Tarrant Texas Voluntary Designation of Homestead is a legal process that allows property owners in Tarrant County, Texas, to designate their property as a homestead, providing certain tax benefits and protection from creditors. This designation is entirely voluntary and allows homeowners to enjoy various advantages associated with homestead status. One type of Tarrant Texas Voluntary Designation of Homestead is the General Residential Homestead Exemption. Under this designation, homeowners can claim a portion of their property's value as exempt from property taxes, resulting in potential savings on their annual tax bills. The exemption applies to the property's assessed value, which is subtracted before determining the property taxes owed. Another type is the Disabled Persons Homestead Exemption, which provides additional benefits for individuals with qualifying disabilities. Property owners who meet the specific disability requirements may be eligible for additional property tax exemptions or reductions, further easing the financial burden associated with homeownership. The Tarrant Texas Voluntary Designation of Homestead also offers protection from certain creditors. By designating a property as a homestead, homeowners can create a legal barrier that prevents most creditors from placing a lien or seizing the property in the event of financial difficulties. This protection is essential for preserving the primary residence and ensuring homeowners have a secure place to live. To qualify for a Tarrant Texas Voluntary Designation of Homestead, homeowners need to meet specific criteria. Generally, the property must be the primary residence of the homeowner, and they must have owned the property on January 1st of the tax year. Additionally, homeowners must submit an application to the Tarrant County Central Appraisal District to claim the homestead designation. In conclusion, the Tarrant Texas Voluntary Designation of Homestead provides Tarrant County property owners with various benefits, including tax exemptions and protection from creditors. Whether it's the General Residential Homestead Exemption or the Disabled Persons Homestead Exemption, homeowners can take advantage of these designations to reduce their property tax burden and secure their primary residence. It is important for homeowners to understand the requirements and application process to ensure they can benefit from these valuable options.

Homestead Designation Services

Description

How to fill out Tarrant Texas Voluntary Designation Of Homestead?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for legal services that, as a rule, are very expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

