or closing costs, which can reduce your overall gain. Furthermore, you may limit your financial flexibility, as accessing your home equity could impact your creditworthiness.