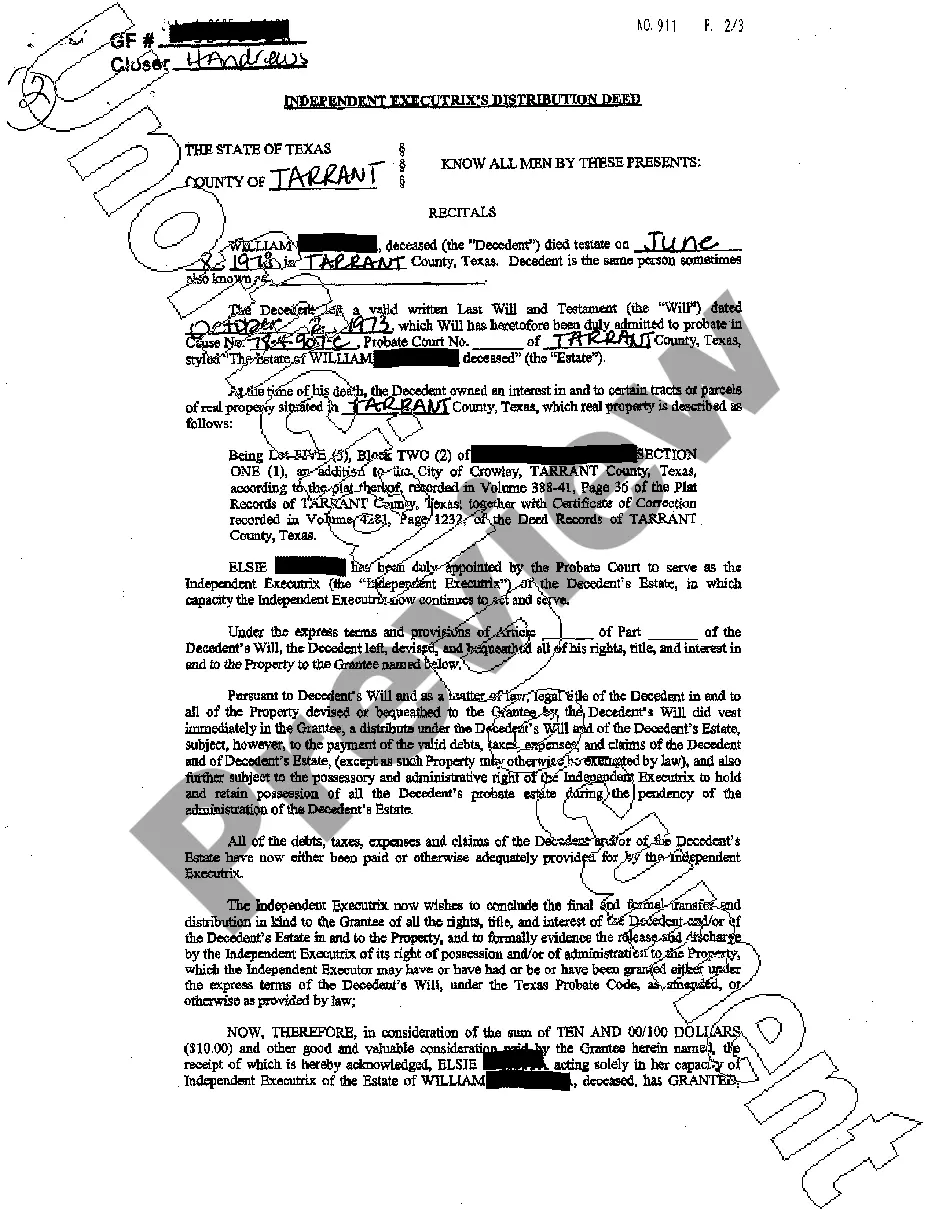

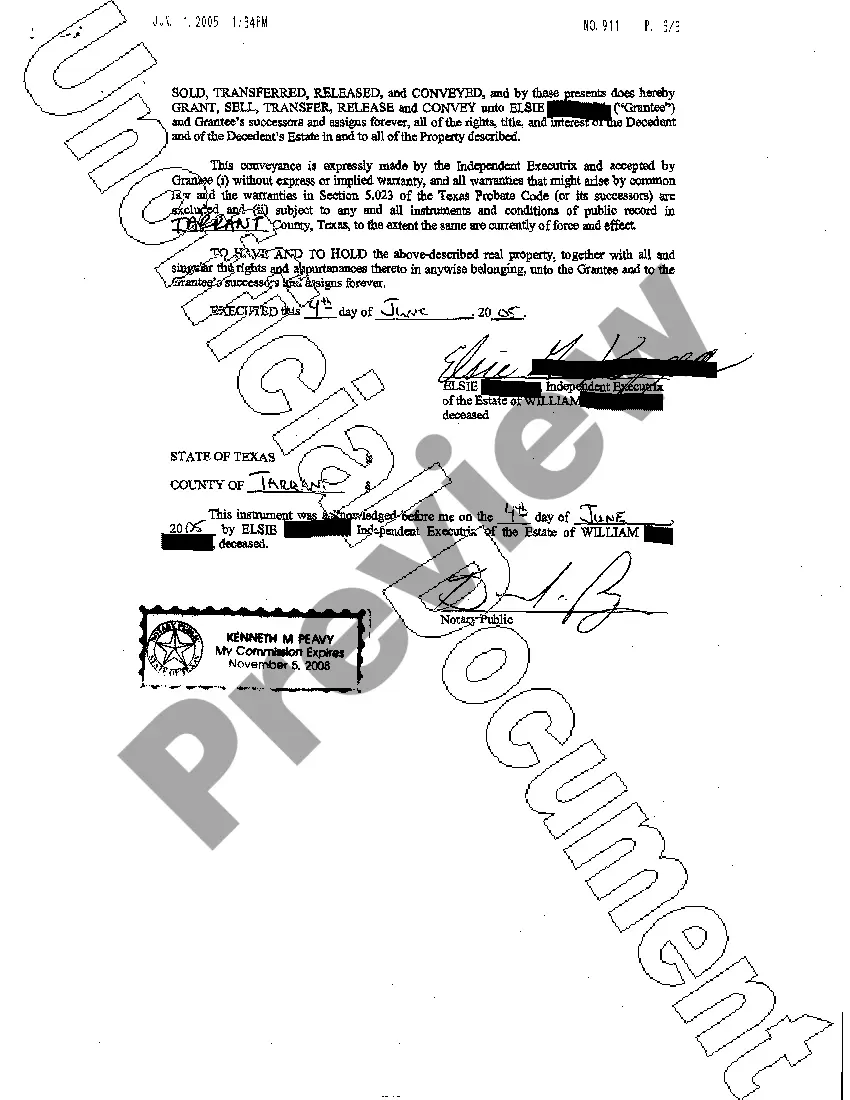

The Austin Texas Independent Executrix's Distribution Deed refers to a legal document that outlines the distribution of assets and properties held by an estate in Austin, Texas. This deed comes into play when an individual, usually the named independent executrix, has been granted the authority to manage and administer the estate according to the decedent's wishes or the laws of intestacy. The Austin Texas Independent Executrix's Distribution Deed serves as a means to transfer ownership and title of various assets, such as real estate, personal property, finances, and investments, from the estate to the designated beneficiaries or heirs. It ensures that the transfer of these assets is carried out in an organized and legally binding manner. This distribution deed is crucial in estate planning and probate processes, providing a clear record of the disposition of assets and an official confirmation of the beneficiaries' legal rights to the inherited properties. It is typically prepared by an attorney or a legal professional experienced in estate planning to ensure compliance with the laws and regulations of Austin, Texas. Different types or variations of the Austin Texas Independent Executrix's Distribution Deed may include: 1. Real Estate Distribution Deed: This deed specifically focuses on the transfer of ownership of real estate properties, such as houses, land, or commercial buildings, from the estate to the designated beneficiaries. 2. Personal Property Distribution Deed: This type of distribution deed pertains to the transfer of personal belongings, such as furniture, vehicles, jewelry, artwork, or any other tangible assets held by the estate to the beneficiaries. 3. Financial Distribution Deed: This deed involves the transfer of financial assets, including bank accounts, stocks, bonds, retirement accounts, or any other monetary holdings, to the beneficiaries or heirs. 