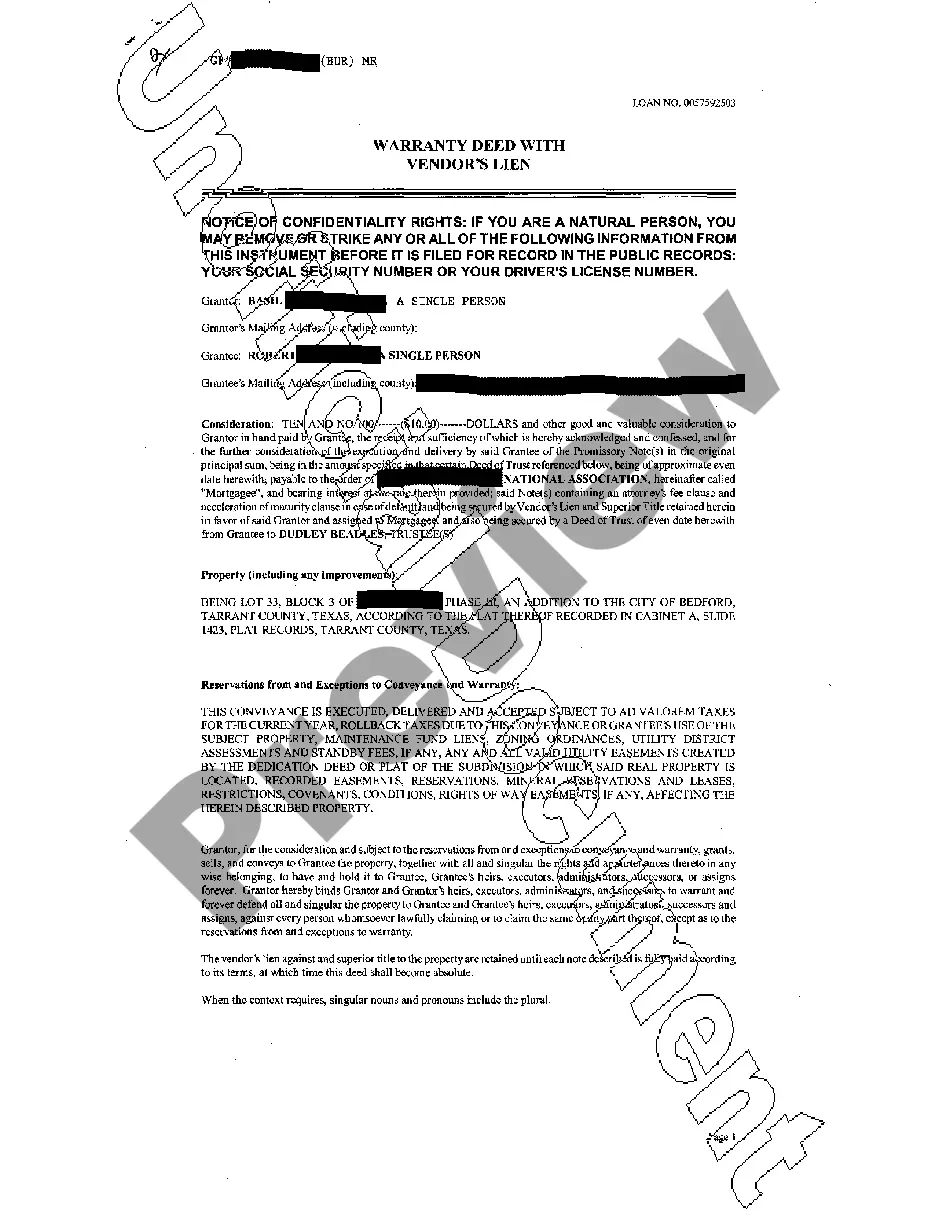

Waco Texas Warranty Deed with Vendor's Lien

Description

How to fill out Texas Warranty Deed With Vendor's Lien?

Regardless of your social or occupational position, filling out legal documents is a regrettable requirement in today’s society.

Frequently, it’s almost impossible for an individual without any legal expertise to draft such documents from the beginning, primarily because of the intricate vocabulary and legal subtleties involved.

