Title: Understanding Wichita Falls Texas Rescission of Acceleration of Loan: Types and Detailed Description Introduction: Wichita Falls, Texas, follows specific laws and regulations when it comes to the rescission of acceleration of loans. This legal process allows borrowers to revert to the original loan terms and conditions after a default, preventing lenders from demanding immediate payment of the entire outstanding loan amount. In this article, we will provide a detailed description of Wichita Falls Texas rescission of acceleration of loans, including its purpose, procedures, and potential types. Keywords: Wichita Falls Texas rescission, acceleration of loan, loan default, loan terms, outstanding loan amount. 1. Purpose of Wichita Falls Texas Rescission of Acceleration of Loan: Wichita Falls Texas rescission of acceleration of loan aims to protect borrowers from the sudden demand of full loan repayment, providing them an opportunity to restore the original loan agreement. It allows borrowers to regain control, reinstate the loan, and continue with regular payment schedules while preventing foreclosure or severe financial consequences. 2. Procedure for Wichita Falls Texas Rescission of Acceleration of Loan: The process begins when a borrower defaults on their loan payment obligations, prompting the lender to send an acceleration notice to demand immediate repayment of the entire outstanding loan amount. To initiate the rescission of acceleration, borrowers typically need to take the following steps: — Legal Representation: Seeking professional legal advice is essential to understand the intricacies of the rescission process and support your case effectively. — Timely Response: Fast action is crucial to maximize the chances of successful rescission. After receiving the acceleration notice, borrowers should respond promptly by submitting a written request for rescission to the lender or their legal representative. — Documentation: Prepare all relevant loan documents, correspondence, and evidence to support your case and prove your eligibility for rescission during the legal proceedings. — Negotiations: It may involve negotiation between borrower and lender to find an agreeable solution, ultimately aiming to revert to the original loan terms and conditions. 3. Types of Wichita Falls Texas Rescission of Acceleration of Loan: Although rescission of acceleration of loan generally follows a standardized procedure, there may be different scenarios or circumstances that result in specific types of rescission, including: — Judicial Rescission: This type of rescission is initiated through a lawsuit, requiring borrowers to file a legal complaint against the lender, citing breach of contract or other relevant legal grounds. — Non-Judicial Rescission: In some cases, lenders may agree to rescind acceleration without resorting to litigation. This happens when both parties reach an agreement or when the lender realizes default was due to an error on their part. — Temporary Rescission: Under this type of rescission, borrowers regain the original loan terms temporarily, usually for a specified period, to provide them with a window of opportunity to repay overdue amounts or rectify the default. — Permanent Rescission: If borrowers are successful in proving their case for rescission, the court may order a permanent rescission, reverting the loan to its original terms for the remaining duration. Conclusion: The Wichita Falls Texas rescission of acceleration of loan is a legal process designed to protect borrowers experiencing loan default from immediate repayment demands. By understanding the purpose, procedures, and potential types of rescission, borrowers can navigate this process with greater confidence, seeking fair resolutions and avoiding severe financial consequences. Keywords: Wichita Falls Texas, rescission of acceleration, loan default, legal process, borrower's rights, loan terms and conditions, judicial rescission, non-judicial rescission, temporary rescission, permanent rescission.

