Killeen Texas Mortgage, also known as a home loan or mortgage loan, refers to the financial assistance provided by lenders in Killeen, Texas to individuals and families for purchasing a property. This type of loan allows borrowers to fund the purchase of their dream home while paying it back over a designated period, typically ranging from 15 to 30 years. Killeen Texas Mortgage offers various loan options tailored to meet the diverse needs and financial circumstances of homebuyers in the Killeen area. Some common types include: 1. Conventional Mortgage: This is a standard mortgage loan offered by banks or lenders that conforms to the guidelines set by government-sponsored enterprises like Fannie Mae or Freddie Mac. It generally requires a down payment of at least 3% to 20% of the home's purchase price, depending on the borrower's creditworthiness. 2. FHA Loan: The Federal Housing Administration (FHA) offers mortgage insurance to lenders, enabling them to provide loans with lower down payment requirements (as low as 3.5%) and less stringent credit score criteria. These loans are especially helpful for first-time homebuyers who may have limited savings or lower credit scores. 3. VA Loan: The Department of Veterans Affairs (VA) provides mortgage loans exclusively to veterans, active-duty military personnel, and eligible surviving spouses. VA loans often offer 100% financing with now down payment required and competitive interest rates. 4. USDA Loan: The United States Department of Agriculture (USDA) offers loans to borrowers looking to purchase homes in rural areas of Killeen, Texas. These loans provide 100% financing, low-interest rates, and are designed to promote homeownership in rural communities. 5. Jumbo Loan: Killeen Texas Mortgage also offers jumbo loans for borrowers seeking a high-value mortgage that exceeds the conventional loan limits set by Fannie Mae and Freddie Mac. Jumbo loans typically require larger down payments and have stricter credit requirements. 6. Refinance Mortgage: Killeen homeowners who already have a mortgage may choose to refinance their existing loan to obtain better interest rates, lower monthly payments, or change the repayment terms. This can be an opportunity to save money in the long run or access equity in their home. When considering a Killeen Texas Mortgage, it is essential for potential borrowers to evaluate their financial situation, credit score, and long-term goals. They should compare the different types of mortgages available and work with trusted lenders or mortgage brokers to find the best loan option that suits their needs and helps them achieve homeownership in Killeen, Texas.

Killeen Texas Mortgage

State:

Texas

City:

Killeen

Control #:

TX-JW-0103

Format:

