Dallas Texas Rescission of Acceleration of Loan refers to a legal process that allows borrowers in Dallas, Texas, to request the cancellation of the acceleration on their loans. This rescission option enables borrowers to revert the loan agreement back to its original terms and eliminates the need for the full repayment of the loan amount upon default. In Dallas, Texas, the rescission of acceleration of loan is designed to protect borrowers from the potentially harsh consequences of loan default. When a borrower fails to meet the repayment terms of a loan, the lender has the right to accelerate the loan, declaring the entire remaining balance due immediately. However, Dallas, Texas provides an avenue for borrowers to request the rescission of this acceleration and revert to more manageable repayment terms. This rescission of acceleration of loan is particularly crucial for borrowers who may have faced unforeseen financial challenges or hardships, which contributed to the default. By utilizing the rescission option, borrowers in Dallas, Texas, can negotiate with their lenders to reinstate the original loan terms, allowing for a more feasible repayment plan that aligns with their current financial circumstances. There are various types of Dallas Texas Rescission of Acceleration of Loan available to borrowers, including: 1. Judicial Rescission: This type of rescission involves a court order to cancel the acceleration of the loan. Borrowers may need to file a lawsuit and present evidence of their financial hardships or other justifiable reasons for the court to grant the rescission. 2. Renegotiation of the Loan Terms: Borrowers may also have the option to negotiate with their lenders directly to modify the loan terms, such as extending the repayment period or reducing the interest rate. This can be done through a formal agreement or an informal negotiation process. 3. Mediation or Arbitration: In some cases, borrowers and lenders may opt for a mediation or arbitration process to resolve loan acceleration issues. A neutral third party can help facilitate the negotiations and reach a mutually beneficial agreement. 4. Loan Modification Programs: Dallas, Texas may have specific loan modification programs available for borrowers facing financial difficulties. These programs can provide assistance in restructuring the loan terms to make it more affordable and prevent the acceleration of the loan. In conclusion, Dallas, Texas Rescission of Acceleration of Loan provides borrowers with an opportunity to mitigate the consequences of loan default. By pursuing the rescission option, borrowers can potentially reinstate the original loan terms or negotiate new repayment terms that align with their current financial situation. The various types of rescission available allow borrowers to explore different pathways in seeking a resolution for their defaulted loans.

Dallas Texas Rescission of Acceleration of Loan

State:

Texas

County:

Dallas

Control #:

TX-JW-0091

Format:

PDF

Instant download

This form is available by subscription

Description

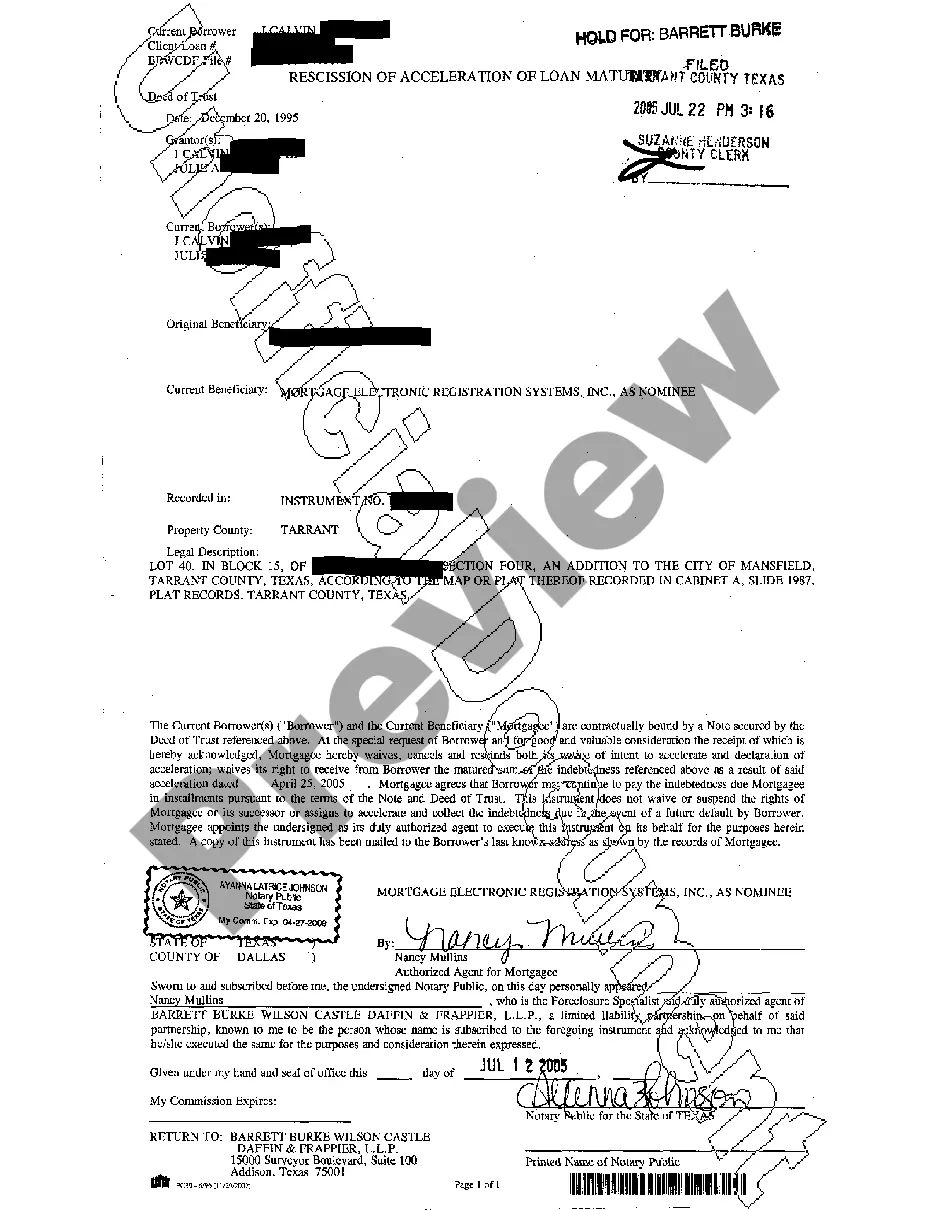

Rescission of Acceleration of Loan

Dallas Texas Rescission of Acceleration of Loan refers to a legal process that allows borrowers in Dallas, Texas, to request the cancellation of the acceleration on their loans. This rescission option enables borrowers to revert the loan agreement back to its original terms and eliminates the need for the full repayment of the loan amount upon default. In Dallas, Texas, the rescission of acceleration of loan is designed to protect borrowers from the potentially harsh consequences of loan default. When a borrower fails to meet the repayment terms of a loan, the lender has the right to accelerate the loan, declaring the entire remaining balance due immediately. However, Dallas, Texas provides an avenue for borrowers to request the rescission of this acceleration and revert to more manageable repayment terms. This rescission of acceleration of loan is particularly crucial for borrowers who may have faced unforeseen financial challenges or hardships, which contributed to the default. By utilizing the rescission option, borrowers in Dallas, Texas, can negotiate with their lenders to reinstate the original loan terms, allowing for a more feasible repayment plan that aligns with their current financial circumstances. There are various types of Dallas Texas Rescission of Acceleration of Loan available to borrowers, including: 1. Judicial Rescission: This type of rescission involves a court order to cancel the acceleration of the loan. Borrowers may need to file a lawsuit and present evidence of their financial hardships or other justifiable reasons for the court to grant the rescission. 2. Renegotiation of the Loan Terms: Borrowers may also have the option to negotiate with their lenders directly to modify the loan terms, such as extending the repayment period or reducing the interest rate. This can be done through a formal agreement or an informal negotiation process. 3. Mediation or Arbitration: In some cases, borrowers and lenders may opt for a mediation or arbitration process to resolve loan acceleration issues. A neutral third party can help facilitate the negotiations and reach a mutually beneficial agreement. 4. Loan Modification Programs: Dallas, Texas may have specific loan modification programs available for borrowers facing financial difficulties. These programs can provide assistance in restructuring the loan terms to make it more affordable and prevent the acceleration of the loan. In conclusion, Dallas, Texas Rescission of Acceleration of Loan provides borrowers with an opportunity to mitigate the consequences of loan default. By pursuing the rescission option, borrowers can potentially reinstate the original loan terms or negotiate new repayment terms that align with their current financial situation. The various types of rescission available allow borrowers to explore different pathways in seeking a resolution for their defaulted loans.

Free preview

How to fill out Dallas Texas Rescission Of Acceleration Of Loan?

If you’ve already utilized our service before, log in to your account and save the Dallas Texas Rescission of Acceleration of Loan on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Dallas Texas Rescission of Acceleration of Loan. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!