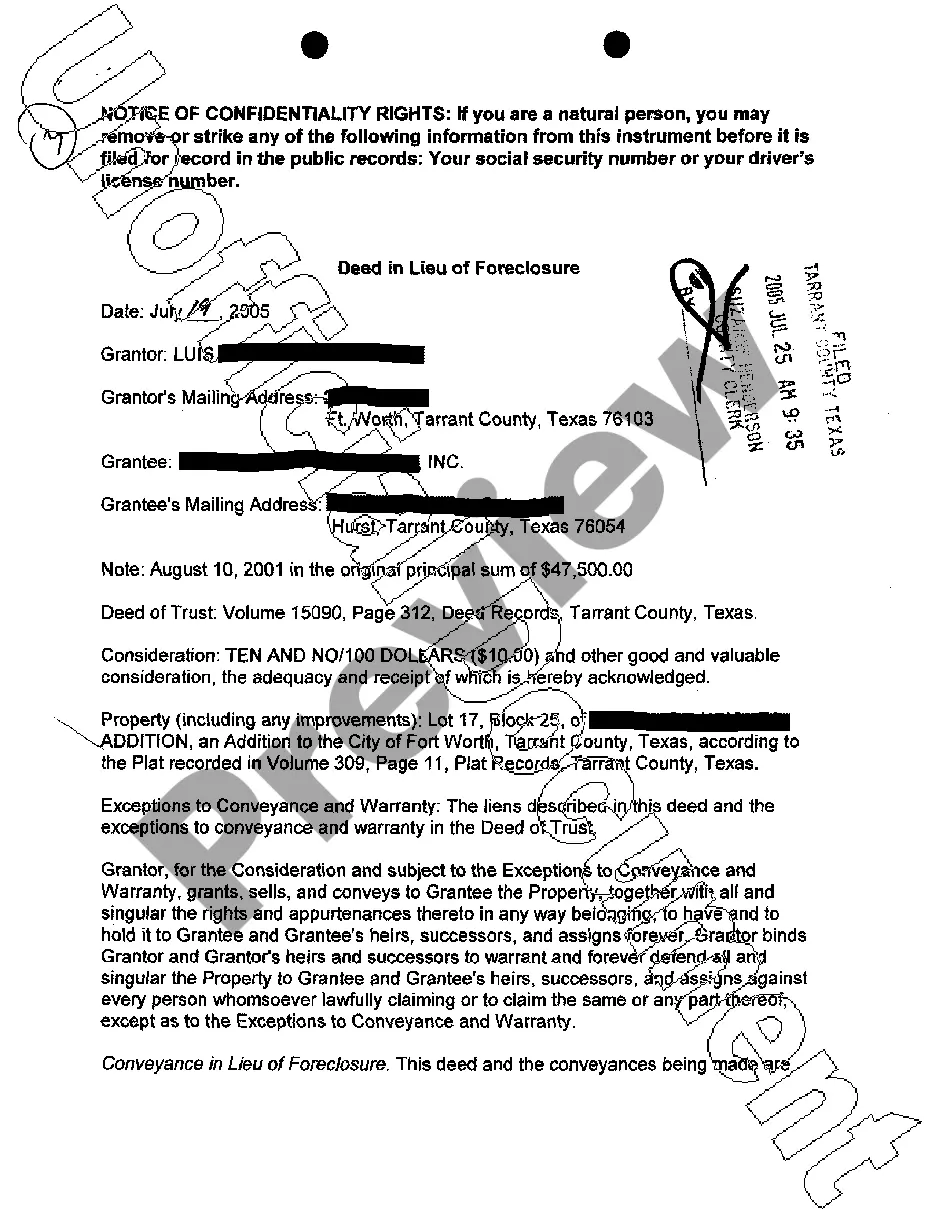

Houston Texas Deed in Lieu of Foreclosure

Description

How to fill out Texas Deed In Lieu Of Foreclosure?

If you have previously taken advantage of our service, Log In to your account and retrieve the Houston Texas Deed in Lieu of Foreclosure on your device by selecting the Download button. Ensure your subscription is active. If it is not, update it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have acquired: you can locate them in your profile under the My documents section whenever you need to retrieve them again. Take advantage of the US Legal Forms service to efficiently locate and save any template for your personal or business needs!

- Ensure you’ve located a suitable document. Review the details and use the Preview feature, if available, to ensure it fulfills your requirements. If it does not suit your needs, utilize the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Enter your credit card information or opt for the PayPal method to finalize the purchase.

- Receive your Houston Texas Deed in Lieu of Foreclosure. Choose the file format for your document and store it on your device.

- Complete your form. Print it or utilize online professional editors to fill it out and sign it digitally.

