McKinney Texas Rescission of Acceleration of Loan is a legal process that refers to the reversal of an accelerated loan repayment demand by the lender or creditor in McKinney, Texas. This process allows the borrower to reinstate the original loan terms and prevent foreclosure proceedings on their property. When a borrower fails to make timely mortgage payments, the lender has the right to accelerate the loan, which means that the entire loan balance becomes due immediately. However, in McKinney, Texas, borrowers have the opportunity to invoke the McKinney Texas Rescission of Acceleration of Loan to halt the foreclosure process and negotiate an alternative payment arrangement. There are two main types of McKinney Texas Rescission of Acceleration of Loan: 1. Voluntary Rescission: This type of rescission occurs when the borrower, after receiving an acceleration notice, promptly takes action to rectify the default by paying the overdue amount or negotiating a repayment plan with the lender. The lender voluntarily rescinds the acceleration notice and reinstates the original loan terms, allowing the borrower to resume regular payments. 2. Court-Ordered Rescission: In some cases, borrowers may choose to contest the acceleration notice in court, claiming errors, unfair practices, or breaches of contract by the lender. If the court finds merit in the borrower's arguments, it may issue a court-ordered rescission of the acceleration notice. This forces the lender to withdraw the acceleration demand and reinstates the loan agreement as originally intended. McKinney Texas Rescission of Acceleration of Loan is a crucial tool for borrowers facing foreclosure or struggling with their mortgage payments in McKinney, Texas. It provides them with an opportunity to rectify defaults, negotiate new payment arrangements, and ultimately save their homes from foreclosure. It is important for borrowers to consult with experienced legal professionals specializing in mortgage and foreclosure laws to understand the process fully and ensure they exercise their rights effectively.

McKinney Texas Rescission of Acceleration of Loan

State:

Texas

City:

McKinney

Control #:

TX-JW-0091

Format:

PDF

Instant download

This form is available by subscription

Description

Rescission of Acceleration of Loan

McKinney Texas Rescission of Acceleration of Loan is a legal process that refers to the reversal of an accelerated loan repayment demand by the lender or creditor in McKinney, Texas. This process allows the borrower to reinstate the original loan terms and prevent foreclosure proceedings on their property. When a borrower fails to make timely mortgage payments, the lender has the right to accelerate the loan, which means that the entire loan balance becomes due immediately. However, in McKinney, Texas, borrowers have the opportunity to invoke the McKinney Texas Rescission of Acceleration of Loan to halt the foreclosure process and negotiate an alternative payment arrangement. There are two main types of McKinney Texas Rescission of Acceleration of Loan: 1. Voluntary Rescission: This type of rescission occurs when the borrower, after receiving an acceleration notice, promptly takes action to rectify the default by paying the overdue amount or negotiating a repayment plan with the lender. The lender voluntarily rescinds the acceleration notice and reinstates the original loan terms, allowing the borrower to resume regular payments. 2. Court-Ordered Rescission: In some cases, borrowers may choose to contest the acceleration notice in court, claiming errors, unfair practices, or breaches of contract by the lender. If the court finds merit in the borrower's arguments, it may issue a court-ordered rescission of the acceleration notice. This forces the lender to withdraw the acceleration demand and reinstates the loan agreement as originally intended. McKinney Texas Rescission of Acceleration of Loan is a crucial tool for borrowers facing foreclosure or struggling with their mortgage payments in McKinney, Texas. It provides them with an opportunity to rectify defaults, negotiate new payment arrangements, and ultimately save their homes from foreclosure. It is important for borrowers to consult with experienced legal professionals specializing in mortgage and foreclosure laws to understand the process fully and ensure they exercise their rights effectively.

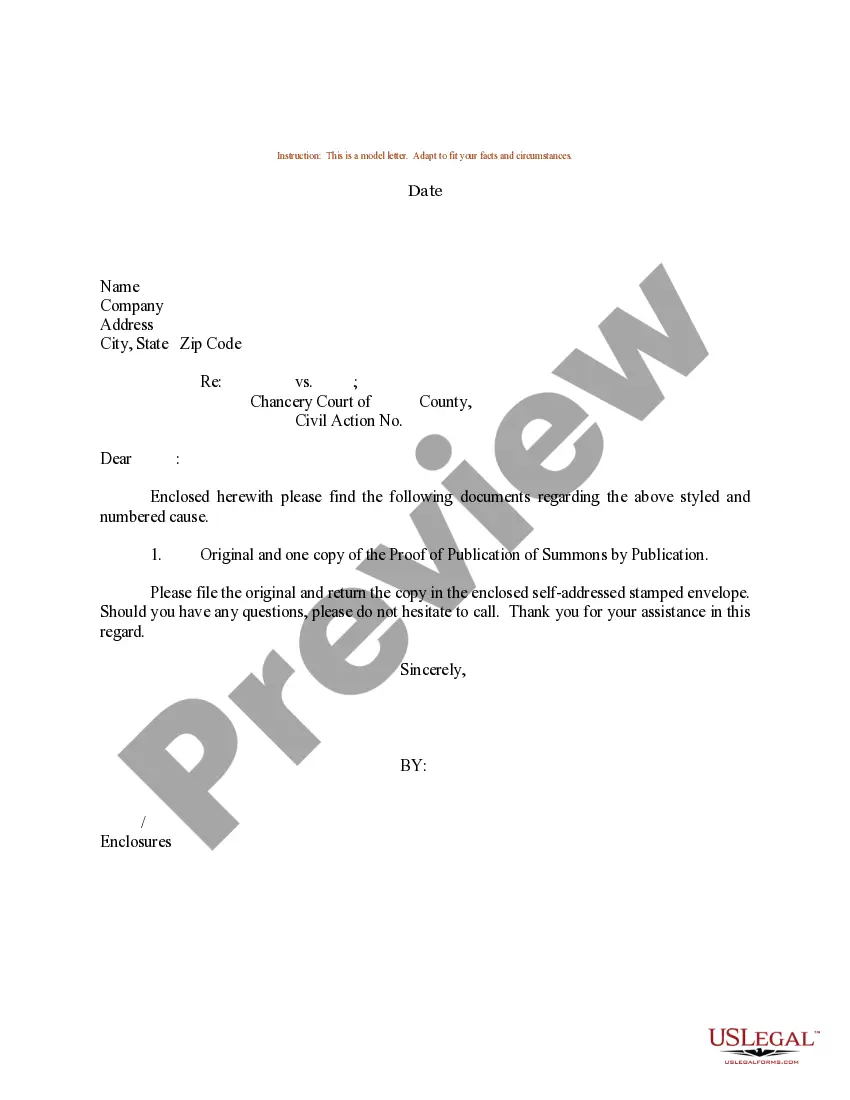

Free preview

How to fill out McKinney Texas Rescission Of Acceleration Of Loan?

If you’ve already utilized our service before, log in to your account and save the McKinney Texas Rescission of Acceleration of Loan on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your McKinney Texas Rescission of Acceleration of Loan. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!