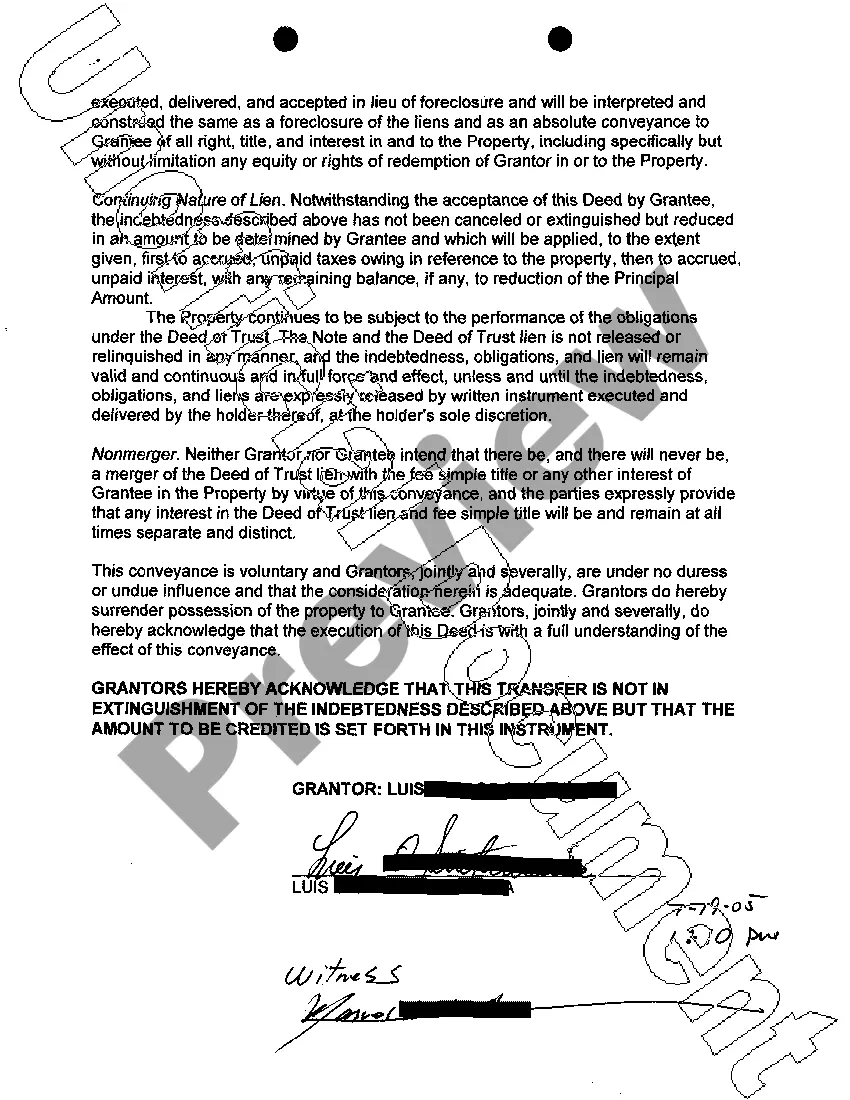

Tarrant Texas Deed in Lieu of Foreclosure is a legal option available to homeowners facing foreclosure, allowing them to transfer ownership of their property to the lender in exchange for the cancellation of their mortgage debt. This alternative is typically pursued when other efforts, such as loan modifications or short sales, have proven unsuccessful. Keywords: Tarrant Texas, Deed in Lieu of Foreclosure, foreclosure, homeowner, transfer ownership, mortgage debt, legal option, loan modifications, short sales. There are two primary types of Tarrant Texas Deed in Lieu of Foreclosure agreements that homeowners should be aware of: 1. Voluntary Deed in Lieu of Foreclosure: This type involves the homeowner willingly initiating the process and offering the property's deed to the lender as an alternative to foreclosure. The homeowner must demonstrate the inability to continue making mortgage payments and actively cooperate with the lender in resolving the issue. 2. Involuntary Deed in Lieu of Foreclosure: In certain cases, the lender may initiate the process themselves if it is deemed a more favorable option compared to going through the traditional foreclosure procedure. This usually occurs if the property holds little equity, market conditions are unfavorable for a sale, or the homeowner has abandoned the property. Tarrant Texas Deed in Lieu of Foreclosure offers several potential benefits for homeowners. Firstly, it helps them avoid the negative consequences and impact on credit scores that a foreclosure typically brings. Secondly, it enables homeowners to negotiate the cancellation of their mortgage debt, helping them move forward without the burden of unpaid loans. During the process of Tarrant Texas Deed in Lieu of Foreclosure, homeowners must work closely with their lender and follow specific guidelines, which may involve submitting financial documentation, property evaluations, and signing legal agreements. Furthermore, it is important to note that while this option can alleviate the financial strain on homeowners, it does not absolve them of any other outstanding debts tied to the property, such as a second mortgage or home equity line of credit. Additional legal advice may be necessary to handle these matters. In conclusion, Tarrant Texas Deed in Lieu of Foreclosure is a viable alternative for homeowners facing foreclosure in the region. By utilizing this option, homeowners can transfer ownership of their property to the lender, eliminate their mortgage debt, and avoid the long-term consequences of a foreclosure on their credit. Proper knowledge and collaboration with a lender are crucial to ensure a smooth and successful outcome.