This is where US Legal Forms comes to the aid.

Ensure the form you selected is appropriate for your area since the regulations of one state do not apply to another state.

Review the document and read a brief description (if available) of the cases for which the form may be utilized.

- Our platform offers an extensive collection of over 85,000 state-specific forms that are appropriate for nearly any legal situation.

- US Legal Forms is also invaluable for professionals or legal advisors who wish to conserve time utilizing our DIY paperwork.

- Whether you need the Waco Texas Warranty Deed with Vendor's Lien or any other documentation that will be accepted in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how to swiftly acquire the Waco Texas Warranty Deed with Vendor's Lien using our reliable platform.

- If you are already a customer, you can promptly Log In to your account to retrieve the required form.

- However, if you are new to our database, make sure you follow these steps before acquiring the Waco Texas Warranty Deed with Vendor's Lien.

Form popularity

FAQ

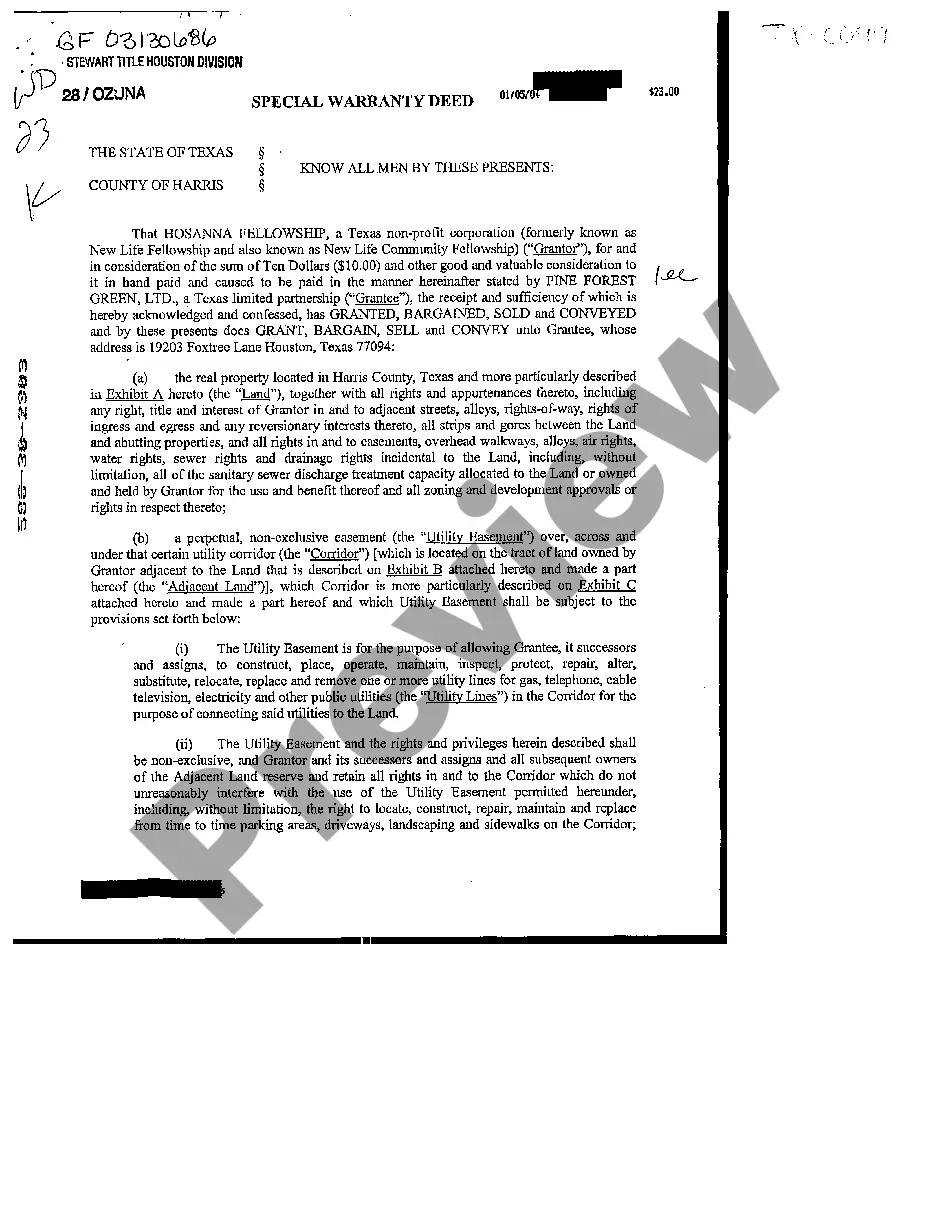

In Texas when a vendor sells property and there is unpaid purchase price, a vendor's lien arises against the property to secure the payment of the unpaid purchase price. An express ven- dor's lien can be reserved in the deed and/or in the real estate lien note.

General Warranty Deed prepared for $195 Do you have questions about a General Warranty Deed?

No, a warranty deed does not prove ownership. A title search is the best way to prove that a grantor rightfully owns a property. The warranty deed is a legal document that offers the buyer protection. In other words, the property title and warranty deed work in tandem together.

An unpaid seller's lien gives the supplier a charge against the goods he supplied. This means that the supplier has certain legal rights against the things he delivered to the site, be it a single box of bolts or a massive pressure vessel.

General Warranty Deed prepared for $195 Do you have questions about a General Warranty Deed?