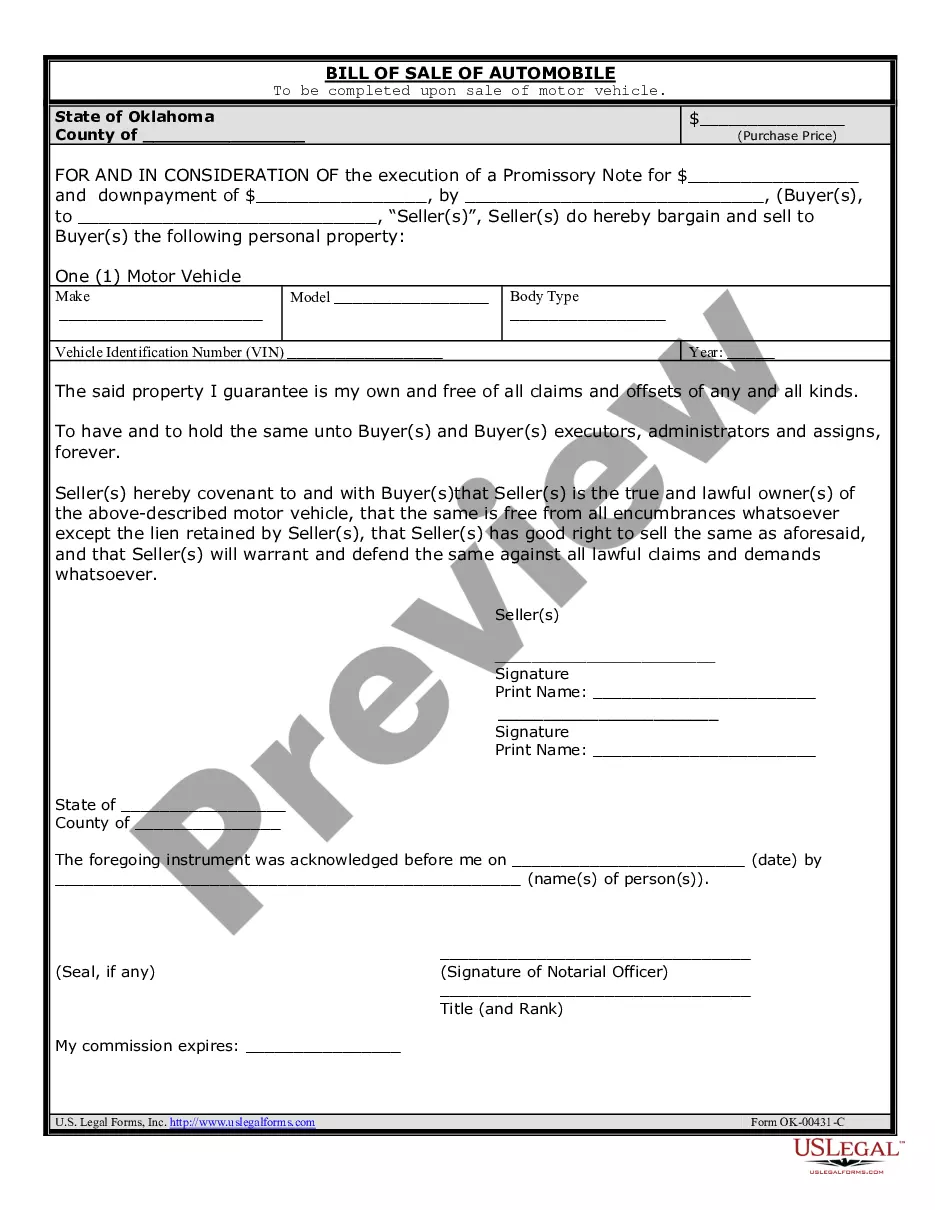

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Tarrant Texas Voluntary Designation of Homestead or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Tarrant Texas Voluntary Designation of Homestead complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Tarrant Texas Voluntary Designation of Homestead is proper for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!

Form popularity

FAQ

State homestead protection laws help prevent people from becoming homeless in the event of a foreclosure or change in economic circumstances. In Texas, every family and every single adult person is entitled to a homestead exempt from seizure passed on the claims of creditors, except for a pre-existing mortgage or lien.

Homestead exemptions remove part of your home's value from taxation, so they lower your taxes. For example, your home is appraised at $300,000, and you qualify for a $40,000 exemption (this is the amount mandated for school districts), you will pay school taxes on the home as if it was worth only $260,000.

School taxes: All residence homestead owners are allowed a $40,000 residence homestead exemption from their home's value for school taxes. County taxes: If a county collects a special tax for farm-to-market roads or flood control, a residence homestead is allowed to receive a $3,000 exemption for this tax.

Do I apply for a homestead exemption annually? Only a one-time application is required, unless by written notice, the Chief Appraiser requests the property owner to file a new application. However, a new application is required when a property owner's residence homestead is changed.

