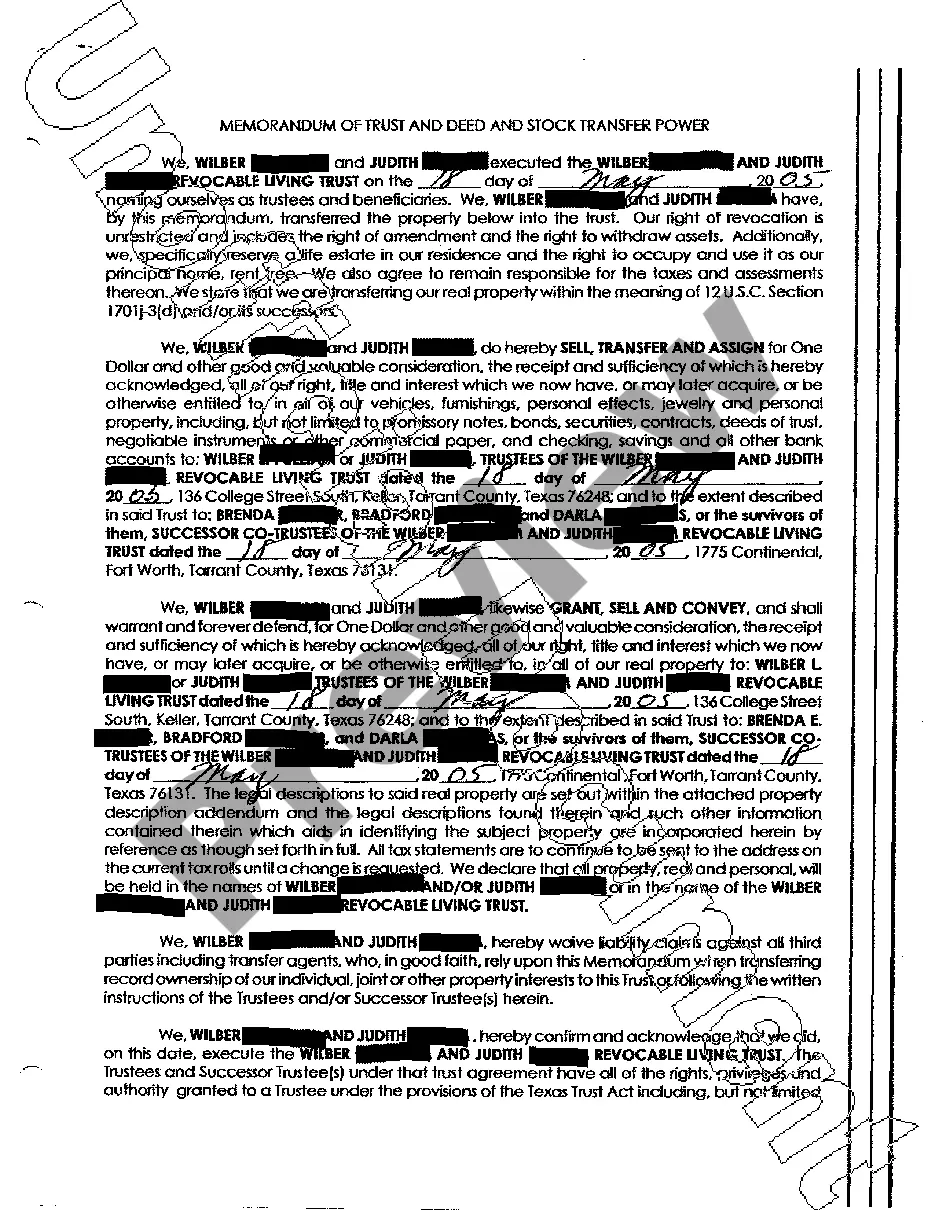

The Dallas Texas Memorandum of Trust, Deed, and Stock Transfer Power are essential legal documents used in various real estate and business transactions within the state of Texas. These documents serve as irreplaceable tools that ensure the smooth transfer of property ownership, both tangible and intangible. The Memorandum of Trust is a document that outlines the key provisions and terms of a trust agreement. It serves as a summary of the trust and provides important information such as the name and contact details of the trustee, the beneficiaries, and any specific instructions or conditions associated with the trust. This document is crucial for establishing the legal framework to execute the intentions of the trust creator, also known as the granter or settler. Similarly, the Deed is another vital document used in real estate transactions. In Texas, a deed is used to convey the ownership of property from one party to another. It contains details about the property being transferred, including its legal description, boundaries, and any liens or encumbrances that may affect the property's title. A properly executed deed ensures the lawful transfer of the property and protects the rights of all parties involved. In addition to these documents, the Stock Transfer Power is used to facilitate the transfer of stock ownership between individuals or entities. This power of attorney document allows the transferor to appoint someone as their authorized representative to transfer stock on their behalf. It includes important information such as the names of the transferee and transferor, the number or type of shares being transferred, and any specific conditions or restrictions associated with the transfer. While there may not be different types of Dallas Texas Memorandum of Trust and Deed and Stock Transfer Power, variations and specific clauses can be added to customize them based on the unique requirements of different transactions. For example, a Memorandum of Trust may differ depending on whether it is for a revocable or irrevocable trust, or if it is used for a living trust or testamentary trust. Similarly, Deeds can be categorized based on the type of property being transferred, such as a Warranty Deed, Quitclaim Deed, or Special Warranty Deed. Each type of deed offers different levels of assurance and potential liabilities for the parties involved. In conclusion, the Dallas Texas Memorandum of Trust, Deed, and Stock Transfer Power are crucial documents used in legal and financial transactions in the state. Understanding their purpose and content is important for anyone involved in real estate or business dealings in Texas.

Dallas Texas Memorandum of Trust and Deed and Stock Transfer Power

Description

How to fill out Dallas Texas Memorandum Of Trust And Deed And Stock Transfer Power?

If you are looking for a valid form, it’s extremely hard to find a more convenient platform than the US Legal Forms site – probably the most considerable libraries on the internet. Here you can get a huge number of form samples for business and individual purposes by types and states, or keywords. Using our advanced search feature, getting the most up-to-date Dallas Texas Memorandum of Trust and Deed and Stock Transfer Power is as easy as 1-2-3. Moreover, the relevance of each file is verified by a team of skilled lawyers that regularly review the templates on our platform and update them according to the most recent state and county regulations.

