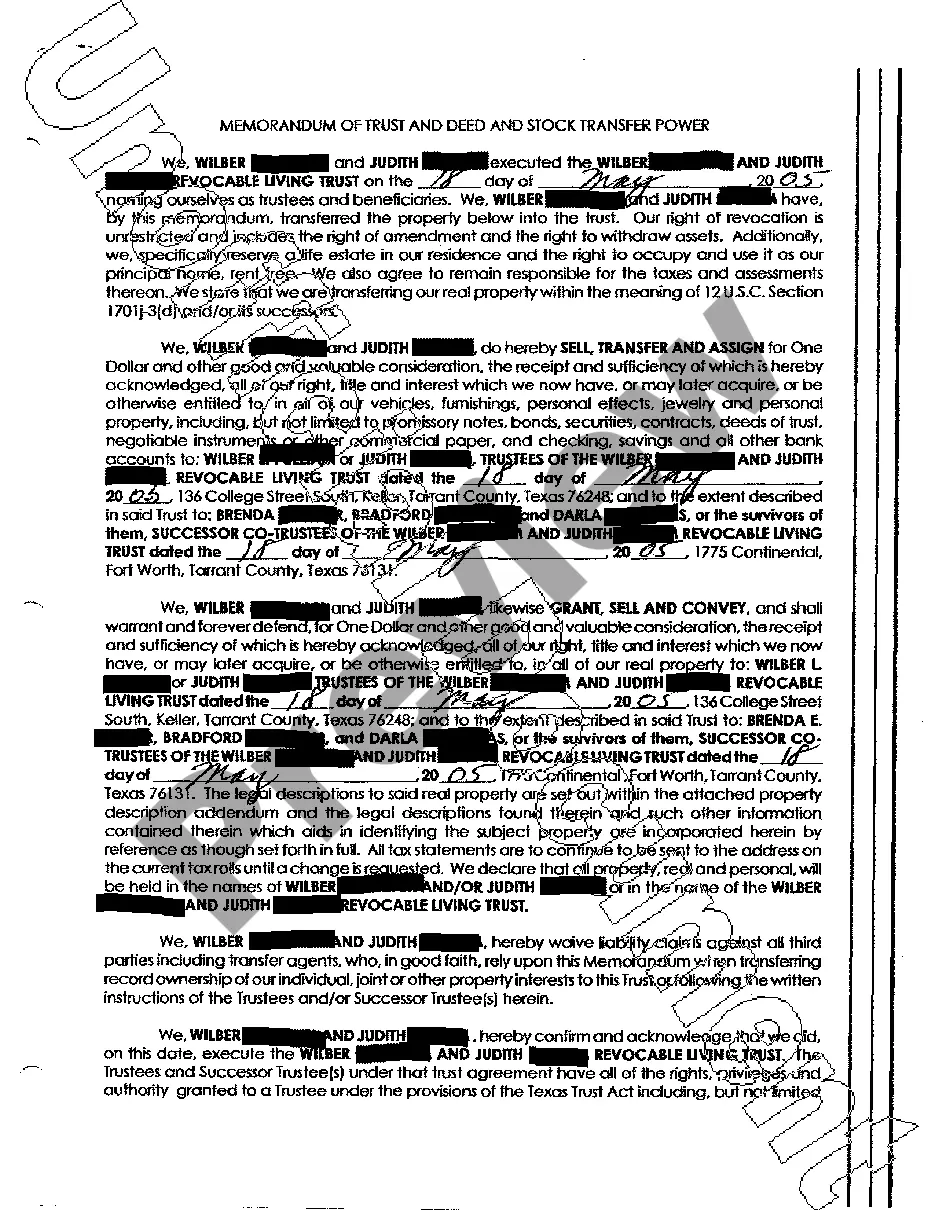

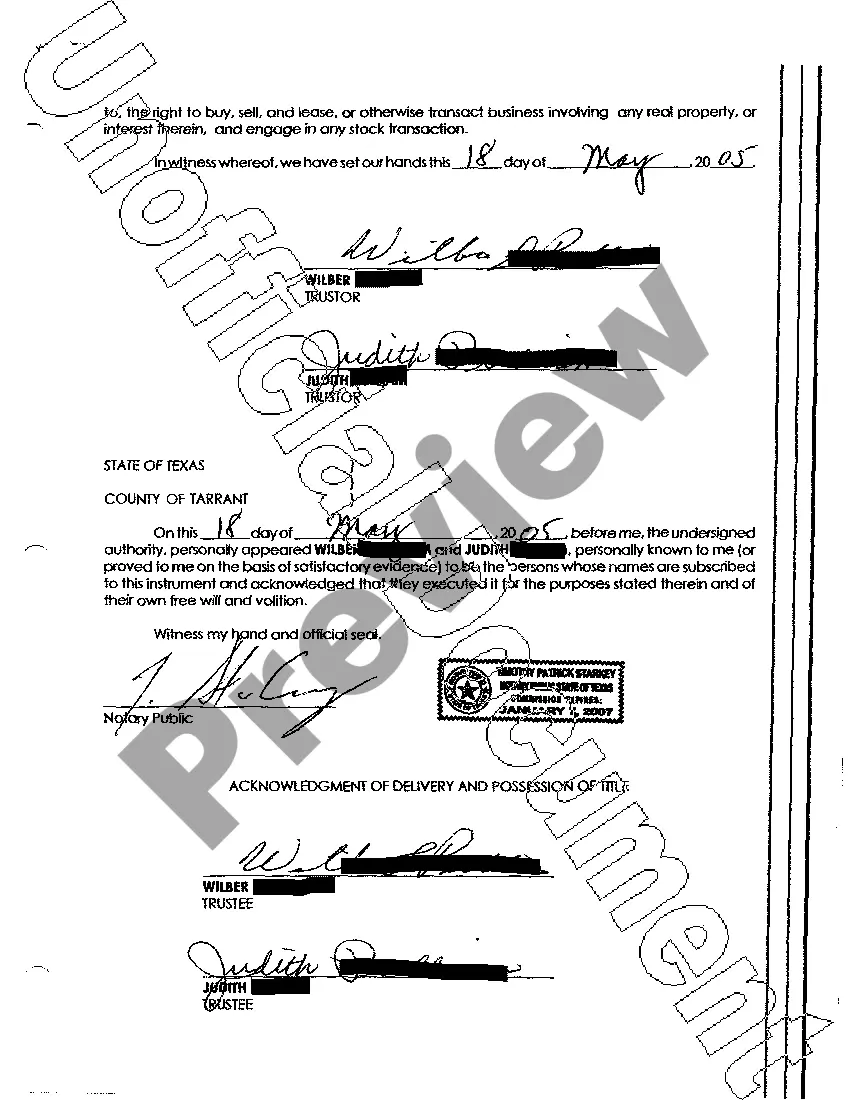

Beaumont, Texas Memorandum of Trust and Deed and Stock Transfer Power: A Comprehensive Guide The Beaumont, Texas Memorandum of Trust and Deed and Stock Transfer Power plays a vital role in the establishment and maintenance of various legal processes related to trusts, deeds, and stock transfers. This detailed description aims to provide insight into these important legal documents, their purpose, and potential variations based on specific requirements. What is a Memorandum of Trust? A Memorandum of Trust is a legal document that serves as a condensed version of a trust agreement. It summarizes the essential provisions of the trust, including the names of the trust's granter (the one who establishes the trust), the trustee (the person or entity responsible for administering the trust), and the beneficiaries (those individuals or organizations who benefit from the trust assets). By outlining the essential details of the trust, a Memorandum of Trust enables privacy protection for trust-related matters. Unlike a full trust agreement, a Memorandum of Trust does not need to be publicly recorded, maintaining confidentiality while still providing necessary guidance to involved parties. Different types of Memorandum of Trust: 1. Revocable Living Trust Memorandum: This type of memorandum is commonly used in estate planning to outline the terms and conditions of a revocable living trust. It allows the granter to maintain control over their assets during their lifetime and seamlessly pass them on to designated beneficiaries upon their death, avoiding probate. 2. Irrevocable Trust Memorandum: Irrevocable trusts are often established to protect assets or secure specific benefits. The Memorandum of Trust for irrevocable trusts serves a similar purpose as the revocable living trust memorandum but outlines the terms and conditions of irrevocable trusts that cannot be altered or revoked by the granter. What is a Deed and Stock Transfer Power? A Deed and Stock Transfer Power refers to a legal instrument used to transfer property ownership, primarily real estate and stock. It ensures the smooth and lawful transition of property rights from one party to another. In Beaumont, Texas, this document is crucial for property buyers, sellers, and shareholders. The Deed and Stock Transfer Power typically consists of specific provisions stating the parties involved in the transfer, a detailed description of the property or stock being transferred, and any applicable terms or conditions. Different variations of Deed and Stock Transfer Power: 1. General Warranty Deed: This type of deed guarantees that the property being transferred is free from any undisclosed encumbrances, and the granter holds the absolute title to the property. 