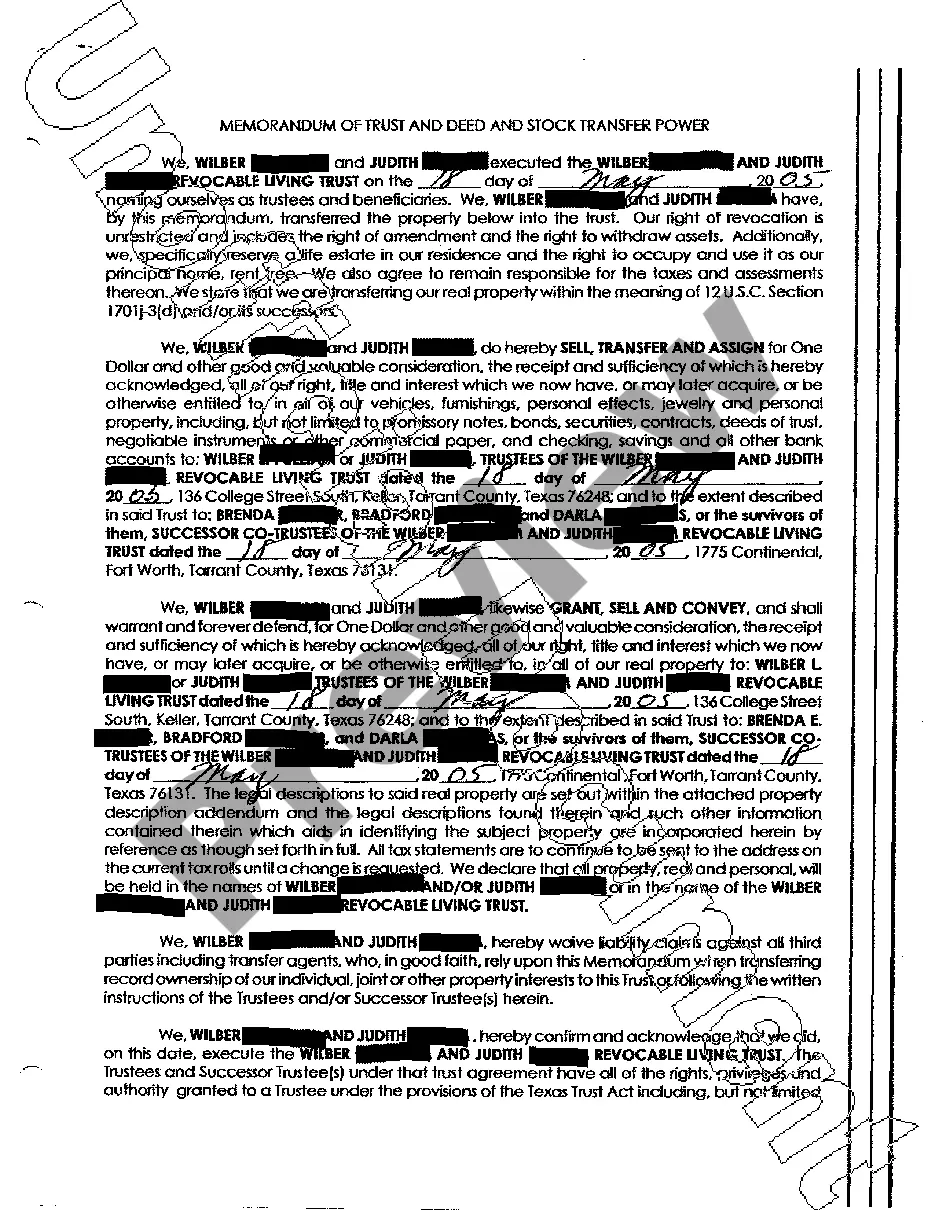

The Irving Texas Memorandum of Trust and Deed and Stock Transfer Power is a legally binding document that sets out the terms and conditions of a trust, deed, and stock transfer power in Irving, Texas. It encompasses critical information for individuals or entities involved in trusts, property ownership, and stock transfer in the mentioned locality. In Irving, Texas, there are different types of Memorandum of Trust and Deed and Stock Transfer Power that are commonly used. These include: 1. Revocable Living Trust Memorandum and Deed with Stock Transfer Power: This type of memorandum establishes a living trust that allows the granter to retain control of their assets during their lifetime. It outlines the terms of the trust, including the distribution of assets, and also incorporates a deed with a stock transfer power, allowing for the transfer of stock ownership. 2. Irrevocable Trust Memorandum and Deed with Stock Transfer Power: An irrevocable trust memorandum provides a means for individuals to transfer assets, relinquishing ownership and control permanently. This memorandum also includes a deed and stock transfer power, enabling the transfer of stocks pertaining to the trust. 3. Testamentary Trust Memorandum and Deed with Stock Transfer Power: This type of memorandum is designed to take effect after the death of the granter. It outlines the distribution of assets according to the terms specified in the granter's will. Additionally, it includes a deed and stock transfer power for the purpose of transferring stocks under the trust. The Irving Texas Memorandum of Trust and Deed and Stock Transfer Power typically contains key details such as the names and addresses of the granter and trustee, a comprehensive description of the trust or property, and the designated beneficiaries or stockholders. It may also specify the powers and responsibilities of the trustee, conditions for revoking the trust, and any additional provisions relevant to the particular type of trust or transfer. It is essential to seek legal advice and consult with a qualified attorney in Irving, Texas, to draft and finalize the Memorandum of Trust and Deed and Stock Transfer Power, ensuring compliance with local laws while meeting specific needs and objectives.

