The San Antonio Texas Rescission of Acceleration of Loan refers to a legal process that allows the borrower to reinstate the original terms of a loan agreement after the lender accelerates the repayment schedule due to a default or breach of the loan terms. This rescission action is applicable in the state of Texas, particularly in the city of San Antonio. When a borrower fails to fulfill their loan obligations, such as making timely repayments, the lender may initiate the acceleration process. Acceleration involves the lender demanding immediate payment of the remaining loan balance, effectively speeding up the repayment schedule. However, the San Antonio Texas Rescission of Acceleration of Loan serves as a mechanism to halt and reverse the acceleration, reinstituting the original loan terms. It is important to note that there are no specific types of San Antonio Texas Rescission of Acceleration of Loan, but rather this term encompasses a general concept applicable to various loan types, such as mortgage loans, personal loans, or business loans. Each loan agreement will have its unique terms and conditions, but the concept of rescission aims to provide borrowers with an opportunity to rectify their default and restore their repayment schedule to its original state. The San Antonio Texas Rescission of Acceleration of Loan is usually initiated by the borrower or their legal representative. The borrower must demonstrate valid reasons for rescission, such as proving that the default or breach was unintentional or resulted from circumstances beyond their control. They may need to provide evidence of changed financial circumstances or unforeseen events that led to their inability to meet the loan obligations. To initiate the rescission process, the borrower or their legal representative will typically prepare a letter or a legal document outlining their intention to rescind the acceleration of the loan. This document will explain the grounds for the rescission, present supporting evidence, and specify the desired outcome, which is usually the reinstatement of the original loan terms. Once the rescission request is received, the lender will evaluate the borrower's arguments and evidence, and assess whether the request is valid and reasonable. The lender may request additional information or documentation from the borrower to support their case. After careful review, the lender will then make a decision regarding the rescission request. If the lender approves the San Antonio Texas Rescission of Acceleration of Loan, the borrower's repayment schedule will revert to the original terms as outlined in the loan agreement. The remaining balance will be recalculated based on the original payment plan, and any additional penalties or fees imposed as a result of the acceleration will be reversed or waived. This allows the borrower an opportunity to rectify their default and continue the loan repayment as agreed upon initially. In summary, the San Antonio Texas Rescission of Acceleration of Loan is a process in which a borrower requesting a reverting of the speeded-up repayment schedule due to default or breach in loan terms. This process allows borrowers in San Antonio, Texas to reinstate the original loan terms, provided they can prove valid reasons for the default and present compelling evidence. While there aren't specific types of rescission, it is a concept applicable to various types of loans.

San Antonio Texas Rescission of Acceleration of Loan

State:

Texas

City:

San Antonio

Control #:

TX-JW-0091

Format:

