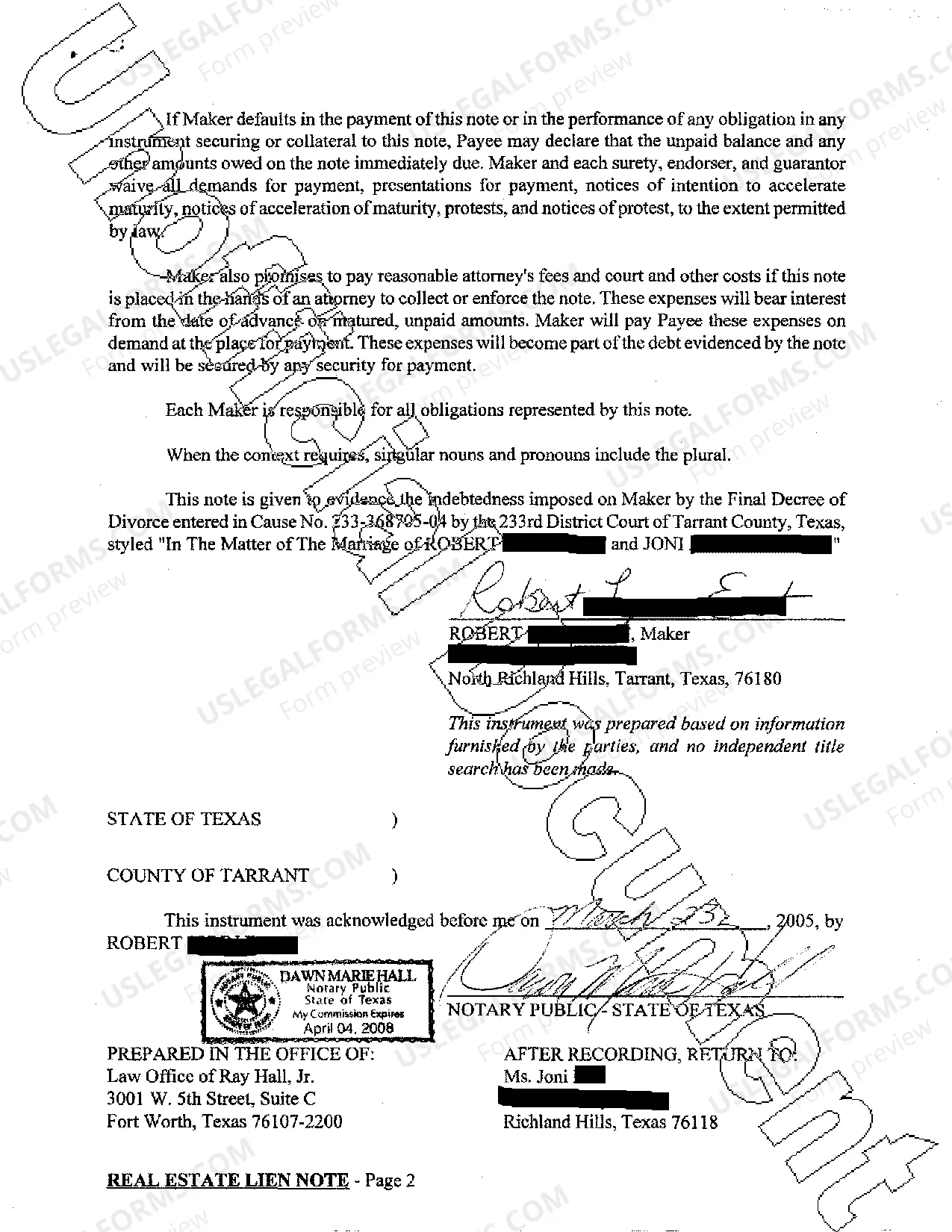

A Fort Worth Texas Real Estate Lien Note is a legal document that serves as a binding agreement between a borrower and a lender in regard to a real estate transaction in the Fort Worth, Texas area. This note represents a debt owed by the borrower, which is secured by a lien on the property involved in the transaction. The Fort Worth Texas Real Estate Lien Note outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees or penalties. It provides details on the rights and responsibilities of both the borrower and the lender throughout the duration of the loan. There are different types of Fort Worth Texas Real Estate Lien Notes, each offering specific features and benefits tailored to the needs of the parties involved. Some common types include: 1. Fixed Rate Lien Note: In this type, the interest rate remains constant throughout the term of the loan. It provides stability for borrowers who prefer predictable monthly payments. 2. Adjustable Rate Lien Note: Unlike a fixed rate note, an adjustable rate note allows the interest rate to fluctuate over time based on market conditions. This type of note may be suitable for borrowers who are willing to take on more risk in exchange for potentially lower initial interest rates. 3. Balloon Lien Note: A balloon lien note involves smaller monthly payments for a set period, typically several years, followed by a larger final payment (the balloon payment) that pays off the remaining balance. This type of note can be beneficial for borrowers who anticipate an increase in income or plan to sell the property before the balloon payment comes due. 4. Interest-Only Lien Note: With an interest-only lien note, the borrower pays only the interest on the loan for a certain period, typically a few years. This allows borrowers to have lower monthly payments initially, but they will need to start paying toward the principal balance after the interest-only period ends. Fort Worth Texas Real Estate Lien Notes are vital in securing the interests of both the borrower and the lender. They provide a legally binding agreement that protects the rights and obligations of all parties involved in the real estate transaction in Fort Worth, Texas.

