Arlington Texas Rescission of Acceleration of Loan refers to the legal process of canceling the acceleration of a loan in Arlington, Texas. When a borrower defaults on their loan payments, the lender has the option to accelerate the full remaining balance, making it due immediately. However, in some cases, the borrower may be able to reverse this process through a rescission. Rescission of Acceleration of Loan is applicable in various situations, including mortgage loans, personal loans, or business loans. In Arlington, Texas, the process may differ based on the type of loan involved. Let's explore some different types of Arlington Texas Rescission of Acceleration of Loan: 1. Mortgage Rescission of Acceleration: In the case of a mortgage loan, where a borrower defaults on their payments, the lender can initiate the acceleration process. However, Arlington, Texas allows borrowers to pursue a rescission of acceleration, which involves taking legal action to stop the acceleration and reinstate the original loan terms. This may require negotiating with the lender or presenting evidence of a legitimate reason for the default. 2. Personal Loan Rescission of Acceleration: If a borrower defaults on a personal loan in Arlington, Texas, the acceleration process can be initiated, causing the entire remaining balance to become due immediately. However, borrowers have the right to request a rescission of acceleration, which can involve demonstrating the ability to resume making regular payments or entering into negotiations to modify the loan terms. 3. Business Loan Rescission of Acceleration: In the context of business loans in Arlington, Texas, when a borrower defaults, the lender can accelerate the loan and demand full repayment. However, business owners have the option to seek a rescission of acceleration to alleviate the immediate financial burden. This may involve presenting a viable plan for repaying the outstanding debt or negotiating new loan terms. Overall, Arlington Texas Rescission of Acceleration of Loan is a legal process that allows borrowers in Arlington, Texas, to reverse the acceleration of their loans, typically by negotiating with the lender or presenting a valid case for the default. Whether it's a mortgage, personal loan, or business loan, borrowers may have the opportunity to restore the original loan terms and regain control over their financial situation.

Arlington Texas Rescission of Acceleration of Loan

State:

Texas

City:

Arlington

Control #:

TX-JW-0091

Format:

PDF

Instant download

This form is available by subscription

Description

Rescission of Acceleration of Loan

Arlington Texas Rescission of Acceleration of Loan refers to the legal process of canceling the acceleration of a loan in Arlington, Texas. When a borrower defaults on their loan payments, the lender has the option to accelerate the full remaining balance, making it due immediately. However, in some cases, the borrower may be able to reverse this process through a rescission. Rescission of Acceleration of Loan is applicable in various situations, including mortgage loans, personal loans, or business loans. In Arlington, Texas, the process may differ based on the type of loan involved. Let's explore some different types of Arlington Texas Rescission of Acceleration of Loan: 1. Mortgage Rescission of Acceleration: In the case of a mortgage loan, where a borrower defaults on their payments, the lender can initiate the acceleration process. However, Arlington, Texas allows borrowers to pursue a rescission of acceleration, which involves taking legal action to stop the acceleration and reinstate the original loan terms. This may require negotiating with the lender or presenting evidence of a legitimate reason for the default. 2. Personal Loan Rescission of Acceleration: If a borrower defaults on a personal loan in Arlington, Texas, the acceleration process can be initiated, causing the entire remaining balance to become due immediately. However, borrowers have the right to request a rescission of acceleration, which can involve demonstrating the ability to resume making regular payments or entering into negotiations to modify the loan terms. 3. Business Loan Rescission of Acceleration: In the context of business loans in Arlington, Texas, when a borrower defaults, the lender can accelerate the loan and demand full repayment. However, business owners have the option to seek a rescission of acceleration to alleviate the immediate financial burden. This may involve presenting a viable plan for repaying the outstanding debt or negotiating new loan terms. Overall, Arlington Texas Rescission of Acceleration of Loan is a legal process that allows borrowers in Arlington, Texas, to reverse the acceleration of their loans, typically by negotiating with the lender or presenting a valid case for the default. Whether it's a mortgage, personal loan, or business loan, borrowers may have the opportunity to restore the original loan terms and regain control over their financial situation.