If you already know about our platform and have an account, all you need to receive the Dallas Texas Memorandum of Trust and Deed and Stock Transfer Power is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have found the form you need. Read its information and utilize the Preview function to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the proper record.

- Affirm your decision. Click the Buy now option. After that, pick your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Make use of your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the file format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the received Dallas Texas Memorandum of Trust and Deed and Stock Transfer Power.

Each form you save in your profile has no expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you need to receive an extra copy for editing or printing, you can come back and save it once more anytime.

Make use of the US Legal Forms extensive library to gain access to the Dallas Texas Memorandum of Trust and Deed and Stock Transfer Power you were seeking and a huge number of other professional and state-specific samples on a single platform!

Form popularity

FAQ

§ 13.002). The Texas Property Code requires additional information to record a deed, including that the deed must: Be acknowledged or sworn to by the grantor before two credible witnesses, or a notary public, who also sign(s) the document (Tex. Prop.

In Texas, there's no requirement that a deed be recorded in the county clerk's records to be valid. The only requirement is that it be executed and delivered to the grantee, at which time the transfer becomes fully effective between the grantor (seller) and the grantee (buyer).

The Deed of Trust must be in writing, signed by the property owner, and filed in the County Clerk property records. The Deed of Trust should describe the loan amount, name a Trustee, and describe the collateral securing the loan. A correct legal description of the property is essential for a valid Deed of Trust.

The grantor must sign the deed and have it notarized. Depending on the type of deed, the grantor's spouse may also need to sign it. The grantee does need to sign the deed but may need to sign related agreements in some circumstances. 4.

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate. It is often used as part of a real estate transaction that includes a Warranty Deed with a Vendor's Lien and a Promissory Note.

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

Whilst you do not need a solicitor to prepare a Declaration of Trust, it is always advisable to seek professional advice. For many people, your home is your biggest asset and having a Declaration of Trust in place is the best way to protect your investment.

§ 13.002). The Texas Property Code requires additional information to record a deed, including that the deed must: Be acknowledged or sworn to by the grantor before two credible witnesses, or a notary public, who also sign(s) the document (Tex. Prop.

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.