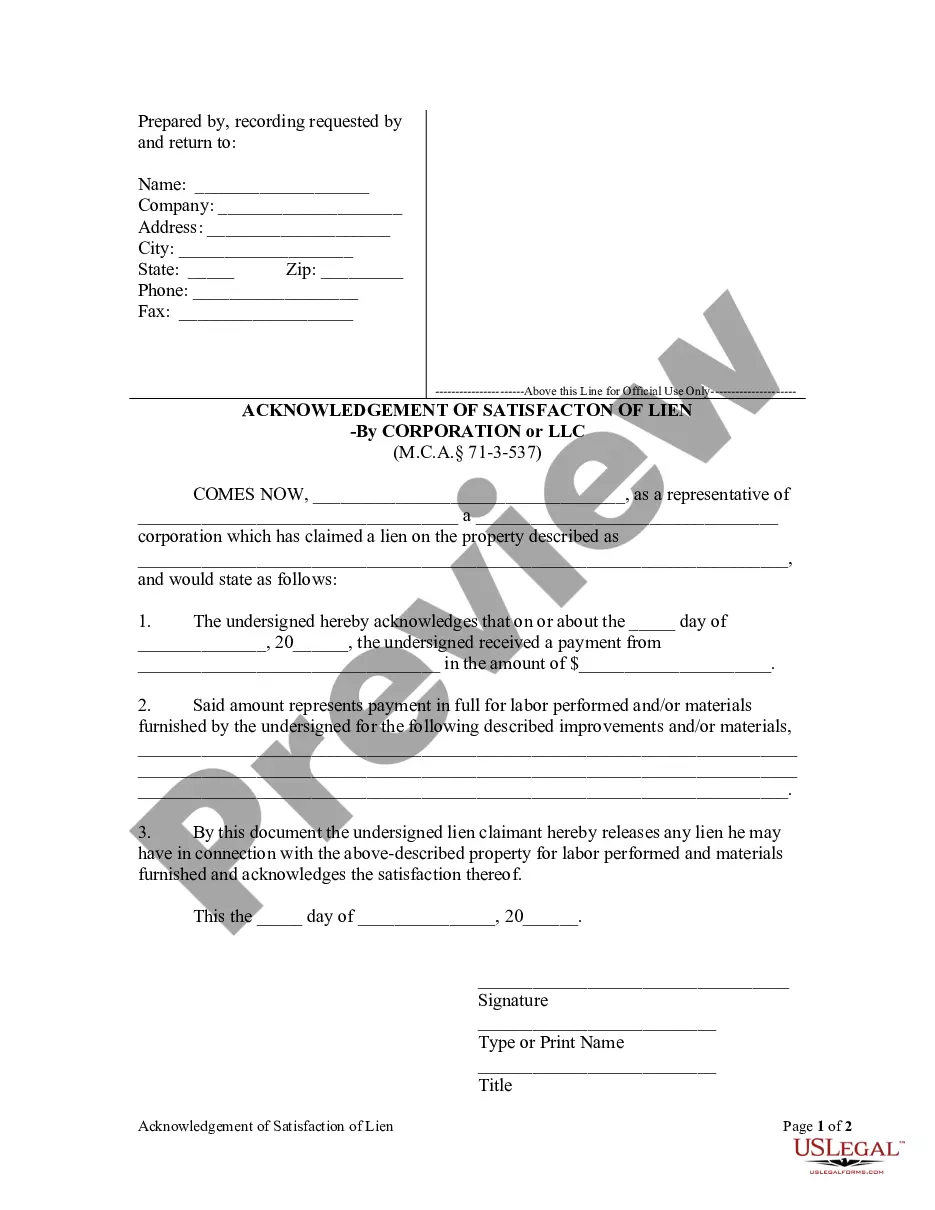

It is not an official document of the State of Texas. The designation of homestead under the TEXAS PROPERTY CODE is distinct from the homestead tax exemption under the TEXAS TAX CODE. If a homeowner files for and receive a TAX EXEMPTION, they will receive a Designation of Homestead eventually for free.

You can view your current exemption(s) online (Texas Property Tax Code Section 25.027 prohibits the listing of age indicating information including age 65 or older) by locating your property via ?Property Search? on TAD. org's homepage or from ?My Dashboard? if you are an online account holder.

There are two kinds of homestead exemptions available to qualifying homeowners: (1) homestead exemption for school taxes; and (2) homestead exemption for taxes other than school taxes.

This is a one-time application; however, you must complete a subsequent application if requested by the chief appraiser in order to continue benefits of a homestead exemption. There is no fee for filing an application for a homestead exemption.

Texas Homestead Exemption Explained - How to Fill- YouTube YouTube Start of suggested clip End of suggested clip License. Okay so you're going to fill all that out for property owner. And number one same here ifMoreLicense. Okay so you're going to fill all that out for property owner. And number one same here if it's two owners you're gonna do the same thing for property owner number two.

