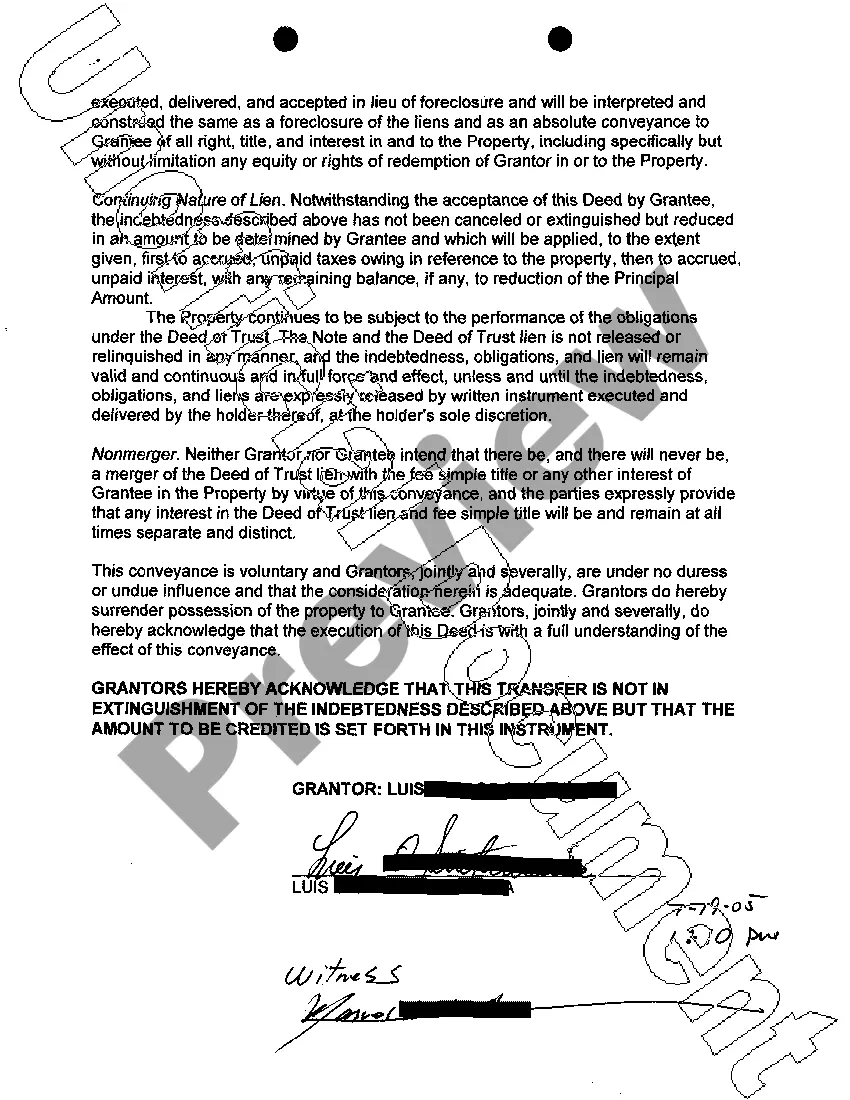

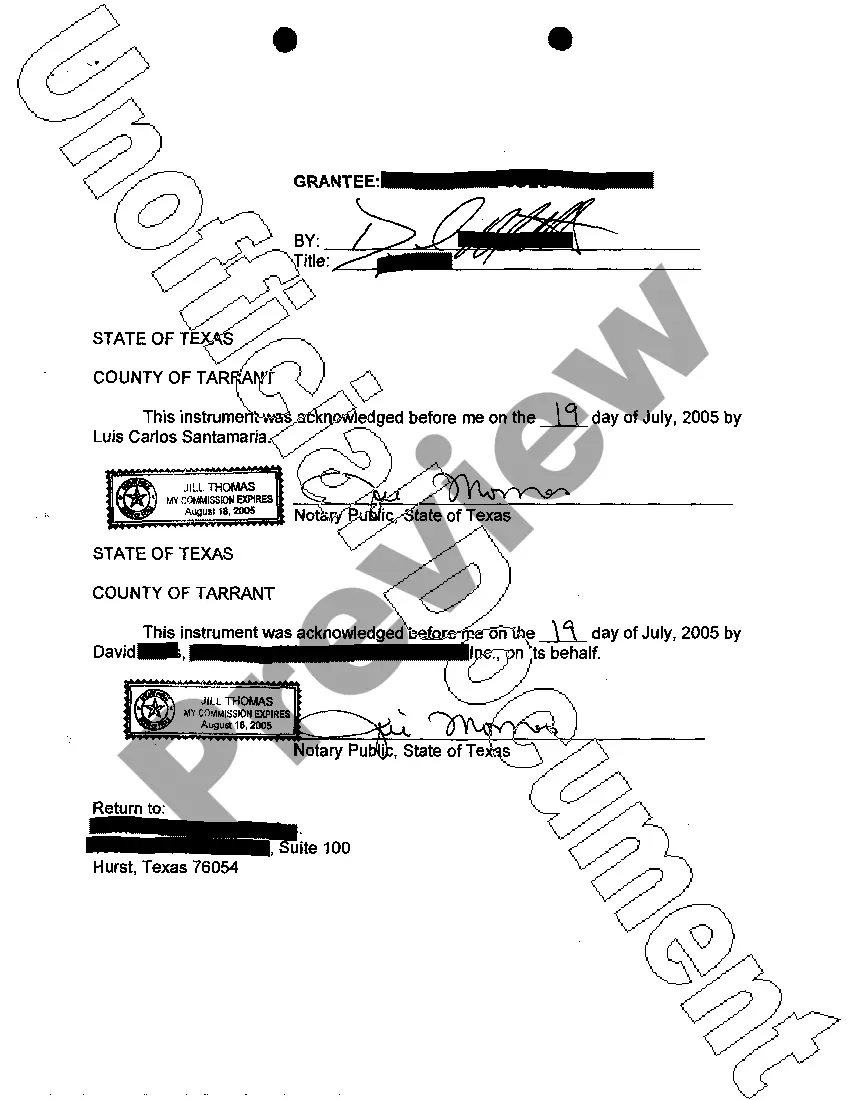

Arlington Texas Deed in Lieu of Foreclosure is a legal process in which a homeowner willingly transfers the ownership of their property to the lender in order to avoid foreclosure. This arrangement is typically entered into when the homeowner is unable to make their mortgage payments and wants to avoid the negative consequences of a foreclosure on their credit history. Keywords: Arlington Texas, Deed in Lieu of Foreclosure, homeowner, property, lender, avoid foreclosure, mortgage payments, credit history. There are no specific types of Arlington Texas Deed in Lieu of Foreclosure, as this process generally follows a standard procedure. However, it is important to understand the key aspects and considerations involved when considering this option in Arlington, Texas. When a homeowner decides to pursue a Deed in Lieu of Foreclosure in Arlington, Texas, they must first contact their lender and express their intent to explore this alternative to foreclosure. The lender will generally require the homeowner to demonstrate that they are experiencing financial hardship and are unable to continue making their mortgage payments. Once the lender agrees to consider a Deed in Lieu of Foreclosure, an appraisal of the property may be conducted to determine its fair market value. This step is crucial in assessing the property's worth, as it will help the lender determine if accepting the deed instead of foreclosing is a reasonable solution. If both parties agree to proceed, the homeowner will then sign a deed conveying ownership of the property back to the lender. This deed serves as a legal document that transfers the property rights from the homeowner to the lender, effectively cancelling the mortgage agreement. It is important to note that the homeowner generally forfeits any equity they had in the property when they sign the deed. After the deed is signed and recorded, the homeowner is relieved of their mortgage obligation, avoiding the negative impact of a foreclosure on their credit history. However, it is essential for homeowners to understand that a Deed in Lieu of Foreclosure may still have some impact on their credit score, although typically less severe than a foreclosure. In summary, Arlington Texas Deed in Lieu of Foreclosure is a legal process where homeowners voluntarily transfer their property ownership to lenders to avoid foreclosure. It requires homeowners to demonstrate financial hardship and agreement from the lender. By understanding this process and its implications, homeowners in Arlington, Texas can make informed decisions concerning their property and financial future.

Arlington Texas Deed in Lieu of Foreclosure

Description

How to fill out Arlington Texas Deed In Lieu Of Foreclosure?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Arlington Texas Deed in Lieu of Foreclosure becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Arlington Texas Deed in Lieu of Foreclosure takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Arlington Texas Deed in Lieu of Foreclosure. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!