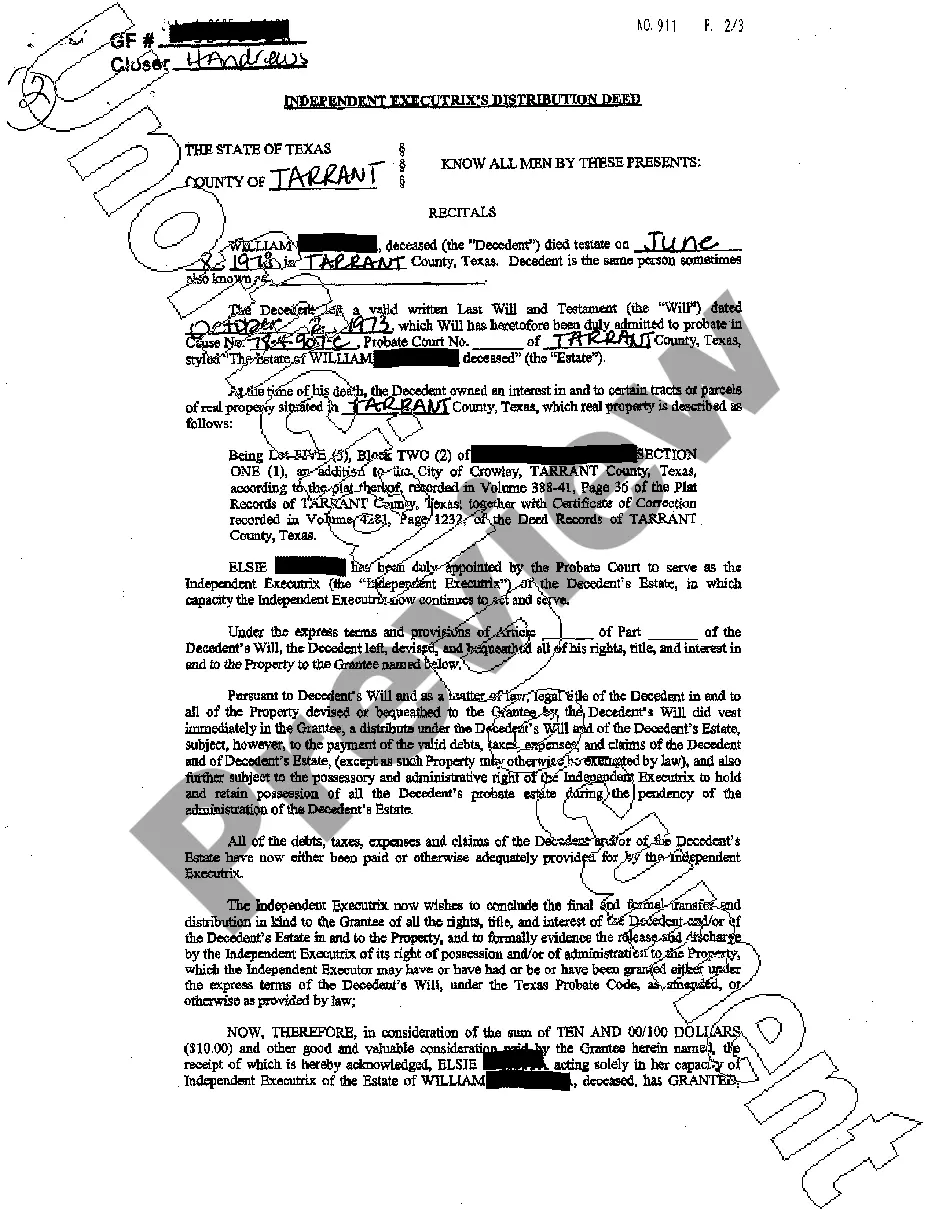

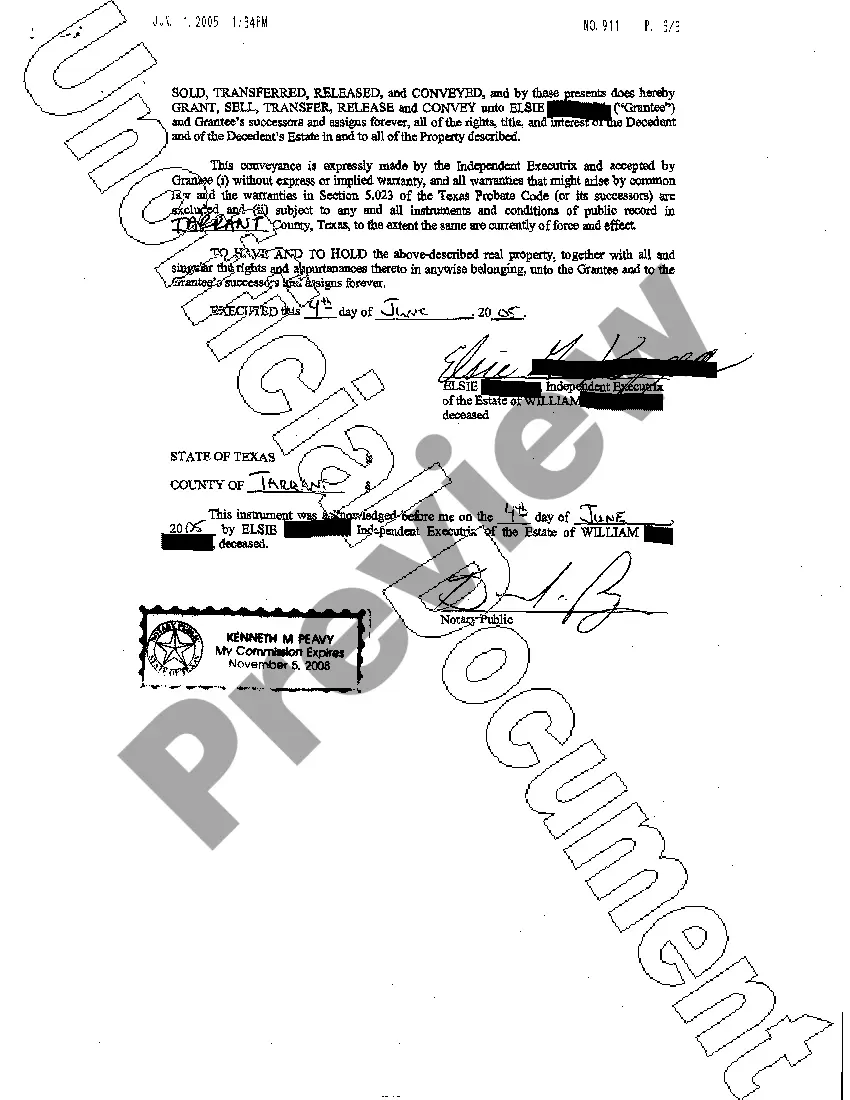

A Round Rock Texas Independent Executrix's Distribution Deed is a legal document that outlines the distribution of assets from an estate to the rightful beneficiaries. This deed is primarily used in Round Rock, Texas, and is applicable when an independent executrix is appointed to administer an estate. An independent executrix is someone who has been granted the authority to handle the affairs of the decedent's estate without the need for court supervision. The primary role of an independent executrix is to ensure that the decedent's assets are distributed according to their wishes, as outlined in their will. The Round Rock Texas Independent Executrix's Distribution Deed serves as a legal instrument for transferring ownership of real property, such as land or houses, from the estate to the beneficiaries. It is an essential document to facilitate the smooth transfer of assets and prevent any disputes or confusion among the beneficiaries. The contents of the Round Rock Texas Independent Executrix's Distribution Deed typically include detailed information about the estate, the beneficiaries, and the distribution plan. It should clearly state the executor's authority, the specific assets being transferred, and the conditions or restrictions, if any, on the distribution. In Round Rock, Texas, there may be various types of Independent Executrix's Distribution Deeds depending on the specific circumstances and requirements of the estate. Some possible variations could include: 1. Simple Distribution Deed: This type of deed is used when the estate consists of a few assets and there are no complex issues or disputes among the beneficiaries. 2. Complex Distribution Deed: In cases where the estate is more sizable or involves multiple assets or beneficiaries, a complex distribution deed may be necessary to address any complicated distribution arrangements, tax implications, or outstanding debts. 3. Partial Distribution Deed: If the estate needs to be distributed in stages or if certain assets need to be specifically allocated to particular beneficiaries, a partial distribution deed can be utilized. 4. Contingent Distribution Deed: In situations where the distribution of assets is contingent upon certain events or conditions, such as reaching a certain age or completing specific obligations, a contingent distribution deed can be drafted. It is crucial for individuals involved in estate administration or beneficiaries in Round Rock, Texas, to consult with an experienced attorney specializing in probate and estate law to ensure the Round Rock Texas Independent Executrix's Distribution Deed accurately reflects the intentions of the decedent and complies with all legal requirements.

Round Rock Texas Independent Executrix's Distribution Deed

Description

How to fill out Round Rock Texas Independent Executrix's Distribution Deed?

We always strive to reduce or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney services that, as a rule, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Round Rock Texas Independent Executrix's Distribution Deed or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Round Rock Texas Independent Executrix's Distribution Deed complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Round Rock Texas Independent Executrix's Distribution Deed is proper for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!