Collin Texas Real Estate Lien Note, also known as a real estate lien note or simply a lien note, is an essential legal document that acts as evidence of a debt owed on a property in Collin County, Texas. This note is associated with a real estate lien, which is a legal claim or encumbrance placed on a property to secure the repayment of a debt. In Collin County, Texas, there are different types of real estate lien notes that can be used depending on the specific circumstances and agreements between the parties involved. Some of these types include: 1. Mortgage Lien Note: This is the most common type of lien note used in Collin County, Texas. It is typically utilized when a property owner obtains financing from a lender or a financial institution to purchase or refinance a property. The mortgage lien note outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and any penalties or charges associated with late payments. 2. Deed of Trust Lien Note: Another common type of lien note in Collin County, Texas, is the deed of trust lien note. This document is similar to a mortgage lien note, but it includes an additional party known as the trustee. The trustee holds legal title to the property until the borrower repays the debt in full, at which point the trustee conveys the title back to the borrower. This type of lien note is often used as an alternative to a mortgage lien note. 3. Mechanic's Lien Note: In Collin County, Texas, a mechanic's lien note may be utilized when a contractor, subcontractor, or supplier provides labor, materials, or services to improve a property but is not paid in full for their work. This lien note serves as a mechanism for these unpaid parties to assert their legal right to seek payment by placing a lien on the property. The mechanic's lien note outlines the amount owed and the details of the work performed. 4. Tax Lien Note: When property taxes go unpaid in Collin County, Texas, the local government may place a tax lien on the property. A tax lien note is then issued to document this encumbrance, detailing the amount owed in taxes, penalties, and interest, along with information on how to resolve the outstanding debt. 5. Judgment Lien Note: A judgment lien note in Collin County, Texas, is employed when a court awards a monetary judgment to a creditor against a property owner. This lien note serves to secure the judgment debt, ensuring that the creditor has a legal claim on the property until the debt is satisfied. It is important to note that each type of lien note in Collin County, Texas, comes with its own set of rules, legal requirements, and implications. Property owners, lenders, contractors, and other parties involved should seek professional advice and consult an attorney to fully understand their rights and obligations when dealing with real estate lien notes.

Collin Texas Real Estate Lien Note

State:

Texas

County:

Collin

Control #:

TX-JW-0129

Format:

PDF

Instant download

This form is available by subscription

Description

Real Estate Lien Note

Collin Texas Real Estate Lien Note, also known as a real estate lien note or simply a lien note, is an essential legal document that acts as evidence of a debt owed on a property in Collin County, Texas. This note is associated with a real estate lien, which is a legal claim or encumbrance placed on a property to secure the repayment of a debt. In Collin County, Texas, there are different types of real estate lien notes that can be used depending on the specific circumstances and agreements between the parties involved. Some of these types include: 1. Mortgage Lien Note: This is the most common type of lien note used in Collin County, Texas. It is typically utilized when a property owner obtains financing from a lender or a financial institution to purchase or refinance a property. The mortgage lien note outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and any penalties or charges associated with late payments. 2. Deed of Trust Lien Note: Another common type of lien note in Collin County, Texas, is the deed of trust lien note. This document is similar to a mortgage lien note, but it includes an additional party known as the trustee. The trustee holds legal title to the property until the borrower repays the debt in full, at which point the trustee conveys the title back to the borrower. This type of lien note is often used as an alternative to a mortgage lien note. 3. Mechanic's Lien Note: In Collin County, Texas, a mechanic's lien note may be utilized when a contractor, subcontractor, or supplier provides labor, materials, or services to improve a property but is not paid in full for their work. This lien note serves as a mechanism for these unpaid parties to assert their legal right to seek payment by placing a lien on the property. The mechanic's lien note outlines the amount owed and the details of the work performed. 4. Tax Lien Note: When property taxes go unpaid in Collin County, Texas, the local government may place a tax lien on the property. A tax lien note is then issued to document this encumbrance, detailing the amount owed in taxes, penalties, and interest, along with information on how to resolve the outstanding debt. 5. Judgment Lien Note: A judgment lien note in Collin County, Texas, is employed when a court awards a monetary judgment to a creditor against a property owner. This lien note serves to secure the judgment debt, ensuring that the creditor has a legal claim on the property until the debt is satisfied. It is important to note that each type of lien note in Collin County, Texas, comes with its own set of rules, legal requirements, and implications. Property owners, lenders, contractors, and other parties involved should seek professional advice and consult an attorney to fully understand their rights and obligations when dealing with real estate lien notes.