PDF

Instant download

This form is available by subscription

Description

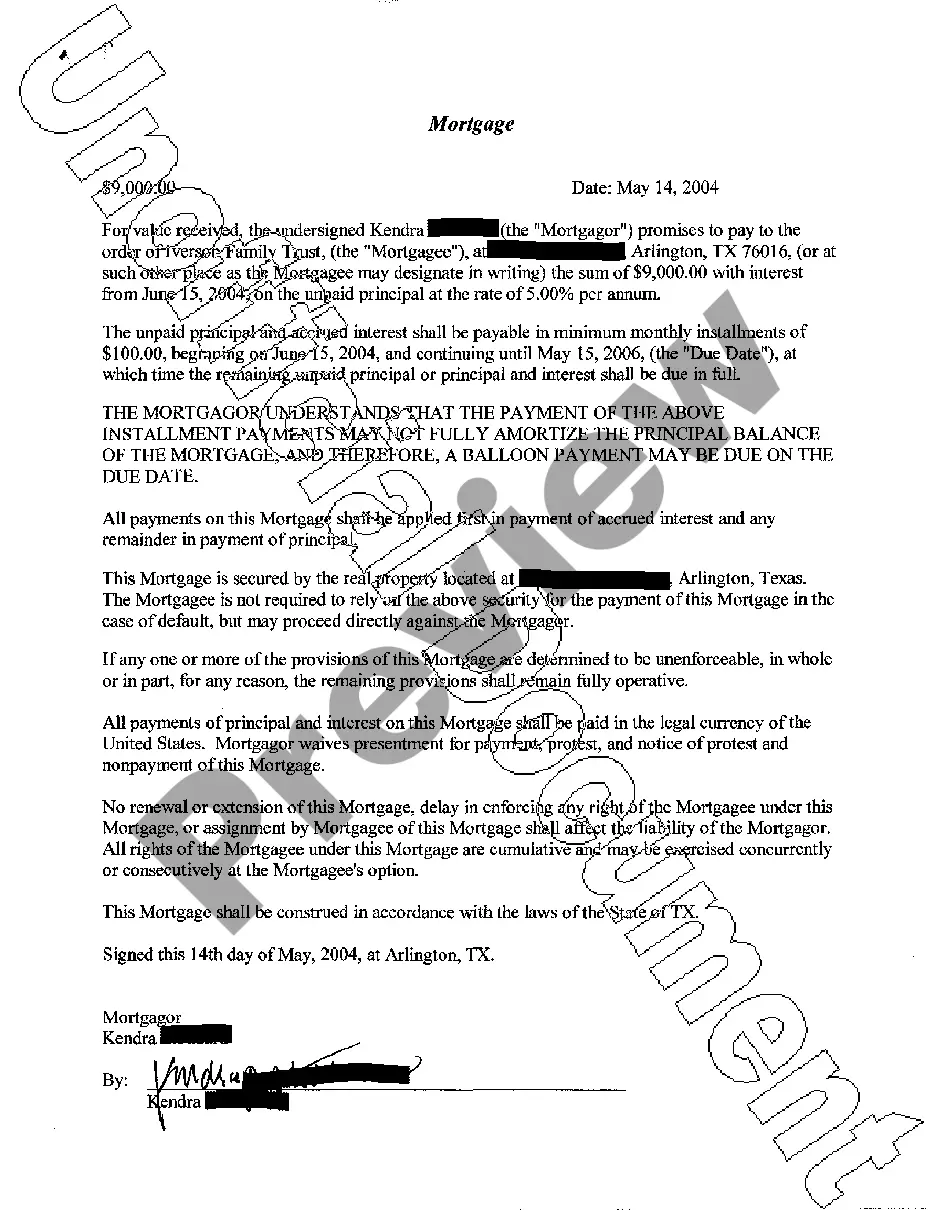

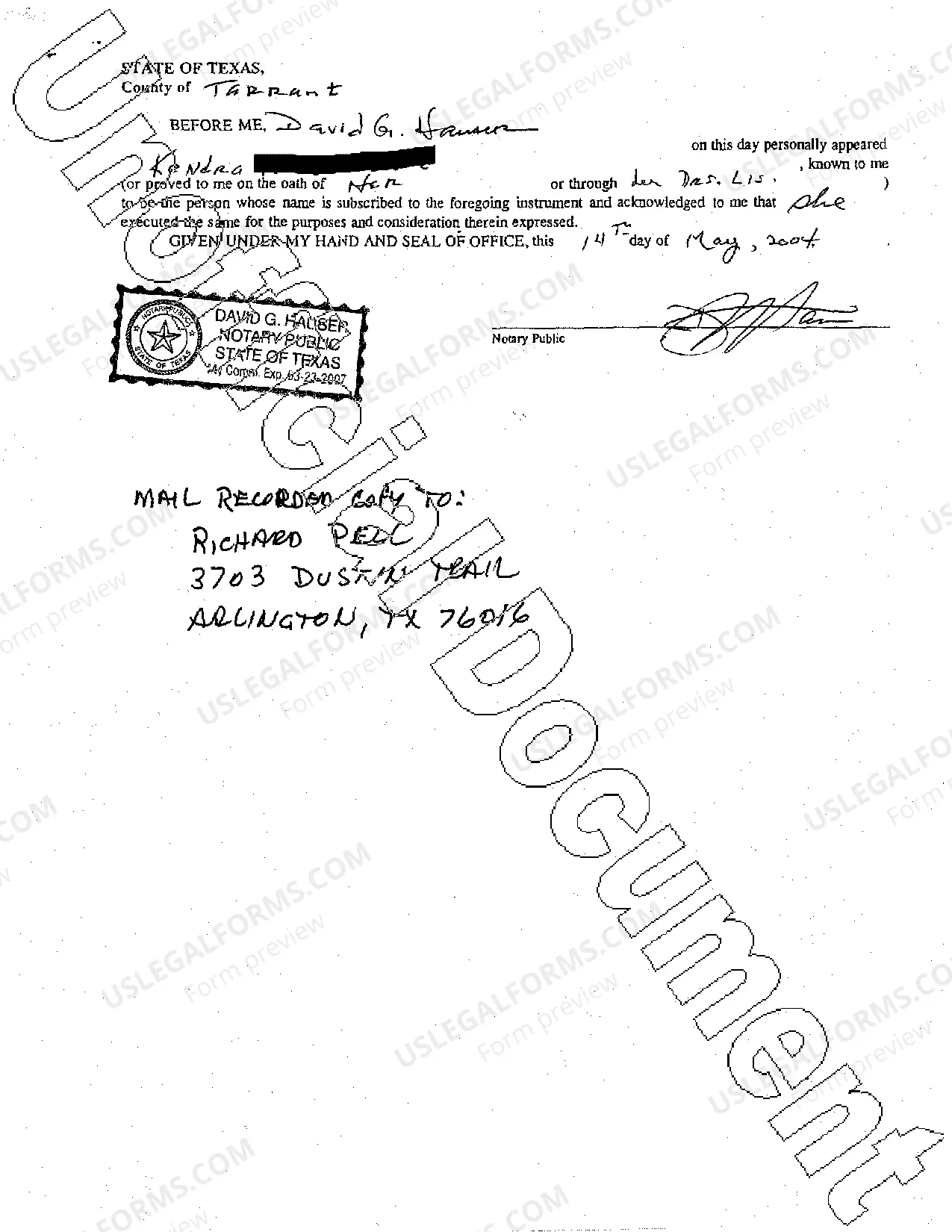

Mortgage

Killeen Texas Mortgage, also known as a home loan or mortgage loan, refers to the financial assistance provided by lenders in Killeen, Texas to individuals and families for purchasing a property. This type of loan allows borrowers to fund the purchase of their dream home while paying it back over a designated period, typically ranging from 15 to 30 years. Killeen Texas Mortgage offers various loan options tailored to meet the diverse needs and financial circumstances of homebuyers in the Killeen area. Some common types include: 1. Conventional Mortgage: This is a standard mortgage loan offered by banks or lenders that conforms to the guidelines set by government-sponsored enterprises like Fannie Mae or Freddie Mac. It generally requires a down payment of at least 3% to 20% of the home's purchase price, depending on the borrower's creditworthiness. 2. FHA Loan: The Federal Housing Administration (FHA) offers mortgage insurance to lenders, enabling them to provide loans with lower down payment requirements (as low as 3.5%) and less stringent credit score criteria. These loans are especially helpful for first-time homebuyers who may have limited savings or lower credit scores. 3. VA Loan: The Department of Veterans Affairs (VA) provides mortgage loans exclusively to veterans, active-duty military personnel, and eligible surviving spouses. VA loans often offer 100% financing with now down payment required and competitive interest rates. 4. USDA Loan: The United States Department of Agriculture (USDA) offers loans to borrowers looking to purchase homes in rural areas of Killeen, Texas. These loans provide 100% financing, low-interest rates, and are designed to promote homeownership in rural communities. 5. Jumbo Loan: Killeen Texas Mortgage also offers jumbo loans for borrowers seeking a high-value mortgage that exceeds the conventional loan limits set by Fannie Mae and Freddie Mac. Jumbo loans typically require larger down payments and have stricter credit requirements. 6. Refinance Mortgage: Killeen homeowners who already have a mortgage may choose to refinance their existing loan to obtain better interest rates, lower monthly payments, or change the repayment terms. This can be an opportunity to save money in the long run or access equity in their home. When considering a Killeen Texas Mortgage, it is essential for potential borrowers to evaluate their financial situation, credit score, and long-term goals. They should compare the different types of mortgages available and work with trusted lenders or mortgage brokers to find the best loan option that suits their needs and helps them achieve homeownership in Killeen, Texas.

Free preview

How to fill out Killeen Texas Mortgage?

If you’ve already used our service before, log in to your account and download the Killeen Texas Mortgage on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Killeen Texas Mortgage. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!