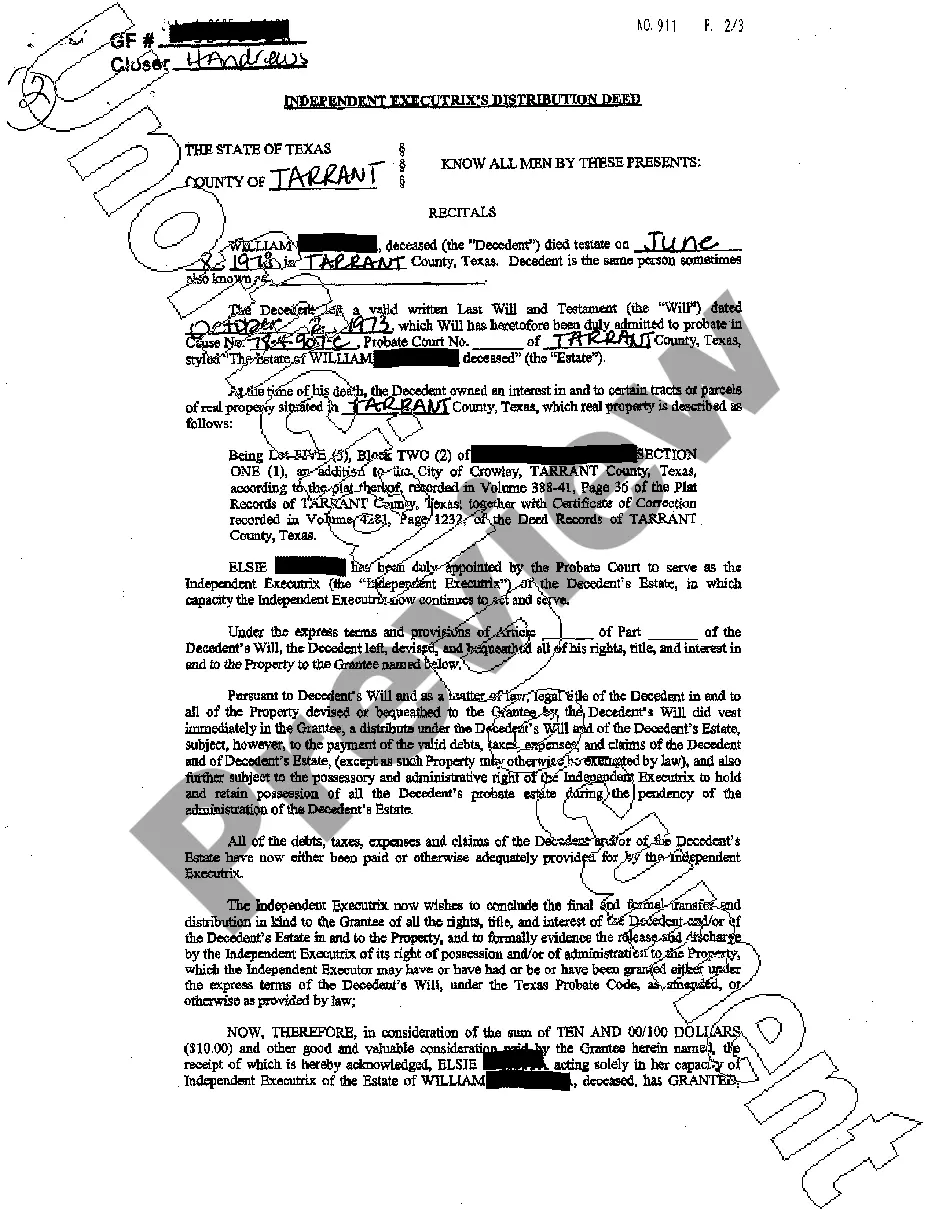

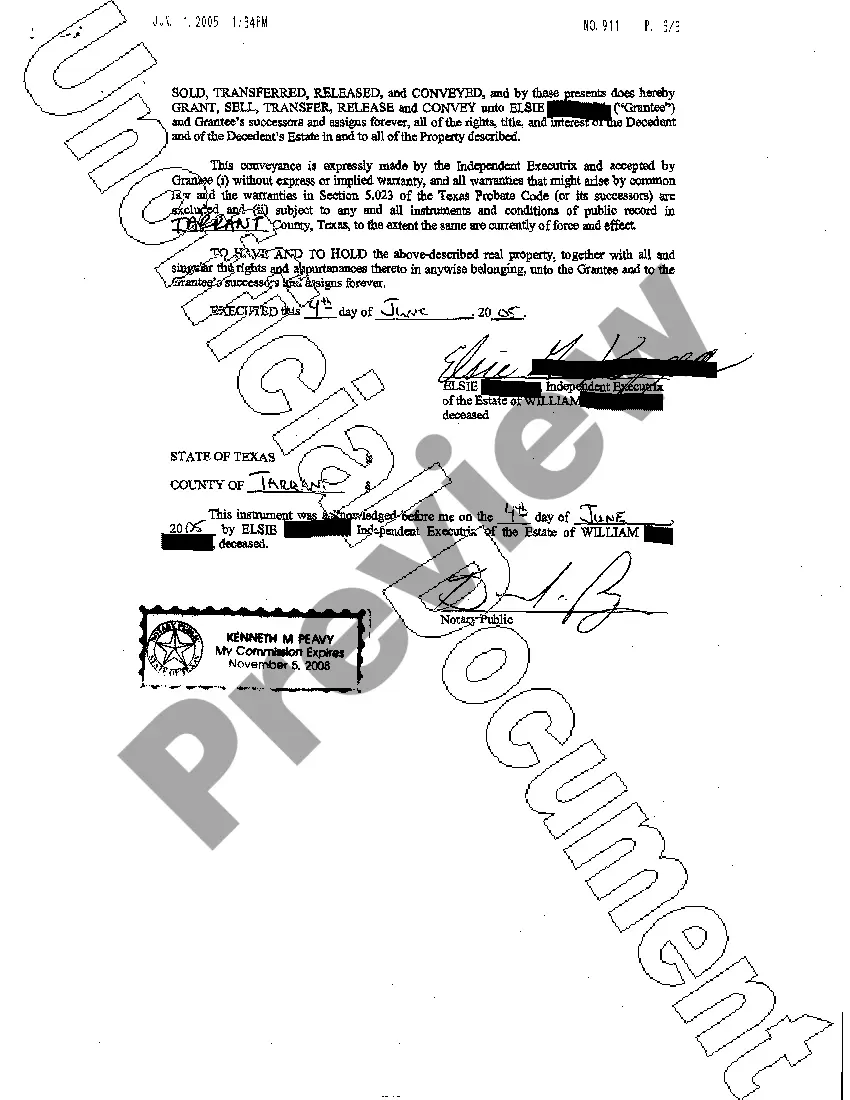

Dallas Texas Independent Executrix's Distribution Deed is a legal document that outlines the distribution of assets and properties owned by a deceased individual in the state of Texas. This document is typically prepared and executed by an independent executrix, who is responsible for administering the decedent's estate and ensuring the proper distribution of assets to the beneficiaries. The Dallas Texas Independent Executrix's Distribution Deed provides a comprehensive framework for the transfer of real estate, personal property, and other assets owned by the decedent. It includes detailed information about the decedent's assets, beneficiary details, and any specific instructions or conditions regarding the distribution of certain properties. Keywords: Dallas Texas, Independent Executrix's Distribution Deed, legal document, assets, properties, deceased individual, Texas, independent executrix, estate administration, distribution of assets, beneficiaries, real estate, personal property, transfer, detailed information, beneficiary details, instructions, conditions, properties. There are several types of Dallas Texas Independent Executrix's Distribution Deeds that may be relevant in specific situations: 1. General Distribution Deed: This type of deed is used when the assets and properties are distributed among multiple beneficiaries in accordance with the decedent's wishes or the laws of intestate succession. 2. Specific Asset Distribution Deed: This deed is utilized when there is a specific asset or property that is to be distributed to a particular beneficiary as designated by the decedent. 3. Partial Distribution Deed: In some cases, the decedent's estate may not be fully settled, and a partial distribution deed is used to transfer a portion of the assets to the beneficiaries while still retaining some assets for further administration. 4. Residuary Distribution Deed: When there are remaining assets or properties after the initial distribution, a residuary distribution deed is prepared to distribute those remaining assets to the beneficiaries. 5. Conditional Distribution Deed: This type of deed is utilized when certain conditions must be met before the distribution of assets takes place. These conditions can be specified by the decedent or imposed by the court. 6. Final Distribution Deed: Once all the necessary steps in the estate administration process are completed, a final distribution deed is executed to transfer the remaining assets to the beneficiaries and officially close the estate. By utilizing these specific types of Dallas Texas Independent Executrix's Distribution Deeds, the decedent's assets and properties can be distributed efficiently and in accordance with their wishes or applicable laws.

Dallas Texas Independent Executrix's Distribution Deed

Description

How to fill out Dallas Texas Independent Executrix's Distribution Deed?