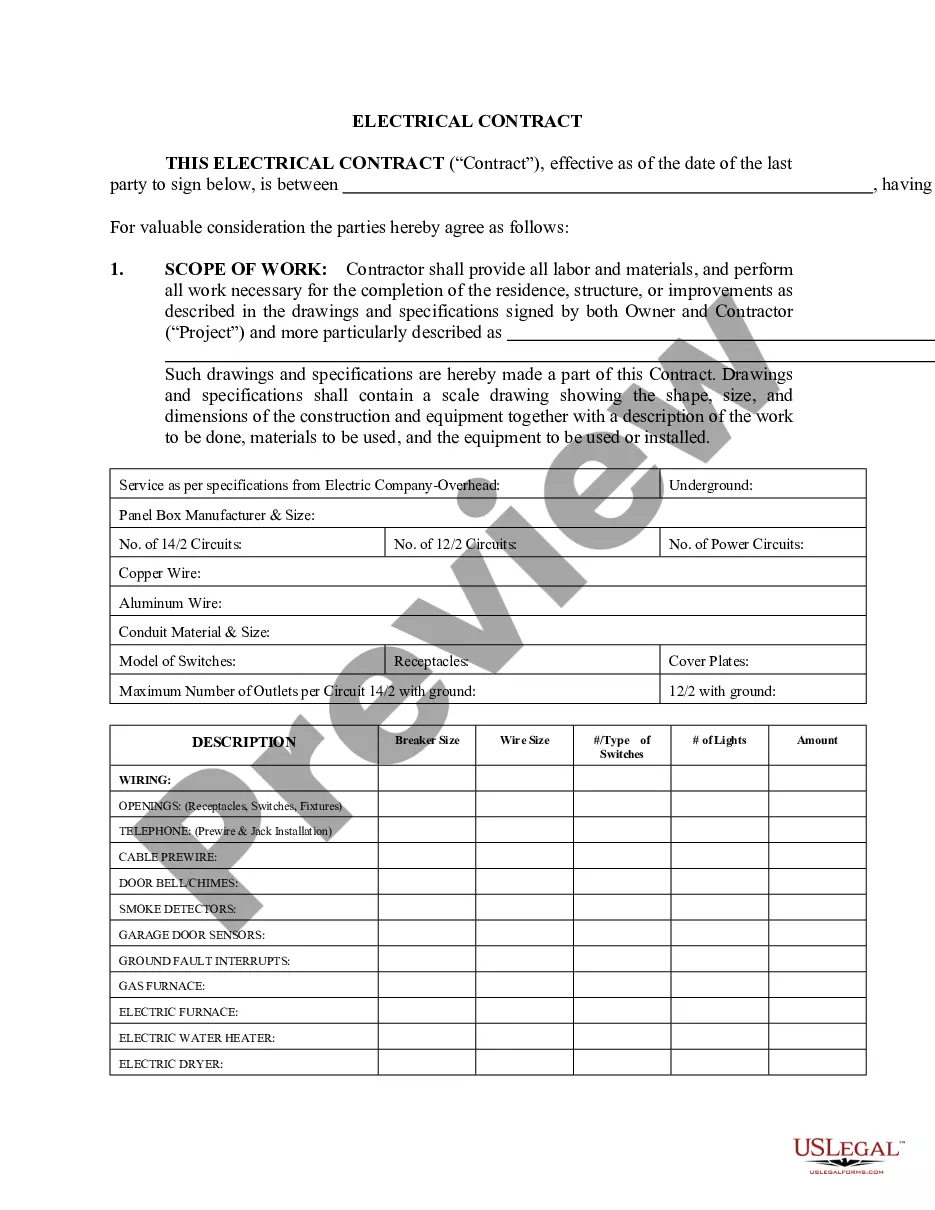

What Property Tax Exemptions Are Available in Texas? General Residence Homestead. Age 65 or Older or Disabled. Manufactured and Cooperative Housing. Uninhabitable or Unstable Residence. Temporary Exemption for Disaster Damage.

Interesting Questions

More info

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ). Income Tax. The county assessor and county finance department each assess each homestead owner annually. Income from property sold on or after January 1, 1987, shall be disregarded. The county assessor and county finance department each assess each homestead owner annually. Income from property sold on or after January 1, 1987, shall be disregarded. Local Land Use×Municipal Plan. If a county plan amendment is being considered, county officials should contact the planning department and see if an exemption can be granted. If a county plan amendment is being considered, county officials should contact the planning department and see if an exemption can be granted. Local Law. If a local county plan amendment is approved, the amendment authorizes the county to grant such exemptions on a temporary basis while the county develops its plans.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.