Irving Texas Memorandum of Trust and Deed and Stock Transfer Power

Description

How to fill out Irving Texas Memorandum Of Trust And Deed And Stock Transfer Power?

If you are in search of an authentic form template, it’s challenging to locate a more suitable location than the US Legal Forms site – one of the most comprehensive libraries online.

With this collection, you can discover numerous templates for commercial and personal use categorized by type and state or based on keywords.

Thanks to the excellent search functionality, locating the latest Irving Texas Memorandum of Trust and Deed and Stock Transfer Power is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finish the account registration.

Obtain the template. Choose the file format and download it to your device.

- Moreover, the validity of each document is confirmed by a group of experienced attorneys who routinely examine the templates on our site and update them to align with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Irving Texas Memorandum of Trust and Deed and Stock Transfer Power is to Log In to your user profile and select the Download option.

- If this is your first time using US Legal Forms, just follow the instructions below.

- Ensure you have located the sample you desire. Review its description and utilize the Preview function to inspect its content. If it doesn’t fulfill your needs, use the Search box at the top of the screen to find the required document.

- Affirm your choice. Click the Buy now button. Then, select your desired subscription plan and enter details to create an account.

Form popularity

FAQ

To transfer a property deed in Texas, you must create a new deed that specifies the transfer from the current owner to the new owner. Ensure that the deed is signed, notarized, and includes the legal description of the property. Afterward, you will need to file the deed with the county clerk. Utilizing the Irving Texas Memorandum of Trust and Deed and Stock Transfer Power can provide added benefits and streamline your transactions.

To transfer ownership of a property in Texas, you need to execute a deed, typically a warranty deed or quitclaim deed. This legal document must be signed, dated, and notarized, then filed with the county clerk's office. Utilizing the Irving Texas Memorandum of Trust and Deed and Stock Transfer Power can simplify this process and ensure clarity in ownership transfer.

Yes, Texas operates under a Deed of Trust system for real estate financing. This means lenders use Deeds of Trust rather than traditional mortgages to secure loans. The unique aspects of this system require individuals to be informed about their rights and obligations under Texas law, particularly in relation to the Irving Texas Memorandum of Trust and Deed and Stock Transfer Power.

Both title and deed play critical roles in property ownership, but they serve different purposes. The deed is the document that transfers ownership, while the title represents your legal right to own and use the property. Understanding both is essential for any real estate transaction, especially when utilizing tools like the Irving Texas Memorandum of Trust and Deed and Stock Transfer Power.

Transferring accounts to a trust typically involves contacting your financial institution and providing them with the trust documents. The bank may require proof of your authority to manage the trust. The Irving Texas Memorandum of Trust and Deed and Stock Transfer Power can facilitate this process and ensure your accounts are transferred smoothly.

To transfer items into a trust, you will need to prepare the necessary legal documentation, such as a trust transfer deed. Ensure that you properly title any asset, like real estate or bank accounts, in the name of the trust. The Irving Texas Memorandum of Trust and Deed and Stock Transfer Power is a valuable resource to guide you through these transfers.

To file a Transfer on Death (Tod) designation in Texas, you need to complete a specific form and file it with the county clerk where the property is located. This process allows you to pass on real estate without going through probate. The Irving Texas Memorandum of Trust and Deed and Stock Transfer Power can provide you with the necessary documents and instructions for this process.

In Texas, you generally do not need to file a trust with the state for it to be valid. However, certain types of trusts may require registration for tax purposes or other legal considerations. The Irving Texas Memorandum of Trust and Deed and Stock Transfer Power can help you understand the requirements for your specific type of trust.

Certain assets, such as retirement accounts and life insurance policies, usually cannot be placed directly in a trust without special arrangements. However, you can often designate the trust as a beneficiary of these assets. It’s essential to consult the Irving Texas Memorandum of Trust and Deed and Stock Transfer Power for specific details relevant to your situation.

To transfer assets to a trust in Texas, you must change the title of the asset to the name of the trust. This process typically involves drafting and signing a new deed or title, depending on the type of asset. Using the Irving Texas Memorandum of Trust and Deed and Stock Transfer Power can simplify this process and ensure that your assets are properly managed.