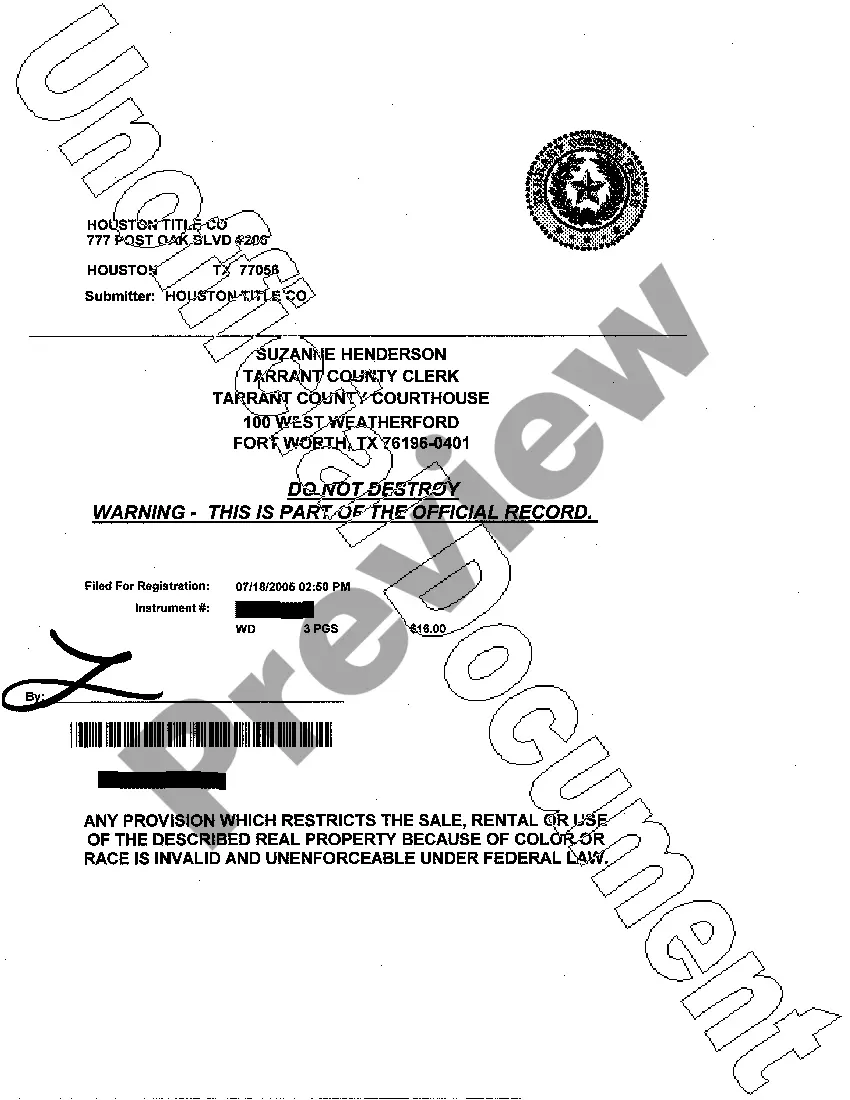

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Dallas Texas Independent Executrix's Distribution Deed becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Dallas Texas Independent Executrix's Distribution Deed takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Dallas Texas Independent Executrix's Distribution Deed. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

Legal title to property passes automatically to an executor (if one is appointed) on the death although they would apply for a grant of probate as evidence of their title. If no executor has been validly appointed the legal title vests in any administrator appointed by the Court.

How long does the administrator have to distribute the inheritance to the heirs? In most instances, an administrator may be removed after notice if he or she fails to make a final distribution of the estate within three years after letters of administration have been granted.

The most common type of deed used in Texas is a general warranty deed. This type of deed guarantees the title comes without any liens, easements, or other title problems.

What Is A Distribution Deed? A distribution deed is another way in which to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will.

Once the probate process has begun, however, there is no deadline by which an estate must be completed in Texas. If an estate is not completed within 15 months, the executor or administrator can, in most cases, be ordered to provide an accounting of all estate assets, debts, and expenses.

Probate is the legal process for paying a deceased person's debts and distributing money and property to heirs.

Appointment of an independent executor; The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

The court held that the Texas Estates Code did not allow the executor to sell the property to himself unless it was authorized by the will. §356.651, §356.652 and §356.655. They held that the use of the words ?sell, manage, and dispose? were not a sufficient authorization for him to deed the property to himself.

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.

Interesting Questions

More info

Dallas County is surrounded by Dallas on three sides, McKinney on four sides, Plano on five sides, and is nearly two hundred miles away from downtown Dallas. Texas statutes give the county limited authority in real estate property transactions. Property owners can apply to the county to issue a certificate of title in the named individual's name. For real estate transactions using a “live person” (the owner, not the executor×, the executor will be called the “personal representative.” The process is fairly straightforward: Application for Title Application to Dallas County Clerk's office. Dallas County is a large county. Since real estate in each county may be subject to different laws, the application form may require some interpretation by the clerk's office. However, the County Clerk's office will provide a sample of appropriate form. Personal Representative's Signature — The personal representative signatures the document and signs your name.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.