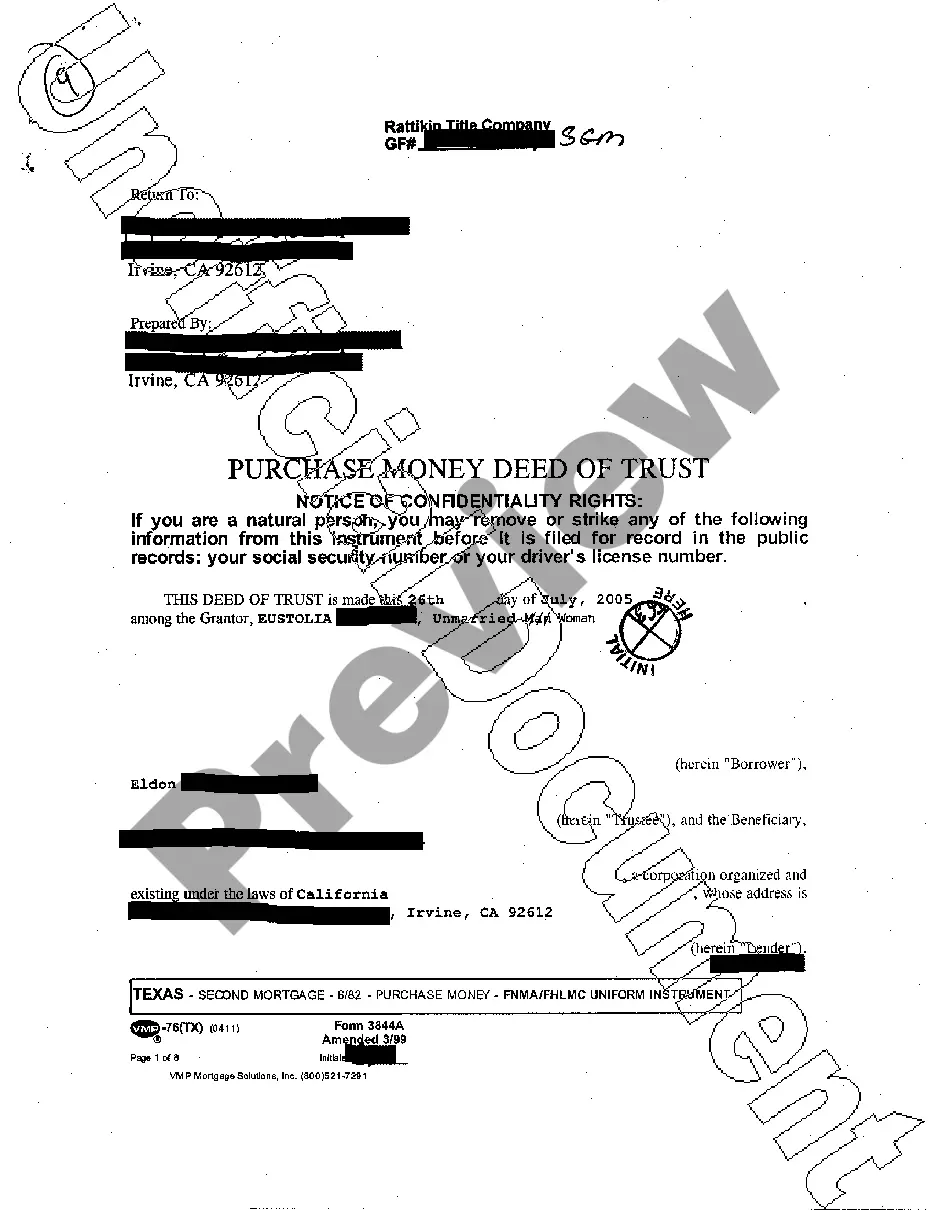

A Purchase Money Deed of Trust is a legal instrument commonly used in Laredo, Texas, to secure a loan used to finance the purchase of real estate. This type of deed of trust allows the lender to have a lien on the property being purchased as collateral for the loan. The Laredo Texas Purchase Money Deed of Trust is an important document that protects both the borrower and the lender in a real estate transaction. It provides security to the lender by giving them the right to foreclose on the property in case the borrower fails to make timely payments. At the same time, it offers certain protections to the borrower, such as clearly stating the terms and conditions of the loan. There are various types of Laredo Texas Purchase Money Deeds of Trust, each tailored to specific circumstances or parties involved in the transaction: 1. Seller-Financed Purchase Money Deed of Trust: This type of deed of trust is used when the seller of the property provides financing to the buyer. In this case, the seller becomes the lender and holds a private mortgage on the property. 2. Institutional Purchase Money Deed of Trust: This is the most common type of deed of trust used when a traditional lending institution, such as a bank or credit union, provides the loan to the buyer. The deed of trust becomes a public record, and the lender's interest in the property is duly noted. 3. Assumption Purchase Money Deed of Trust: In this scenario, the buyer assumes an existing mortgage on the property without obtaining a new loan. The existing deed of trust is transferred to the buyer, and they become responsible for making the mortgage payments. 4. Wraparound Purchase Money Deed of Trust: This type of deed of trust involves a secondary loan that wraps around an existing loan on the property. The buyer makes a single payment to the holder of the wraparound deed of trust, who then distributes the appropriate amount to the original lender. In conclusion, the Laredo Texas Purchase Money Deed of Trust is a crucial component of real estate transactions in the region. Whether it is a seller-financed, institutional, assumption, or wraparound deed of trust, this legal instrument provides the necessary security for lenders and borrowers alike, ensuring a smooth and fair transaction.

Laredo Texas Purchase Money Deed of Trust

Description

How to fill out Texas Purchase Money Deed Of Trust?

If you are searching for a pertinent form, it’s incredibly challenging to uncover a superior service than the US Legal Forms website – one of the most extensive repositories on the internet.

With this repository, you can locate a vast array of document examples for business and personal purposes categorized by type and location, or key terms.

