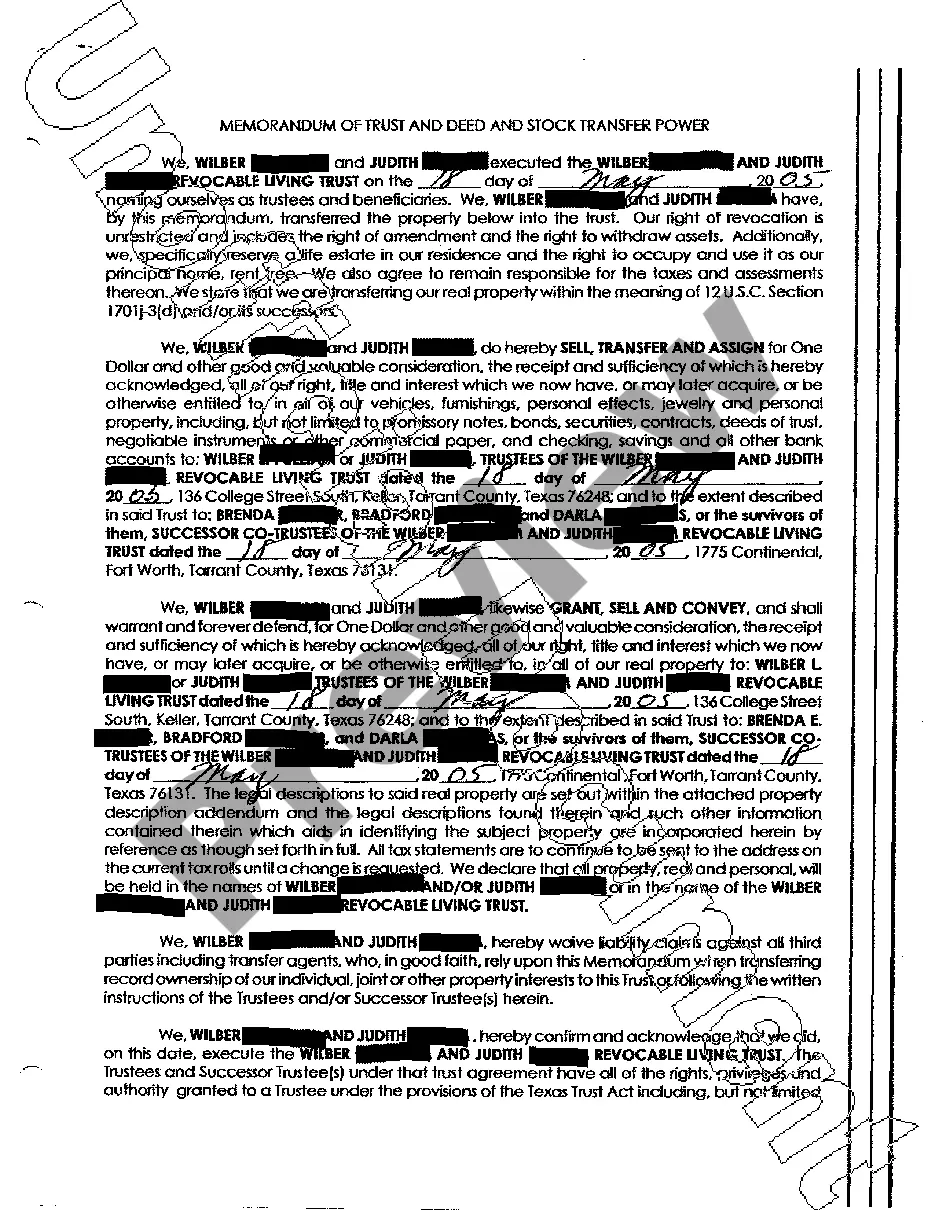

The Wichita Falls Texas Memorandum of Trust, Deed, and Stock Transfer Power serves as crucial legal documents when it comes to managing assets, property, and investments in the city of Wichita Falls, Texas. These documents outline the specifics of trust agreements, property deeds, and the transfer of stocks — all of which are essential for maintaining a transparent and legally compliant environment for both individuals and businesses. The Memorandum of Trust, often known as the Trust Agreement, is a legal document that establishes a trust and governs its terms and conditions. It outlines the intentions of the granter (trust creator) and the rights and responsibilities of the trustee (person or institution managing the trust) in handling the trust's assets. This document acts as a guide for the trustee, providing vital information such as the beneficiaries, distribution guidelines, and any specific instructions for managing the trust. Different types of Memorandum of Trust in Wichita Falls Texas include Revocable Trusts, Irrevocable Trusts, and Special Needs Trusts, each serving distinct purposes based on their inherent features and objectives. The Deed is a legal instrument used to transfer property ownership from one party to another. In Wichita Falls, Texas, a Deed outlines the specific details of a property, including its legal description, boundaries, encumbrances, and any other relevant information. The city has various types of Deeds, including General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds. Each type offers varying degrees of protection to the buyer, making it necessary for individuals involved in real estate transactions to choose the appropriate deed type that best suits their needs. The Stock Transfer Power is a document used to transfer ownership of stocks or shares from one person or entity to another. It is an essential component of managing investments and ensuring the accurate recording of ownership changes. The Stock Transfer Power generally requires the signature of the stockholder or authorized representative, along with the relevant stock information such as company name, stock quantity, and any specific conditions for the transfer. By utilizing the Stock Transfer Power, individuals or entities can maintain proper documentation and comply with legal requirements, providing transparency and clarity in stock ownership transfer operations. In summary, the Wichita Falls Texas Memorandum of Trust, Deed, and Stock Transfer Power are crucial legal documents that play a vital role in managing assets, property, and investments within the city. These documents ensure the execution of trust agreements, property transfers, and stock ownership transfers comply with legal standards, providing clarity, transparency, and legal protection to all involved parties.

Wichita Falls Texas Memorandum of Trust and Deed and Stock Transfer Power

Description

How to fill out Wichita Falls Texas Memorandum Of Trust And Deed And Stock Transfer Power?

Take advantage of the US Legal Forms and get immediate access to any form template you need. Our helpful website with a large number of documents makes it simple to find and get almost any document sample you will need. You are able to export, complete, and sign the Wichita Falls Texas Memorandum of Trust and Deed and Stock Transfer Power in a few minutes instead of surfing the Net for several hours trying to find the right template.

Using our library is a wonderful strategy to raise the safety of your form filing. Our professional legal professionals on a regular basis review all the documents to make sure that the templates are relevant for a particular region and compliant with new laws and regulations.

