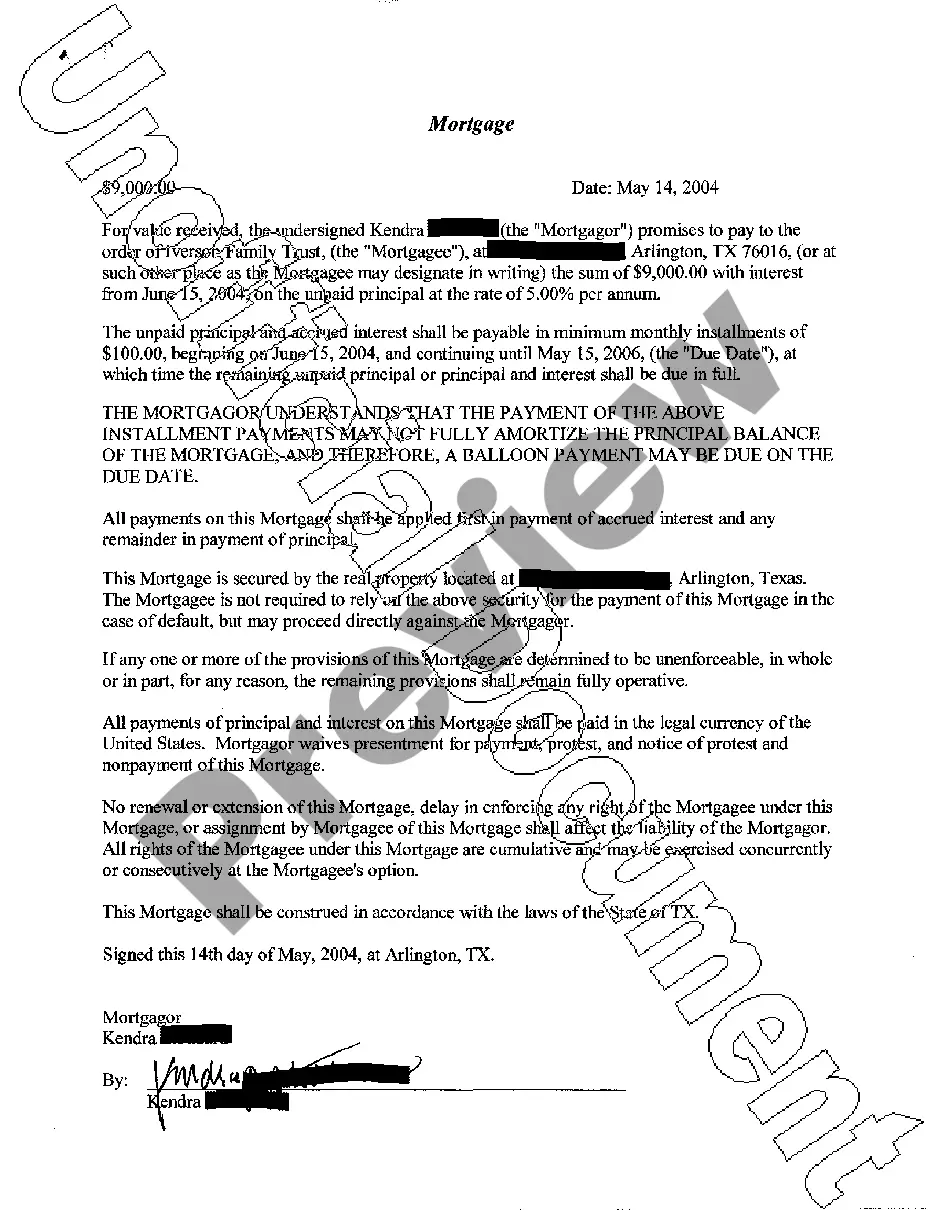

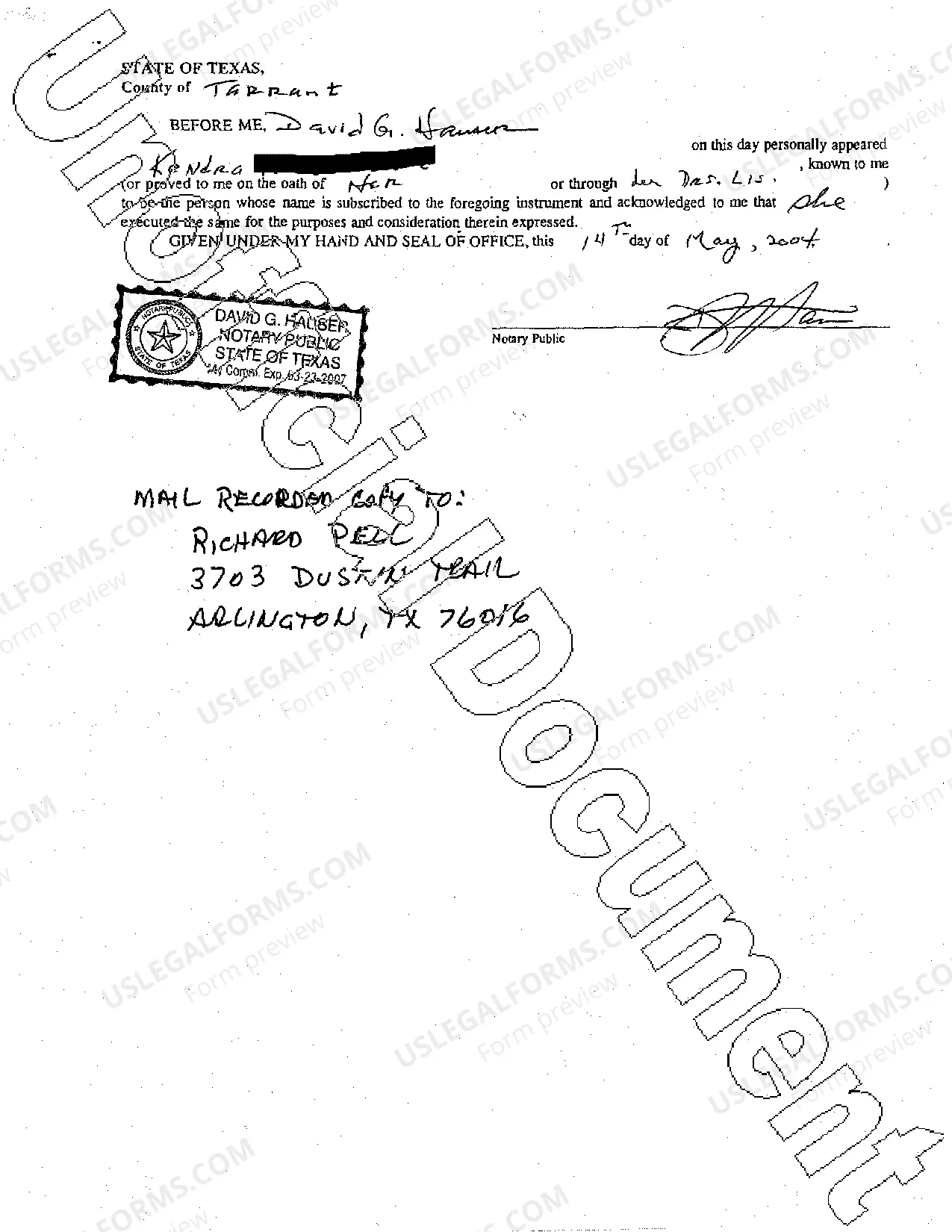

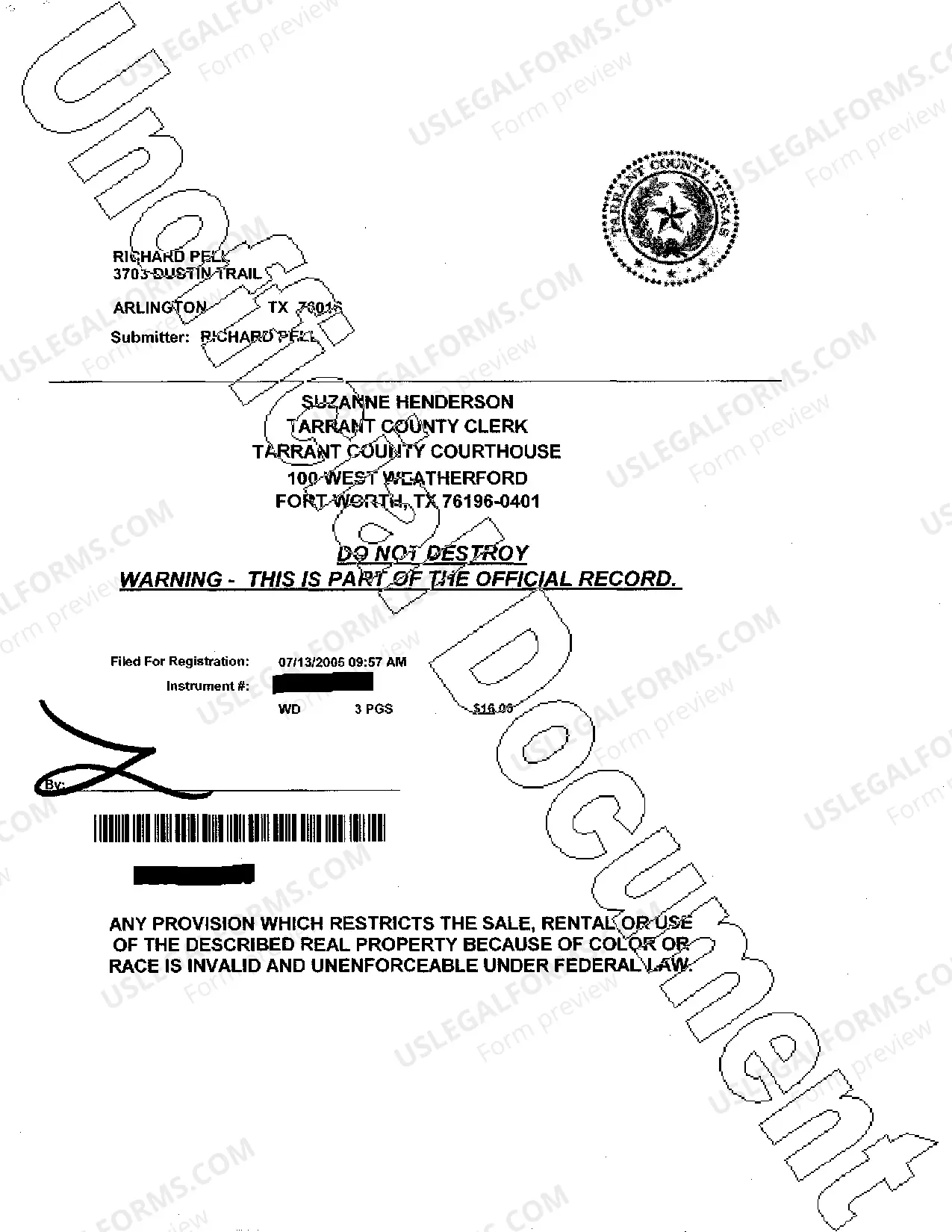

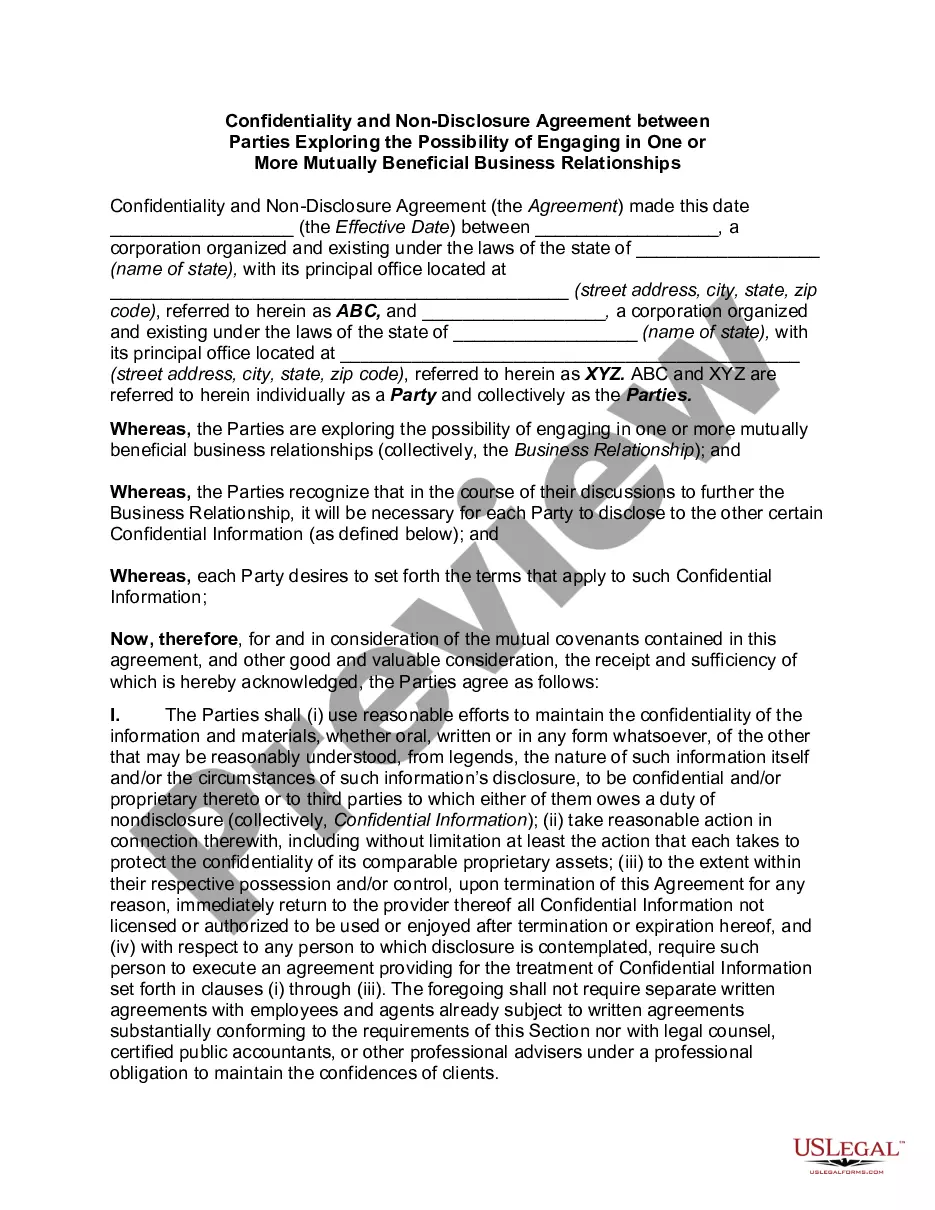

Grand Prairie Texas Mortgage refers to the process of borrowing money from a lender in order to purchase a property in the city of Grand Prairie, Texas. With its vibrant community and robust real estate market, Grand Prairie offers various mortgage options to cater to different needs and financial situations. Here are some types of Grand Prairie Texas Mortgage that are commonly available: 1. Fixed-Rate Mortgage: This type of mortgage offers a stable interest rate throughout the duration of the loan, which is usually 15, 20, or 30 years. It provides borrowers with predictability and consistency in their monthly payments, ensuring that they can budget accordingly. 