Lewisville Texas Mortgage refers to the various loan options available for real estate purchases in Lewisville, Texas. Mortgage loans are essential financial tools that enable individuals and families to acquire properties without paying the full purchase amount upfront. Lewisville Texas Mortgage options are provided by various lenders and financial institutions, each with their terms and conditions. Here are some types of Lewisville Texas Mortgages: 1. Fixed-rate Mortgage: This type of mortgage loan has a fixed interest rate for the entire loan term, typically ranging from 15 to 30 years. Borrowers enjoy stable monthly payments and can plan their financial commitments accordingly. 2. Adjustable-rate Mortgage (ARM): An ARM is a mortgage loan with an interest rate that can vary over time. Initially, the interest rate is typically lower than that of a fixed-rate mortgage. However, after a specific period (e.g., five years), the interest rate can adjust periodically based on the prevailing market rates. 3. Jumbo Mortgage: A jumbo mortgage is used for properties that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. In Lewisville, Texas, the conforming loan limit is $548,250 as of 2021, so any loan higher than this limit would be considered a jumbo mortgage. 4. FHA Loan: The Federal Housing Administration (FHA) offers mortgage loans that are insured by the government. These loans are popular among first-time homebuyers and require a lower down payment (as low as 3.5%) compared to conventional loans. 5. VA Loan: The Department of Veterans Affairs (VA) provides mortgage loans exclusively for qualified veterans, active-duty military personnel, and their eligible spouses. VA loans often have favorable interest rates, low or no down payment requirements, and waived mortgage insurance premiums. 6. USDA Loan: The United States Department of Agriculture (USDA) offers mortgage loans for rural or suburban homebuyers who meet specific income and property location criteria. USDA loans often require now down payment and offer competitive interest rates. 7. Refinance Mortgage: Refinancing is the process of replacing an existing mortgage loan with a new one to potentially lower interest rates, change loan terms, or tap into home equity. Homeowners in Lewisville, Texas, can consider refinancing their mortgages to take advantage of improved financial situations or market conditions. When considering a Lewisville Texas Mortgage, borrowers should compare interest rates, loan terms, closing costs, and eligibility criteria offered by different lenders. It's recommended to consult with mortgage professionals or loan officers to determine the best mortgage option suited to individual financial goals and circumstances.

Lewisville Texas Mortgage

Description

How to fill out Lewisville Texas Mortgage?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Lewisville Texas Mortgage gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Lewisville Texas Mortgage takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

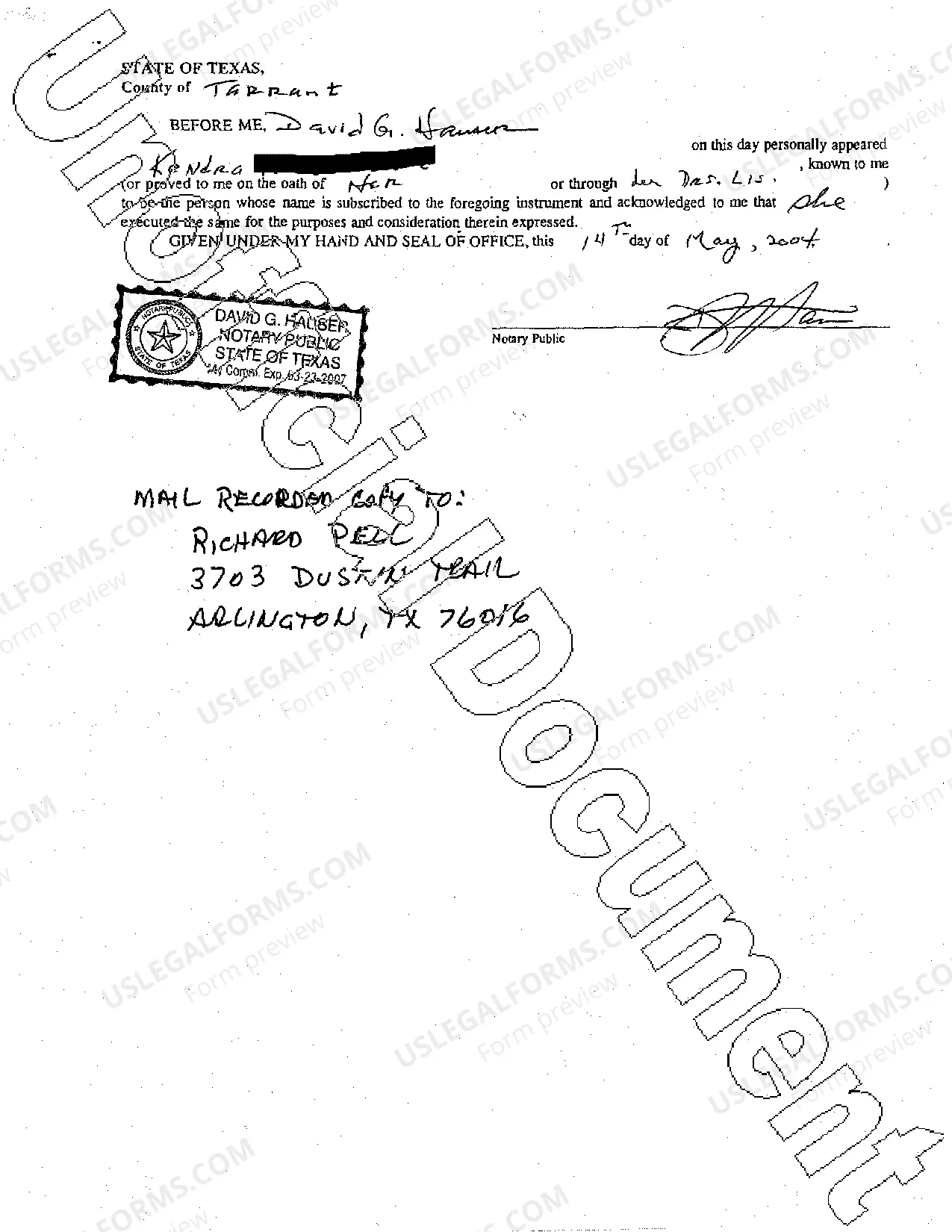

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Lewisville Texas Mortgage. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!