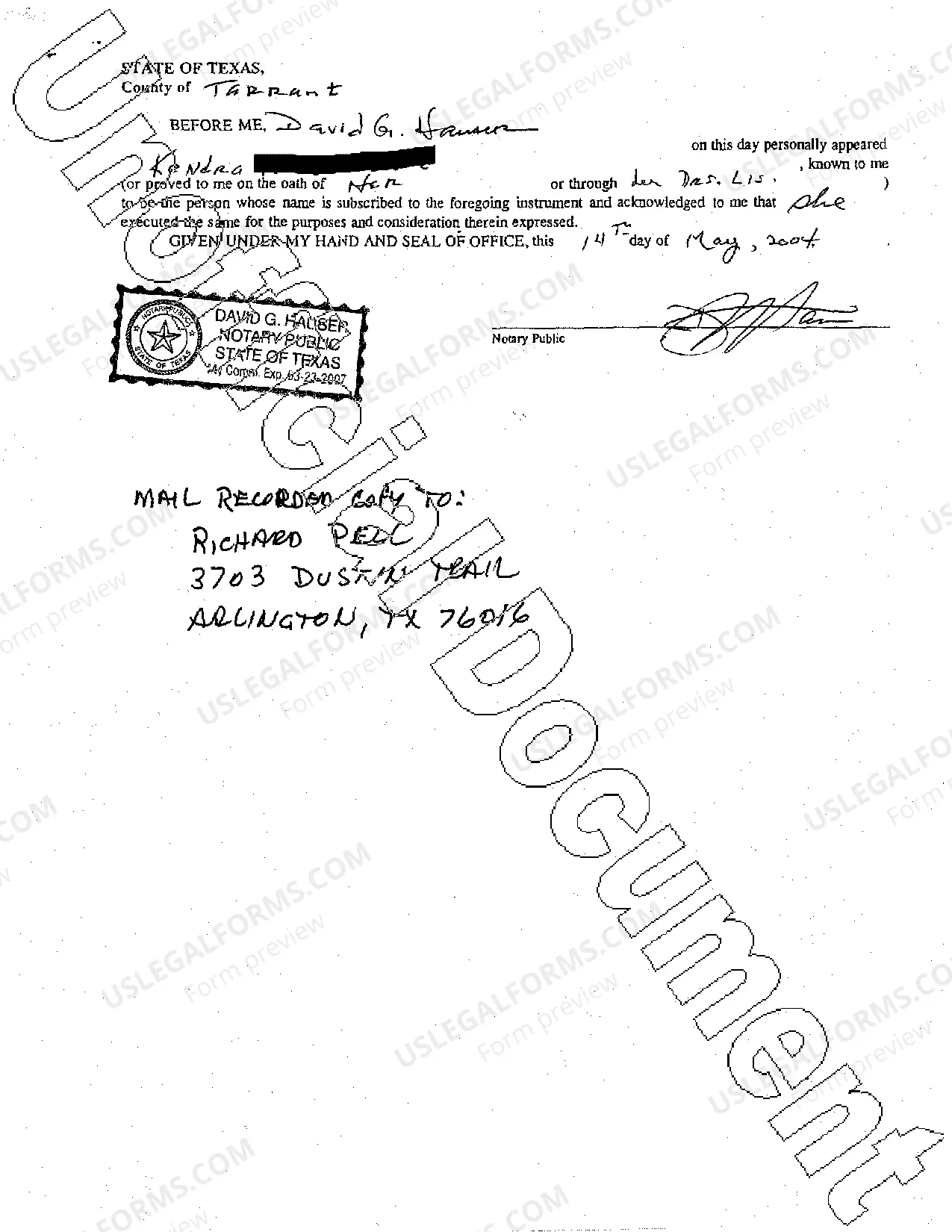

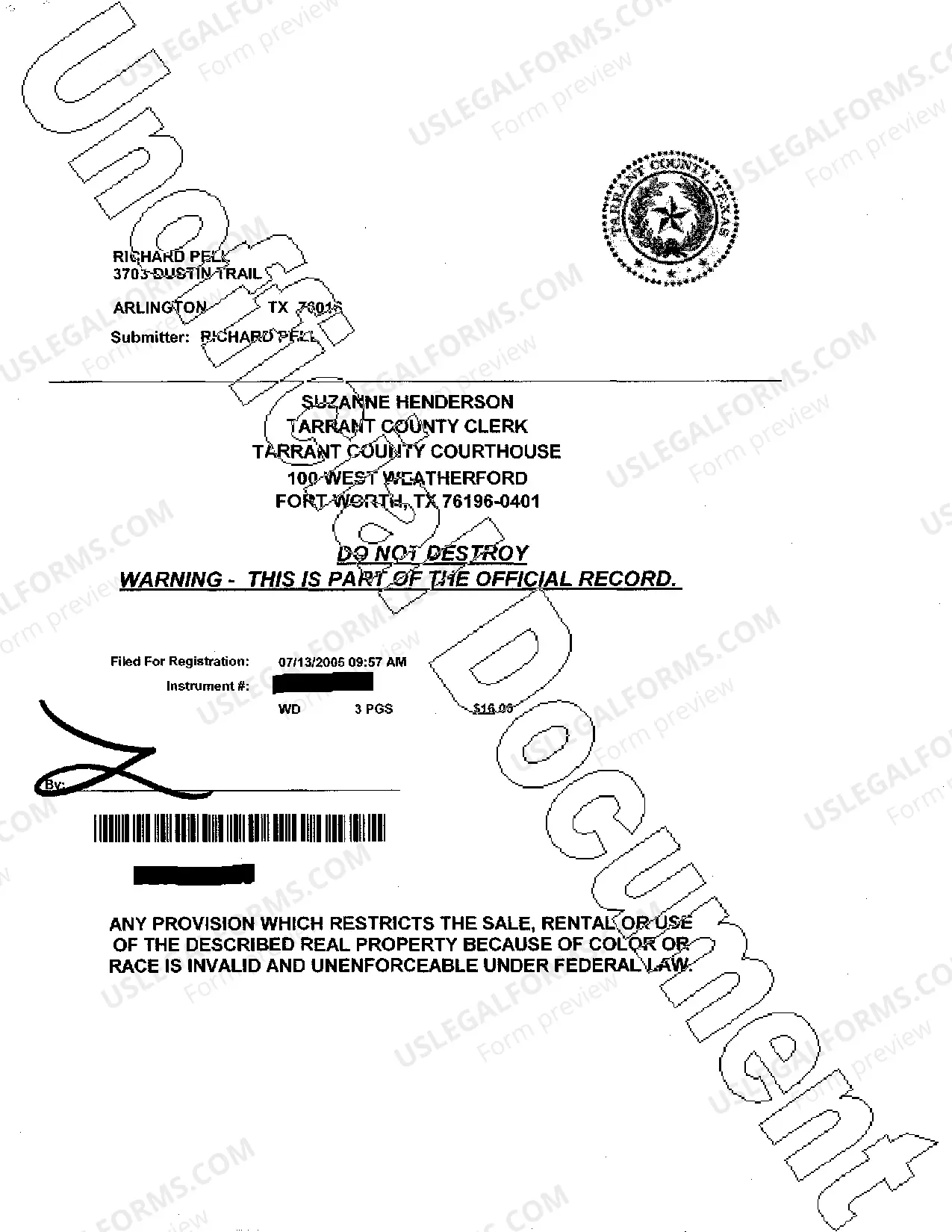

Fort Worth Texas Mortgage refers to the financing option available to individuals or families looking to purchase a home in the city of Fort Worth, Texas. It is a type of loan offered by various financial institutions, including banks, credit unions, and mortgage lenders, to help borrowers fund their real estate purchases. There are several types of Fort Worth Texas mortgages, each designed to cater to the different needs and financial situations of potential homeowners. These include: 1. Fixed-rate mortgage: This is the most common type of mortgage in Fort Worth, Texas, as well as nationwide. With a fixed-rate mortgage, the interest rate remains the same throughout the loan term. This provides borrowers with stability and predictability in their monthly mortgage payments. 2. Adjustable-rate mortgage (ARM): An adjustable-rate mortgage, also known as a variable-rate mortgage, offers an initial fixed interest rate for a certain period, typically 3, 5, 7, or 10 years. After the initial period, the interest rate may fluctuate based on market conditions. ARM's usually have lower initial interest rates compared to fixed-rate mortgages. 3. FHA loan: The Federal Housing Administration (FHA) provides loans that are insured by the government to assist borrowers with lower credit scores or who have less money available for a down payment. These loans often have more flexible qualification requirements, making homeownership more accessible to a wider range of individuals. 4. VA loan: Offered to eligible veterans, active-duty military personnel, and their surviving spouses, a VA loan is a mortgage provided by the Department of Veterans Affairs. These loans typically have lower interest rates and require little to now down payment. 5. Jumbo loan: A jumbo loan is a type of mortgage that exceeds the loan limits set by government-sponsored entities like Fannie Mae and Freddie Mac. In Fort Worth, Texas, where the real estate market is thriving, jumbo loans are often utilized to finance high-end and luxury properties. Each type of Fort Worth Texas mortgage has its own