Pasadena Texas Mortgage: A Comprehensive Guide to Mortgage Services in Pasadena, Texas Looking for a reliable mortgage service in Pasadena, Texas? Look no further than Pasadena Texas Mortgage, your one-stop destination for all your housing financing needs. Whether you aim to buy a new home, refinance an existing property, or tap into your home's equity, Pasadena Texas Mortgage offers a range of mortgage options tailored to suit your unique requirements. Types of Pasadena Texas Mortgage: 1. Fixed-Rate Mortgage: Pasadena Texas Mortgage provides fixed-rate mortgages that offer stability and predictability in monthly mortgage payments. With a fixed interest rate, borrowers can enjoy consistent payments throughout the loan term, providing peace of mind and budgeting convenience. 2. Adjustable-Rate Mortgage (ARM): For those seeking flexibility, Pasadena Texas Mortgage offers adjustable-rate mortgages. ARM loans feature interest rates that can fluctuate based on market conditions, allowing borrowers to take advantage of potential interest rate drops. 3. FHA Loans: Pasadena Texas Mortgage specializes in Federal Housing Administration (FHA) loans that are insured by the government. These loans offer low down payment options and flexible qualifying criteria, making homeownership more accessible, particularly for first-time buyers. 4. VA Loans: Serving military veterans and active-duty service members, Pasadena Texas Mortgage also provides VA loans. These exclusive mortgage options are guaranteed by the Department of Veterans Affairs and often feature favorable terms, including low or no down payment requirements. 5. Jumbo loans: If you're looking to purchase a higher-priced home or require a larger loan amount, Pasadena Texas Mortgage offers jumbo loans. Designed for loan amounts exceeding conventional loan limits, these mortgages cater to borrowers with specific high-value property financing needs. 6. Refinance Loans: Pasadena Texas Mortgage also offers refinancing options, enabling homeowners to reduce their monthly mortgage payments, obtain more favorable interest rates, or extract equity from their property to fund other goals. Why Choose Pasadena Texas Mortgage: — Expertise: With years of experience in the mortgage industry, Pasadena Texas Mortgage boasts a team of knowledgeable professionals who guide clients through the entire mortgage process, ensuring a smooth and hassle-free experience. — Competitive Rates: Pasadena Texas Mortgage strives to provide competitive interest rates and loan terms, equipping borrowers with affordable financing solutions that align with their financial goals. — Personalized Support: Their dedicated mortgage specialists understand that every borrower is unique and offers personalized guidance, analyzing financial situations to recommend the most suitable mortgage options. — Streamlined Application Process: Pasadena Texas Mortgage has streamlined its application process, making it quick and efficient. You can conveniently apply online or schedule an appointment for an in-person consultation to get started. — Community-Focused: As a locally-operated mortgage service, Pasadena Texas Mortgage is deeply ingrained in the Pasadena community. They prioritize building enduring relationships with borrowers and supporting the local housing market. In conclusion, Pasadena Texas Mortgage caters to a wide range of mortgage needs, offering comprehensive options such as fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, jumbo loans, and refinancing solutions. With their commitment to excellent service, competitive rates, and personalized support, Pasadena Texas Mortgage is the go-to choice for securing your dream home or optimizing your current mortgage in Pasadena, Texas. Contact them today and take the first step towards owning your ideal property.

Pasadena Texas Mortgage

Description

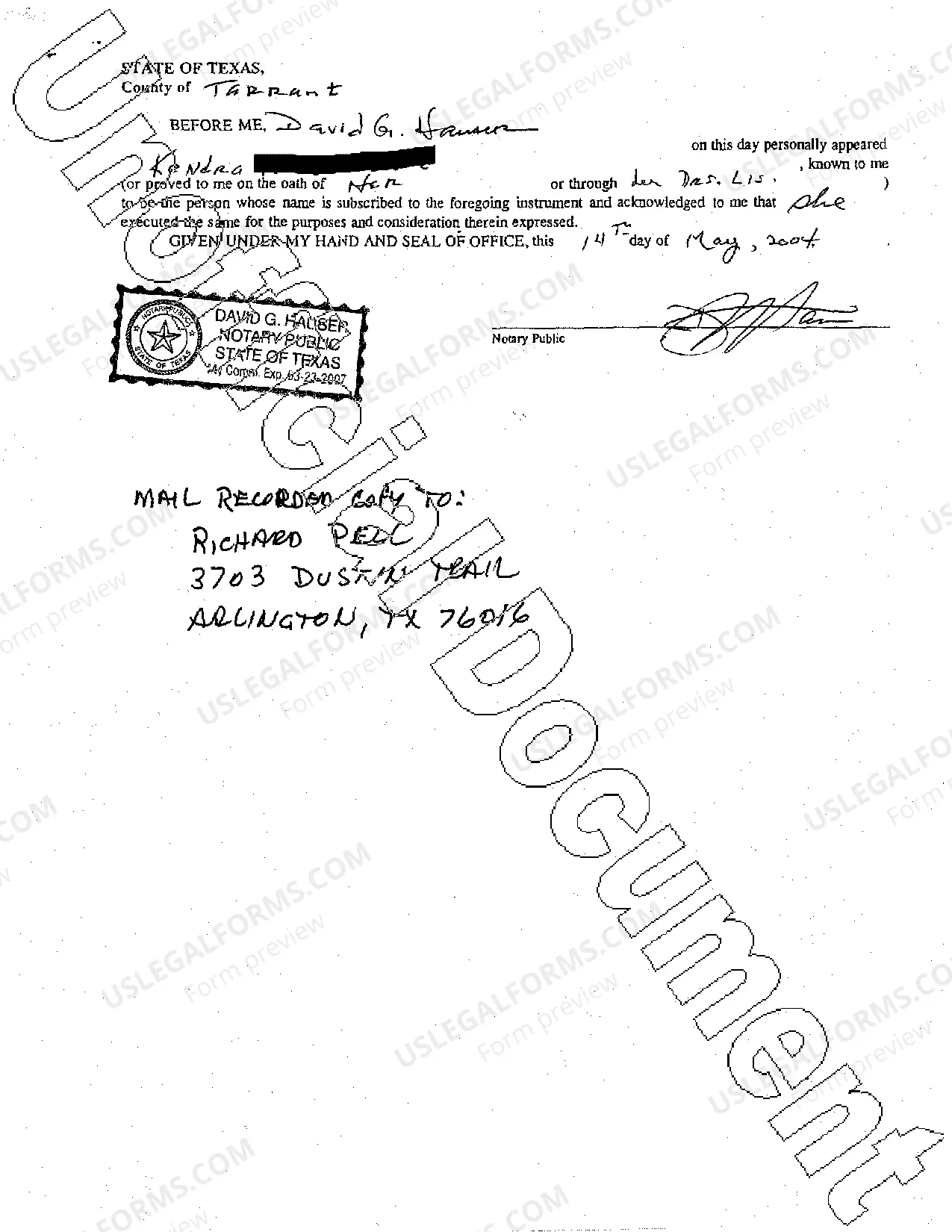

How to fill out Pasadena Texas Mortgage?

Do you need a trustworthy and affordable legal forms supplier to buy the Pasadena Texas Mortgage? US Legal Forms is your go-to choice.

Whether you require a basic arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Pasadena Texas Mortgage conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the form is good for.

- Restart the search if the template isn’t good for your specific situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Pasadena Texas Mortgage in any available file format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal paperwork online once and for all.