With the enhanced search feature, locating the latest Laredo Texas Purchase Money Deed of Trust is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the file format and download it onto your device. Adjust as needed. Fill out, review, print, and endorse the obtained Laredo Texas Purchase Money Deed of Trust.

- Moreover, the applicability of each document is validated by a group of proficient attorneys who routinely evaluate the templates on our site and refresh them according to the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to obtain the Laredo Texas Purchase Money Deed of Trust is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, just follow the guidelines below.

- Ensure you have found the sample you need. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn’t match your requirements, use the Search field at the top of the screen to locate the necessary document.

- Confirm your selection. Click the Buy now option. After that, opt for the desired subscription plan and provide information to create an account.

Form popularity

FAQ

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

A deed of trust is drafted by a solicitor, normally during the conveyancing process when buying, however you can draft a deed of trust after you purchase. You can only have a deed of trust to protect your money in a property if you hold it as tenants in common.

Legal Definition of non-purchase money : not involving or being a debt secured by the property purchased with the money borrowed.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

There are a variety of deeds that are recognized in Texas, but the four most common deeds seen are general warranty deeds, special warranty deeds, no warranty deeds, and quitclaims.

What is a Purchase Money Trust? In trusts and estates law, a purchase money resulting trust is a type of trust that is created when an individual contributes funds to purchase a particular property, but instructs the seller to transfer title to the property to a different individual.

In trusts and estates law, a purchase money resulting trust is a type of trust that is created when an individual contributes funds to purchase a particular property, but instructs the seller to transfer title to the property to a different individual. It is also known as a purchase money trust.

WHERE DO I RECORD THE DEED? After the deed has been signed and notarized, the original needs to be filed and recorded with the county clerk in the county where the property is located. You can mail the deed or take it to the county clerk's office in person. Only original documents may be recorded.

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.