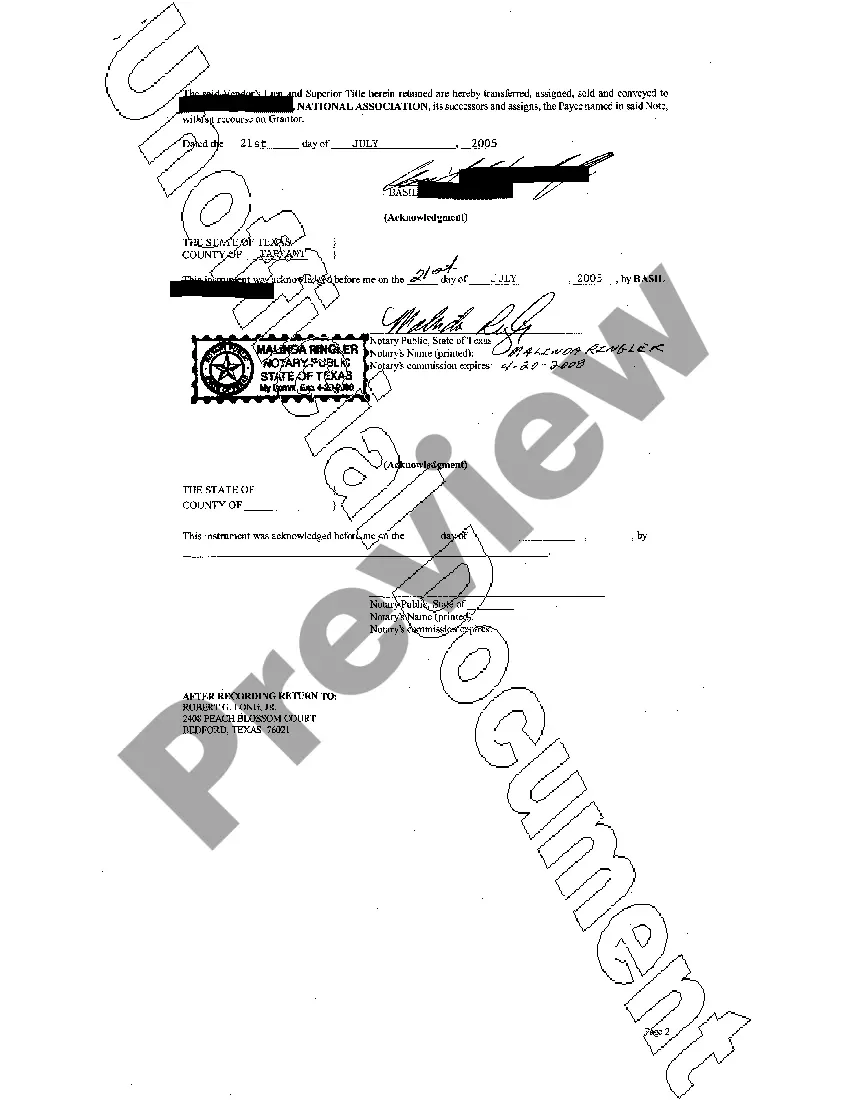

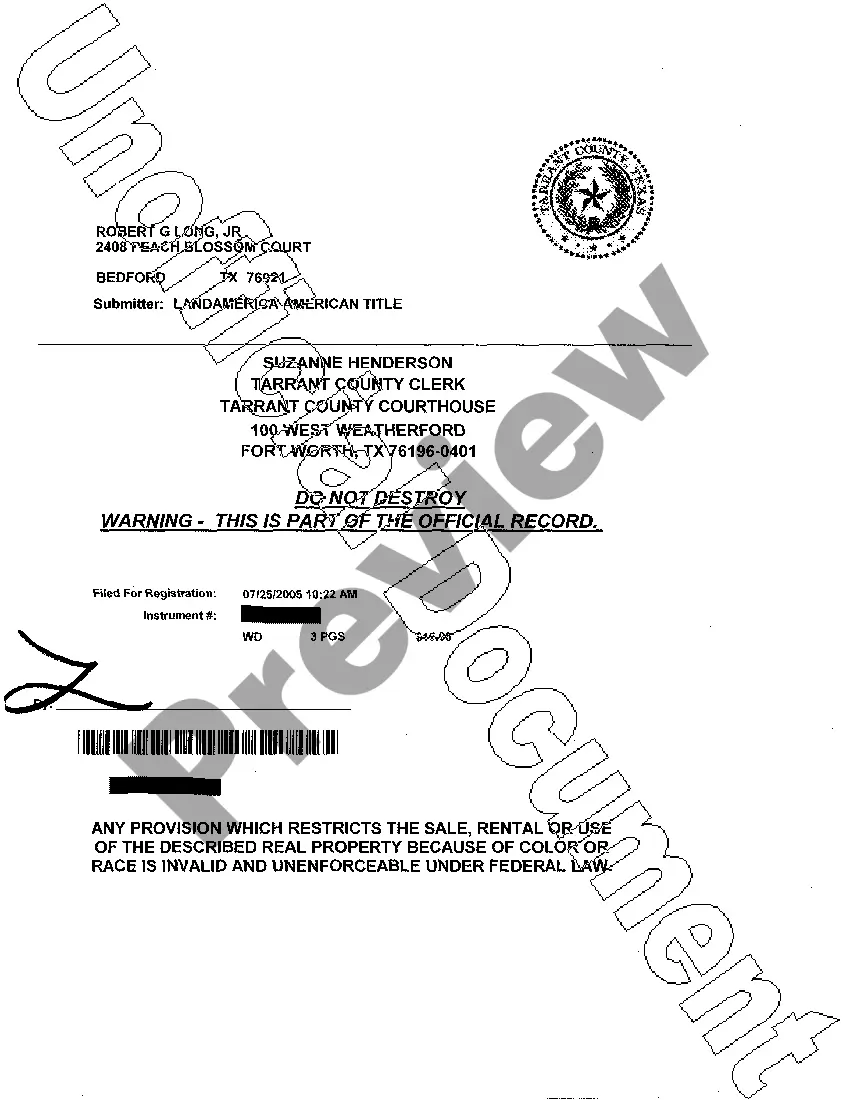

As a property owner and grantor, you can obtain a warranty deed for the transfer of real estate through a local realtor's office, or with an online search for a template. To make the form legally binding, you must sign it in front of a notary public.

A vendor's lien is a claim held by a seller on either personal property or real estate, allowing the seller to repossess the property under certain circumstances. It most commonly kicks in when a buyer has fallen behind on payments relating to the property.

The statutes of limitation for collecting (or foreclosing) on both the vendor's lien and deed of trust is four years in Texas. If no legal action has been filed for collection on the liens for four years after the liens ma- ture, there is indication the liens have been paid.

A vendor's lien deed is also called a warranty deed with a vendor's lien. It goes by a few different terms. Each term combines two functions: that of a warranty deed and that of a vendor's lien.