4. Investment Distribution Deed: In cases where the estate holds investments, such as stocks, mutual funds, or real estate investment trusts (Rests), this type of distribution deed facilitates the legal transfer of these investments to the beneficiaries. It is important to note that the specific terms, conditions, and provisions of the Austin Texas Independent Executrix's Distribution Deed may vary depending on the complexities of the estate and the intentions of the decedent. Seeking professional legal advice and guidance is highly recommended ensuring the accurate drafting and execution of the deed in accordance with the applicable laws and individual circumstances.

Austin Texas Independent Executrix's Distribution Deed

Description

How to fill out Austin Texas Independent Executrix's Distribution Deed?

Benefit from the US Legal Forms and obtain immediate access to any form sample you require. Our beneficial website with a huge number of templates makes it simple to find and obtain almost any document sample you require. It is possible to download, fill, and sign the Austin Texas Independent Executrix's Distribution Deed in a few minutes instead of browsing the web for hours trying to find a proper template.

Utilizing our collection is a superb way to raise the safety of your document submissions. Our professional legal professionals regularly review all the records to ensure that the templates are relevant for a particular region and compliant with new laws and polices.

How do you obtain the Austin Texas Independent Executrix's Distribution Deed? If you already have a profile, just log in to the account. The Download option will appear on all the samples you look at. Furthermore, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Find the form you require. Make certain that it is the template you were looking for: examine its headline and description, and take take advantage of the Preview option if it is available. Otherwise, make use of the Search field to find the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the document. Indicate the format to get the Austin Texas Independent Executrix's Distribution Deed and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy document libraries on the internet. We are always ready to assist you in any legal procedure, even if it is just downloading the Austin Texas Independent Executrix's Distribution Deed.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!