PDF

Instant download

This form is available by subscription

Description

Rescission of Acceleration of Loan

The San Antonio Texas Rescission of Acceleration of Loan refers to a legal process that allows the borrower to reinstate the original terms of a loan agreement after the lender accelerates the repayment schedule due to a default or breach of the loan terms. This rescission action is applicable in the state of Texas, particularly in the city of San Antonio. When a borrower fails to fulfill their loan obligations, such as making timely repayments, the lender may initiate the acceleration process. Acceleration involves the lender demanding immediate payment of the remaining loan balance, effectively speeding up the repayment schedule. However, the San Antonio Texas Rescission of Acceleration of Loan serves as a mechanism to halt and reverse the acceleration, reinstituting the original loan terms. It is important to note that there are no specific types of San Antonio Texas Rescission of Acceleration of Loan, but rather this term encompasses a general concept applicable to various loan types, such as mortgage loans, personal loans, or business loans. Each loan agreement will have its unique terms and conditions, but the concept of rescission aims to provide borrowers with an opportunity to rectify their default and restore their repayment schedule to its original state. The San Antonio Texas Rescission of Acceleration of Loan is usually initiated by the borrower or their legal representative. The borrower must demonstrate valid reasons for rescission, such as proving that the default or breach was unintentional or resulted from circumstances beyond their control. They may need to provide evidence of changed financial circumstances or unforeseen events that led to their inability to meet the loan obligations. To initiate the rescission process, the borrower or their legal representative will typically prepare a letter or a legal document outlining their intention to rescind the acceleration of the loan. This document will explain the grounds for the rescission, present supporting evidence, and specify the desired outcome, which is usually the reinstatement of the original loan terms. Once the rescission request is received, the lender will evaluate the borrower's arguments and evidence, and assess whether the request is valid and reasonable. The lender may request additional information or documentation from the borrower to support their case. After careful review, the lender will then make a decision regarding the rescission request. If the lender approves the San Antonio Texas Rescission of Acceleration of Loan, the borrower's repayment schedule will revert to the original terms as outlined in the loan agreement. The remaining balance will be recalculated based on the original payment plan, and any additional penalties or fees imposed as a result of the acceleration will be reversed or waived. This allows the borrower an opportunity to rectify their default and continue the loan repayment as agreed upon initially. In summary, the San Antonio Texas Rescission of Acceleration of Loan is a process in which a borrower requesting a reverting of the speeded-up repayment schedule due to default or breach in loan terms. This process allows borrowers in San Antonio, Texas to reinstate the original loan terms, provided they can prove valid reasons for the default and present compelling evidence. While there aren't specific types of rescission, it is a concept applicable to various types of loans.