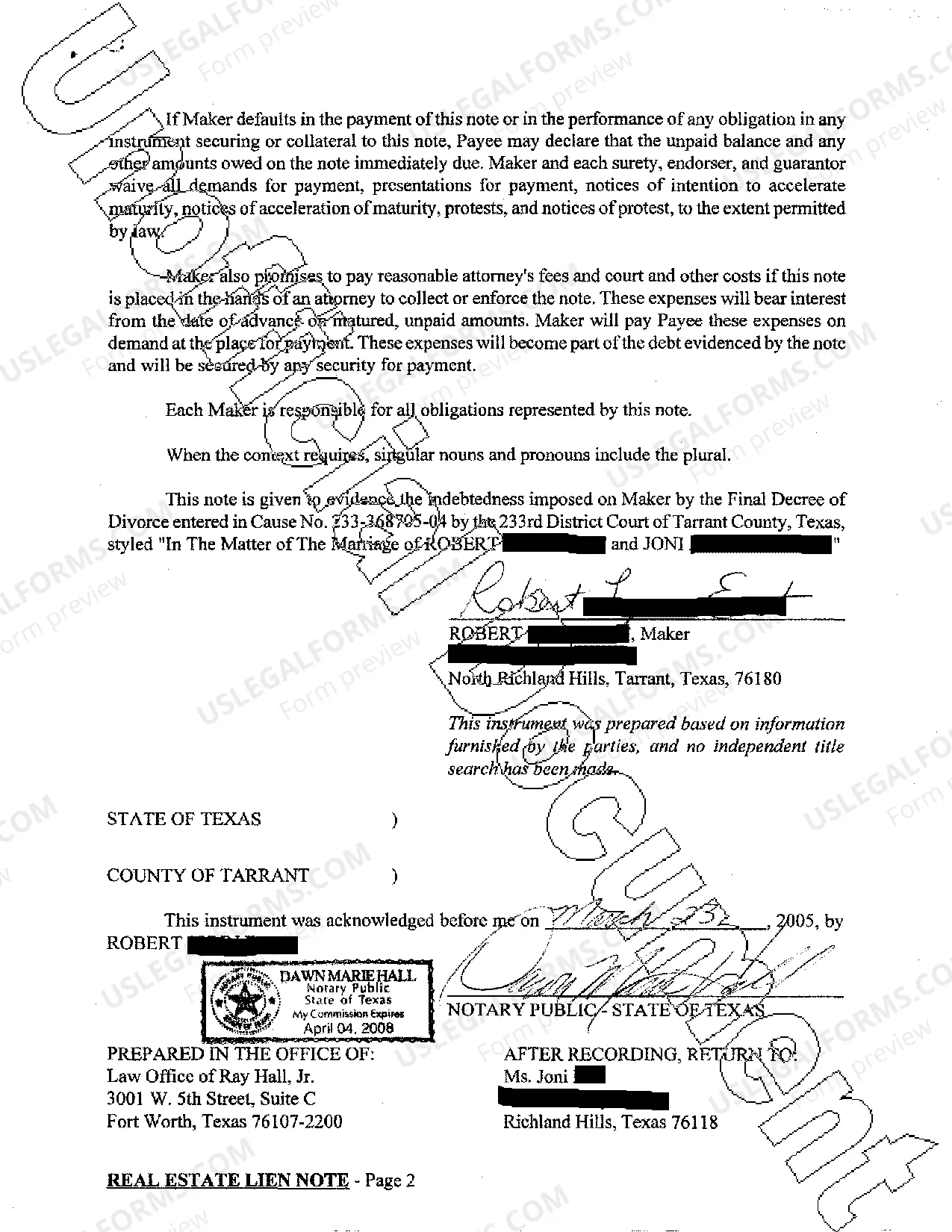

Free preview

How to fill out Collin Texas Real Estate Lien Note?

If you’ve already used our service before, log in to your account and download the Collin Texas Real Estate Lien Note on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Collin Texas Real Estate Lien Note. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!