Fort Worth Texas Real Estate Lien Note

Description

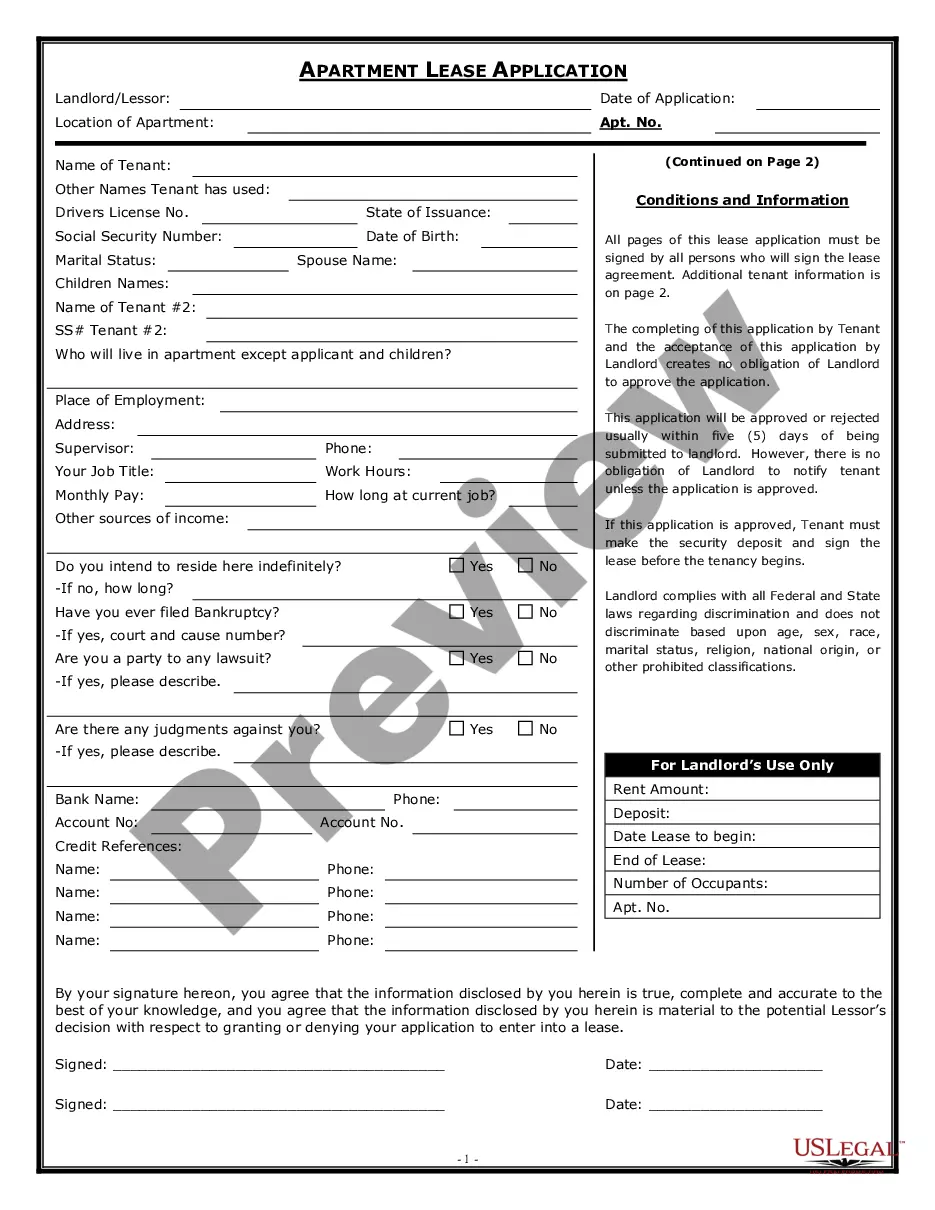

How to fill out Fort Worth Texas Real Estate Lien Note?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney services that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Fort Worth Texas Real Estate Lien Note or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Fort Worth Texas Real Estate Lien Note complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Fort Worth Texas Real Estate Lien Note would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!