Amarillo Texas Mortgage refers to the financial service that enables individuals or businesses in Amarillo, Texas, to obtain a loan for purchasing a property. Whether you are a first-time homebuyer or looking to refinance an existing property, Amarillo Texas Mortgage offers various mortgage options to suit different needs and financial situations. One of the most common types of Amarillo Texas Mortgage is the conventional mortgage. This type of loan is not insured or guaranteed by the government and typically requires a higher credit score and a larger down payment. However, conventional mortgages offer competitive interest rates and flexible terms. Another type of Amarillo Texas Mortgage is the FHA (Federal Housing Administration) loan. These loans are insured by the government and often appeal to first-time homebuyers or individuals with lower credit scores. FHA loans require a lower down payment and have more lenient qualification criteria, making homeownership more accessible. For veterans and active-duty military personnel, Amarillo Texas Mortgage offers VA (Department of Veterans Affairs) loans. VA loans provide favorable terms and benefits, including lower interest rates, zero down payment requirements, and no private mortgage insurance. These loans are designed to support service members in achieving homeownership. Amarillo Texas Mortgage also provides options for those seeking to purchase rural properties. The USDA (United States Department of Agriculture) loan is a type of mortgage that supports individuals looking to buy homes in eligible rural areas. These loans offer low-interest rates and don't require a down payment, making them an attractive option for rural homebuyers. Additionally, borrowers may consider adjustable-rate mortgages (ARM's) or fixed-rate mortgages. ARM shave interest rates that start low for a certain initial period and then fluctuate according to market conditions. In contrast, fixed-rate mortgages maintain the same interest rate throughout the loan term. Both types have their advantages, and prospective borrowers should carefully consider their long-term financial goals before choosing. When seeking an Amarillo Texas Mortgage, it is advisable to consult with a reputable mortgage lender or broker who can guide you through the entire process. They will evaluate your financial situation, explain the available options, and help you choose the most suitable mortgage product. Whether you're buying your dream home or refinancing an existing property, Amarillo Texas Mortgage aims to make homeownership attainable and affordable for residents of Amarillo, Texas.

Amarillo Texas Mortgage

State:

Texas

City:

Amarillo

Control #:

TX-JW-0103

Format:

PDF

Instant download

This form is available by subscription

Description

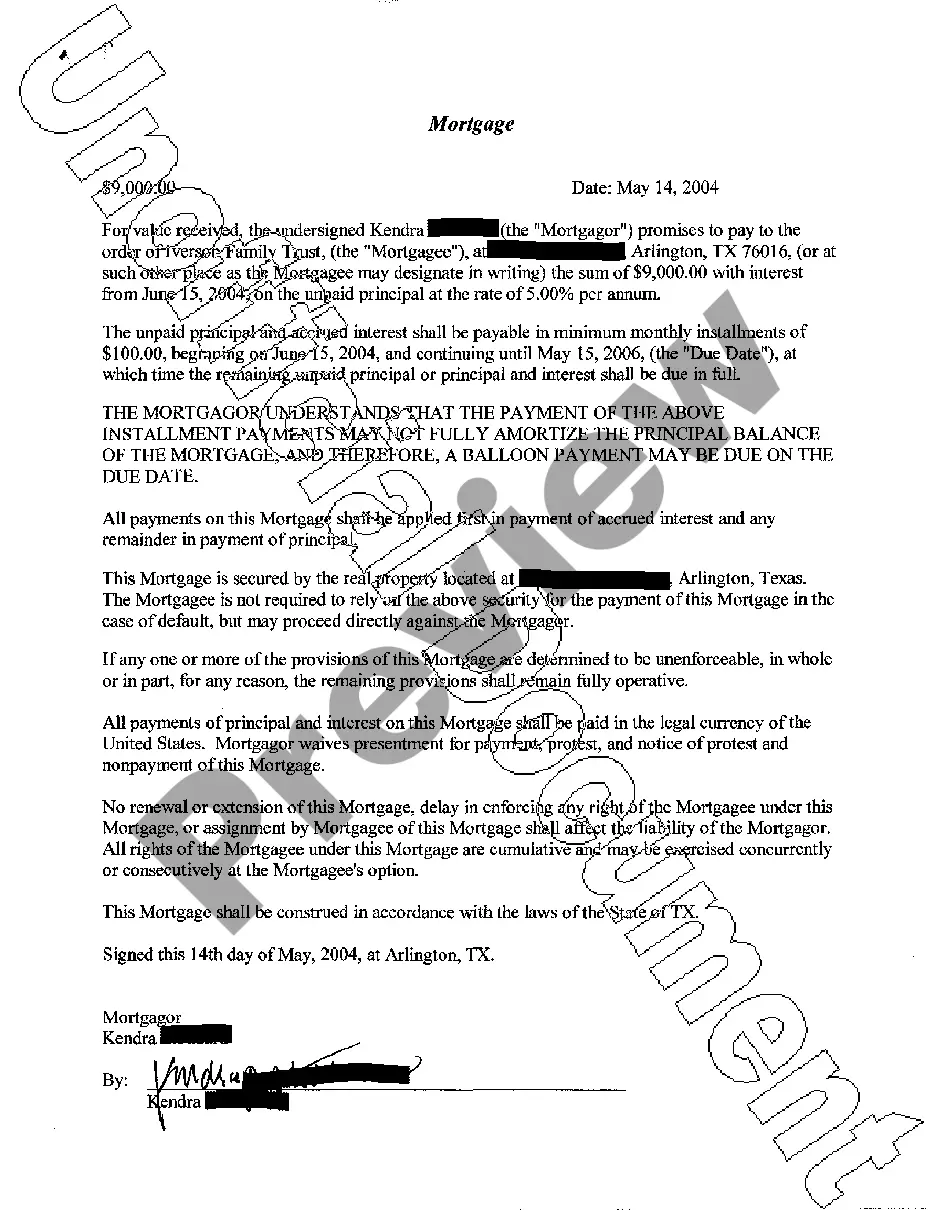

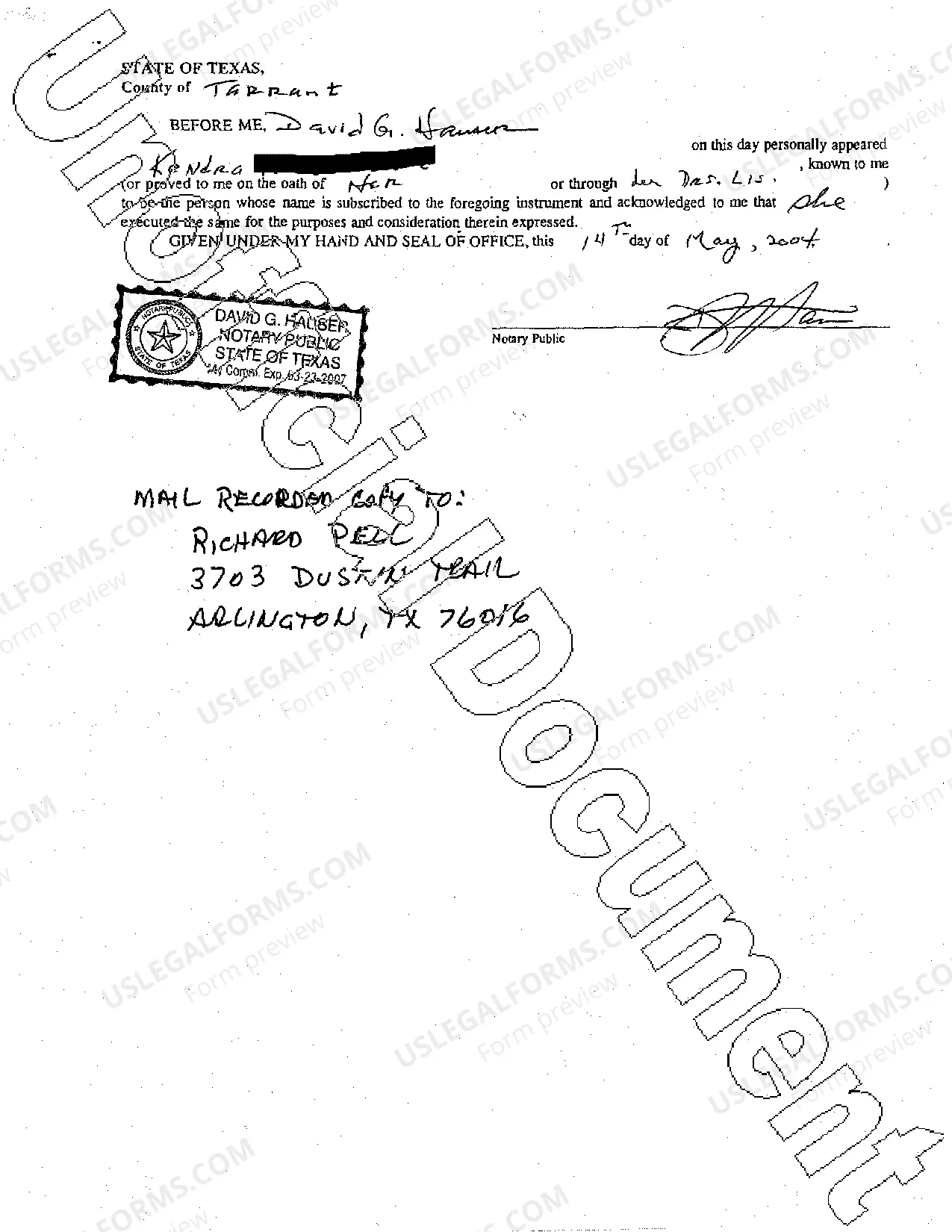

Mortgage

Amarillo Texas Mortgage refers to the financial service that enables individuals or businesses in Amarillo, Texas, to obtain a loan for purchasing a property. Whether you are a first-time homebuyer or looking to refinance an existing property, Amarillo Texas Mortgage offers various mortgage options to suit different needs and financial situations. One of the most common types of Amarillo Texas Mortgage is the conventional mortgage. This type of loan is not insured or guaranteed by the government and typically requires a higher credit score and a larger down payment. However, conventional mortgages offer competitive interest rates and flexible terms. Another type of Amarillo Texas Mortgage is the FHA (Federal Housing Administration) loan. These loans are insured by the government and often appeal to first-time homebuyers or individuals with lower credit scores. FHA loans require a lower down payment and have more lenient qualification criteria, making homeownership more accessible. For veterans and active-duty military personnel, Amarillo Texas Mortgage offers VA (Department of Veterans Affairs) loans. VA loans provide favorable terms and benefits, including lower interest rates, zero down payment requirements, and no private mortgage insurance. These loans are designed to support service members in achieving homeownership. Amarillo Texas Mortgage also provides options for those