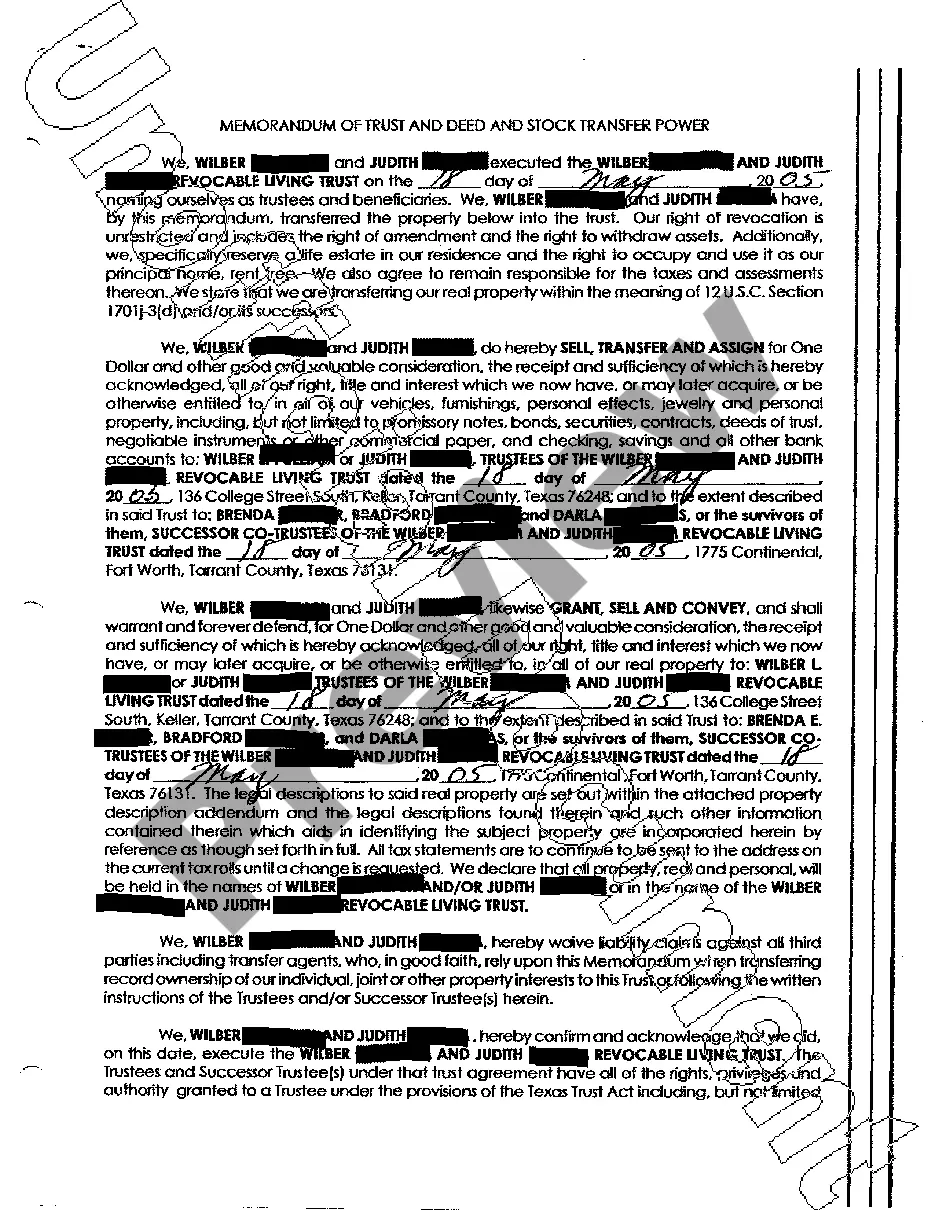

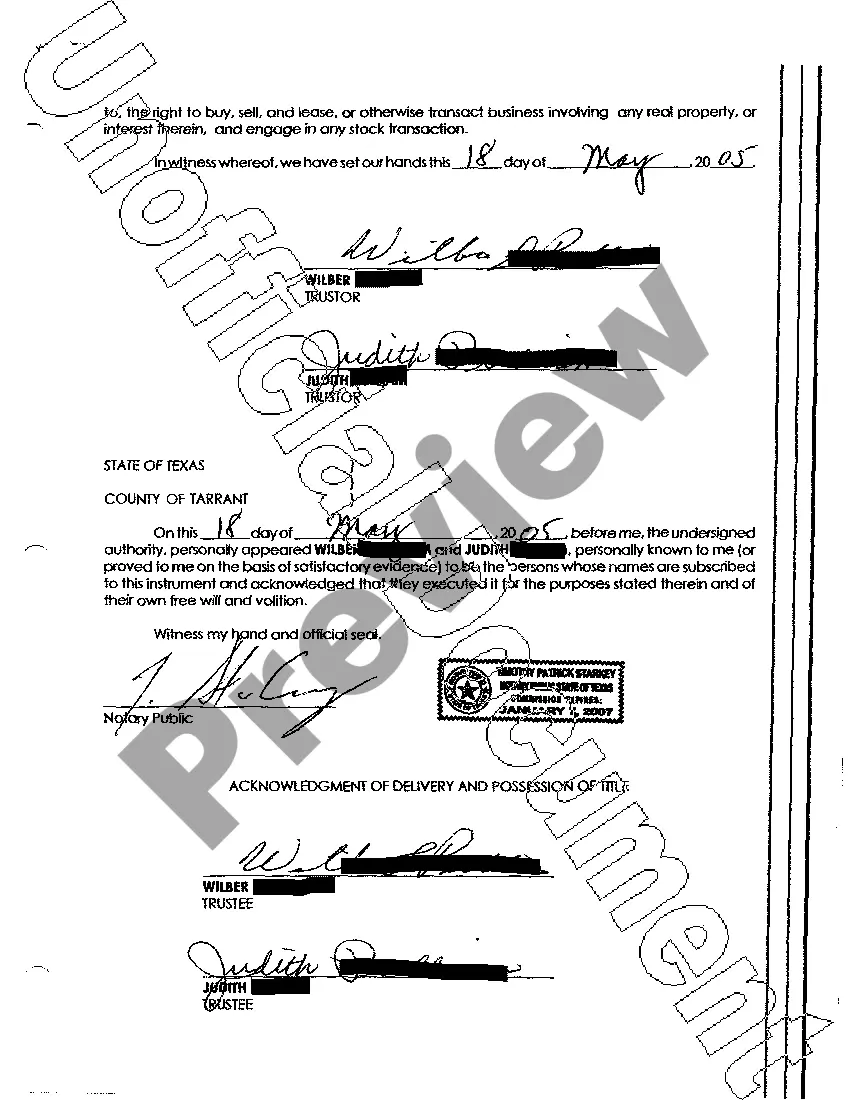

The Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power is a legal document with significant importance in the transfer and management of trusts, deeds, and stock ownership in the city of Sugar Land, Texas. This comprehensive document outlines the specifics of the trust agreement, the transfer of property through deeds, and the transfer of stock ownership within the Sugar Land jurisdiction. The Memorandum of Trust is a legally binding agreement that sets forth the terms and conditions under which the trust operates. It includes the names of the trust creator (granter), the trustee(s), and the beneficiaries. This memorandum delineates the rights, obligations, and responsibilities of each party involved in the trust, ensuring proper management and equitable distribution of assets. In Sugar Land, Texas, the Deed transfer is a separate component of this legal document. It refers to the legal instrument used to transfer property ownership from one individual or entity to another within the city limits. The Deed serves as proof of ownership and provides details about the property, including its location, legal description, and any encumbrances. It protects both the seller's and the buyer's interests during property transactions and ensures a smooth transfer of real estate ownership. Stock Transfer Power, another vital aspect of this document, relates to the transfer of stock ownership within the Sugar Land area. It grants the shareholder the authority to transfer stock to another individual or entity. The Stock Transfer Power requires specific information about the stock, such as the name of the corporation, the number and class of shares being transferred, and the recipient's details. This provision helps facilitate the smooth transfer of stock ownership while adhering to legal requirements. Types of the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power may vary depending on specific circumstances or purposes. For instance, there could be different versions for revocable or irrevocable trusts, testamentary trusts, land trusts, or charitable trusts. Similarly, the Deed transfer may vary depending on the type of property involved, whether it is residential, commercial, or agricultural. The Stock Transfer Power can take various forms, including specific powers for transfers of restricted stock or those required by a stock option agreement. Ultimately, the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power serves as crucial legal instruments that safeguard the rights and interests of individuals and entities involved in trust management, property transfers, and stock ownership within the city. Consulting with an experienced attorney familiar with the specific regulations and requirements applicable in Sugar Land, Texas is essential when dealing with these legal matters to ensure compliance and secure a seamless process.

Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power

Description

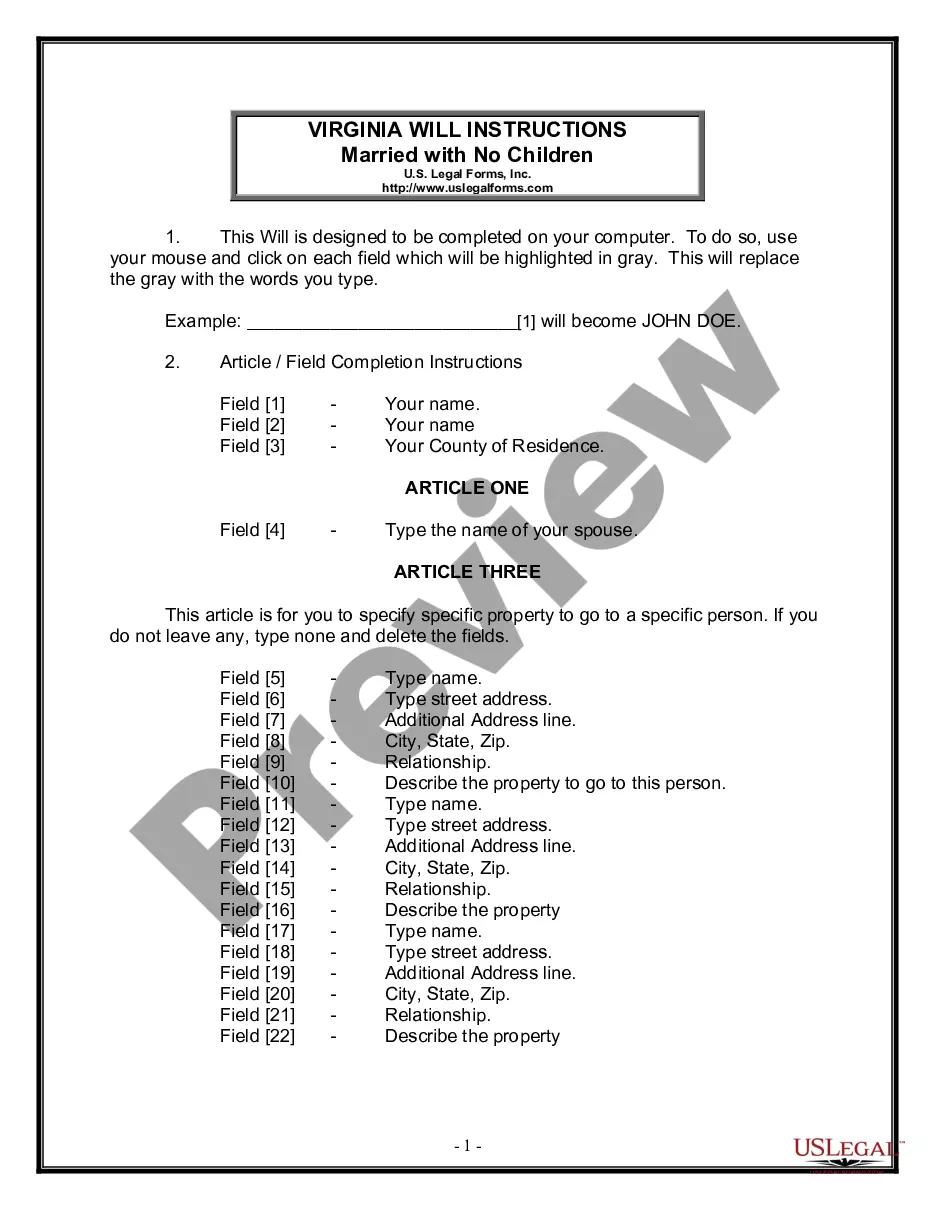

How to fill out Sugar Land Texas Memorandum Of Trust And Deed And Stock Transfer Power?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power? US Legal Forms is your go-to option.

Whether you require a simple agreement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to find out who and what the form is good for.

- Restart the search in case the template isn’t suitable for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power in any available format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal paperwork online once and for all.

Form popularity

FAQ

Filing a deed of trust in Texas involves preparing the deed document, ensuring it meets state requirements, and then submitting it to the appropriate county clerk's office. Make sure to include all necessary information, such as the property details and the names of the parties involved. Once filed, the deed of trust will become a public record that protects the lender's interest and reflects a Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power. For easy access to templates and guidance on this process, you can explore the resources provided by USLegalForms.

To transfer assets to a trust in Texas, you must first create a trust document that outlines the trust's terms and conditions. Next, you will need to retitle your assets in the name of the trust, which can include real estate, bank accounts, and investment accounts. It's essential to follow legal procedures to ensure the assets are properly transferred and protected under the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power. For assistance, consider using the USLegalForms platform, which offers resources and templates for a smooth transfer process.

To transfer real estate to a family member without incurring taxes, you can explore options like a transfer on death deed or ensure the transfer falls within certain exemptions. Strategies under the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power can help minimize potential tax burdens. Consulting with a tax professional or attorney may provide further insights on how best to approach this transfer without added financial liabilities.

When gifting property in Texas, there may be tax implications to consider for both the giver and the recipient. Generally, you will need to report the gift on a gift tax return if its value exceeds the annual exclusion amount. Understanding how the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power applies to your situation can help you make informed decisions about your property and taxes.