2. Adjustable-Rate Mortgage (ARM): Unlike a fixed-rate mortgage, an ARM has an interest rate that can fluctuate over time. This is typically a lower rate initially, usually for a set period of 3, 5, 7, or 10 years, after which it adjusts based on market conditions. ARM mortgages can be advantageous for those planning to sell or refinance before the rate adjustment period. 3. FHA Loans: The Federal Housing Administration (FHA) offers loans to first-time homebuyers and those with lower credit scores or limited down payment funds. These loans are insured by the government, allowing lenders to offer more flexible terms and lower interest rates. 4. VA Loans: The U.S. Department of Veterans Affairs (VA) provides VA loans exclusively for current and former military members and their eligible spouses. These loans come with various benefits, such as competitive interest rates, low or no down payment requirements, and no private mortgage insurance. 5. Jumbo Loans: Grand Prairie Texas is home to several high-value properties. Jumbo loans are designed to finance luxury homes or properties that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. These loans typically have higher credit score and down payment requirements and may come with slightly higher interest rates. 6. Home Equity Loans: Homeowners in Grand Prairie can also explore home equity loans, which allow borrowing against the equity built in the property. These loans can be used for various purposes, such as home improvements, debt consolidation, or education expenses. When considering a Grand Prairie Texas Mortgage, it's important to thoroughly research the different types, compare rates, and consult with mortgage professionals to find the best fit for individual financial circumstances.

Grand Prairie Texas Mortgage

Description

How to fill out Grand Prairie Texas Mortgage?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Grand Prairie Texas Mortgage? US Legal Forms is your go-to solution.

Whether you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of separate state and area.

To download the document, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Grand Prairie Texas Mortgage conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is intended for.

- Restart the search if the form isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Grand Prairie Texas Mortgage in any provided format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal paperwork online once and for all.