seeking to purchase rural properties. The USDA (United States Department of Agriculture) loan is a type of mortgage that supports individuals looking to buy homes in eligible rural areas. These loans offer low-interest rates and don't require a down payment, making them an attractive option for rural homebuyers. Additionally, borrowers may consider adjustable-rate mortgages (ARM's) or fixed-rate mortgages. ARM shave interest rates that start low for a certain initial period and then fluctuate according to market conditions. In contrast, fixed-rate mortgages maintain the same interest rate throughout the loan term. Both types have their advantages, and prospective borrowers should carefully consider their long-term financial goals before choosing. When seeking an Amarillo Texas Mortgage, it is advisable to consult with a reputable mortgage lender or broker who can guide you through the entire process. They will evaluate your financial situation, explain the available options, and help you choose the most suitable mortgage product. Whether you're buying your dream home or refinancing an existing property, Amarillo Texas Mortgage aims to make homeownership attainable and affordable for residents of Amarillo, Texas.

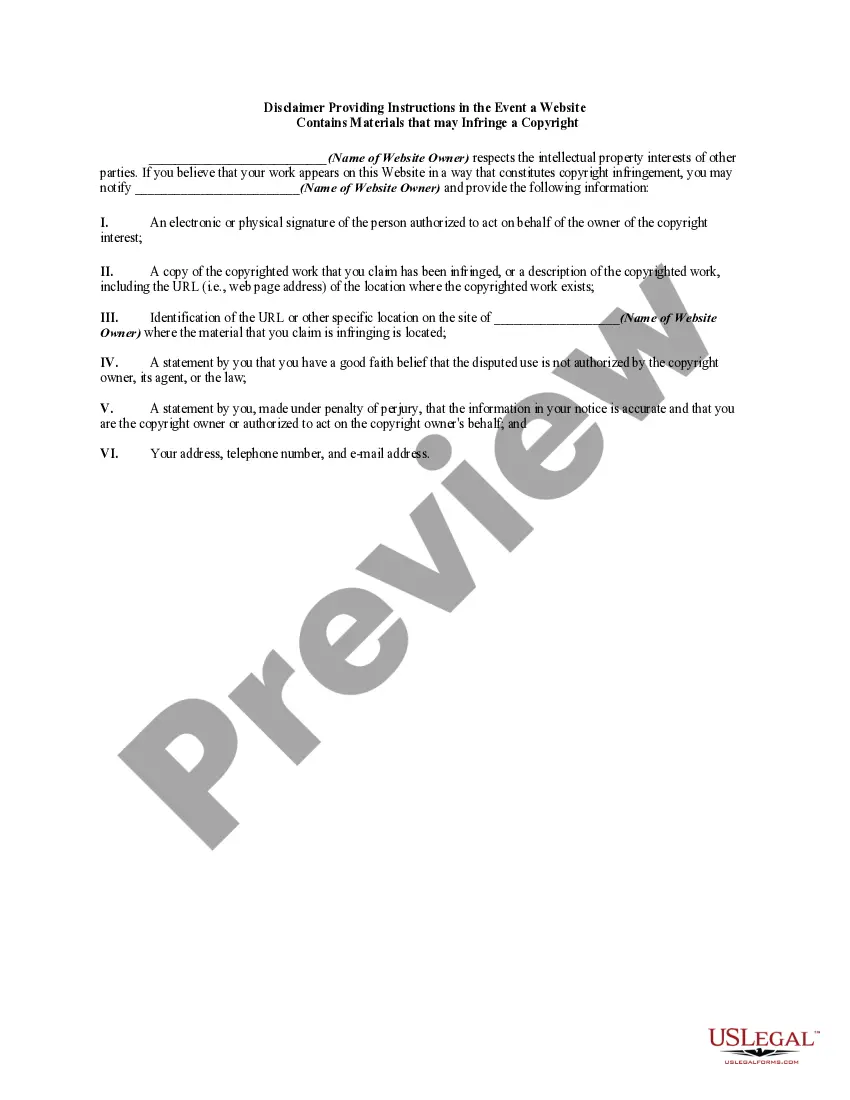

Free preview

How to fill out Amarillo Texas Mortgage?

If you’ve already utilized our service before, log in to your account and save the Amarillo Texas Mortgage on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Amarillo Texas Mortgage. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!