Laredo Texas Rescission of Acceleration of Loan refers to a legal process that allows borrowers to reverse the acceleration of their loan repayment. This means that if a borrower fails to meet the terms of their loan agreement, typically by missing several payments, the lender has the right to accelerate the loan and demand immediate repayment of the entire loan balance. However, in Laredo Texas, borrowers have the opportunity to rescind or undo this acceleration, giving them a chance to continue with the original repayment terms. There are different types of Laredo Texas Rescission of Acceleration of Loan, including: 1. Judicial Rescission: This is when a borrower files a lawsuit against the lender, seeking a court's intervention to reverse the acceleration of the loan. The court will consider various factors, such as the borrower's financial situation and any potential contractual violations by the lender, before making a decision. 2. Voluntary Rescission: In some cases, lenders may be willing to rescind the acceleration voluntarily if the borrower presents a reasonable plan to catch up on missed payments and reaffirm the original repayment terms. This type of rescission usually involves negotiations between the borrower and the lender. 3. Statutory Rescission: Laredo Texas may have specific laws or regulations that provide borrowers with the right to rescind an acceleration of a loan under certain circumstances. These laws typically outline the conditions, procedures, and timelines for initiating the rescission process. When dealing with a Laredo Texas Rescission of Acceleration of Loan, it is crucial for borrowers to understand their rights and obligations under applicable state and federal laws. Seeking legal advice from a qualified attorney specializing in real estate or consumer protection can ensure that borrowers navigate the process correctly. Keywords: Laredo Texas, Rescission of Acceleration, loan repayment, borrower, lender, loan agreement, acceleration, immediate repayment, legal process, lawsuit, court intervention, financial situation, contractual violations, voluntary agreement, catch up on missed payments, reaffirm, negotiations, statutory rights, state laws, federal laws, legal advice, attorney, real estate, consumer protection.

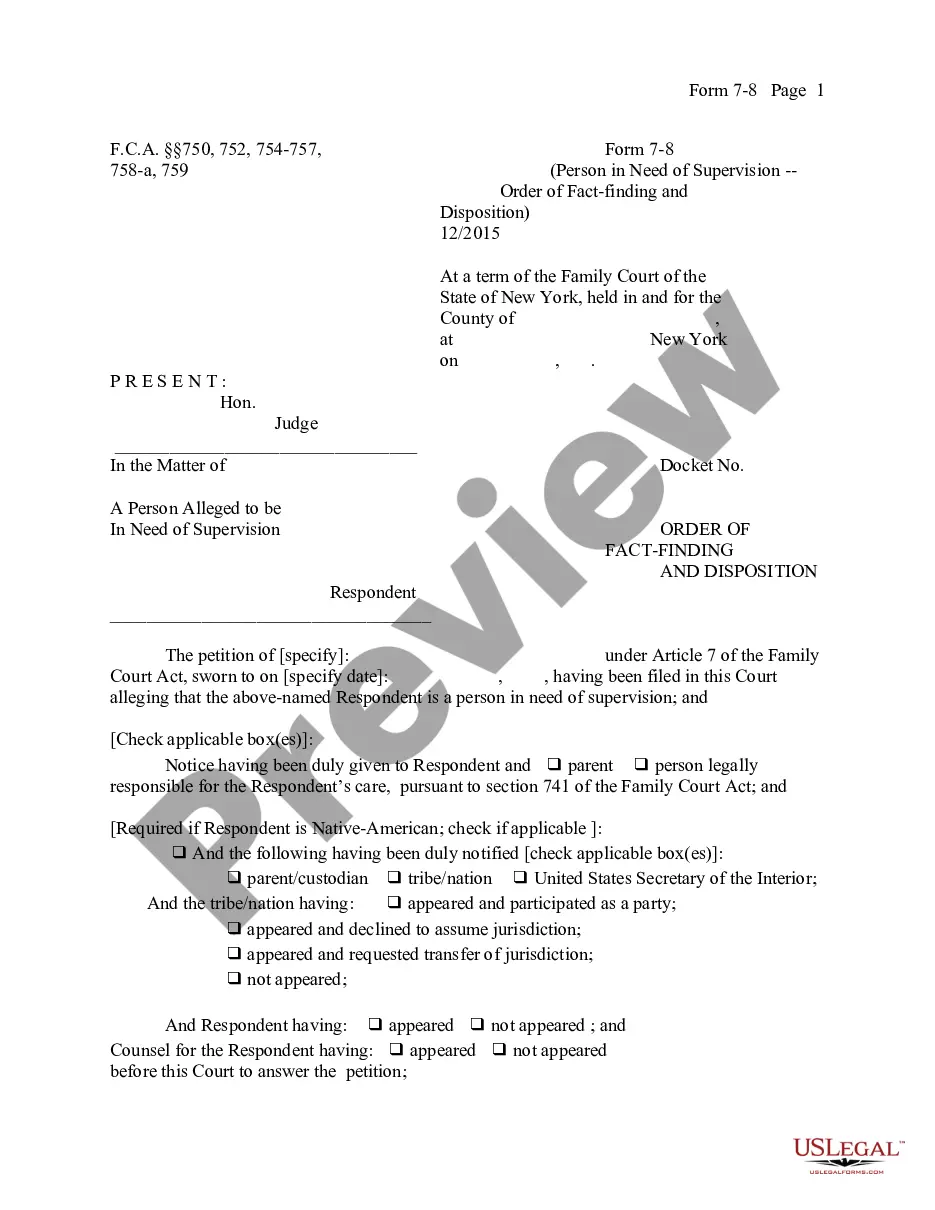

Laredo Texas Rescission of Acceleration of Loan

Description

How to fill out Laredo Texas Rescission Of Acceleration Of Loan?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Laredo Texas Rescission of Acceleration of Loan or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Laredo Texas Rescission of Acceleration of Loan adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Laredo Texas Rescission of Acceleration of Loan would work for you, you can select the subscription option and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!