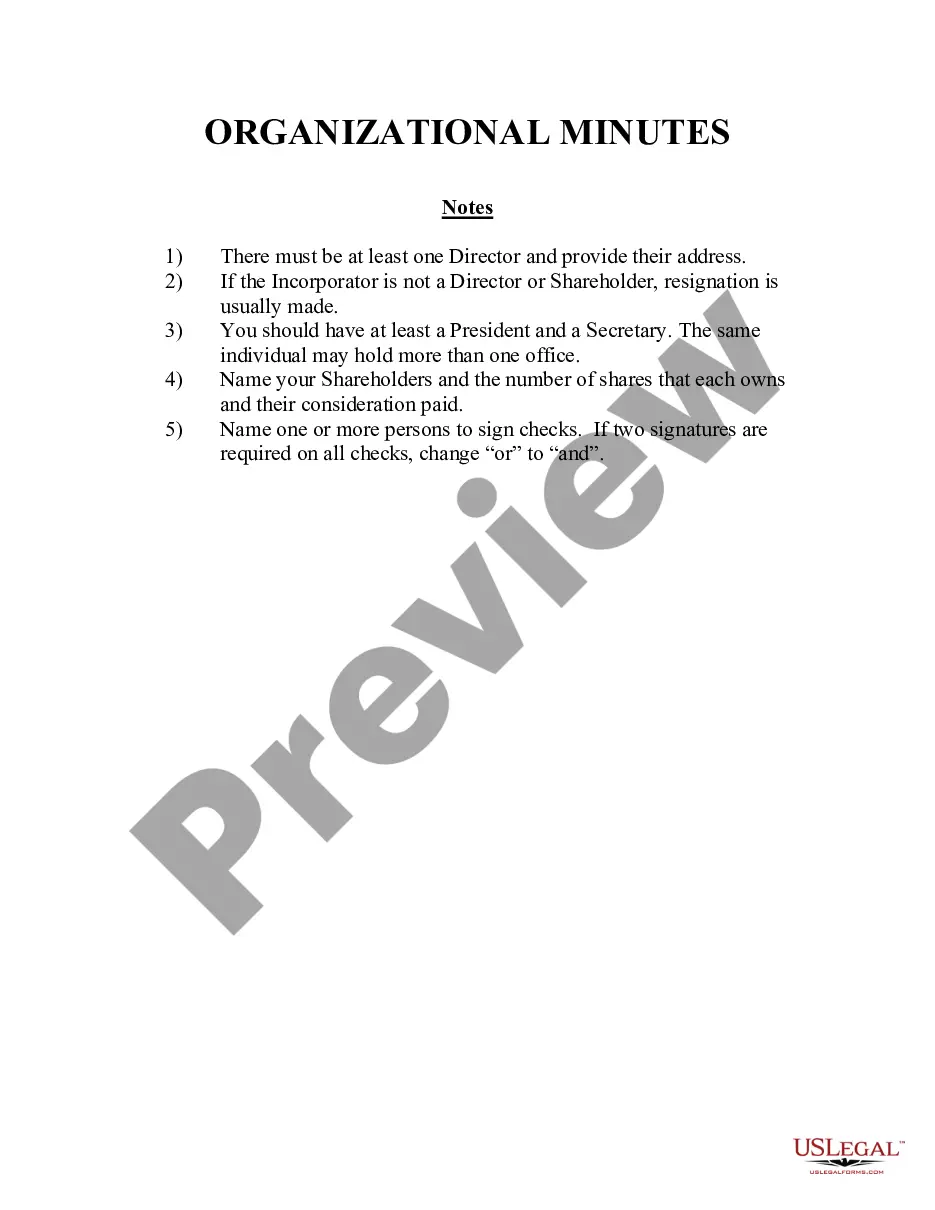

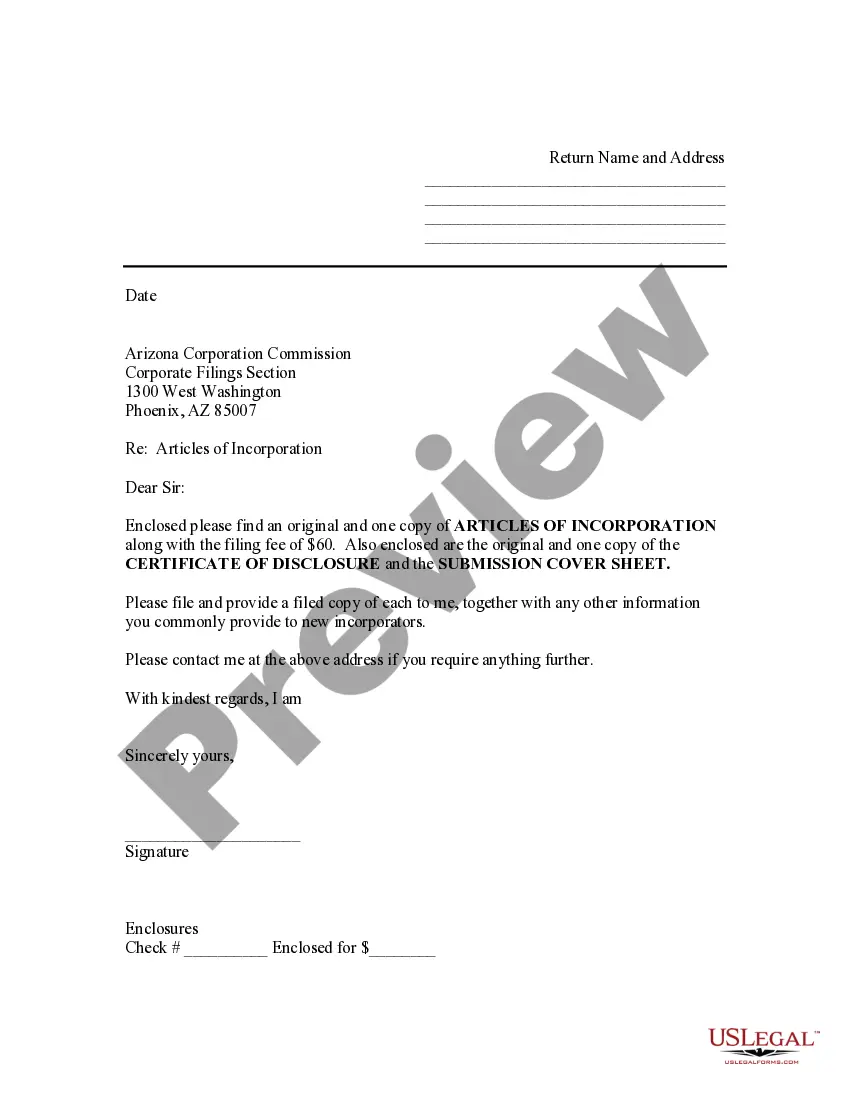

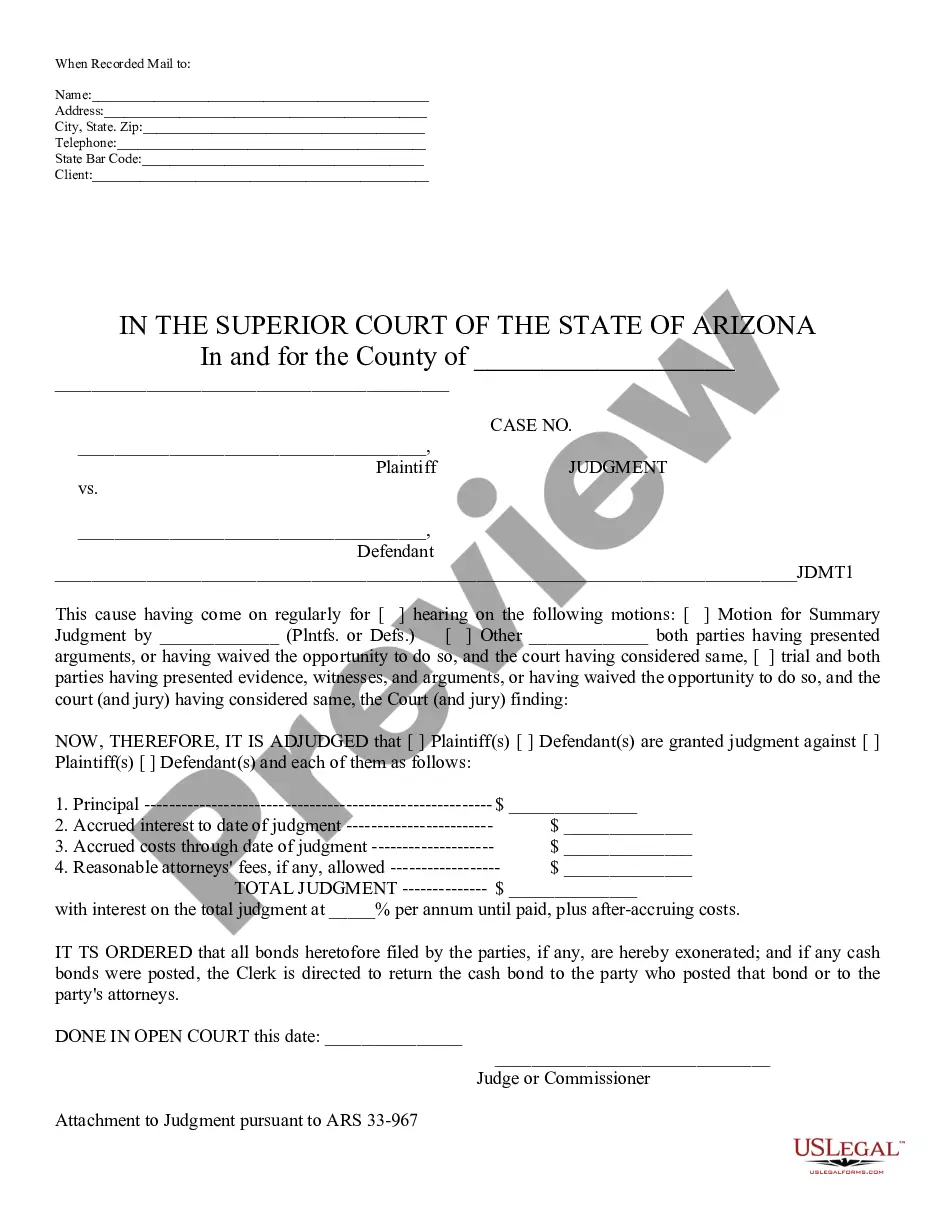

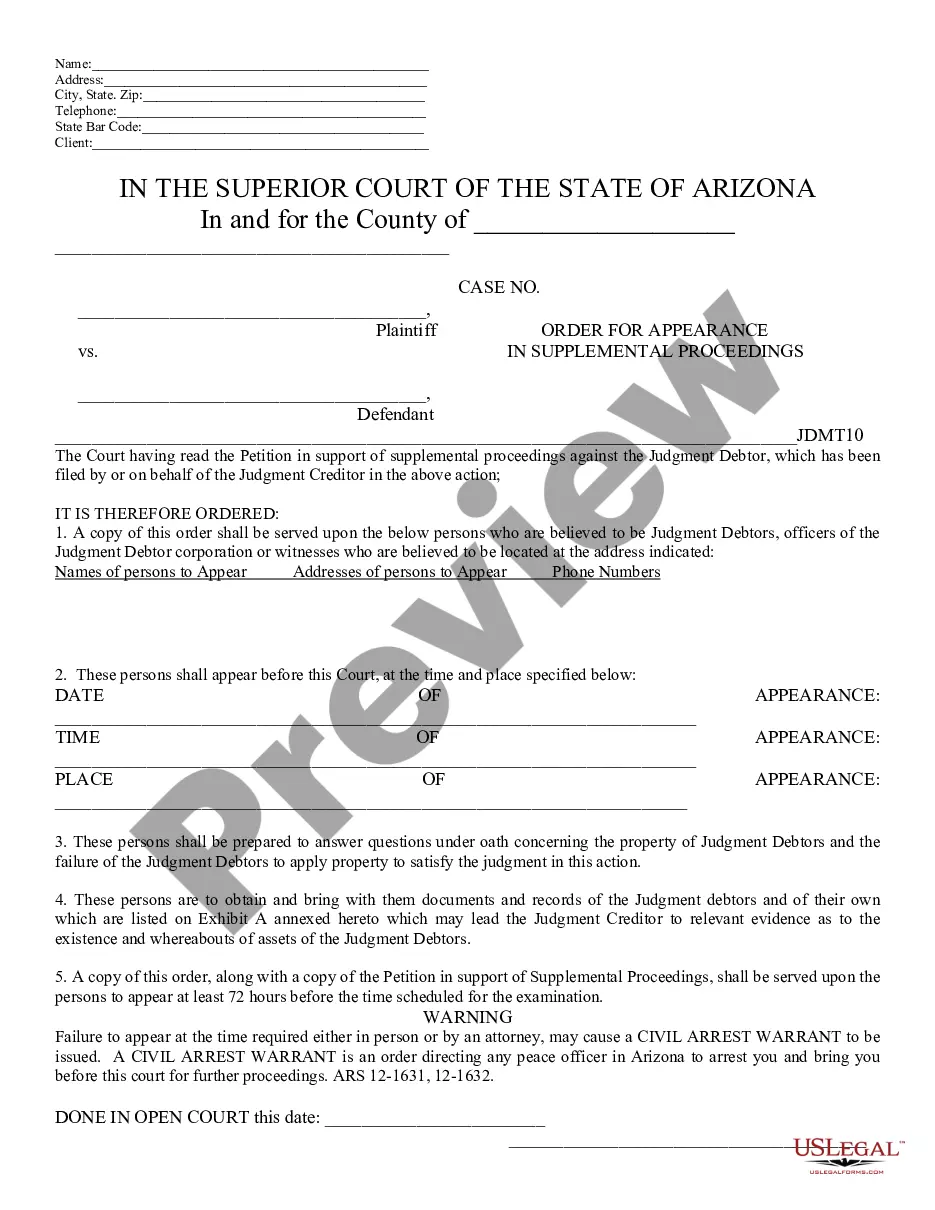

Free preview

How to fill out San Antonio Texas Rescission Of Acceleration Of Loan?

If you’ve already utilized our service before, log in to your account and save the San Antonio Texas Rescission of Acceleration of Loan on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your San Antonio Texas Rescission of Acceleration of Loan. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!