In Fort Worth, Texas, the term "Rescission of Acceleration of Loan" refers to the process or action taken by a borrower to cancel or invalidate the acceleration of loan repayment. This action essentially revokes the lender's right to demand immediate payment of the entire loan balance in case of default by the borrower. It is an important legal tool available to borrowers who wish to halt the acceleration process. In common terms, acceleration of a loan occurs when a borrower fails to meet the agreed-upon repayment terms (such as missing multiple payments or breaching the loan agreement), leading the lender to demand the full loan amount instead of the regular payment installments. This acceleration can put significant financial pressure on the borrower as they may not have the means to repay the entire loan in a lump sum. A Fort Worth Texas Rescission of Acceleration of Loan involves the borrower challenging and negating the lender's decision to accelerate the loan repayment. By utilizing the concept of rescission, the borrower aims to revert the loan back to its original terms, allowing them to resume regular installment payments rather than facing the immediate repayment. Different types of Fort Worth Texas Rescission of Acceleration of Loan may include: 1. Statutory Rescission: This type of rescission follows specific legal provisions and requirements outlined in state laws or regulations in Texas to invalidate the acceleration of loan repayment. These provisions may specify the time frame, procedure, and conditions under which a borrower can exercise their right to rescind acceleration. 2. Contractual Rescission: Some loan agreements may include specific clauses or provisions that grant the borrower the right to rescind acceleration under certain circumstances. This type of rescission is based on the terms negotiated between the borrower and lender during the loan agreement's formation. 3. Judicial Rescission: In some cases, a borrower may need to resort to legal proceedings to seek rescission of acceleration. This involves filing a lawsuit and presenting evidence to a court that demonstrates the lender's acceleration decision was wrongful or violated legal requirements. It is important to note that each Fort Worth Texas Rescission of Acceleration of Loan case may have unique factors and circumstances. The availability and applicability of different types of rescission can vary depending on the specific loan agreement, Texas state laws, and the merits of the borrower's case. It is recommended for borrowers seeking rescission to consult with an attorney who specializes in loan and contract law to understand their rights and determine the most appropriate course of action.

Fort Worth Texas Rescission of Acceleration of Loan

Description

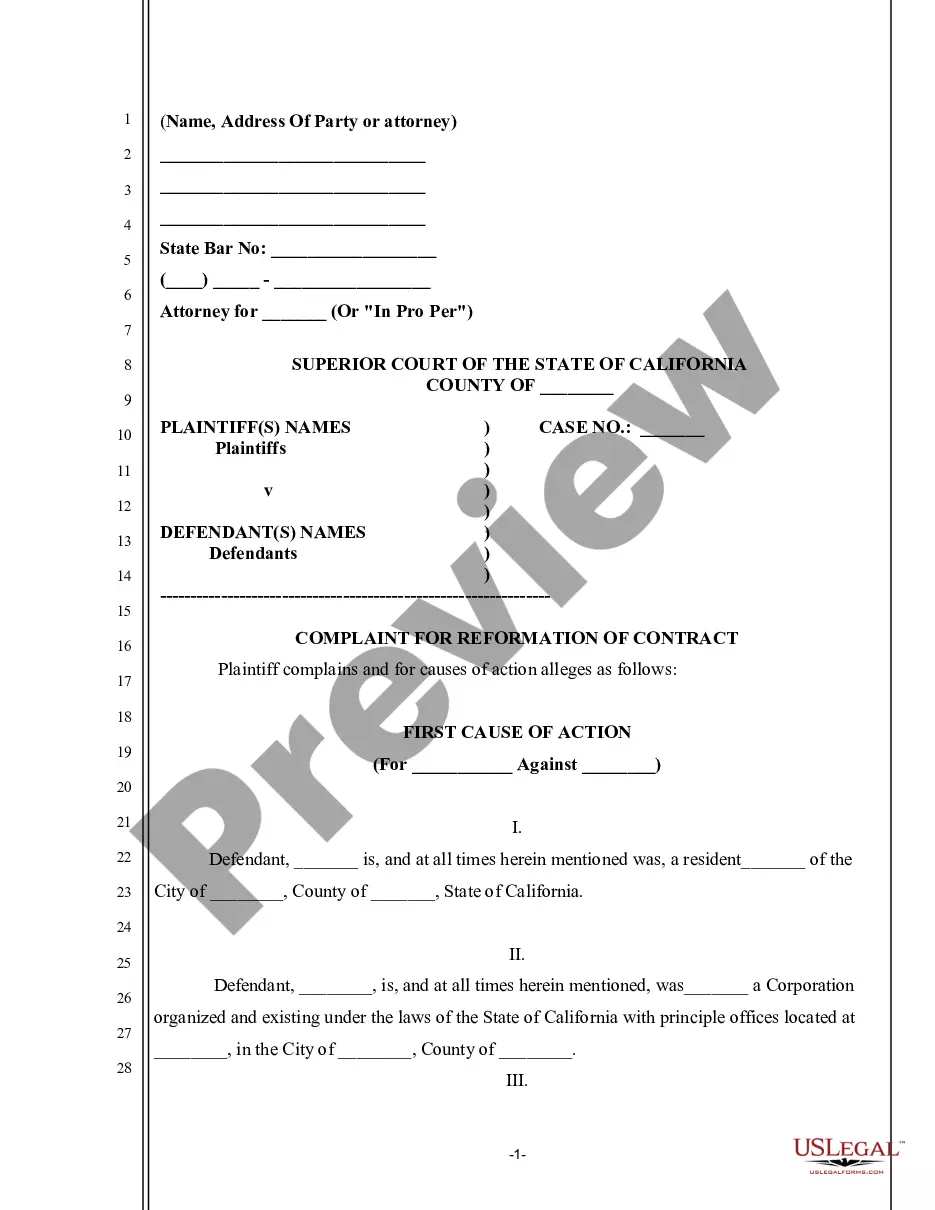

How to fill out Fort Worth Texas Rescission Of Acceleration Of Loan?

If you are searching for a valid form template, it’s impossible to find a better service than the US Legal Forms site – one of the most considerable online libraries. Here you can get a huge number of templates for business and individual purposes by categories and regions, or key phrases. Using our high-quality search feature, getting the most recent Fort Worth Texas Rescission of Acceleration of Loan is as easy as 1-2-3. In addition, the relevance of each record is proved by a group of professional lawyers that on a regular basis check the templates on our platform and revise them based on the newest state and county laws.

If you already know about our system and have an account, all you should do to get the Fort Worth Texas Rescission of Acceleration of Loan is to log in to your user profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the form you want. Check its information and make use of the Preview option to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to discover the proper document.

- Affirm your decision. Select the Buy now option. After that, choose your preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Select the file format and download it to your system.

- Make changes. Fill out, modify, print, and sign the received Fort Worth Texas Rescission of Acceleration of Loan.

Every form you save in your user profile does not have an expiry date and is yours forever. You can easily access them via the My Forms menu, so if you want to receive an extra version for enhancing or creating a hard copy, you can return and save it again anytime.

Take advantage of the US Legal Forms extensive library to get access to the Fort Worth Texas Rescission of Acceleration of Loan you were seeking and a huge number of other professional and state-specific templates in a single place!