eligibility criteria, down payment requirements, interest rates, and terms. It is crucial for potential borrowers to research and compare these mortgage options to determine which one best fits their financial situation and homeownership goals. Additionally, consulting with a mortgage professional or loan officer can provide valuable guidance throughout the mortgage application process.

Fort Worth Texas Mortgage

Description

How to fill out Fort Worth Texas Mortgage?

If you are looking for a valid form template, it’s difficult to find a better place than the US Legal Forms site – probably the most extensive libraries on the web. Here you can find a large number of form samples for business and individual purposes by categories and regions, or keywords. With the high-quality search function, finding the latest Fort Worth Texas Mortgage is as easy as 1-2-3. Moreover, the relevance of each file is confirmed by a group of professional lawyers that regularly review the templates on our platform and update them based on the most recent state and county regulations.

If you already know about our platform and have an account, all you should do to get the Fort Worth Texas Mortgage is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have found the sample you want. Check its explanation and make use of the Preview function (if available) to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to find the proper file.

- Confirm your choice. Select the Buy now option. After that, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Select the file format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the acquired Fort Worth Texas Mortgage.

Each and every template you save in your account has no expiry date and is yours forever. You always have the ability to access them via the My Forms menu, so if you want to get an extra copy for modifying or creating a hard copy, you may come back and export it once again whenever you want.

Make use of the US Legal Forms professional catalogue to get access to the Fort Worth Texas Mortgage you were seeking and a large number of other professional and state-specific samples on a single website!