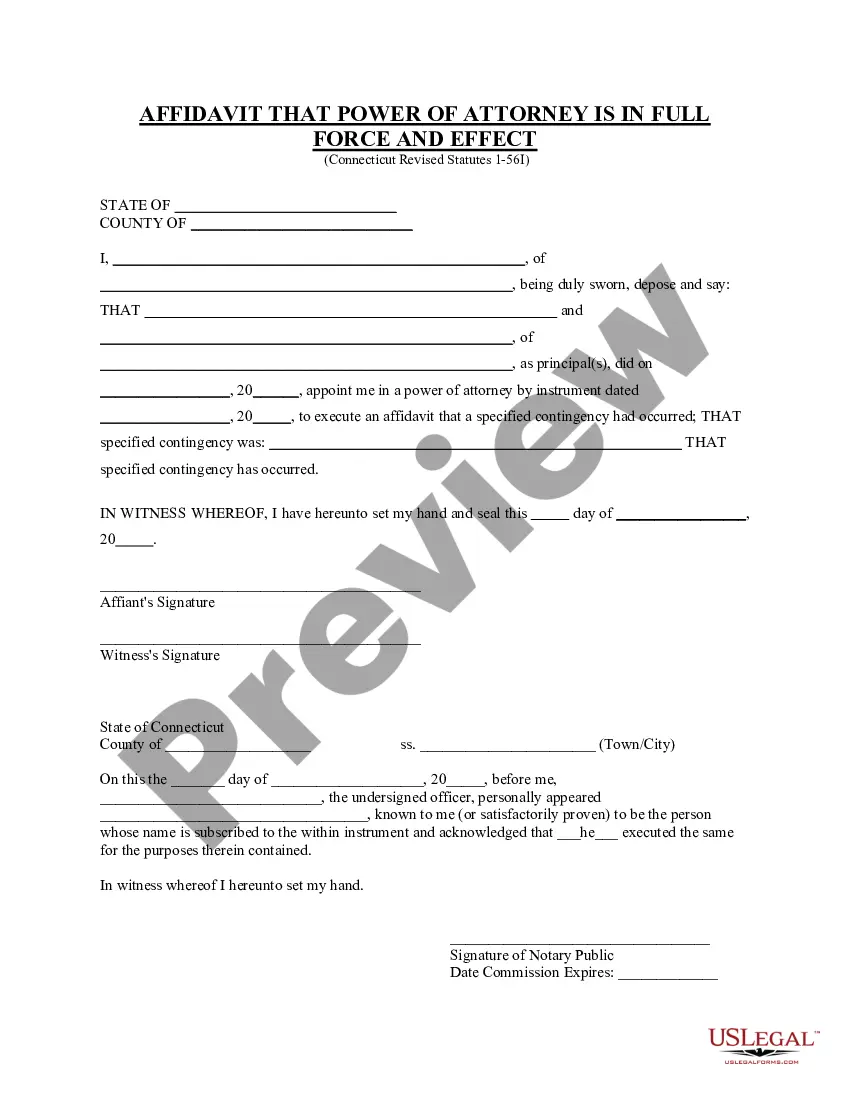

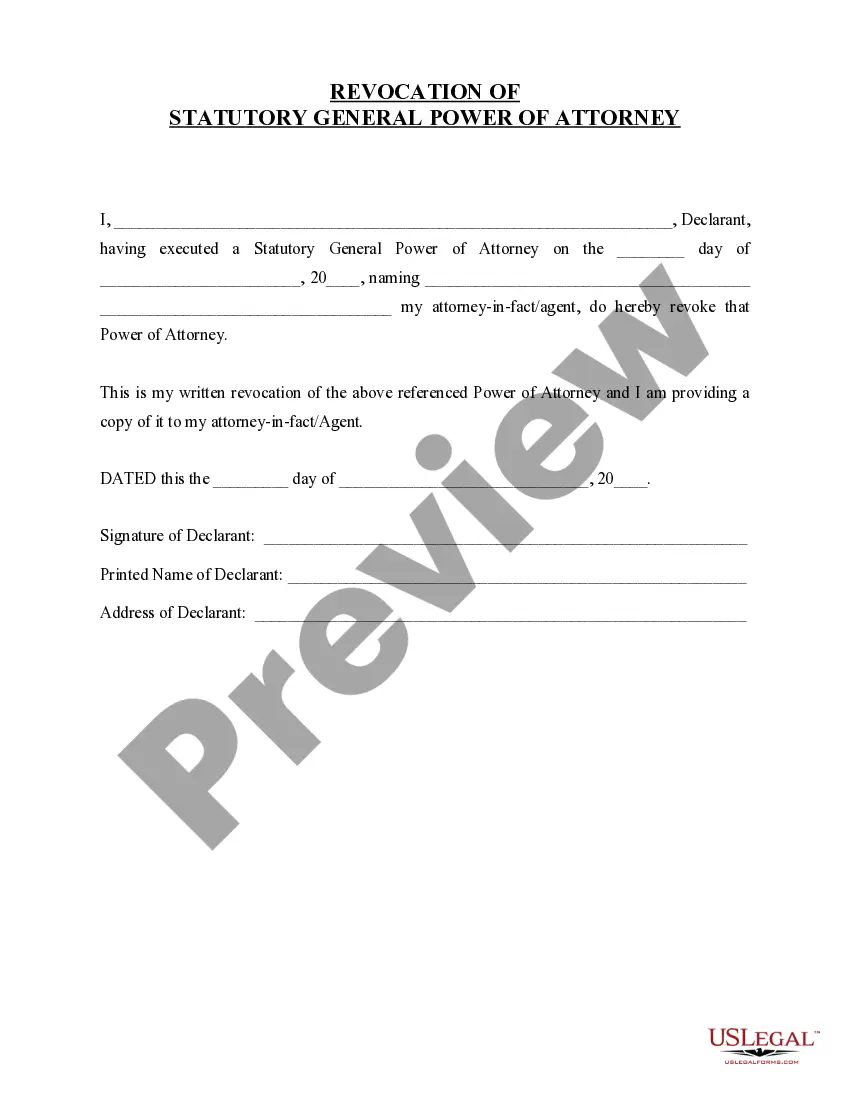

Free preview

How to fill out Arlington Texas Rescission Of Acceleration Of Loan?

If you’ve already used our service before, log in to your account and download the Arlington Texas Rescission of Acceleration of Loan on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Arlington Texas Rescission of Acceleration of Loan. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!