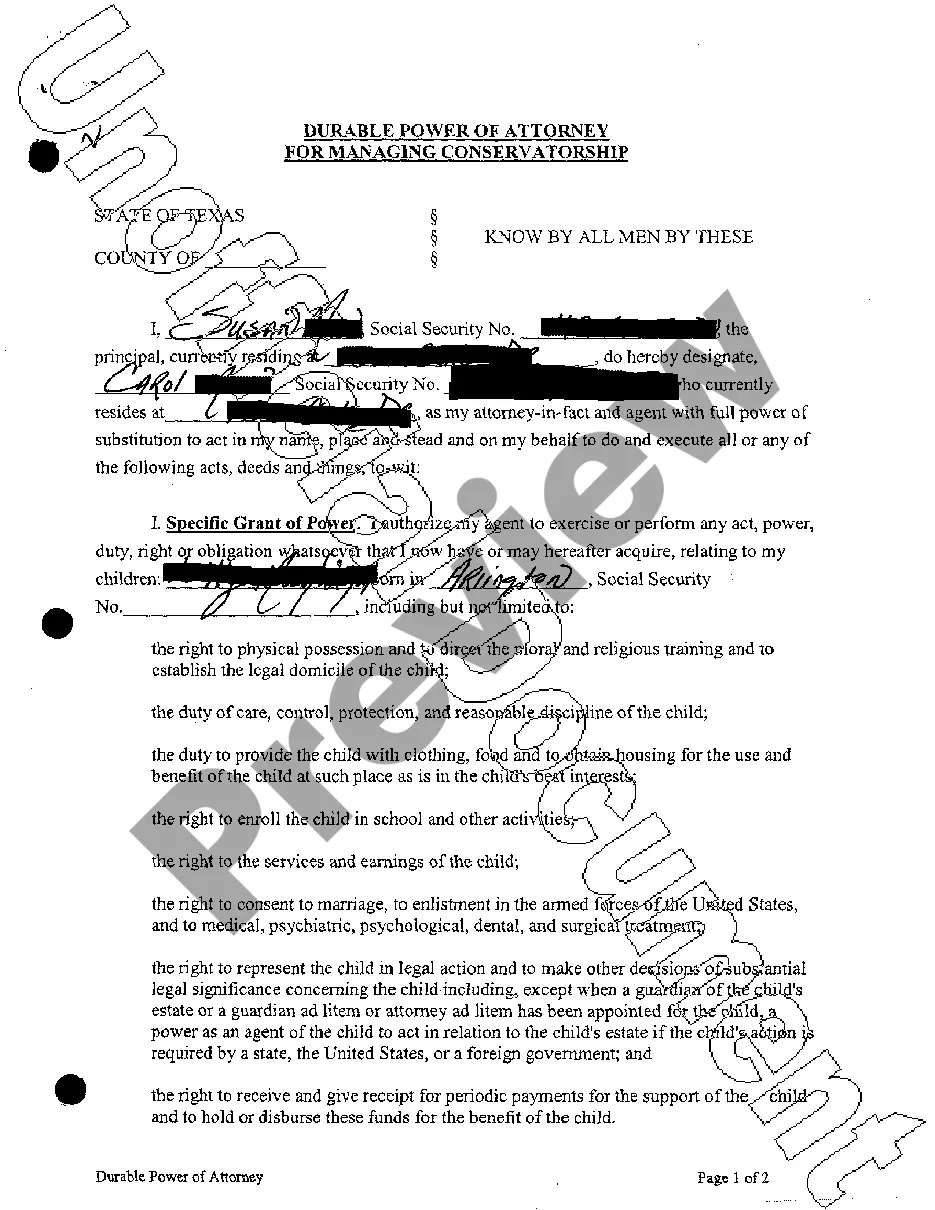

A Brownsville Texas Durable Power of Attorney for Managing Conservatorship is a legal document that allows an individual, known as the principal, to appoint another person, referred to as the agent or attorney-in-fact, to make important decisions regarding their personal care and finances in the event that they become incapacitated or unable to make decisions on their own. This type of power of attorney is particularly designed to address the needs of individuals who require ongoing assistance, such as elderly or disabled individuals, who may need someone to manage their affairs, including medical decisions and financial matters. There are different types of Brownsville Texas Durable Power of Attorney for Managing Conservatorship, each with its own specific focus and scope: 1. Healthcare Durable Power of Attorney: This type of power of attorney specifically grants the agent the authority to make healthcare decisions on behalf of the principal. It includes decisions regarding medical treatment, medications, surgical procedures, and other healthcare-related choices. 2. Financial Durable Power of Attorney: This grants the agent the authority to handle financial matters on behalf of the principal. This includes managing bank accounts, paying bills, managing investments, and making financial decisions. 3. Limited Durable Power of Attorney: This type of power of attorney limits the agent's authority to a specific set of tasks or a specific period of time. It is often utilized when the principal anticipates a temporary incapacity or needs assistance with a specific matter, such as selling a property or managing a business. It is important to note that a durable power of attorney for managing conservatorship in Brownsville Texas must comply with the relevant state laws and regulations. The document must clearly outline the extent of the agent's authority, and it may require notarization or witnesses for validity. In conclusion, a Brownsville Texas Durable Power of Attorney for Managing Conservatorship is a crucial legal instrument that enables an appointed agent to handle important personal care and financial decisions on behalf of an incapacitated or disabled individual. The types of this power of attorney include healthcare, financial, and limited. Seeking legal advice from an experienced attorney is strongly recommended ensuring compliance with local laws and to tailor the document to individual needs.

Brownsville Texas Durable Power of Attorney for Managing Conservatorship

Description

How to fill out Brownsville Texas Durable Power Of Attorney For Managing Conservatorship?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no legal education to draft such paperwork cfrom the ground up, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive collection with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Brownsville Texas Durable Power of Attorney for Managing Conservatorship or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Brownsville Texas Durable Power of Attorney for Managing Conservatorship quickly employing our trusted service. If you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are a novice to our platform, ensure that you follow these steps before obtaining the Brownsville Texas Durable Power of Attorney for Managing Conservatorship:

- Be sure the template you have chosen is specific to your location because the regulations of one state or area do not work for another state or area.

- Preview the document and read a brief description (if provided) of cases the document can be used for.

- In case the one you selected doesn’t meet your requirements, you can start over and look for the needed form.

- Click Buy now and choose the subscription plan you prefer the best.

- Log in to your account credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Brownsville Texas Durable Power of Attorney for Managing Conservatorship once the payment is done.

You’re all set! Now you can go ahead and print the document or fill it out online. In case you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.