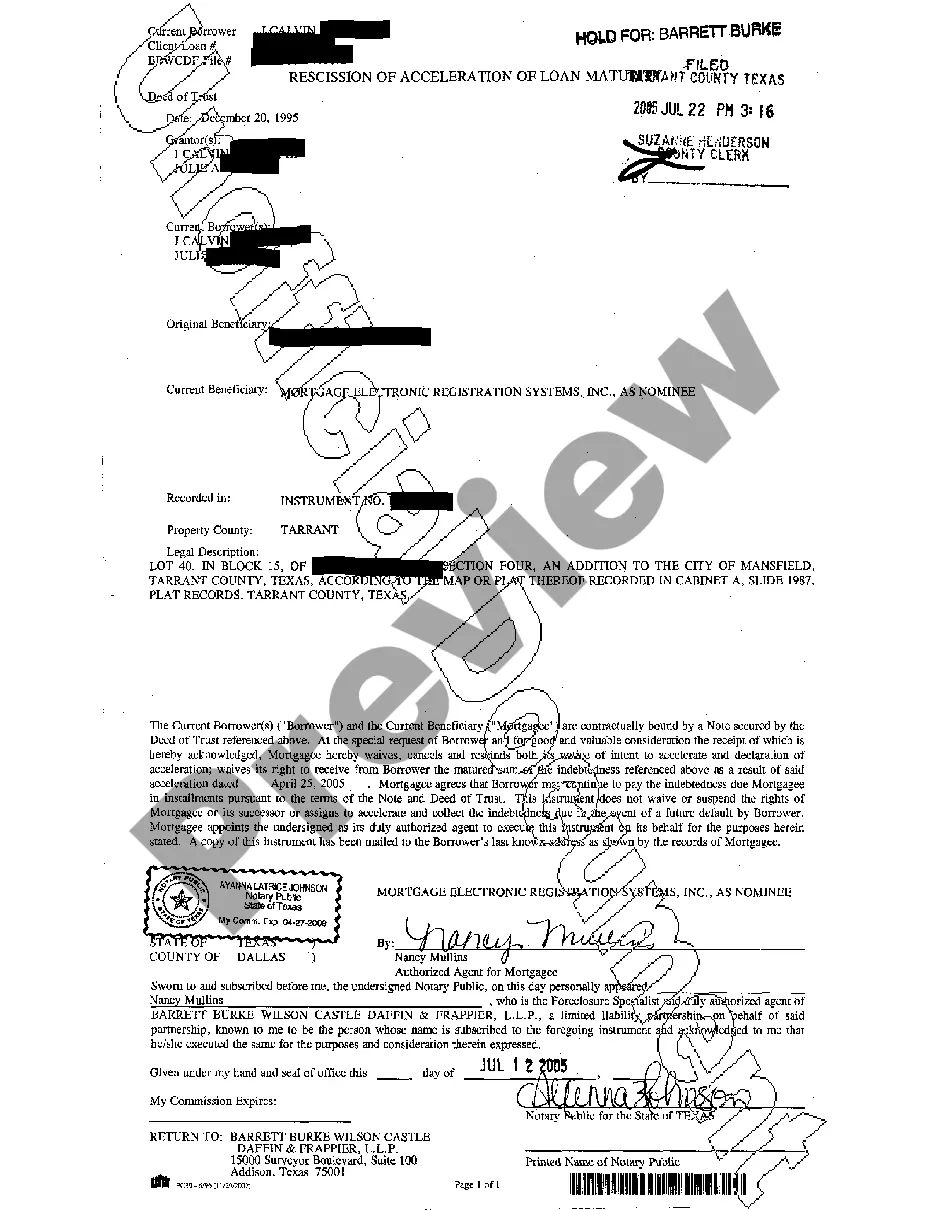

Frisco, Texas Rescission of Acceleration of Loan: Explained in Detail In the world of lending and mortgages, the term "rescission of acceleration of loan" refers to a legal process available to borrowers in Frisco, Texas, that allows them to halt or reverse the acceleration of their outstanding loan balance. This rescission typically comes into play when a borrower is facing financial difficulties and struggling to make timely loan payments. It serves as a protective measure for borrowers seeking temporary relief from immense financial pressure. The rescission process can vary depending on the type of loan and the specific circumstances of it. In Frisco, Texas, different types of rescission of acceleration of loans include: 1. Residential Mortgage Loans: This type of loan rescission primarily applies to individuals or families who have taken out loans to finance the purchase or renovation of their homes in Frisco. In case of default or non-payment, borrowers may have the option to seek a rescission of acceleration, enabling them to temporarily pause the acceleration of their loan balance and negotiate repayment terms with the lender. 2. Commercial Loans: Frisco, being a hub of economic growth, also witnesses a significant number of commercial loans. In cases where businesses fail to meet their repayment obligations, the rescission of acceleration of loan can provide a means to halt the lender's accelerated actions, offering the borrower a chance to explore alternative solutions or negotiate new repayment terms. 3. Auto Loans: Despite being less common, rescission of acceleration of loans may also apply to automobile financing. If a borrower in Frisco, Texas, encounters financial hardship and struggles to make auto loan payments, they may be able to utilize the rescission process to temporarily suspend the acceleration of the loan and arrange new repayment terms that suit their current financial situation. It is important to note that seeking a Frisco Texas rescission of acceleration of loan does not absolve the borrower of their repayment responsibilities. Rather, it provides a temporary reprieve and an opportunity for individuals or businesses in financial distress to work out a viable solution with their lender. To initiate the rescission process, borrowers must promptly notify their lender of their intention to seek a rescission of acceleration. This formal notification should include a detailed explanation of the borrower's financial hardship and a proposed plan to address the arbitrages. Following the notification, lenders and borrowers can work together to determine suitable repayment options that alleviate the immediate financial burden while ensuring the long-term viability of the loan. In conclusion, the Frisco, Texas rescission of acceleration of loan is a legal recourse available to borrowers facing financial difficulties. By temporarily halting the acceleration of outstanding loan balances, it offers borrowers the chance to negotiate new repayment terms and find a more manageable financial solution. By understanding the different types of rescission depending on the loan, borrowers in Frisco can take informed steps to protect their rights and find a way to fulfill their financial obligations.

Frisco Texas Rescission of Acceleration of Loan

Description

How to fill out Frisco Texas Rescission Of Acceleration Of Loan?

Do you need a reliable and affordable legal forms supplier to buy the Frisco Texas Rescission of Acceleration of Loan? US Legal Forms is your go-to solution.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Frisco Texas Rescission of Acceleration of Loan conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the document is intended for.

- Start the search over if the template isn’t good for your legal situation.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Frisco Texas Rescission of Acceleration of Loan in any available format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time researching legal papers online once and for all.