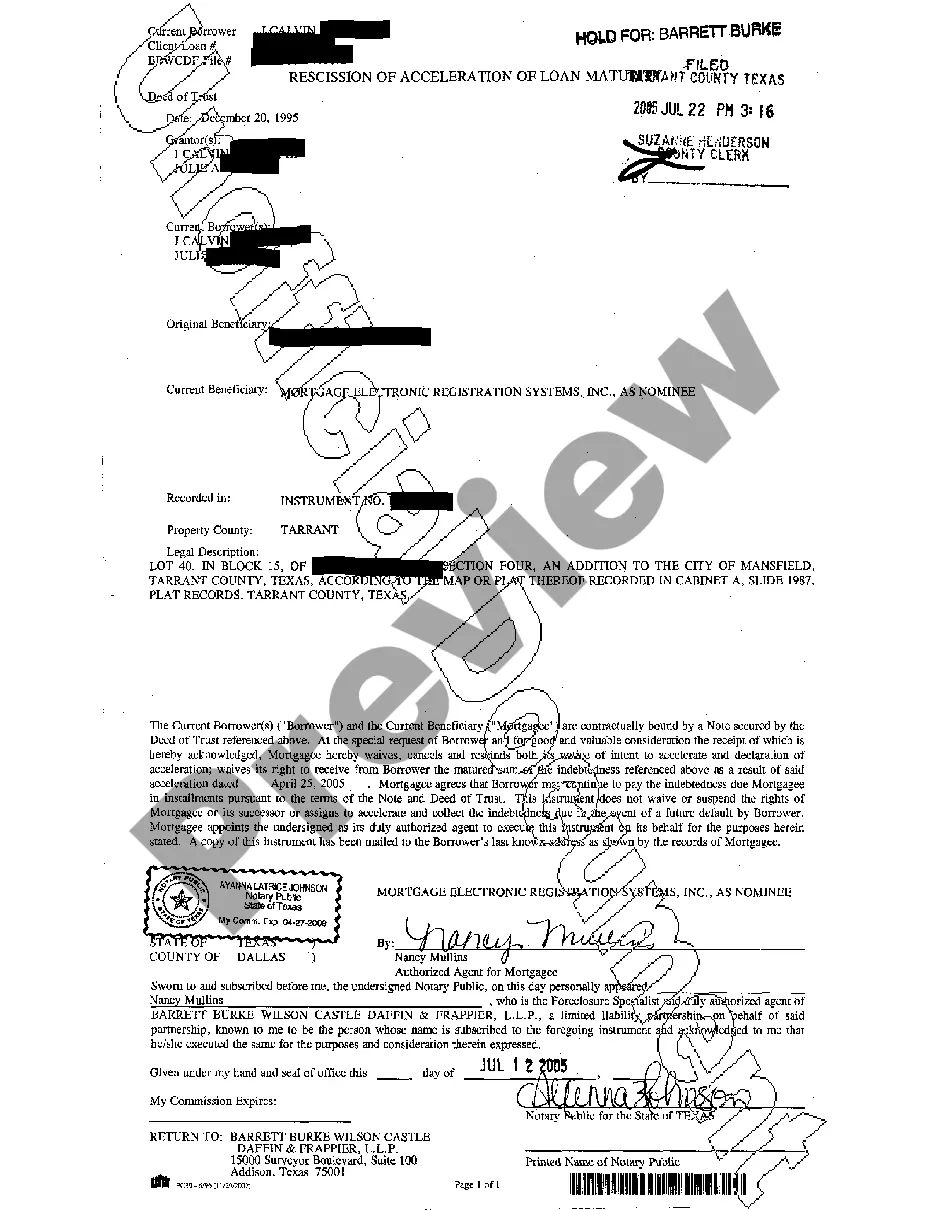

Wichita Falls Texas Rescission of Acceleration of Loan

Description

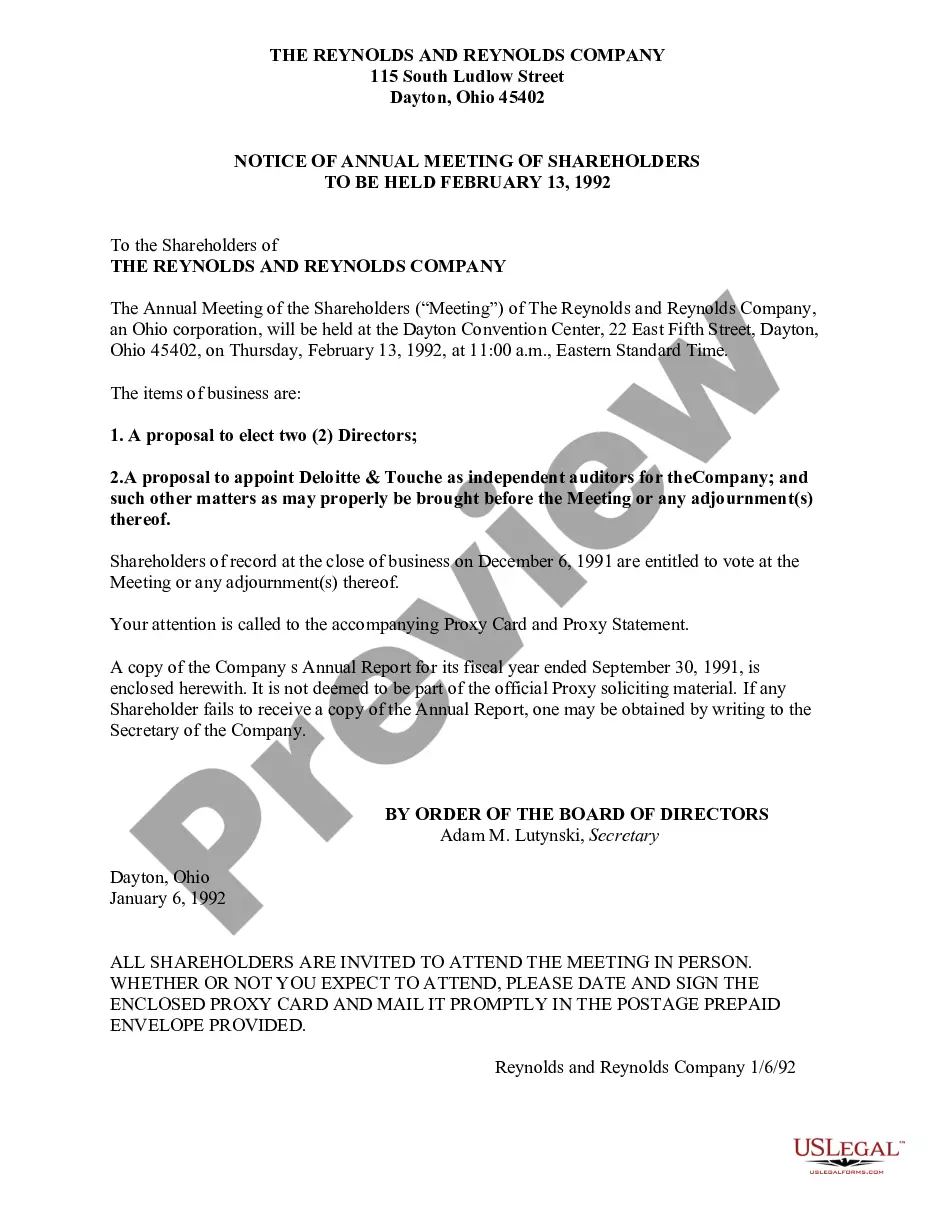

How to fill out Wichita Falls Texas Rescission Of Acceleration Of Loan?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Wichita Falls Texas Rescission of Acceleration of Loan becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Wichita Falls Texas Rescission of Acceleration of Loan takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Wichita Falls Texas Rescission of Acceleration of Loan. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

An acceleration clause is often part of a loan contract, and it allows a lender to require you to immediately repay all of your outstanding loan balance if you don't meet certain conditions. A lender may take advantage of this clause if you miss too many payments or breach the contract in some other way.

For mortgages that have an acceleration clause (most do), that means that, after breaching your contract by missing payments, your lender can demand that you either pay off the entire balance of your mortgage or be foreclosed upon.

Delayed or Missed Payments ? Repeated missed payments may force the lender to effectuate an acceleration clause. Thankfully, making full mortgage payments before can reverse the process.

As mentioned above, a lender can theoretically call your loan due for just one missed payment, depending on the terms of your mortgage agreement. However, commonly, you have to miss two or three mortgage payments before a lender decides to take this step.

An accelerated clause is a term in a loan agreement that requires the borrower to pay off the loan immediately under certain conditions. An accelerated clause is typically invoked when the borrower materially breaches the loan agreement.

The good news is, borrowers are generally able to avoid acceleration by working out a loan modification or repayment plan with their lender to make up delinquent payments. This is called a mortgage reinstatement.

In most cases, if you don't pay the full amount back in 30 days then the lender will begin the foreclosure process.

An accelerated clause is a term in a loan agreement that requires the borrower to pay off the loan immediately under certain conditions. An accelerated clause is typically invoked when the borrower materially breaches the loan agreement.

An acceleration clause is a condition inside a contract that allows a lender to ?accelerate? the repayment of your home loan if certain conditions aren't met. The acceleration clause will outline the different situations a lender can demand loan repayment and how much repayment is required.

If a homeowner fails to fulfill the terms of their mortgage agreement, they'll receive an acceleration letter notifying them that the lender has triggered the acceleration clause.