Transferring a property title to a family member in Texas involves drafting a warranty deed or a quitclaim deed. You need to clearly identify the property and the individuals involved, ensuring the deed complies with any requirements associated with the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power. It's often beneficial to consult with a legal professional to ensure a smooth transfer process.

A deed of trust in Texas must include specific information to be valid. This includes the names of both the borrower and the lender, the legal description of the property, and the power of sale clause, if applicable. When preparing a Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power, ensure all necessary elements are present to protect your interests in the transaction.

Filling out a property deed requires accurate information about the property and the parties involved. Typically, you need to include the legal description of the property, the names of the grantor and grantee, and any relevant details regarding the Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power. Additionally, having a notary public witness the signing can help authenticate the deed.

Yes, a trust deed can include a power of sale clause. This clause allows the trustee to sell the property in case of default without court intervention. In the context of a Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power, this clause is crucial for both lenders and borrowers. Understanding the implications of this clause can help you navigate your real estate transactions effectively.

One of the main disadvantages of a trust deed is that it may limit the borrower's ability to sell or refinance without lender approval. Additionally, in case of default, the lender can initiate a non-judicial foreclosure, which may impact the borrower's credit score more rapidly. Understanding these potential drawbacks is vital when reviewing a Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power.

The power of sale clause in a deed of trust in Texas allows lenders to sell the property without going through a court process if the borrower defaults. This clause enables a more streamlined foreclosure process, benefiting both lenders and borrowers. Understanding this clause is crucial when dealing with a Sugar Land Texas Memorandum of Trust and Deed and Stock Transfer Power.