How do you obtain the Wichita Falls Texas Memorandum of Trust and Deed and Stock Transfer Power? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you look at. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the instruction listed below:

- Open the page with the template you require. Make certain that it is the form you were seeking: examine its name and description, and use the Preview option if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Export the document. Select the format to get the Wichita Falls Texas Memorandum of Trust and Deed and Stock Transfer Power and revise and complete, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy form libraries on the web. Our company is always happy to assist you in virtually any legal case, even if it is just downloading the Wichita Falls Texas Memorandum of Trust and Deed and Stock Transfer Power.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!

Form popularity

FAQ

Yes, a trustee can refuse to pay a beneficiary if the trust allows them to do so. Whether a trustee can refuse to pay a beneficiary depends on how the trust document is written. Trustees are legally obligated to comply with the terms of the trust when distributing assets.

Is a trustee able to sell trust property? Yes. They have the powers of an absolute owner and can even postpone a sale. However, in order to sell any property there must be at least two trustees able to sign the contract for sale.

A 'beneficial owner' is any individual who ultimately, either directly or indirectly, owns or controls the trust and includes the settlor or settlors, the trustee or trustees, the protector or protectors (if any), the beneficiaries or the class of persons in whose main interest the trust is established.

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them.

Generally, a beneficiary designation will override the trust provisions. There are situations, however, in which the beneficiary designation will fail and the proceeds of the account will pass under the terms of the trust.

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

It is always a good idea to have a trust to handle your assets after your death. Naming the beneficiaries of your accounts ensures that they can avoid probate, but it overrides any estate planning you may have in place already.

Under an irrevocable trust, legal ownership of the trust is held by a trustee. At the same time, the grantor gives up certain rights to the trust.

When the settlor transfers assets into an irrevocable trust, they're really transferring ownership to the trustee (of which there can be more than one). Trustees have the legal title to assets, while beneficiaries have the equitable title. The settlor no longer has title to the assets.

A trustee cannot favor one beneficiary over another. The trustee must also act impartially in investing and managing trust property, while at the same time considering the differing interests of the beneficiaries.

Interesting Questions

More info

Transfer for the purpose of starting a business in the State of Texas. Filing, for the purpose of establishing an active or inactive business to manufacture, cultivate, harvest fruit or vegetables, produce or process dairy products. Attestations of completion of a state-certified agricultural training program. A. I was able to file, from the beginning the entire document by hand. B. I learned that the “M” is a “C”, but I still have to make a “P” and make a mistake by putting my name at the end of each line. Furthermore, I'm not sure what happened. The documents are not numbered in the order that they are recorded. There's an “I” at the end of the document. When I was registering, I was told I had to sign all the pages. I don't remember doing that, but I remember signing the first page. C. I have not had this problem before.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.