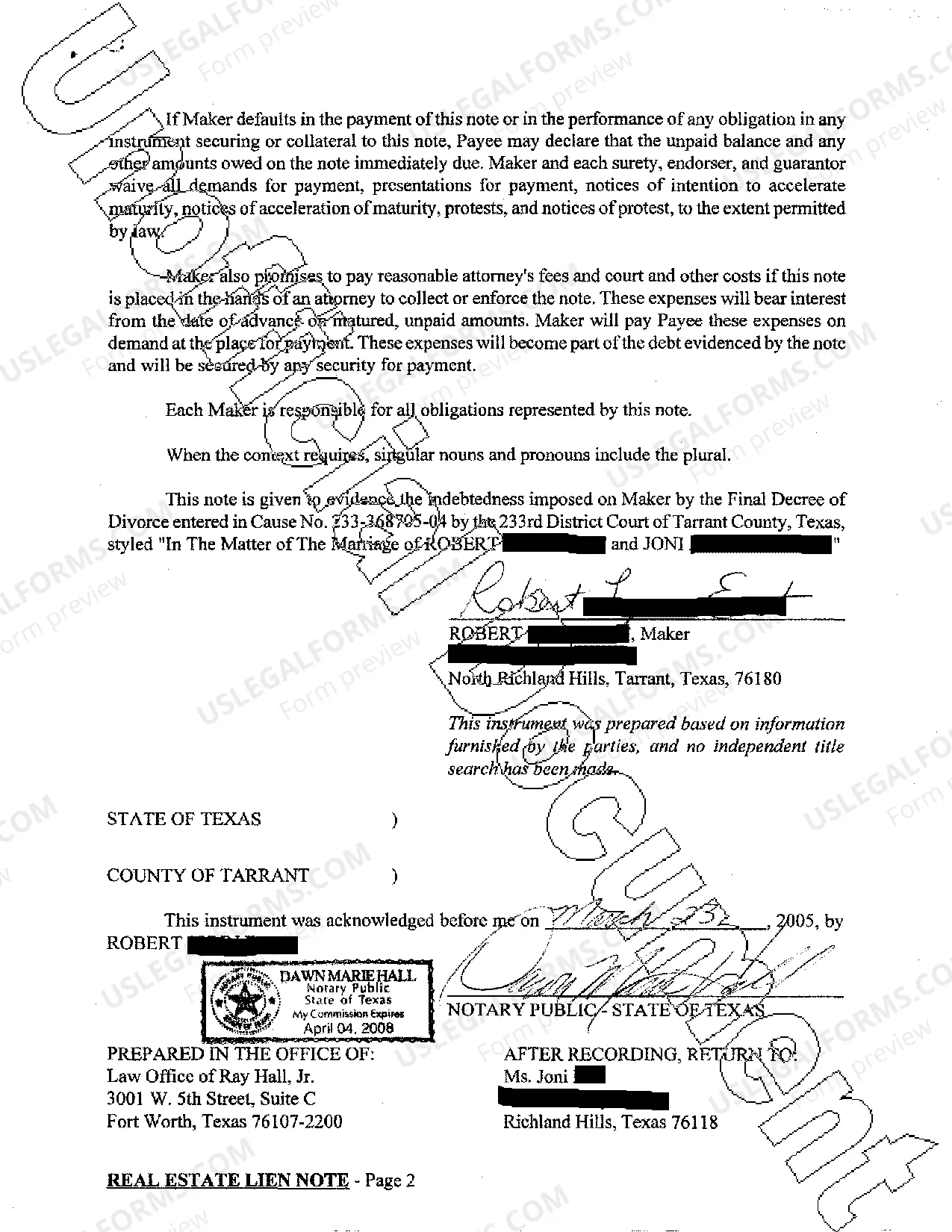

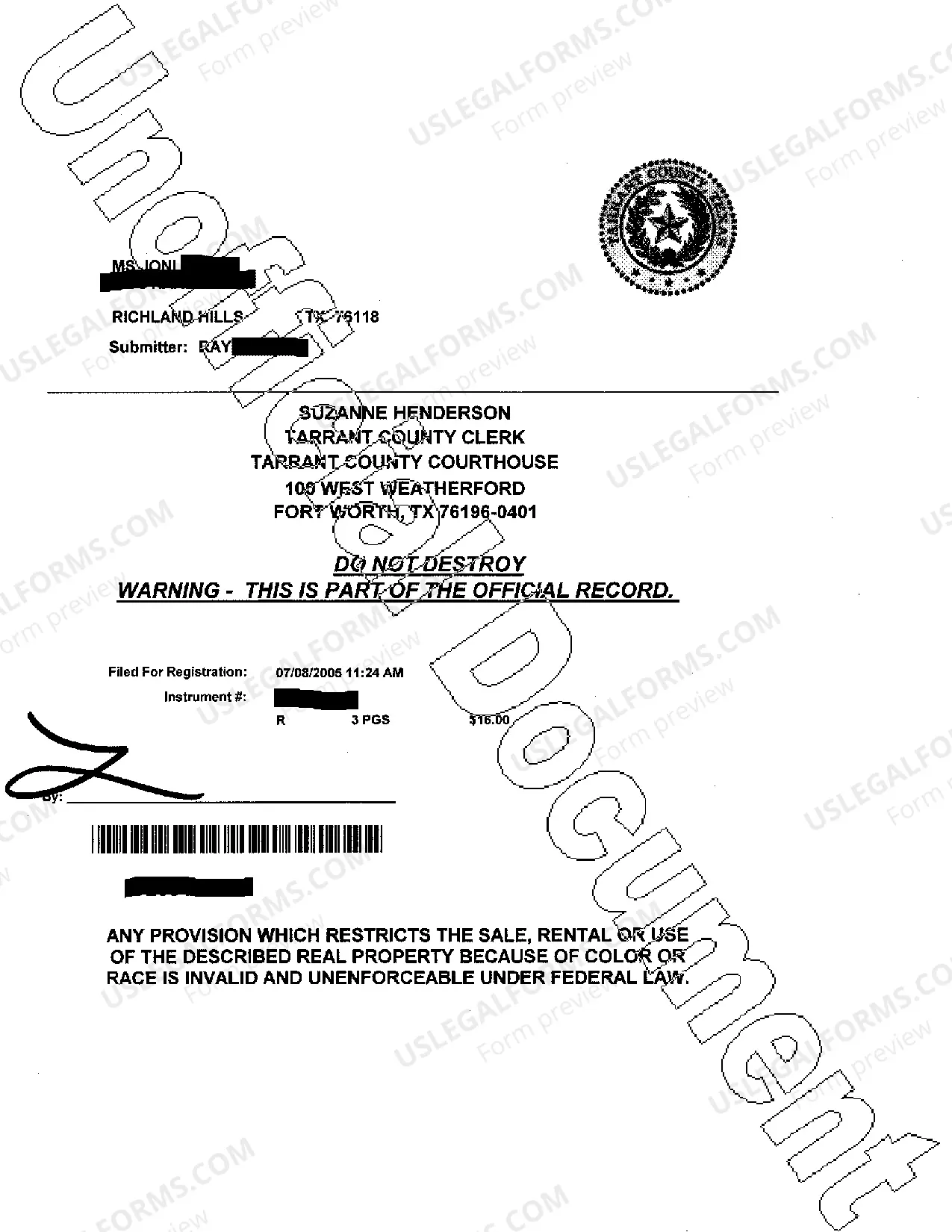

Corpus Christi Texas Real Estate Lien Note is a legal document that serves as evidence of a debt owed against a property in Corpus Christi, Texas. This lien note is typically created when a property owner borrows money and pledges their property as collateral. It acts as a promise to repay the loan amount with the property as security and gives the lender the right to sell the property if the borrower defaults on the loan. Keywords: Corpus Christi Texas, real estate, lien note, legal document, debt owed, property, collateral, borrow money, repay, security, lender, default. There are different types of Corpus Christi Texas Real Estate Lien Notes, including: 1. Mortgage Lien Note: This type of lien note represents a loan secured by a mortgage on the property. The lender has the right to foreclose the property if the borrower fails to make the mortgage payments. 2. Deed of Trust Lien Note: This lien note is used when the borrower signs a deed of trust, which gives a trustee the power to hold the property as security until the loan is repaid. If the borrower defaults, the trustee can sell the property through a foreclosure process. 3. Mechanics Lien Note: A mechanics lien note is filed to secure payment for construction or renovation work done on a property. If the property owner fails to pay the contractor, subcontractor, or supplier, they can file a mechanics lien note, giving them the right to force the sale of the property to recover their unpaid fees. 4. Tax Lien Note: When property taxes are not paid in Corpus Christi, Texas, the county tax collector can issue a tax lien note against the property. This note allows the county to recover the unpaid taxes by auctioning off the property. Overall, Corpus Christi Texas Real Estate Lien Notes play a crucial role in securing loans against properties and protecting the rights of lenders in Corpus Christi, Texas. It is vital for property owners and potential buyers to understand the different types of lien notes and their implications on real estate transactions in order to make well-informed decisions.

Corpus Christi Texas Real Estate Lien Note

State:

Texas

City:

Corpus Christi

Control #:

TX-JW-0129

Format:

PDF

Instant download

This form is available by subscription

Description

Real Estate Lien Note

Corpus Christi Texas Real Estate Lien Note is a legal document that serves as evidence of a debt owed against a property in Corpus Christi, Texas. This lien note is typically created when a property owner borrows money and pledges their property as collateral. It acts as a promise to repay the loan amount with the property as security and gives the lender the right to sell the property if the borrower defaults on the loan. Keywords: Corpus Christi Texas, real estate, lien note, legal document, debt owed, property, collateral, borrow money, repay, security, lender, default. There are different types of Corpus Christi Texas Real Estate Lien Notes, including: 1. Mortgage Lien Note: This type of lien note represents a loan secured by a mortgage on the property. The lender has the right to foreclose the property if the borrower fails to make the mortgage payments. 2. Deed of Trust Lien Note: This lien note is used when the borrower signs a deed of trust, which gives a trustee the power to hold the property as security until the loan is repaid. If the borrower defaults, the trustee can sell the property through a foreclosure process. 3. Mechanics Lien Note: A mechanics lien note is filed to secure payment for construction or renovation work done on a property. If the property owner fails to pay the contractor, subcontractor, or supplier, they can file a mechanics lien note, giving them the right to force the sale of the property to recover their unpaid fees. 4. Tax Lien Note: When property taxes are not paid in Corpus Christi, Texas, the county tax collector can issue a tax lien note against the property. This note allows the county to recover the unpaid taxes by auctioning off the property. Overall, Corpus Christi Texas Real Estate Lien Notes play a crucial role in securing loans against properties and protecting the rights of lenders in Corpus Christi, Texas. It is vital for property owners and potential buyers to understand the different types of lien notes and their implications on real estate transactions in order to make well-informed decisions.

Free preview

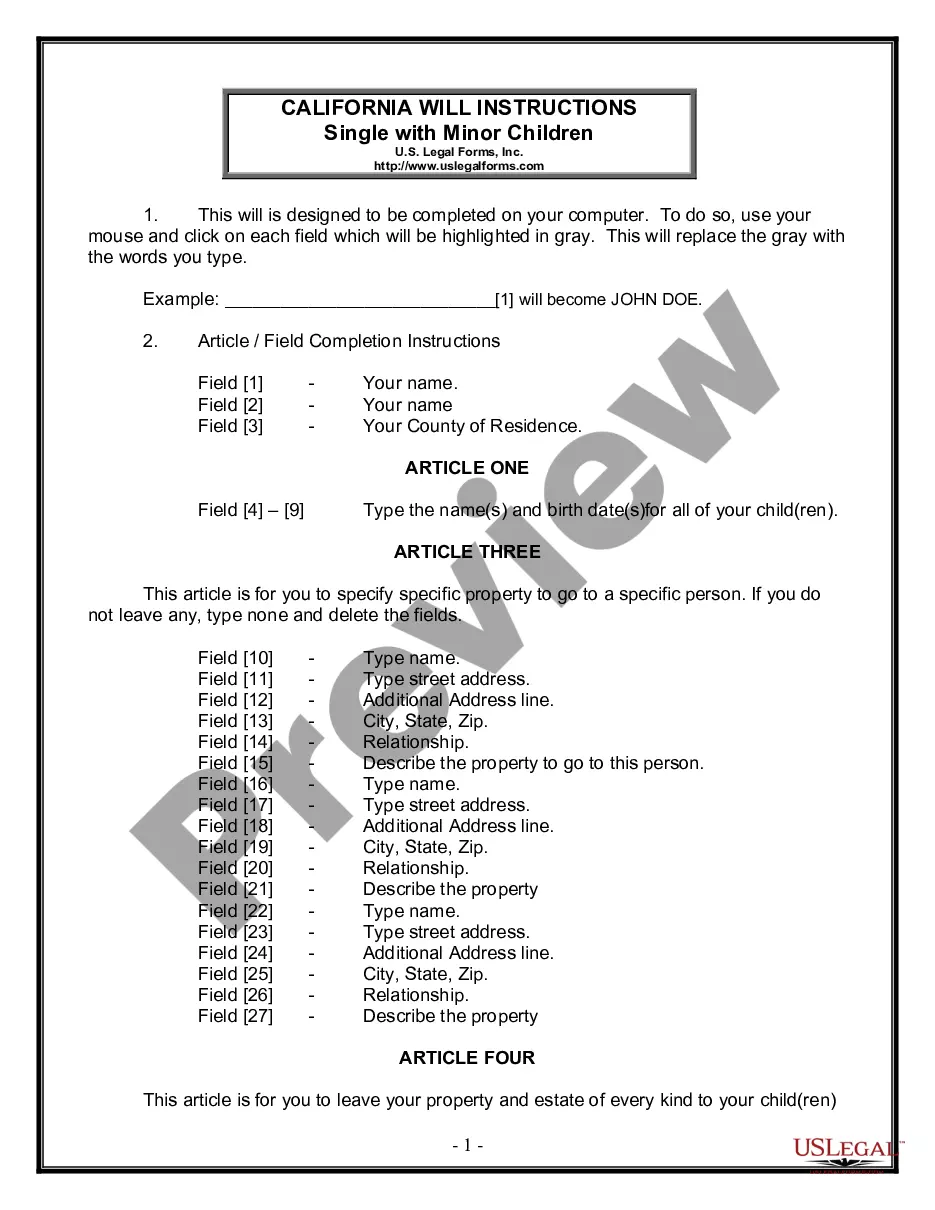

How to fill out Corpus Christi Texas Real Estate Lien Note?

If you’ve already utilized our service before, log in to your account and save the Corpus Christi Texas Real Estate Lien Note on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Corpus Christi Texas Real Estate Lien Note. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!