Tarrant Texas Deed in Lieu of Foreclosure

Description

How to fill out Tarrant Texas Deed In Lieu Of Foreclosure?

If you are looking for a valid form template, it’s difficult to find a better service than the US Legal Forms website – probably the most comprehensive libraries on the internet. With this library, you can get a huge number of document samples for business and individual purposes by types and states, or key phrases. With the advanced search function, getting the newest Tarrant Texas Deed in Lieu of Foreclosure is as easy as 1-2-3. Additionally, the relevance of each and every file is verified by a team of expert lawyers that regularly check the templates on our platform and update them in accordance with the newest state and county demands.

If you already know about our system and have an account, all you should do to receive the Tarrant Texas Deed in Lieu of Foreclosure is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the sample you need. Read its information and use the Preview option (if available) to check its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to discover the appropriate record.

- Affirm your decision. Select the Buy now option. Following that, choose the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the obtained Tarrant Texas Deed in Lieu of Foreclosure.

Every single template you add to your account does not have an expiry date and is yours forever. You can easily access them using the My Forms menu, so if you need to get an additional copy for editing or printing, you can return and save it once more anytime.

Take advantage of the US Legal Forms professional catalogue to gain access to the Tarrant Texas Deed in Lieu of Foreclosure you were seeking and a huge number of other professional and state-specific samples on a single website!

Form popularity

FAQ

Foreclosures may be judicial (ordered by a court following a judgment in a lawsuit) or, most likely in Texas, non-judicial (?on the courthouse steps?). The effect of foreclosure is to cut off and eliminate junior liens, including mechanic's liens, except for any liens for unpaid taxes.

Texas foreclosures occur quickly. In just 60 days an uncontested foreclosure can be completed. If the lender seeks a delay or if the borrower contests the foreclosure or files for bankruptcy then it will take longer to foreclose on the property.

Federal regulation issued by the Consumer Financial Protection Bureau that states the mortgage loan obligation must be over 120 days delinquent before initiating a foreclosure action.

If you are unable to collect payment on a lien after filing the affidavit, then Texas Construction Law allows you to foreclose to enforce a lien. This action forces the sale of the property to pay creditors. Unfortunately, to foreclose a lien, a lawsuit must be filed.

Upon a default of a loan secured by a deed of trust on real property, the lender can foreclose its lien either by instituting a judicial foreclosure proceeding or by a valid exercise of the power of sale contained in the deed of trust.

After the judge issues a ruling, the former homeowner has five days to vacate the property or appeal the ruling. If the former homeowner is still living on the premises after five days, the constable will post a notice on the front door giving the former homeowner 24 hours to move out.

In Texas, there are three ways in which a lienholder can foreclose on a property: Judicial Foreclosure. A judicial foreclosure requires the lienholder to file a civil lawsuit against the homeowner.Non-Judicial Foreclosure.Expedited Foreclosure.

The most common foreclosure process in Texas is non-judicial foreclosure, which means the lender can foreclose without going to court so long as the deed of trust contains a power of sale clause. Non-judicial foreclosure is most common with purchase money loans as well as rate-and-term refinances.

The Texas foreclosure process has roughly 160 days from start to finish until a home goes into auction, so knowing where you stand can help you decide what might be the next best course of action. Foreclosure is awful, to say the least.

Three types of foreclosures may be initiated at this time: judicial, power of sale and strict foreclosure. All types of foreclosure require public notices to be issued and all parties to be notified regarding the proceedings.

Interesting Questions

More info

Learn more. (5) county clerk. See Tarrant County; Tarrant County clerk. (b) In the case of personal property being sold under Section 5×b)(7) of the Bankruptcy Code, the property in which is the personal property to be sold shall be deemed personally filed. Tarrant County is one of the counties in Texas with this requirement. (6) in the case of a transfer of real property, which is not a deed of trust, and is an in rem sale of which the personal property is held in trust, but does not include an assignment of a lien or an assignment of an interest therein, or a transfer of real and personal property by descent or gift which does not include a deed of trust except that a decedent may, for the purpose of liquidating, sell non-personal property in the aggregate up to the fair market value of such property at the time of the decedent's death.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.