Form popularity

FAQ

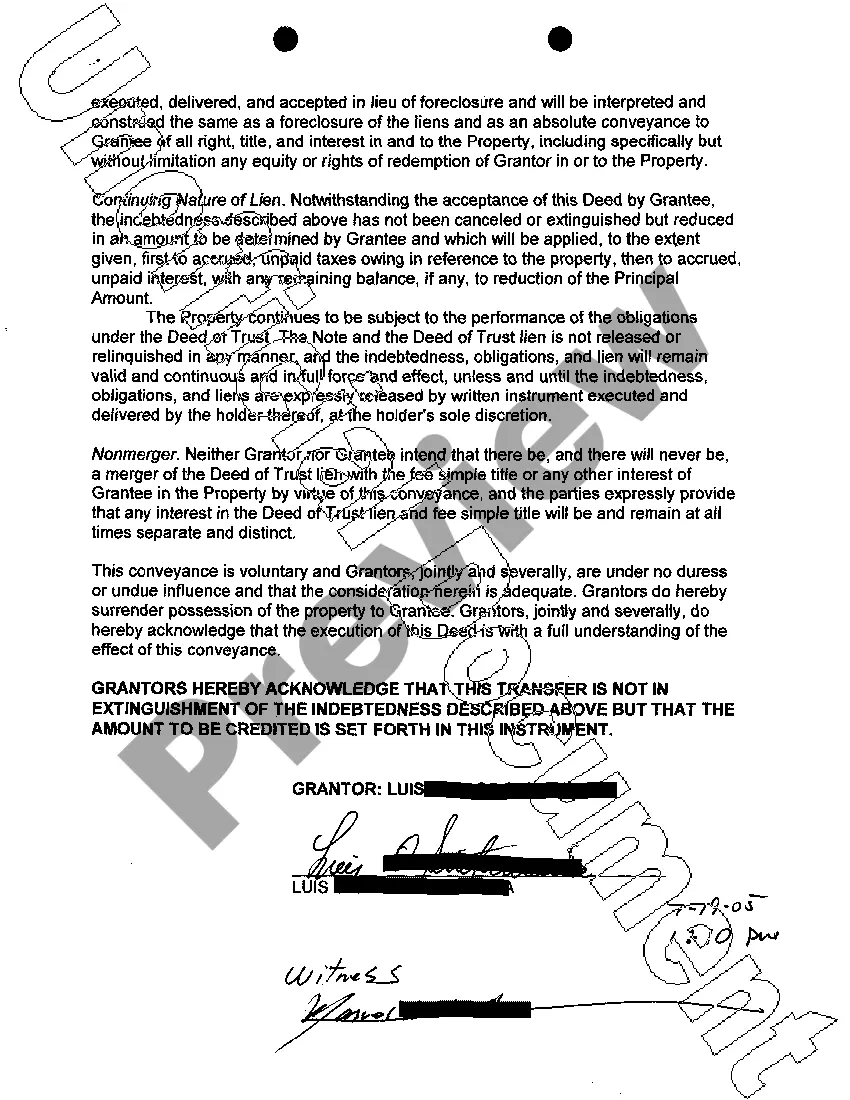

Drawbacks Of A Deed In Lieu Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop. You also won't be able to easily get another mortgage if you have a deed in lieu on your credit report.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.

Your credit score may drop by a range of 50 to 125 points after a deed in lieu of foreclosure, depending on where it stood before the deed in lieu, according to FICO data. The impact is slightly less severe than a foreclosure filing, though, which may drop your credit score by as many as 160 points.

A deed in lieu of foreclosure is an option taken by a mortgagor?often a homeowner?usually as a means of avoiding foreclosure. It is a step that's usually taken only as a last resort, when the property owner has exhausted all other options, such as a loan modification or a short sale.

This deed instrument allows homeowners to satisfy a mortgage loan that's at risk of defaulting, and, most importantly, avoid foreclosure proceedings. A deed in lieu can benefit both the borrower and lender, specifically by sparing both parties from an expensive and time-consuming foreclosure process.

What is the most likely disadvantage to a lender in accepting Deed in Lieu of Foreclosure? Rationale: The liability for existing liens on the property is the most likely disadvantage.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. inlieu of foreclosure may help you avoid being personally liable for any amount remaining on the mortgage.

What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? It is an adverse element in the borrower's credit history. The lender takes the real estate subject to all junior liens. The process is lengthy and involves a lawsuit.

If the lender is willing to accept a deed in lieu of foreclosure, you'll sign a legal document that transfers the legal title of your property to the lender. Then they'll issue a mortgage release, which shows you're no longer required to pay your mortgage debt.