2. Quitclaim Deed: Unlike a General Warranty Deed, a Quitclaim Deed transfers the granter's interest in the property without providing any warranties or guarantees regarding the property's title. 3. Special Warranty Deed: This type of deed assures the buyer that the granter holds clear title to the property during their ownership, and there have been no encumbrances or claims against it during their tenure, except those specifically mentioned in the deed. 4. Stock Transfer Power: In the realm of corporate stock transfers, a Stock Transfer Power is a document signed by the owner of shares to authorize the transfer of ownership to another party. This document is crucial for maintaining clear ownership records and ensuring compliance with securities regulations. Overall, the Beaumont, Texas Memorandum of Trust and Deed and Stock Transfer Power are indispensable legal documents. They provide clarity, protect privacy, and facilitate smooth transfers of property and stock ownership. Understanding the different types can aid individuals or organizations in navigating specific scenarios that require these documents in the course of their legal obligations or desires.

Beaumont Texas Memorandum of Trust and Deed and Stock Transfer Power

Description

How to fill out Beaumont Texas Memorandum Of Trust And Deed And Stock Transfer Power?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person without any law education to create this sort of paperwork cfrom the ground up, mostly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you want the Beaumont Texas Memorandum of Trust and Deed and Stock Transfer Power or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Beaumont Texas Memorandum of Trust and Deed and Stock Transfer Power quickly using our trustworthy service. If you are already an existing customer, you can go on and log in to your account to get the needed form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps before downloading the Beaumont Texas Memorandum of Trust and Deed and Stock Transfer Power:

- Ensure the template you have chosen is suitable for your location since the regulations of one state or area do not work for another state or area.

- Preview the form and read a short description (if available) of cases the document can be used for.

- In case the one you chosen doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- utilizing your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Beaumont Texas Memorandum of Trust and Deed and Stock Transfer Power as soon as the payment is through.

You’re all set! Now you can go on and print the form or fill it out online. Should you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.