Harris Texas Real Estate Lien Note is a legally binding document created when a property owner in Harris County, Texas borrows money and pledges their real estate as collateral. This note serves as evidence of the debt owed to the lender and outlines the terms and conditions of the loan agreement. Keywords: Harris Texas Real Estate Lien Note, real estate, lien, property owner, Harris County, Texas, collateral, debt, lender, loan agreement. There are different types of Harris Texas Real Estate Lien Notes depending on the specific situation and purpose of the loan. Here are a few common types: 1. First lien note: This type of note holds the highest priority in terms of repayment when there are multiple liens against the property. In case of foreclosure, the first lien note will be paid off first before any other lien notes. 2. Second lien note: A second lien note holds a secondary position to the first lien note. In case of foreclosure, the proceeds from the sale of the property will be used to cover the outstanding balance of the first lien note, and any remaining funds will be allocated to the second lien note. 3. Subordinate lien note: This type of note is subordinate to both the first and second lien notes. In the event of foreclosure, subordinate lien note holders will be paid only after the first and second lien notes are satisfied. 4. Deed of trust lien note: In some cases, a deed of trust is used instead of a mortgage to secure a loan. A deed of trust lien note outlines the terms and conditions of the loan, and the property is held in trust until the debt is fully repaid. These different types of Harris Texas Real Estate Lien Notes allow lenders and borrowers to establish a clear hierarchy of debt repayment and provide legal protection for all parties involved in the loan agreement. It is important for property owners in Harris County, Texas to carefully review and understand the terms of the lien note before entering into any real estate transaction.

Harris Texas Real Estate Lien Note

State:

Texas

County:

Harris

Control #:

TX-JW-0129

Format:

PDF

Instant download

This form is available by subscription

Description

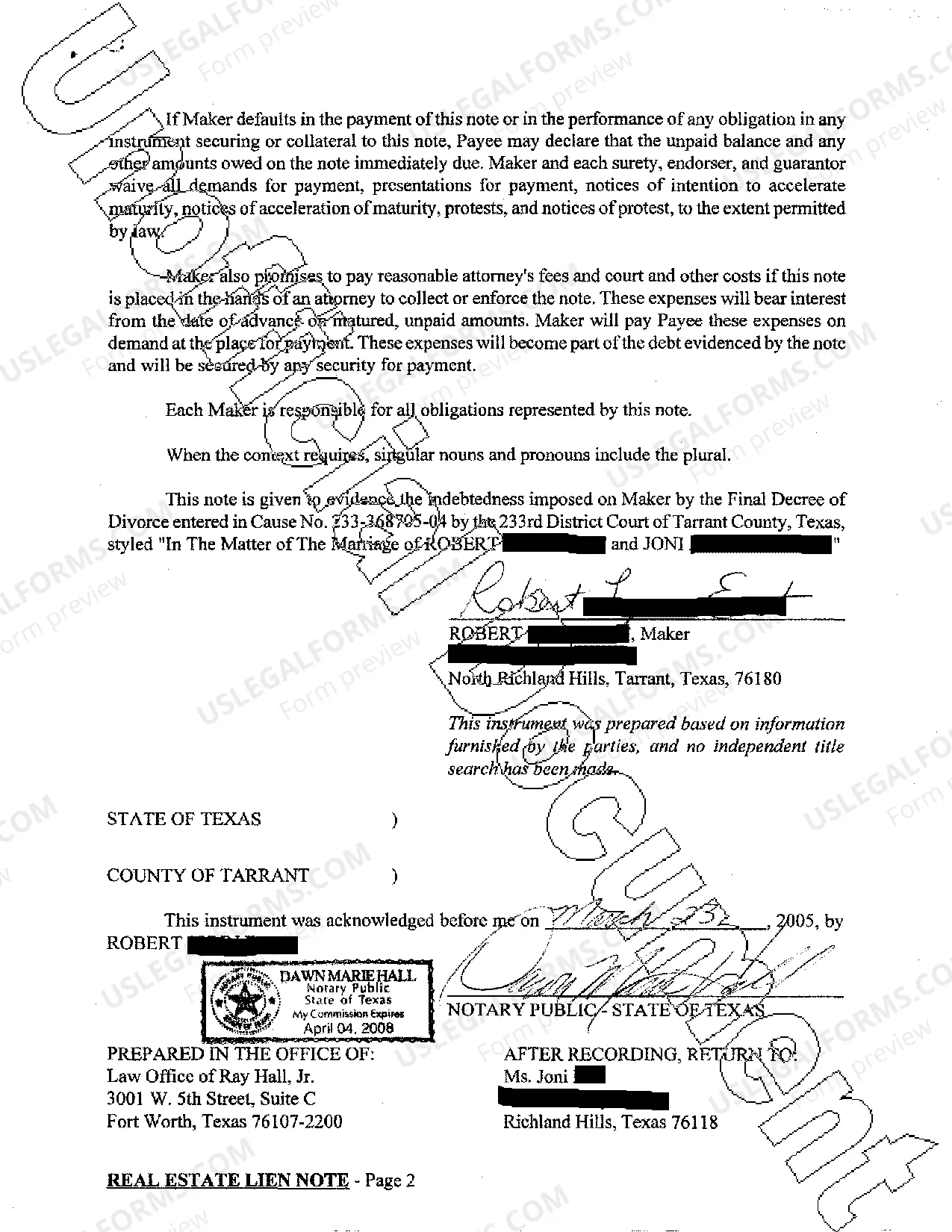

Real Estate Lien Note

Harris Texas Real Estate Lien Note is a legally binding document created when a property owner in Harris County, Texas borrows money and pledges their real estate as collateral. This note serves as evidence of the debt owed to the lender and outlines the terms and conditions of the loan agreement. Keywords: Harris Texas Real Estate Lien Note, real estate, lien, property owner, Harris County, Texas, collateral, debt, lender, loan agreement. There are different types of Harris Texas Real Estate Lien Notes depending on the specific situation and purpose of the loan. Here are a few common types: 1. First lien note: This type of note holds the highest priority in terms of repayment when there are multiple liens against the property. In case of foreclosure, the first lien note will be paid off first before any other lien notes. 2. Second lien note: A second lien note holds a secondary position to the first lien note. In case of foreclosure, the proceeds from the sale of the property will be used to cover the outstanding balance of the first lien note, and any remaining funds will be allocated to the second lien note. 3. Subordinate lien note: This type of note is subordinate to both the first and second lien notes. In the event of foreclosure, subordinate lien note holders will be paid only after the first and second lien notes are satisfied. 4. Deed of trust lien note: In some cases, a deed of trust is used instead of a mortgage to secure a loan. A deed of trust lien note outlines the terms and conditions of the loan, and the property is held in trust until the debt is fully repaid. These different types of Harris Texas Real Estate Lien Notes allow lenders and borrowers to establish a clear hierarchy of debt repayment and provide legal protection for all parties involved in the loan agreement. It is important for property owners in Harris County, Texas to carefully review and understand the terms of the lien note before entering into any real estate transaction.

Free preview

How to fill out Harris Texas Real Estate Lien Note?

If you’ve already utilized our service before, log in to your account and save the Harris Texas Real Estate Lien Note on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Harris Texas Real Estate Lien Note. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!